You may have heard the term “fortress balance sheet” before.

Just a few years ago, every real estate investment trust (“REIT”) effectively had a fortress balance sheet, because interest rates were so low it didn’t really matter whether your interest rate on borrowings was 4% or sub-2%. Either way, interest costs were low. Debt levels were almost a non-factor.

Today, a lot fewer REITs have truly “fortress” balance sheets, because interest rates are no longer at ultra-low levels.

Put differently, having a fortress balance sheet actually matters today where it didn’t so much during the ultra-low interest rate period.

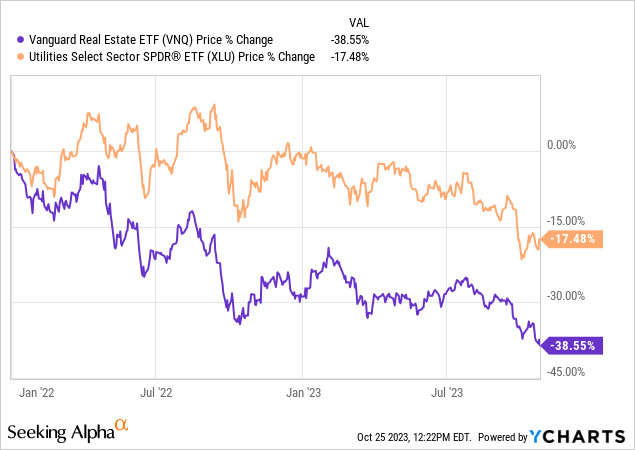

Even so, as Treasury yields spike, the entire REIT sector has sold off heavily, much more so than the other traditional dividend-paying sector of utilities.

You can see in this chart that the Vanguard Real Estate ETF (VNQ) has collapsed by nearly 40% since its peak in early 2022, while the Utilities Select Sector SPDR ETF (XLU) is down only 17.5%.

There are some REITs with truly fortress balance sheets that have been tossed out with the bathwater along with the rest of the real estate sector.

This makes sense only if REITs are nothing more than bond proxies, but REITs are much more than bond proxies!

- REIT dividends typically grow over time, whereas bond coupons are fixed

- REIT dividends can be immediately reinvested to further grow income

- REIT property portfolios typically rise in value over time, whereas bonds have a fixed face value

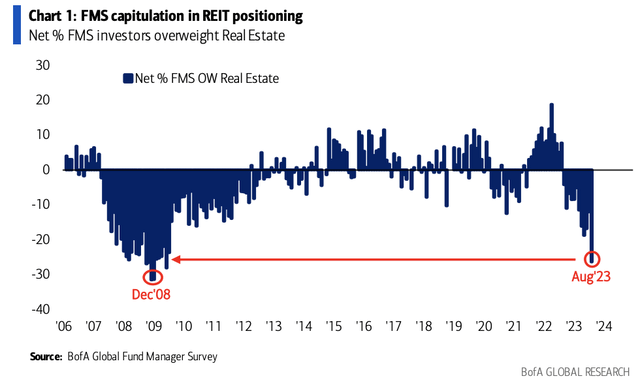

I think many investors (both individual and professional) are heavily underweight REITs right now largely because of the assumption that REITs all have a steady slate of debt maturities year after year.

Bank of America FMS

There seems to be no consideration being given to those REITs with fortress balance sheets, little to no near-term debt maturities, and almost entirely fixed-rate debt profiles.

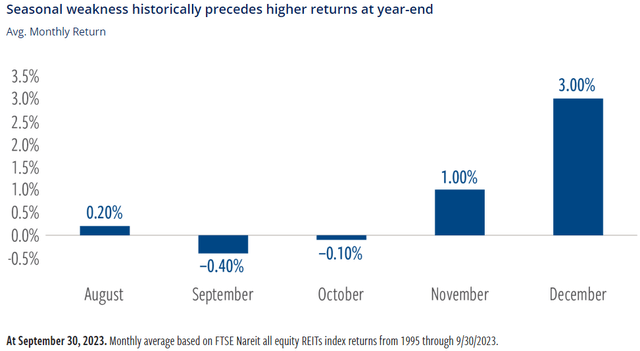

Plus, there’s a seasonality factor at play.

