Sales of new homes jumped in September, even as mortgage rates climbed toward 8%. The surprise gain is a sign that buyers remain eager to purchase new homes in a market that lacks previously owned options. Eye-catching price cuts and incentives from builders probably don’t hurt.

The news wasn’t enough to excite home builder investors: shares of exchange-traded funds tracking the industry were lower in midmorning trading.

New home sales, a measure of contract signings for newly constructed homes, rose 12.3% to a seasonally-adjusted annual rate of 759,000 from August’s upwardly-revised rate of 676,000, government data released Wednesday show. Economists had expected a 0.7% gain from August’s preliminary level, according to FactSet. September’s rate was about 34% higher than one year ago, and the highest since February 2022.

The gain shows that prospective buyers have remained in the market despite quickly-rising mortgage rates. The data captures a period when mortgage rates climbed to their highest levels in two decades. Since the end of September, mortgage rates have continued to gain, with the average 30-year fixed mortgage rate rising last week to 7.63%, its highest level since late 2000.

With few previously owned homes available for sale, the data suggests buyers have continued to seek out more options—not to mention price cuts or buyer incentives—from builders. About three in 10 builders surveyed by the National Association of Home Builders in October said they reduced home prices, while 62% said they offered sales incentives more broadly.

The decline in prices also may grab attention. The median price of new homes sold in September was $418,800, down 12.3% from the year-ago period. It’s not as unusual for new home sale prices to fall below year-ago levels as it is for existing-home prices—but the magnitude of the decline was head turning. It was the greatest drop in the median price of a new home since February 2009.

The price drop of new homes doesn’t necessarily mean that prices are falling more broadly. The median existing home in September sold for $394,300, an increase of 2.8% from one year prior, as supply remained scarce. Rather, the price decline in new home sales could be a signal of builders’ willingness to meet affordability-crunched buyers where they are to keep home sales flowing, instead of holding out for higher prices. “Pricing is down both due to builder incentive use and a shift towards building slightly smaller homes,” the National Association of Home Builders said in a release.

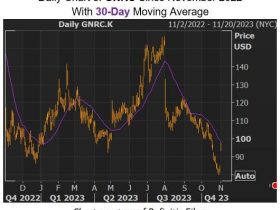

That could be one reason why the robust sales figure failed to excite investors in home builders. Two exchange-traded funds tracking the home builders and related industries, the

SPDR S&P Homebuilders

ETF (XHB) and the

iShares U.S. Home Construction

ETF (ITB), were down 1.9% and 1.6%, respectively, in midmorning trading, according to Dow Jones Market Data. If the ETFs were to close at this morning’s levels, it would be the lowest closes since spring and early summer.

Another reason for industry stocks’ continued sag could be the upswing in the 10-year Treasury yield, which was 4.907% in midmorning trading following the report’s release.

The 10-year Treasury yield is closely watched by housing investors because it often moves in tandem with mortgage rates—though the spread between the two has remained larger than normal through 2023. While Freddie Mac’s weekly rate has yet to breach 8%, daily rates climbed to that level last week, as the 10-year Treasury yield approached 5%.

Write to Shaina Mishkin at shaina.mishkin@dowjones.com

Read the full article here

Leave a Reply