Introduction

On September 24, I co-published an article with Brad Thomas on increasing risks in the real estate space. We focused on multi-family housing, which is one of the sectors seeing billions of dollars of inflows from investors.

Despite being one of the healthiest segments, it is now seeing some serious cracks, as we’re looking at a wall of maturing debt in the next few years (emphasis added):

Newmark’s data reveals a significant amount of multifamily loans originated during the pandemic liquidity bubble are set to mature in 2023, 2024, and 2025.

In total, the report found that $436 billion of multifamily debt is potentially troubled, while total CRE debt in the same condition totals $1.2 trillion!

To make things worse, banks are particularly exposed to the multifamily market, with a significant percentage of loans set to mature by 2025. The report indicates that 52% of such loans are held by banks, emphasizing their vulnerability to the dynamics of the multifamily sector.

Due to rising rates and refinancing needs, we could be looking at more than a trillion dollars in troubled commercial real estate debt, which is a mind-blowing number.

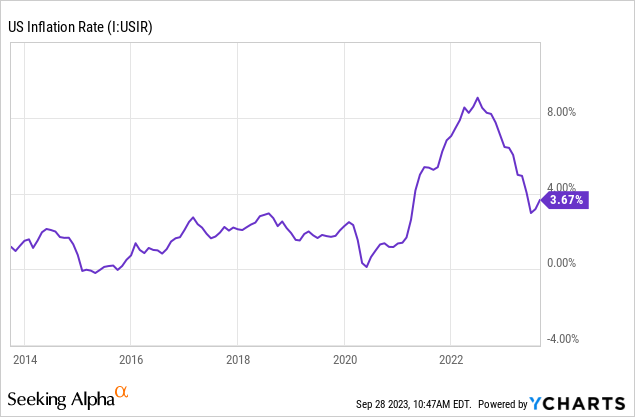

I’m not writing this to scare anyone but to assess the bigger picture. As most of my readers know, I’m in the camp that expects inflation to remain sticky, causing a very uncomfortable situation for the Fed. After all, the Fed wants to maintain financial stability while fighting inflation.

Unfortunately, given the trend of rebounding inflation and weakening economic growth, it is moving toward a situation where something might break.

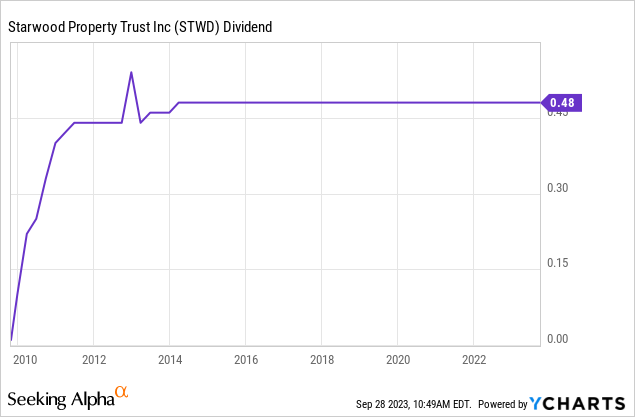

This brings me to Starwood Property Trust, Inc. (NYSE:STWD), one of America’s largest mortgage real estate investment trusts, or mREITs. Although this 10-yielding giant hasn’t hiked its dividend in years, it’s often seen as one of the most stable performers in its industry.

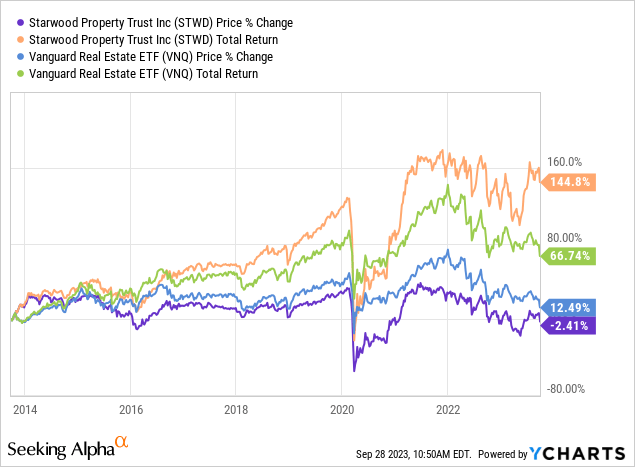

This is no surprise, as the company has a terrific total return.