Since REITs have already been among the worst performing sectors this year, they are a prime candidate for tax loss harvesting. Mutual funds’ fiscal years end at the end of October, so undoubtedly many of them are selling REITs to harvest some tax losses. This at least partly explains the seasonality of equity REIT performance by month:

Cohen & Steers

As funds’ tax loss harvesting closes out at the end of October, maybe we will see the relentless selling in REITs end. Maybe REITs will get some reprieve.

Or maybe they won’t.

In any case, amid such an uncertain future in terms of the path of interest rates and the economy, I find a lot of comfort in being invested in REITs with well-positioned balance sheets.

By “well-positioned,” I mean very few upcoming debt maturities over the next few years and little to no floating-rate debt.

In what follows, allow me to expound on five of my favorites.

5 REITs Well-Positioned To Withstand High Interest Rates

Most of the following REITs I would certainly consider to have “fortress” balance sheets. There’s one possible exception with a fairly high net debt to EBITDA that would be much higher if you combined debt and preferred equity in that calculation.

Nevertheless, all five of these REITs’ balance sheets strike me as being extraordinarily well-positioned to weather a period of high interest rates.

| Net Debt To EBITDA | Debt To EV | % Fixed-Rate Debt | |

| Agree Realty (ADC) | 4.5x (Q3) | 28% | 98% |

| Alexandria Real Estate (ARE) | 5.4x (Q3) | 35% | 99% |

| Innovative Industrial Properties (IIPR) | 1.2x (Q2) | 13% | 100% |

| Gladstone Land (LAND) | 7.4x (Q2) | 36% | 100% |

| Rexford Industrial (REXR) | 3.7x (Q3) | 17% | 100% |

The lone exception to the “fortress balance sheet” label would be LAND. Only about 38% of LAND’s total capitalization comes from common equity. The rest comes from debt and preferred equity.

Judging by that alone, I wouldn’t really consider LAND to have a top-notch balance sheet. But it also enjoys a favorable debt maturity schedule, amortizing debt, and no exposure to floating rates.

Let’s take these one by one.

Agree Realty Corporation

One thing (among many) that I love about ADC is that it has a well-defined land, and it stays squarely in that lane. The ADC lane is owning and developing single-tenant net lease properties leased by the nation’s 20-30 largest and strongest retailers.

These retailers are recession-resistant, e-commerce-resistant, COVID-resistant, inflation-resistant, “higher for longer”-resistant, and so on. Name something bad, and they’re probably resistant to it. They sell essential goods that people need in any and every economy.

ADC October Presentation

Over 2/3rds of the tenant base have investment grade credit ratings, and another ~15% are not rated by have IG profiles. Think of names like Hobby Lobby (zero debt) and Aldi.

About 10% of rent comes from the nation’s strongest grocery store brands like Walmart (WMT), Kroger (KR), and Publix.

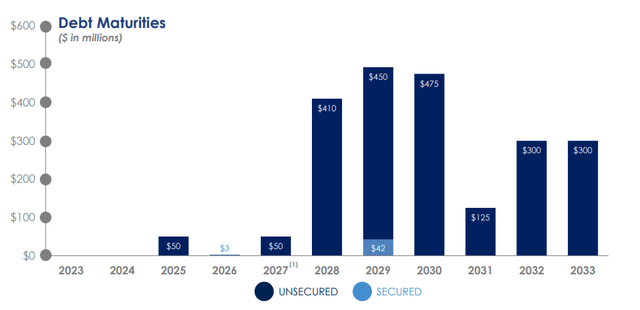

But perhaps the best part of all is ADC’s balance sheet. Not only is debt quite low and the credit rating of BBB strong, the REIT has extremely little debt maturing until 2028.

ADC October Presentation

ADC has no refinancing headwinds whatsoever in 2024, and the $50 million of maturities in 2025 could theoretically be handled with the REIT’s ~$80 million in annual retained cash after dividend payments. The weighted average debt maturity is about 7 years.

Although ADC has now run out of all low-cost forms of capital for growth, management stated in the Q3 2023 conference call that they would still produce at least 3% AFFO per share growth in 2024 even with no acquisitions at all.

