A spin-off from Verint Systems, Cognyte (NASDAQ:CGNT) is a company providing investigative analytics software for governments and global enterprises.

All-time share performance since going public in 2021 at a price of $30 has been underwhelming so far. Since the end of 2021, share price has continued to decline, reaching an all-time low of $2.6 in October 2022. CGNT has slightly recovered since, and today is trading at $6.9, up almost 11% YTD and 66% over the past year. Nonetheless, CGNT today has lost over 77% of its value since going public.

I give a neutral rating to CGNT. My 1-year price target of $7 suggests that CGNT is fully valued, considering it is trading at $6.9.

Financial Reviews

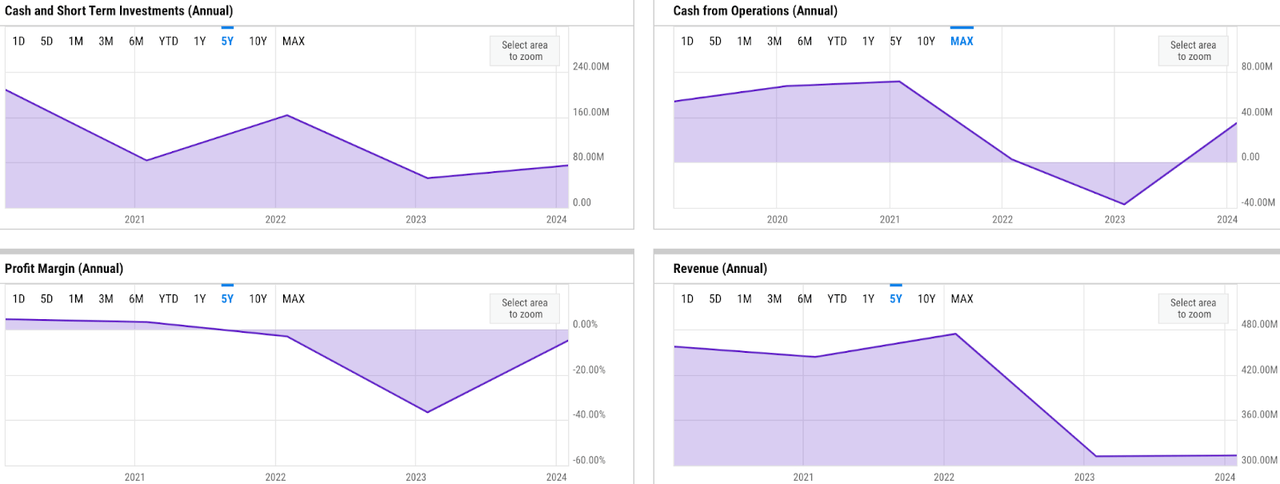

ycharts

CGNT has recently seen a considerable challenge in its business due to reduced funding and shift in spending priorities on the clients’ side. Revenue saw a steep 34% decline in FY 2023 (FY ending January 2023) from $474 million to $312 million, and as of the latest FY, FY 2024, revenue has not yet seen any positive movement from that level. In FY 2024, revenue was $313 million, which is flat YoY.

Amid the potentially persisting headwinds on top-line growth in FY 2024, CGNT made a conscious decision to do cost restructuring, which resulted in net loss margin narrowing from -36% to -5%. This has helped boost operating cash flow (OCF) generation. After burning through -$37 million of OCF last year, CGNT made some of that back as it generated over $34 million of OCF. The demand shock in 2023 also lowered liquidity level to over $52 million, more than a third of the previous year’s. However, the OCF boost appears to have improved liquidity in FY 2024, with CGNT ending the FY with over $74 million of cash and short-term investments with no debt.

Catalyst

CGNT appears to have executed well in FY 2024 in terms of bringing in new clients. In 2023, CGNT saw over 30% decline in its business due to budget issues faced by its existing clients, and it has been struggling to re-accelerate revenue growth since.

Therefore, the recent sales wins in FY 2024 not only demonstrate the company’s adaptability and resilience despite the lingering effect of the downturn last year, but also more importantly indicates future revenue growth potential in FY 2025, as commented by the management in the Q4 earnings call:

Looking at the full year, we signed contracts with 29 new customers, which is up 70% year-over-year. These new customers present a meaningful opportunity to drive growth. In most cases, new customers start small and we believe that our lending expense strategy will drive incremental revenue growth, profitability and cash flow over time.

