By Peter Bourbeau and Margaret Vitrano

Moving to the Middle as Growth Slows

Market Overview

Equities took a breather in the third quarter, pressured by rising bond yields, a hawkish turn by the Federal Reserve, and signs of late cycle spending fatigue. The S&P 500 Index fell 3.27% while the Nasdaq Composite declined 4.10% as the Fed indicated that generationally high interest rates could remain elevated well into 2024. The benchmark Russell 1000 Growth Index gave back some gains, dropping 3.13% and performing mostly in line with the Russell 1000 Value Index (-3.17%). Growth remains ahead of value by over 2,300 basis points year-to-date.

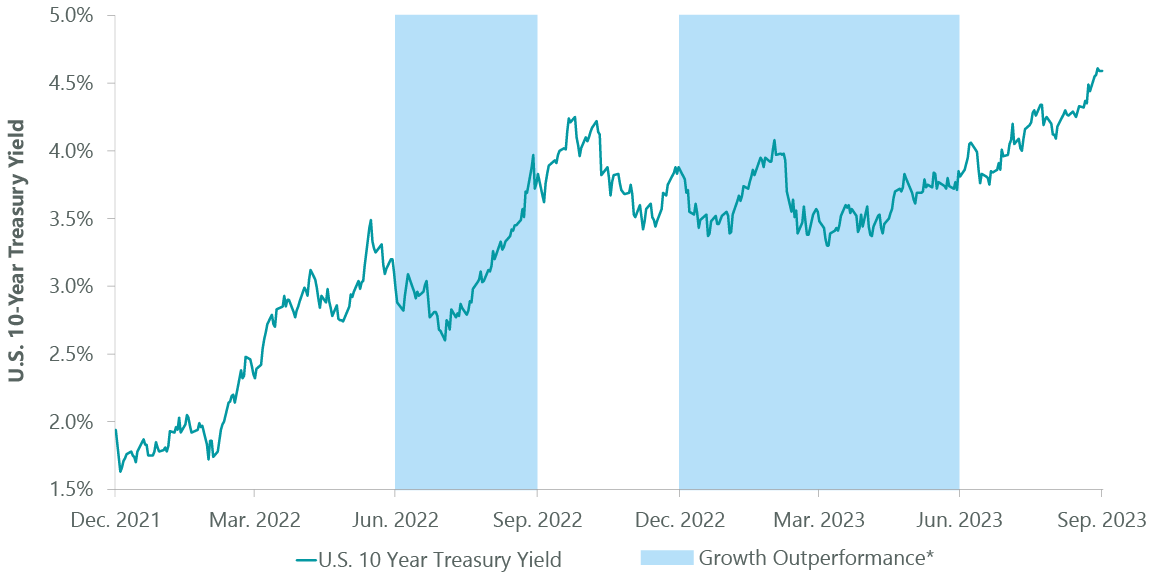

The 10-year Treasury yield climbed 74 bps during the quarter, reaching its highest level in 16 years (Exhibit 1). Surging yields have resulted from resilient economic data and a rebound in inflation that caused the Fed to push out any hopes of a rate cut in the near future. While the central bank may be nearing or at the end of its tightening cycle, we believe the lagging impacts of 525 bps of interest rate hikes in the last 18 months will be felt on corporate and consumer balance sheets well into the future.

Exhibit 1: Rising Yields Again Pressuring Growth Stocks

*Growth Outperformance indicates quarterly periods where the Russell 1000 Growth Index outperformed the Russell 1000 Value Index. Data as of Sept. 30, 2023. Source: FactSet.

Energy (+15.26%) and communication services (+5.19%) were the only sectors in the benchmark to deliver gains for the quarter while health care (-0.10%) and financials (-0.54%) also outperformed. Utilities (-12.61%), real estate (-11.29%), and consumer staples (-6.72%) were the worst performers, followed by materials (-5.96%) and information technology (IT, -5.92%) while consumer discretionary (-3.18%) finished mostly in line with the benchmark.

The ClearBridge Large Cap Growth Strategy underperformed for the quarter, as weakness in our higher multiple medical device holdings and consumer names with direct exposure to China weighed on performance. Year-to-date relative performance remains solid, supported by positive stock selection that has more than offset being underweight strongly performing mega caps Apple (AAPL) and Microsoft (MSFT). The quarterly underperformance of those two stocks, the largest in the benchmark, added to relative performance. Such results suggest that our focus on diversification should keep the Strategy well-positioned in a market we expect to remain unsettled.