ADC is my largest individual stock holding, and I continue to buy more every chance I get.

Alexandria Real Estate Equities

This best-in-class owner and developer of high-quality life science real estate just reported strong Q3 results, including an earnings beat and raising the midpoint of guidance for 2023, to which the market shrugged and continued selling.

A REIT reports bad results, the market sells.

A REIT reports in-line results, the market sells.

A REIT reports good results, the market sells.

ARE’s results were good, almost unequivocally. Sure, you can find some minor things to complain about, but they’re really a reach. Arguably the main reason ARE is selling off is because the market is treating it no different than a traditional office REIT. The June 2023 short report on ARE put out by Land And Buildings has added to this perception.

But ARE is not even close to being like traditional office or suffering the headwinds that office faces.

Unlike in the traditional office sector, where office buildings are more or less commodity products that are interchangeable to their tenants, the quality of ARE’s properties in terms of building design and location is a major competitive advantage amid the current wave of new supply.

The world’s leading biotech companies don’t want to settle for the second or third best locations or submarkets within a major market. For the most part, it simply isn’t worth it for most biotech firms to sign leases in undesirable buildings outside of prime innovation clusters in order to pay somewhat lower rent.

ARE’s trophy properties in prime locations within the nation’s most innovative life science clusters are a moat in and of themselves.

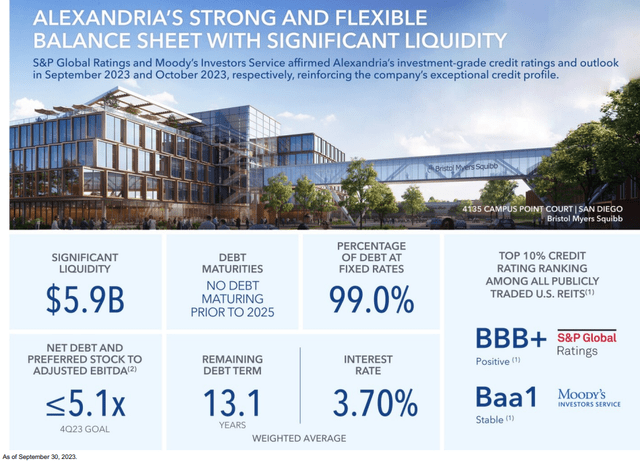

And then there’s ARE’s excellent balance sheet that would be a crime not to consider.

ARE Q3 2023 Supplemental

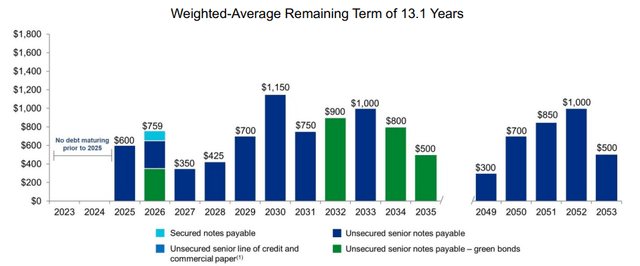

It’s a pretty enviable position to have 99% of your debt fixed for 13 years at an average interest rate almost half the prevailing BBB corporate bond yields today.

What’s more, ARE has no debt maturities in 2024 and a very manageable slate of maturities each year thereafter.

ARE Q3 2023 Supplemental

During the ultra-low interest rate period from 2019 through early 2023, ARE even issued 30-year bonds at very favorable interest rates.

ARE exudes quality, and I’m happy to keep buying as the market (foolishly, in my opinion) sells.

Innovative Industrial Properties

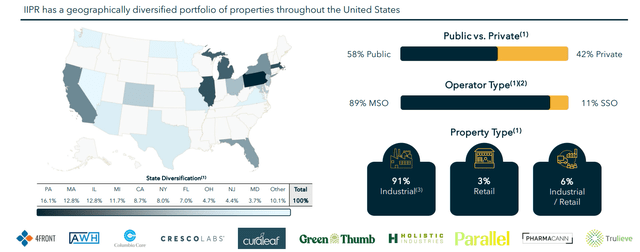

IIPR owns cannabis properties, primarily on the industrial/cultivation side as the name implies, leased to the leading multi-state operators in the United States.