Source: Q4 earnings call.

Another potential catalyst that could help bolster CGNT’s business growth longer term would be the expected increase in activities in North America.

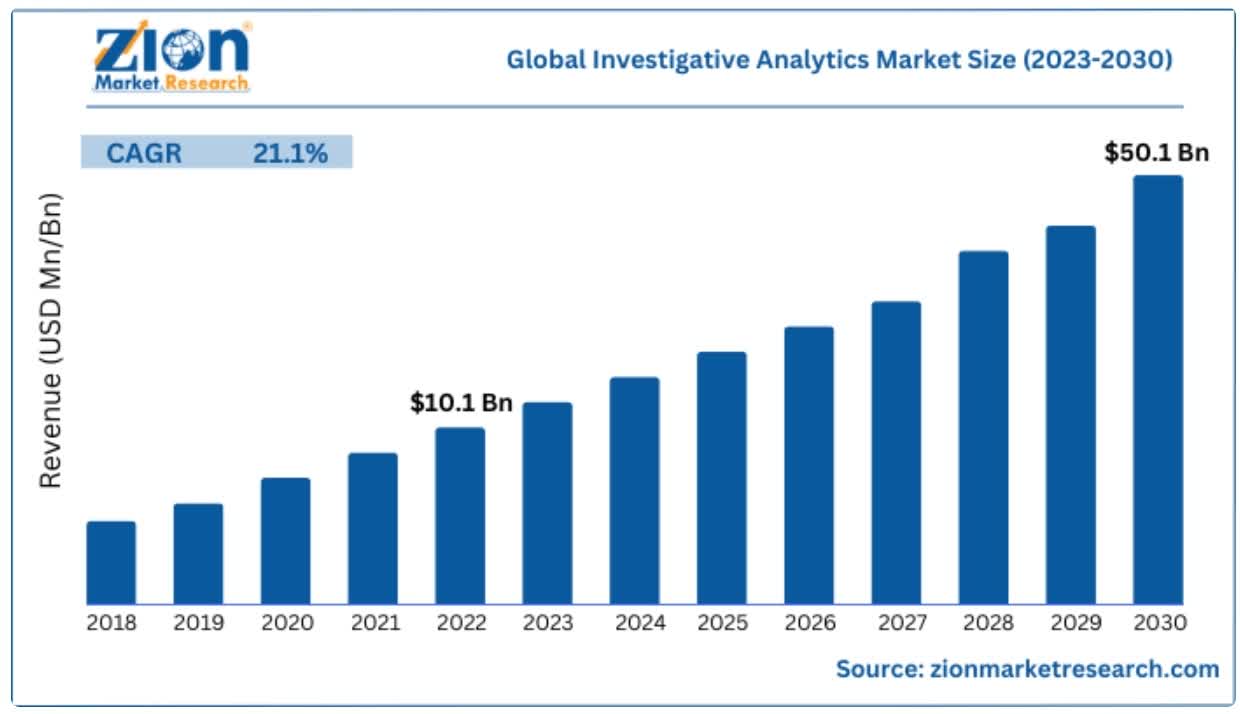

Zion Research

As projected by a market research firm, global investigative analytics TAM will be $50 billion in 2030, with North America making up a significant share of that market. With an estimated TAM of $12 billion in 2023, CGNT would probably own just a little under 3% of the market today. However, since a lot of that share actually is concentrated within Israeli market, where almost 70% of CGNT’s revenue came from as of FY 2024, I see quite a room for upside in North America.

While I don’t expect CGNT to be the number one market leader in North America given the more intense competition, I believe the large TAM presents a good opportunity for CGNT to boost revenue growth. CGNT also appears to have made strategic move by investing more into R&D as it plans to deepen activities in the market without sacrificing profitability. As such, I believe CGNT has made a decent move that carries minimal risks.

Risk

I believe that it will take a while before CGNT can recover to where it was before the demand shock in 2023. About 96% of CGNT’s revenue comes from its existing clients, meaning that it relies largely on installed base expansion for growth:

The majority of our orders are generated from existing customers expanding their usage of Cognyte solutions they have already deployed or the purchase of new solutions from our portfolio to be deployed in other areas of their operations. Revenue recognized from existing customers was approximately 96% for the year ended January 31, 2024.

Source: 20F.