Positive clinical trials showing cardiovascular benefits for GLP-1 diabetes and obesity therapeutic semaglutide boosted shares of portfolio holding Eli Lilly (LLY), which markets Mounjaro for these conditions. However, the potential for improved patient outcomes raised the risk of lower utilization for DexCom (DXCM), a maker of continuous glucose monitoring devices, and Intuitive Surgical (ISRG), whose robotic surgical systems are used in weight loss procedures. While headline risk to these stocks is unlikely to go away soon, we believe any financial impact from GLP-1s will be restrained due to a limited current patient population and the need to continue to treat progressive diseases, like diabetes, through regular monitoring.

Athletic footwear and apparel marketer NIKE (NKE) and cosmetics maker Estee Lauder (EL) also lagged during the quarter due to consumer weakness in China, a core market for both companies. The world’s second-largest economy continues to be held back by a tepid COVID-19 recovery and weakness in its sprawling property sector. As the marginal consumer of everything from commodities to smartphones, we are closely monitoring Chinese demand and our exposures there.

Offsetting these areas of softness, we were pleased with the positive contributions from our IT holdings. Data monitoring software maker Splunk (SPLK) re-rated on a takeout offer from Cisco Systems (CSCO), while workflow software maker Atlassian (TEAM) and newer position Intuit (INTU) delivered solid results. Shares of NVIDIA (NVDA), the clear leader in supplying graphics processing units to power AI applications, finished the quarter on an upswing and remained substantially higher for the year. Nvidia’s multiple has actually compressed year-to-date due to better-than-expected earnings growth and, while we remain confident in the company’s long-term growth trajectory, we trimmed the position for the third time this year to manage our overall portfolio risk.

Portfolio Positioning

We maintained our “moving to the middle” approach to positioning in the third quarter, taking profits in medical devices and animal health to trim our health care overweight and provide funds for repositioning into areas earlier in their growth cycle.

Investing in growth companies going through earnings resets has proved effective during the recent period of improved Strategy performance. Long-time holding Amazon.com (AMZN) and new addition Target (TGT) are the latest examples of businesses that have likely seen their profit forecasts bottom. We added to Amazon during the quarter, as the company has demonstrated progress in improving retail profitability after a large period of investment during COVID-19 and because its AWS cloud business has shown signs of growth stabilization.

Big box retailer Target provides early-cycle consumer exposure but with support from cash flow and a dividend. Target reset earnings in August by lowering its full-year outlook to account for weak sales and one-time cost issues, leaving its shares trading at a historically wide discount to peers Walmart (WMT) and Costco (COST). We see the company as a turnaround story, with better-than-expected margin and inventory controls leading to improved comparisons. In addition, we view the controversy around Target’s Pride merchandise assortment, and consequent backlash, to be fixable. A deeper-than-expected downturn in consumer spending and a failure to reverse traffic declines and recent market share losses are risks to our thesis, but we believe they are sufficiently accounted for in the stock’s current valuation.

New addition Union Pacific (UNP) also falls in our cyclical bucket of companies working through short-term headwinds. The rail operator provides the added benefit of a low correlation to the rest of the portfolio. As an efficient way to transport grain, coal, and autos and with networks that extend from Mexico through the U.S. to Canada, the freight rail industry generates high returns on invested capital and is positioned to benefit from reshoring. We have been researching rails for the last 18 months, waiting for earnings estimates to come down amidst a weakening macro backdrop. By the start of the third quarter, we believe estimates had declined enough to make us comfortable in establishing exposure. We chose Union Pacific as its risk-reward is compelling if the turnaround being led by new CEO Jim Vena is successful. Rail volumes are coincident with macro conditions, causing us to establish a minimal position that can be built opportunistically.

We exited Sea Limited (SE), which has experienced headwinds in its gaming and e-commerce businesses since COVID-19 began to recede. Sea began rapidly moving toward profitability in 2022 and we expected management to continue down that path. However, the company announced a pivot back to re-investing for growth in e-commerce early in the quarter which we believe makes for too many strategic pivots in a short time, causing diminished shareholder confidence and delays in the stock’s value realization. This, combined with tightening up the portfolio’s exposure to international and economically sensitive end markets, ultimately led to the sale.