Interestingly, IIPR’s executive chairman Alan Gold also co-founded ARE and another life science REIT, BioMed Realty Trust, acting as its CEO and Chairman from 1998 through its buyout in 2016, before going on to co-found IIPR later in 2016.

IIPR went public at just the right time from a regulatory standpoint. Shortly after its IPO on the NYSE, the federal government disallowed other cannabis-focused companies from becoming publicly traded on a major US exchange. This gives IIPR something of a legal moat.

The problem is that federal legislation still makes banking extremely difficult for cannabis operators, and raising capital has become much harder and more expensive in the current environment. Operators are turning to generating cash flow instead of relentless growth, but turning a profit is still a difficult task.

Luckily, IIPR’s portfolio is filled with most of the largest and strongest operators in the US, and properties are generally concentrated in limited-license states.

IIPR August Presentation

Even so, IIPR’s rent collection rate has dipped slightly this year to 98%. Its tenant-operators will probably continue to struggle paying rent until either federal legislation allows easier banking or interest rates fall to accommodate capital-raising, or both.

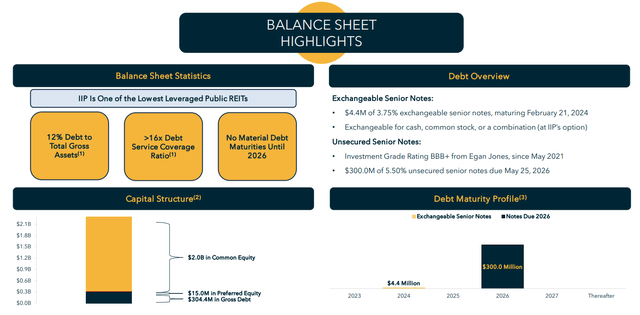

Fortunately for IIPR, its balance sheet is top-notch, sporting a BBB+ rating from Egan Jones (admittedly not a major ratings agency).

IIPR August Presentation

The REIT’s one and only bond matures in 2026. Next year, there is $4.4 million in exchangeable senior notes coming due, but IIPR could simply pay for that with retained cash after dividends.

I have not been buying IIPR this year, as other opportunities have garnered my attention, but it might be time for another look.

Gladstone Land

LAND, as the name implies, owns farmland across the United States. Mainly, the REIT owns farms that produce fruits, berries, vegetables, and nuts. These types of crops typically offer higher-yielding farm properties than low-yielding row crops like wheat, soy, and corn (although LAND owns some of that too).

LAND’s debt is primarily in the form of farmland mortgages with ag lenders. These are amortizing mortgages, which means that principal is paid over time along with interest. Right now, 100% of debt features fixed interest rates.

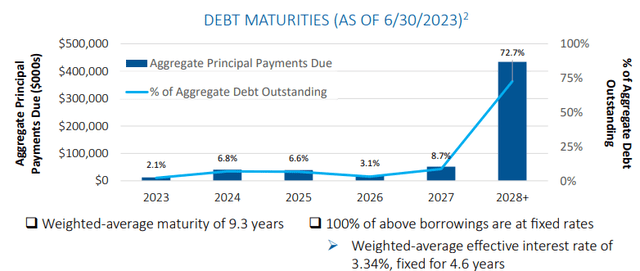

LAND Q2 2023 Presentation

Moreover, these loans have long terms. LAND boasts a weighted average debt maturity over 9 years, fixed for about 4.5 years at a 3.3% interest rate.

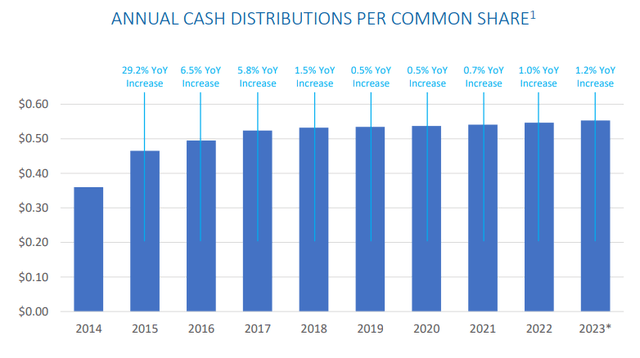

In addition to this low-cost debt, however, LAND also has a fairly significant amount of preferred equity (~25% of total capitalization) at a cost of about 6%. The REIT has used preferred equity to finance a lot of its farm acquisitions in recent years, and these farms come with cap rates right around 6%. As such, AFFO per share and dividend growth has been paltry.

