The corrective phase in the stock market may have started in Q2, but there were red flags beforehand in Q1. Yields were climbing, the rally was slowing, and sector performance was reflecting a more risk-off environment.

One of the sectors warning of a change was utilities, as represented by the Utilities Select Sector SPDR Fund ETF (NYSEARCA:XLU). This was breaking out and outperforming while more risk-on sectors such as technology were lagging (XLK). This article looks closer at XLU, the reasons for its outperformance and whether it is a buy, sell or hold.

The SPDRs

The Select Sector SPDRs are one of the easiest and efficient ways to track and trade sectors of the S&P 500 (SPY). There are 11 ETFs; all are low cost with the same 0.09% expense ratio, and all are liquid. Together, they represent the entire S&P500 (albeit with different weights) and investing in specific sectors with specific weightings can help you beat the index.

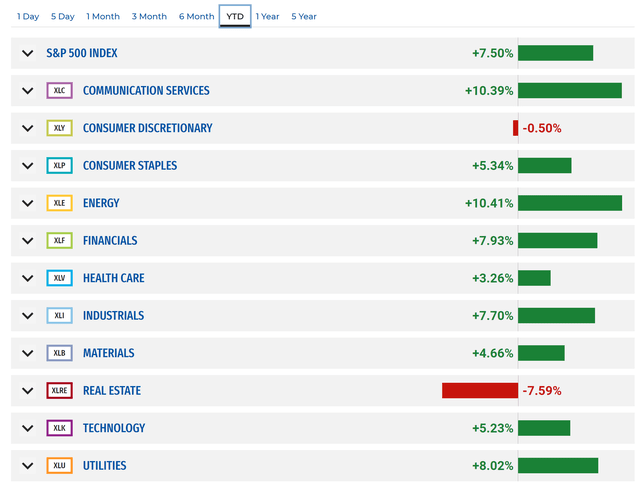

Sector performance tells us about the dynamics of the S&P500. Which sectors are outperforming or underperforming can be a good indicator of risk on or risk off. This is how the sectors are performing in 2024 –

SPDR Sector Performance (Sectorspdrs.com)

The lead from energy (XLE) is not usually a good sign as it is associated with higher energy costs. As already mentioned, XLK is lagging XLU, which is the third best performing sector YTD; another red flag.

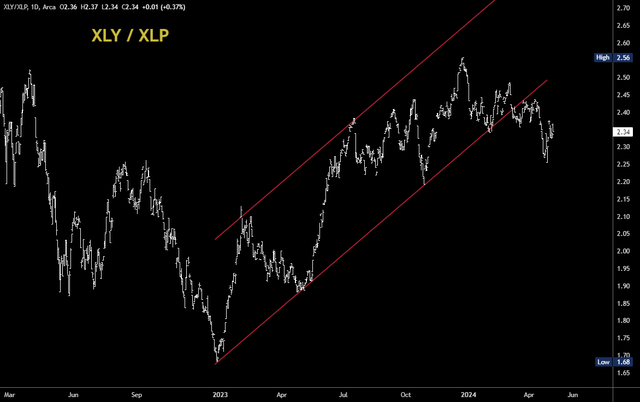

Consumer staples (XLP) outperforming consumer discretionary (XLY) is also a signal of more caution. The XLY/XLP ratio went up during 2023 but has rolled over since December.

XLY/XLP (TradingView)

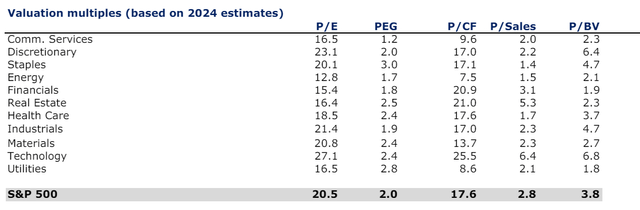

These sector rotations reflect the S&P500 is no longer firing on all cylinders, but they can be seen as healthy for the bigger picture trend. Some sectors are overbought and have high valuations. XLK, in particular, is stretched and could use a rest to allow multiple contraction. If price were to stay unchanged and earnings meet 2024 expectations, the PE ratio would drop to a more realistic 27.1.

Sector PE ratios (sectorspdrs.com)

A moderate risk off environment driven partly by overly hot sectors should be beneficial for XLU, which would not perform well if the S&P500 was in a steep bear market. After all, it still relies on earnings and a healthy economy.

XLU Fundamentals

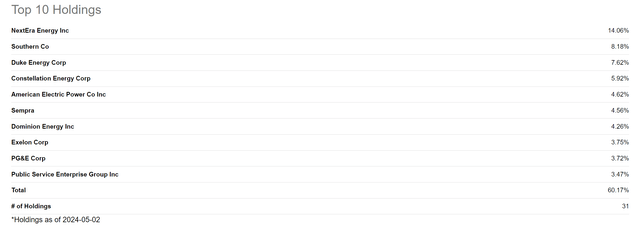

XLU tracks the Utilities Select Sector Index (the “Index”). It makes up only 2.35% of the S&P500 and is composed of around 30 stocks. These have been identified as “Utilities companies by the Global Industry Classification Standard (GICS®), including securities of companies from the following industries: electric utilities; water utilities; multi-utilities; independent power and renewable electricity producers; and gas utilities.”