With the declining business in 2023 due to budget cuts happening within existing clients, it could take time before CGNT replaces these clients with newer ones, in my opinion. This would likely be the reason why CGNT saw a flat revenue growth YoY.

So far, CGNT has done its best by signing up 29 new customers in FY 2024. However, while this opens up good expansion opportunities in the future, it is also still unclear how likely these clients will increase their spending with CGNT. As such, I may expect limited upside potential here until CGNT could demonstrate ability to consistently land key clients in the next few quarters.

Valuation / Pricing

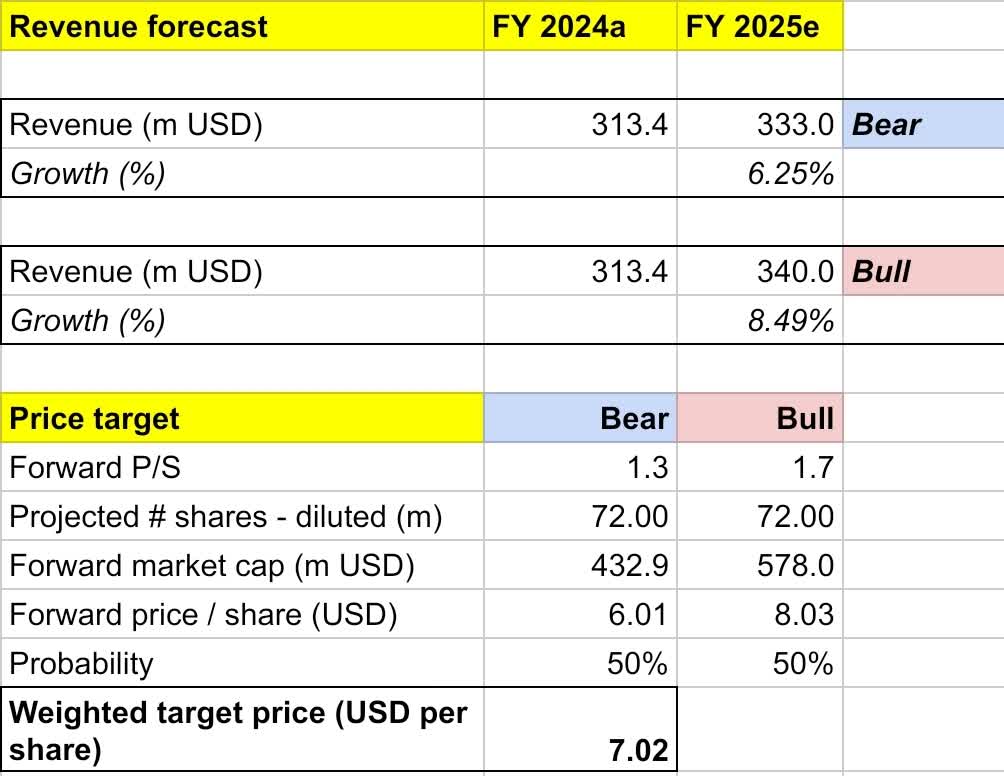

My target price for CGNT is driven by the following assumptions for the bull vs bear scenarios of the FY 2025 (FY ending January 2025) projection:

-

Bull scenario (50% probability) assumptions – I expect revenue to grow 8.5% YoY to $340 million, in line with the company’s guidance. I assume forward P/S to expand to 1.7x, implying a share price appreciation to $8.

-

Bear scenario (50% probability) assumptions – CGNT to deliver FY 2024 revenue of $333 million, more than 2% lower than the bull-case revenue and potentially missing the low-end revenue guidance. I assign CGNT a forward P/S of 1.3x, a contraction from today’s 1.5x that projects correction to $6 or sideways price action at best.

own analysis

Consolidating all the information above into my model, I arrived at an FY 2025 weighted target price of $7 per share. Given that CGNT is trading at $6.9, it appears fully valued today, and I assign the stock a neutral rating.

Conclusion

CGNT is a company operating in a global investigative analysis software market. It is estimated to be an $12 billion market today globally, with the North American market making up quite a major share of it. Consequently, I see CGNT’s initiative to invest more into the North American market and recent promising sales wins as potential catalysts. On the flipside, I believe CGNT will still have a lot of homework to recover from the demand downturn in 2023. While CGNT appears to have a good start to FY 2025, my price target projection suggests that the stock appears fully-valued. I rate the stock neutral.

Read the full article here

Leave a Reply