While its shares have lost 2.4% over the past ten years, the total return (including dividends) was 145%, beating the Vanguard Real Estate Index ETF (VNQ) by a wide margin.

Writing this article has two purposes.

- I want to know what the industry is up to from one of the biggest players.

- 10%-yielding STWD is on the radar of many investors. I want to take a closer look to assess how attractive this stock may or may not be.

So, let’s get to it!

About Starwood

Starwood is an externally managed mortgage REIT. The REIT is managed by SPT Management, which is controlled by Barry Sternlicht, the billionaire founder of Starwood, who serves as its Chairman and CEO.

The primary focus of the company is originating, acquiring, financing, and managing mortgage loans and real estate investments in the United States, Europe, and Australia. The business segments include commercial and residential lending, infrastructure lending, real estate property, and real estate investing and servicing.

STWD aims to achieve attractive risk-adjusted returns by managing a diversified portfolio of target assets and financing them in a way that delivers favorable returns across different market conditions and economic cycles.

The investment strategy includes the origination and acquisition of real estate debt assets, acquisition of equity interests in commercial real estate properties, and strategic focus on strong real estate markets with barriers to entry.

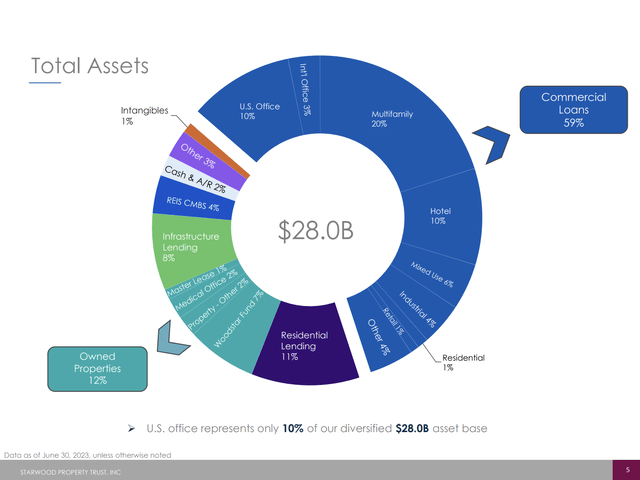

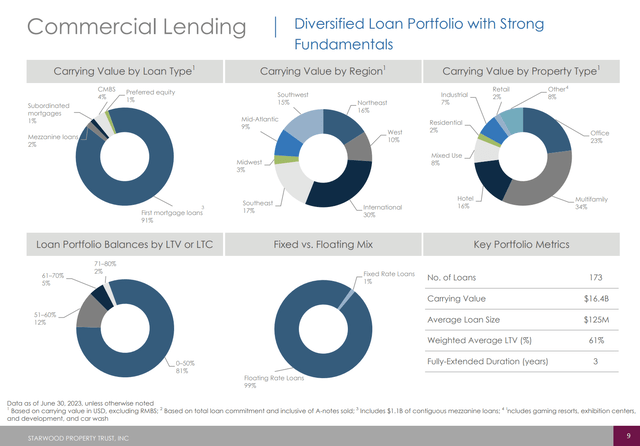

As the overview below shows, 59% of the company’s $28.0 billion assets consist of commercial loans. 12% of its assets are properties it owns. This sets the company apart from many mortgage companies that mainly engage in CRE lending.