The Index is one of eleven Select Sector Indexes developed and maintained in accordance with the following criteria: (1) each of the component securities in the Index is a constituent of the S&P 500 Index; and (2) the Index is calculated by S&P Dow Jones Indices LLC (“S&P DJI”) based on a proprietary “modified market capitalization” methodology.

Here are its top 10 holdings, which are heavily concentrated in power companies.

XLU Top 10 Holdings (Seeking Alpha)

Growth in utilities is slow, but there are tailwinds in the sector as energy consumption is expected to rise due to the increase in EVs and AI. Earnings season has been solid so far.

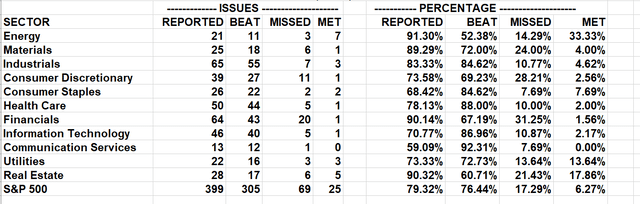

Q1 2024 Earnings (S&P Global)

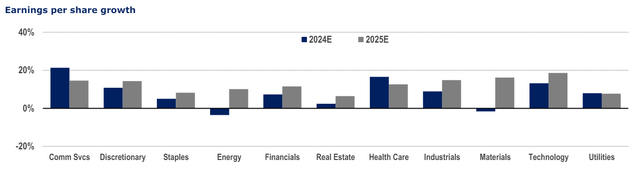

Moreover, EPS is forecast to rise steadily in 2024 and 2025.

Earnings Growth (Sectorspdrs.com)

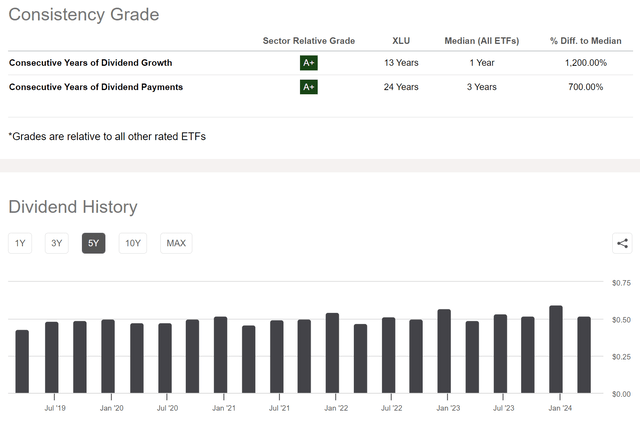

XLU pays a dividend of 3.18%, and the distributions are slowly growing. Seeking Alpha’s Quant Rating is A+.

Dividend Growth (Seeking Alpha)

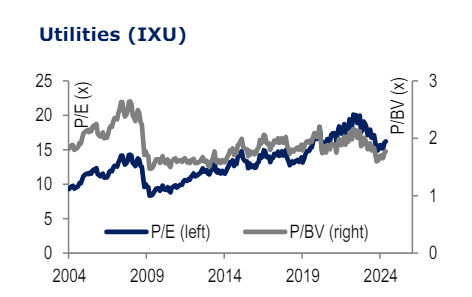

Valuations are typically low. After a spike in the PE ratio into the 2022 peak, it has contracted again and remains attractive.

Utilities Valuation (Sectorspdrs.com)

The steady earnings growth projected and a PE ratio of 16 support the view that XLU could continue to outperform. Lower interest rates going forward could also be a tailwind. Utilities typically have large debt loads, so the expected cuts in 2024 and the Fed’s continued dovish stance are a positive.

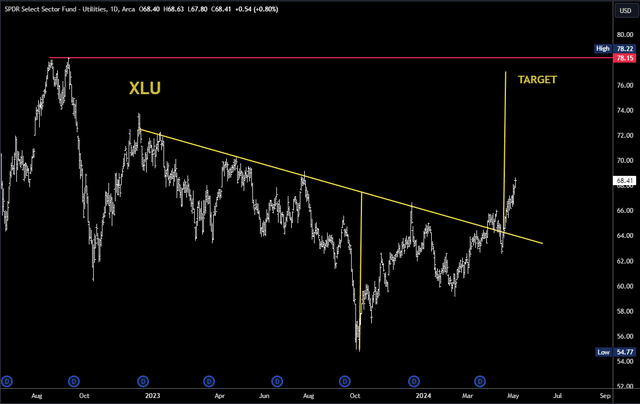

The XLU chart is bullish as it has broken out of an “inverse head and shoulders” pattern.

XLU Chart (TradingView)

This pattern has a target of around $77, which is just shy of the $78.22 all-time high. I think that is a reasonable level to target. $77 would represent a 12% gain from today’s price.

Risks

XLU is at risk of long periods of underperformance. It trended lower throughout the first half of 2023 while the S&P500 was trending higher.

XLU may be associated with a more risk off environment, but it is not immune to broader market sell-offs, especially if they are sharp. It fell significantly in October 2022 when the S&P500 dropped into its bear market low.

The Fed made it quite clear in the May meeting they do not want to hike and see it as “unlikely”. However, if inflation expectations become unanchored, they may be forced into tightening and this could weigh significantly on debt-laden companies in the utilities sector.

Conclusions

Healthy sector rotation out of overvalued sectors and a moderate risk-off environment are leading to XLU outperformance. The sector could continue to rally due to solid earnings growth and an attractive valuation. Lower interest rates in 2024 should provide a tailwind. A bullish chart pattern has a target of $77.

Read the full article here

Leave a Reply