Outlook

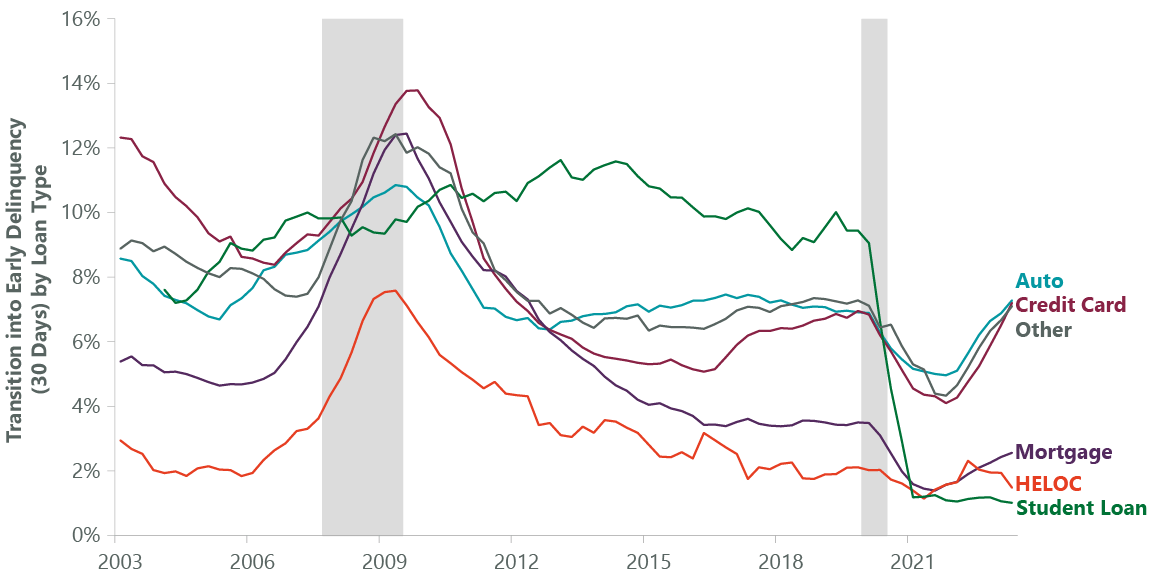

The U.S. economy remains on the precipice of a recession or soft landing, with inflation and labor costs moderating. We are very late in the current cycle and expect stocks will bottom ahead of company fundamentals. We are already seeing this in areas like consumer discretionary as earnings have weakened, consumer credit balances are increasing and credit quality is worsening (Exhibit 2). The industrial complex is starting to normalize as pandemic supply dislocations and the benefits of inflation are going away. On the enterprise level, businesses are becoming more austere and managing budgets more tightly.

These worsening conditions support the goals of recent portfolio activity. A soft landing could lead to a period of low GDP growth like 2014-2016, where a company’s ability to generate organic growth and self-fund future investments was important. We believe the portfolio is well-exposed to these types of fundamentally sound growth franchises.

Our holdings in the stable growth bucket, like Visa (V) and UnitedHealth Group (UNH), have done a good job managing earnings in more volatile periods, and should be able to execute well through the economy’s normalizing process. We also have cyclical companies delivering strong operating earnings growth like Grainger (GWW), Eaton (ETN), and Uber (UBER).

Exhibit 2: Rising Delinquency Rates Could Slow Spending

HELOC stands for Home Equity Line of Credit. Data as of June 30, 2023, latest available as of Sept. 30, 2023. Source: NY Fed, Equifax.

Finally, we are confident in our select growth exposure. These companies are being driven by earnings growth rather than multiple expansion, and maintain reasonable valuations compared to other parts of the IT and communication services sectors. The Strategy remains overweight enterprise software, where holdings like Adobe (ADBE) and Salesforce (CRM) are seeing business trends stabilize. Online advertising is also seeing a healthy recovery which should benefit Meta Platforms (META) and Amazon.

In addition to stable grower Microsoft, many of our select names are directly indexed to the secular growth of artificial intelligence (AI). Our research efforts, supported by ClearBridge’s sector analysts, are focused on new use cases as inference models ramp up, as well as determining which software and services companies will be supplanted by AI and which will remain relevant. Success will likely be a function of who has the best proprietary data to offer enhanced services, a setup where we see large companies as having an advantage over startups.

Portfolio Highlights

The ClearBridge Large Cap Growth Strategy underperformed its benchmark in the third quarter. On an absolute basis, the Strategy posted losses across the 10 sectors in which it was invested (out of 11 sectors total). The primary detractors from performance were the health care, industrials, and IT sectors.

Relative to the benchmark, overall stock selection detracted from performance. In particular, stock selection in the health care, communication services, industrials, financials, and consumer staples sectors and underweight to communication services weighed on results. On the positive side, stock selection and an underweight allocation to the IT sector contributed the most to performance.

On an individual stock basis, the leading absolute contributors were positions in Splunk, Nvidia, Atlassian, Meta Platforms, and UnitedHealth Group. The primary detractors were Microsoft, Apple, Netflix (NFLX), RTX (RTX), and DexCom.

Peter Bourbeau, Managing Director, Portfolio Manager

Margaret Vitrano, Managing Director, Portfolio Manager

Past performance is no guarantee of future results. Copyright © 2023 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information.

Performance source: Internal. Benchmark source: Russell Investments. Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication.

Performance source: Internal. Benchmark source: Standard & Poor’s.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here

Leave a Reply