Starwood Property Trust

When it looks for new deals, STWD primarily invests in target assets secured by U.S., European, or Australian collateral, including whole mortgage loans, B-Notes, mezzanine loans, CMBS, corporate bank debt, equity, RMBS, residential loans, infrastructure loans, and net leases, among others.

A quarter of its property carrying value consists of offices. Hotels account for 16%. I like to avoid both as much as possible.

Starwood Property Trust

With regard to its dividend, the company is very careful not to promise something it cannot keep. While dividends are never legal obligations, STWD is very conservative.

As I already briefly mentioned in the introduction, STWD hasn’t hiked its dividend since 2014. In 2Q23, the company paid a $0.48 per share dividend. This was backed by $0.49 in distributable earnings (“DE”). This translates to a payout ratio of 98%.

This is what the company said with regard to its dividend during the 2Q23 earnings call (emphasis added):

Our company’s leverage improved again in the quarter to 2.4 turns which is about a full turn of leverage lower than our peer group average. If our asset mix looked more like our lending peers or if we increase leverage by over 1 full turn to look more like them, our company would significantly out-earn its dividend in this higher rate environment. But that is not how we chose to run the company at this time. We built a diversified company with a conservative balance sheet that would best enable it to pay a stable and perhaps at times a growing dividend.

In other words, the company chooses safety over payout, which has NOT hurt its total return. It could easily pay a higher dividend if it used more leverage. However, that is not the case here.

Speaking of leverage, let’s take a closer look at how STWD is doing in this environment.

How Is Starwood Doing?

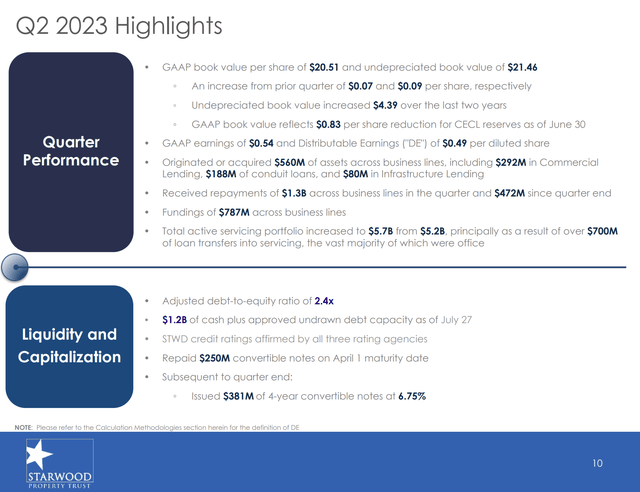

In the second quarter of this year, STWD reported distributable earnings of $158 million or $0.49 per share, with GAAP net income at $169 million or $0.54 per share.

The GAAP book value per share rose to $20.51, which reflects an increase of $0.07, and the undepreciated book value increased to $21.46, up by $0.09.

Starwood Property Trust

This increase in book value metrics includes an accumulated CECL (Current Expected Credit Losses) reserve balance of $260 million or $0.83 per share.

The company also bolstered its liquidity position, raising $381 million through convertible notes in July, and saw substantial repayments of $1.3 billion in commercial and infrastructure loans during the quarter.

In other words, the company was able to capitalize on this environment, as it is improving its liquidity and benefitting from a tight lending market.

The Federal Reserve’s rapid increase in interest rates to combat inflation has created some collateral damage. Transaction volumes in real estate across the globe have declined precipitously as owners wait for more accommodating financial markets and lenders have cut lending, particularly in the regional banking system as they manage their balance sheets. This environment should provide exceptional lending opportunities for STWD as the underlying real estate markets remain in fundamentally good condition. – STWD (emphasis added).

The Commercial and Residential Lending segment made a significant contribution in the second quarter, generating DE of $182 million or $0.56 per share.

- Commercial lending saw a notable uptick in repayments, exceeding $1 billion in the quarter, particularly from mixed-use and hotel loans. These repayments were partially offset by funding totaling $272 million from refinanced loans and pre-existing commitments.

