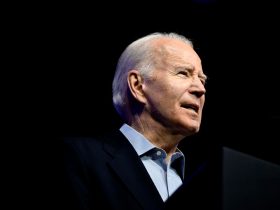

The Biden administration is working on a new student loan forgiveness plan. And borrowers who face significant hardships could potentially qualify for relief.

The new program, designed to replace Biden’s first mass student debt relief initiative that was rejected by the Supreme Court, is currently being developed by the Education Department. Earlier this week, the department released draft regulations identifying four categories of borrowers who could qualify for student loan forgiveness under the new plan. This may include borrowers who owe more now than what they originally borrowed, those who attended predatory schools, borrowers who took out student loans more than 25 years ago, and those who qualify for existing loan forgiveness programs and haven’t applied.

But the department also indicated that it is considering student loan forgiveness for a fifth category of borrowers — those who are “experiencing hardship that is not otherwise addressed by the existing student loan system.” Officials have not released draft regulations for this component of the new student loan forgiveness plan because they are still trying to determine who may qualify, and how to determine eligibility. Nevertheless, the Biden administration has provided some key initial details about how “hardship” could be defined under the program.

Student Loan Forgiveness For Borrowers Experiencing Hardship

In a memo released in advance of next week’s scheduled negotiated rulemaking hearings on the new student loan forgiveness plan, the Education Department provided a preview as to how officials may consider hardship within the context of the new student loan forgiveness program. The rulemaking committee, tasked with trying to reach consensus on the rules governing the new initiative, outlined a number of categories that could indicate a borrower is facing significant hardship:

- The borrower attended a school that closed.

- The person received a Pell Grant, a form of financial aid that does not have to be repaid and is only awarded to students with demonstrated financial need.

- Borrowers who have student loans that they borrowed for their own education, as well as Parent PLUS loans that they took out for a child’s undergraduate education.

- Those who are on Medicare and do not have a Medicare Income-Related Monthly Adjustment Amount. That means their income would be below $97,000 as a single individual.

- Someone who receives an Affordable Care Act subsidy, which would indicate that they earn less than 400 percent of the federal poverty limit under applicable guidelines.

- Borrowers with significant childcare or dependent care expenses.

- Those who are burdened by significant medical expenses or have significant medical conditions but may not qualify for student loan forgiveness through the Total and Permanent Disability discharge program.

- Individuals who have had to file for bankruptcy but did not receive a discharge of their student debt.

- Elderly borrowers.

These are not final categories of borrowers who may qualify for hardship-based student loan forgiveness. Rather, this is an initial outline of possible groups of individuals who could be easily identified as having a hardship.

Possible Process And Amount Of Student Loan Forgiveness

The details of the new student loan forgiveness program are still being hashed out. In addition to determining who may qualify, the rulemaking committee must also consider how the Education Department will evaluate borrowers for hardship-based relief, and how much student loan forgiveness a borrower may receive.

The department’s memo also provides some clues in this regard. The program may require “an individualized review of a borrower’s income compared to their expenses to determine if the borrower faces persistent hardship,” says the department in the issue paper. “Persistence” of a hardship “can be based on whether a borrower meets certain presumptive categories, such as being over a certain age, not having completed their degree, or their loans having been in repayment for at least 10 years.” The department may also evaluate “whether the borrower has demonstrated a good faith effort to repay the debt” when considering hardship-based student loan forgiveness.

Under the draft regulations, the Education Department could provide complete or partial student loan forgiveness.

What Borrowers Seeking Student Loan Forgiveness Should Know About Process And Timing

This new student loan forgiveness plan is still very much in the development phase. The rulemaking committee must hold a series of public hearings where the details of the program are discussed and members try to reach consensus. The initial hearing was held in October.

At the next set of hearings scheduled for next week, the Education Department has tasked the committee with further discussing the potential parameters for hardship-based student loan forgiveness. “The Department has not provided regulatory text addressing this group because additional discussion is needed to define the problem and identify possible solutions,” notes the department in its issue paper.

Another set of hearings will occur in December. After that, the department will release final regulations, taking into account the conclusions and recommendations of the rulemaking committee and the public. This will be followed by another period of public comment and feedback before the plan is finalized.

The loan forgiveness program may not go live until the summer of 2025. However, it is possible that President Biden will direct the Education Department to implement elements of the program earlier than that.

Further Student Loan Forgiveness Reading

Student Loan Nightmare: Millions See Payment Errors as Biden Administration Punishes Servicer

Education Department Unveils Major Details On New Student Loan Forgiveness Plan

5 Student Loan Forgiveness Updates As On-Ramp Begins And Problems Worsen

Check Your Email: 50,000 Borrowers Get Student Loan Forgiveness Notices, And Yes, They’re Real

Read the full article here

Leave a Reply