LAND Q2 2023 Presentation

That’s why I no longer own LAND, having been fortunate enough to sell it for a nice gain in 2022.

Instead, I own the 6% Series B Cumulative Redeemable Preferred stock (LANDO), which pays a monthly dividend just like the common stock. Right now, because of its 30%+ discount to par, LANDO yields about 8.7%, and that preferred dividend is backed by highly defensive farmland.

Rexford Industrial Realty

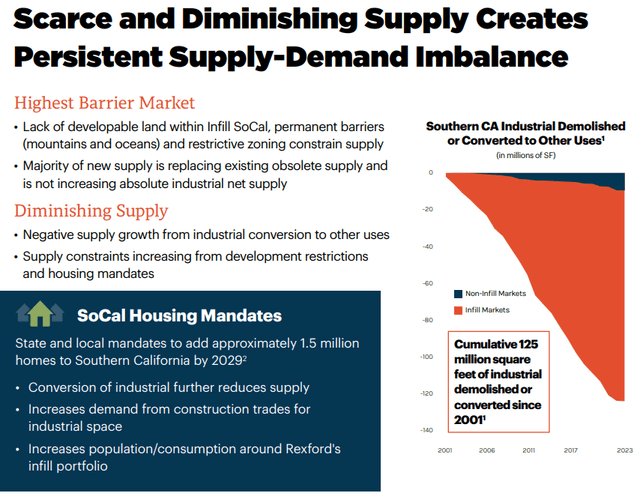

REXR is the premier owner of infill industrial real estate in the extremely supply-constrained markets of Southern California. These properties are situated primarily in the parts of Southern California where new industrial supply deliveries average about 1-2% per year, not including demolitions and conversions of industrial space to other uses.

Over many years, industrial supply has shrunk significantly in Southern California and is expected to shrink further as some older properties are converted to other uses such as housing.

REXR Q3 2023 Presentation

Less supply plus stable or growing demand should equal continued rent growth.

As REXR’s leases steadily expire in the coming years and are re-leased at the market rate, the portfolio should see roughly 50% rent growth. That should translate into 79% FFO per share once all in-place rents are reset to the much higher market rate.

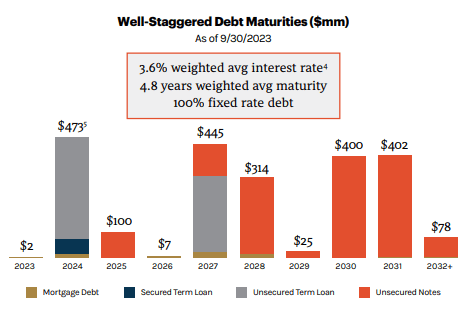

REXR’s ultra-strong balance sheet and cost of capital, exemplified by its BBB+ credit rating, are major advantages in expensive markets where high-quality industrial properties don’t come cheap.

It also helps majorly that REXR has very little debt maturing without extension options over the next few years.

REXR Q3 2023 Presentation

Note that a $400 million term loan scheduled to mature next year has two one-year extension options, and another $60 million term loan maturing next year as three one-year extension options.

Assuming these are extended, REXR has only $13 million in debt maturing next year (although it is unclear to me whether this is maturities or just mortgage principal payments). The next big refinancing year won’t be until 2026, when the $400 million term loan has no more extension options available.

REXR exudes quality in every way, and being able to buy this double-digit-growing REIT at a nearly 3.7% dividend yield strikes me as an incredible opportunity.

Bottom Line

Not all REITs are created equal. Not all REITs are burdened by heavy leverage, substantial floating rate debt, and a wall of near-term debt maturities.

If you want more exposure to real estate (both for income and upside) but don’t want to worry about the pinch of floating rate debt and upcoming debt maturities, I’d say these five REITs are good places to look.

Read the full article here

Leave a Reply