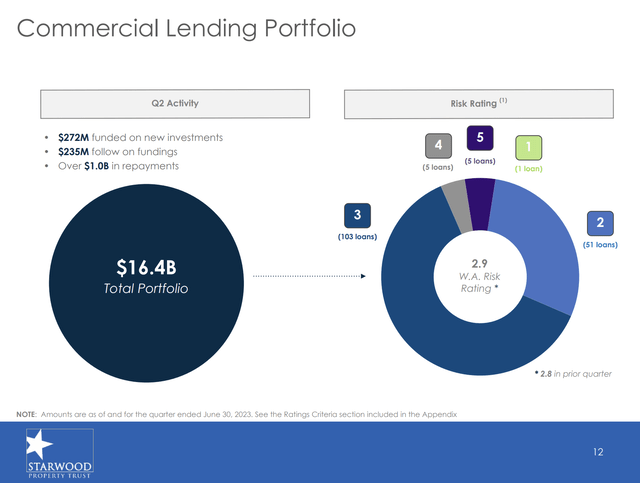

- The portfolio, primarily consisting of senior secured first mortgage loans, stood at $16.4 billion, with a weighted average risk rating of 2.9.

Starwood Property Trust

- The CECL adjustments were substantial, with a $104 million increase in general reserves due to a worsened macroeconomic outlook, particularly affecting office loans.

With regard to residential lending, the on-balance sheet loan portfolio for residential lending came in at $2.6 billion, covering both non-QM (non-qualified mortgage) and agency-eligible loans.

The Property segment contributed $21 million of DE, which was largely attributed to the well-performing Florida affordable housing fund. The fund witnessed an unrealized fair value increase of $209 million due to HUD-released maximum rent levels being 7.5% higher than the previous year, indicating a positive outlook for this segment.

I’m not surprised by these numbers, as residential investments continue to do much better than commercial properties.

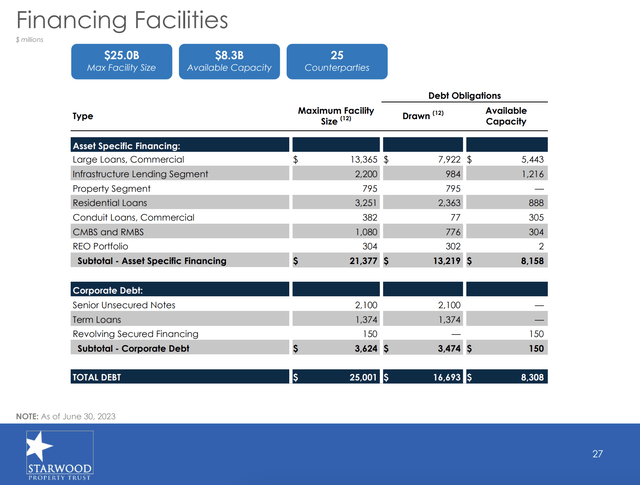

With that in mind, during the 2Q23 earnings call, STWD highlighted its strong financial position, including $25 billion of potential bank financing lines and $8 billion of undrawn funds, providing substantial access to diverse financing markets. These credit facilities are based on 25 counterparties.

Starwood Property Trust

Furthermore, the company’s prudent approach to risk management was underscored, utilizing interest rate protection and third-party macroeconomic forecasts to calculate CECL reserves. They anticipate these cautious strategies to yield positive outcomes in the future.

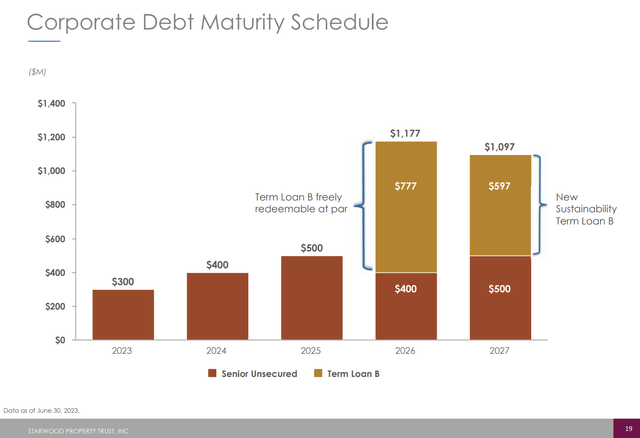

The company currently has $21.4 billion in debt. $14.6 billion of this is secured debt. It has a BB+ rating (one step below an investment-grade rating) and a 3.0x leverage ratio, including off-balance sheet liabilities like collateralized loan obligations.

Most CLOs are held in special-purpose vehicles that are off-balance sheets. So, it’s key to include those, which STWD is doing.

Most of its maturities are after 2025, which is great news for the company and its investors.

Starwood Property Trust

So, what does STWD expect going forward?

What’s Next?

The second quarter wasn’t at all bad. However, it’s the trend that matters. Rising CECLs aren’t a great sign, even if the company is still in a very good spot.

During the Q2 2023 call, Mr. Sternlicht talked about the collateral damage to the real estate sector caused by the Fed’s policies, leading to increased interest rates and widened spreads.

He pointed out that this environment has created a challenging landscape for real estate transactions, with a reluctance to sell due to refinancing uncertainties.

Looking at the chart below, we see that CRE transactions have fallen off a cliff.

Wells Fargo

I believe that a scenario where forced selling starts due to higher delinquencies could trigger rapidly falling prices. As “nobody” is buying and selling real estate, it’s very hard to find a fair price, in my opinion.

Sternlicht also outlined that the current economic scenario has provided a favorable environment for STWD to deploy capital opportunistically. I also briefly highlighted this in the earnings discussion part of this article.

STWD sees the ongoing challenges as an opportunity to invest strategically, leveraging its financial strength, while many other market players remain on the sidelines.

I completely agree with Mr. Sternlicht.

However, I worry that economic resilience could soon end if the Fed hikes too far. After all, most economic models (even the ones STWD uses) are expecting inflation to slow quite significantly. So far, this does not seem to be the case.

At that point, STWD will have to prepare more reserves to deal with potential losses. It also may have a harder time getting rid of unfavorable assets like office loans.

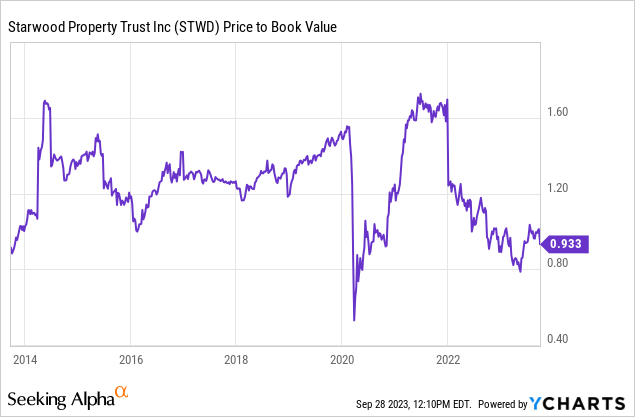

So, even though Starwood Property Trust, Inc. is trading at a very favorable book valuation (as seen below), I will pass on STWD. As much as I respect its prudent management, the macro environment is simply too uncertain to make the case that this is an attractive high-yield stock.

I’m not writing this to scare people out of STWD. Please feel free to disagree with me here.

My point is that the risk/reward isn’t attractive enough to get me into mortgage REITs at these prices.

I will give STWD a Hold rating and keep monitoring the stock. In a scenario where its stock price sells off due to a further deterioration in economic conditions, I may be interested in adding it to my trading portfolio.

For now, it’s a hard pass, at least for me.

Read the full article here

Leave a Reply