(Note the company name change to Veren (VRN) on or around May 15, 2024)

The previous article on Crescent Point Energy (NYSE:CPG) (TSX:CPG:CA) noted that the management strategy had changed from an acquisition strategy to increase cash flow and profitability (while decreasing the debt ratio) to one of a long-term growth and income strategy. That strategy still appears to be intact. But a disposal of noncore operations was announced for C$600 million and an impairment was taken for these assets as well. That made for a lot of adjustments to earnings and cash flow. Portfolio optimization will gradually decline now that no more acquisitions are in the picture. But it will take some time (probably a year) and some patience. In the meantime, the strong buy outlook appears in place for this former zombie corporation that now has generous cash flow prospects.

Earnings Adjustments

I think one of the most frustrating things for readers is that companies make acquisitions and then report losses, as is the case here. Yet, the acquisitions were supposed to improve the situation.

(Note: This is a Canadian company that reports in Canadian dollars unless otherwise indicated.)

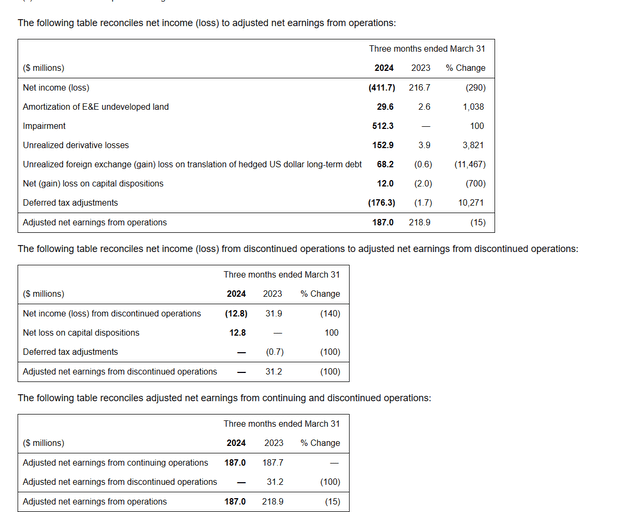

Crescent Point Energy First Quarter Reconciliation Of Adjusted Earnings For Continuing Operations To GAAP Earnings (Crescent Point Energy First Quarter 2024, Earnings Press Release)

As a company improves its situation (as was the case here in dramatic fashion), there may be legacy assets that no longer compete for capital. Those assets, management has decided to dispose of. Therefore, the recent impairment of C$512.3 million has to do with legacy properties that are no longer worth management’s time and efforts.

The numbers to use for comparison purposes are the earnings from continuing operations in the third box above. Going forward, continuing operations are what matters. What tends to make this complicated is if management decides in the very near future to discontinue some of the remaining operations, it retroactively changes the numbers shown here.

The additional consideration is that any acquisitions really need to be combined with past numbers to again find an adequate comparable. This is why the investor evaluation of management is so very important. There is an awful lot of decision-making that often makes quarterly comparisons hard until an acquisition is at least a year old. The dependency upon management integrity and conservatism is huge.

First Quarter Cash Flow And Financial Summary

Many times, the first inkling of improvement from an acquisition program is shown on the cash flow statement.

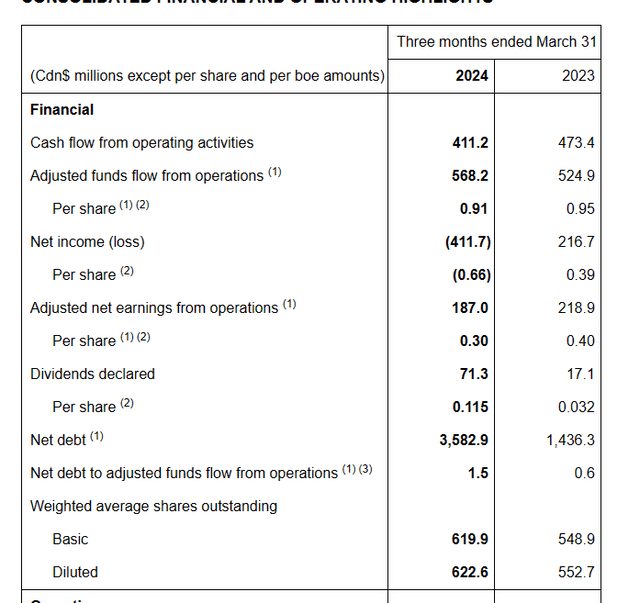

Crescent Point Energy Summary Of First Quarter 2024, Financial Results (Crescent Point Energy First Quarter 2024, Earnings Press Release)

Note that the latest acquisition caused the debt ratio to balloon probably to the top of the market acceptable level. The proposed sale of noncore assets appears to bring that debt ratio down quite a bit when it closes.

Now the average price per BOE dropped roughly C$10 BOE while the operating netback dropped about C$8 BOE. That would seem to indicate that cash flow held up rather well considering the decline in prices.

Since just about any measure of cash flow or profitability is a fraction of revenue, any revenue decline is often magnified by the time one calculates cash flow or profits because costs often remain close to the same per BOE. It is very hard to make up for a revenue decline with a corresponding cost decline.

Guidance

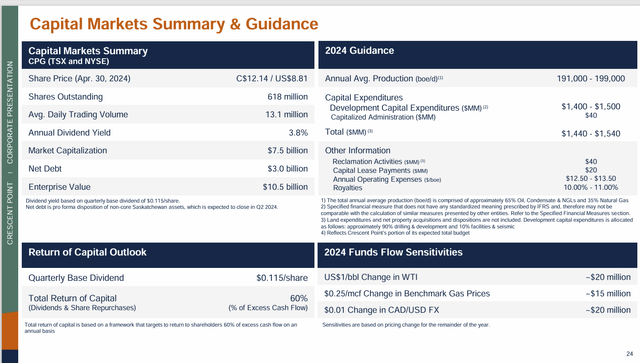

Management anticipates that the total amount of debt will be below C$3 billion by the end of the fiscal year. This is mostly dependent upon the announced sale of noncore properties closing.

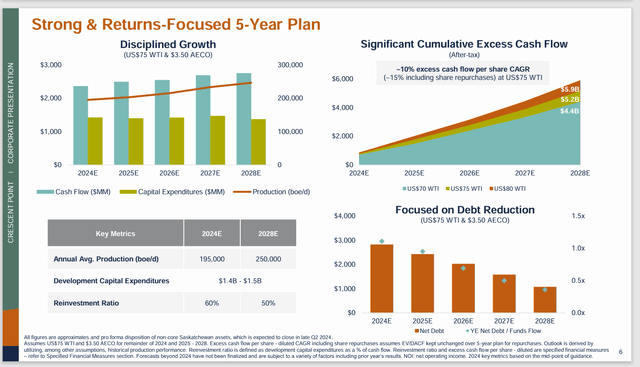

Crescent Point Energy 2024 Guidance In Graphs (Crescent Point Energy Corporate Presentation May 2024)

The growth goal itself is probably a solid goal that will not change as long as commodity prices cooperate. However, the base volume could still change a little bit as management evaluates the portfolio projects and decides if there needs to be more sales. While there is unlikely to be a major sale, it does not cause much of a sale to cause a revision to the numbers shown in the slide above.

More sales would accelerate the debt progress shown at the bottom of the slide (as would higher commodity prices).

Profitable Assets

Most Canadian producers have the advantage of being paid for their oil with selling prices that are linked to United States prices and hence the stronger United States dollar. But the costs are in the weaker Canadian dollar. This helps the Canadian industry’s competitive position tremendously.

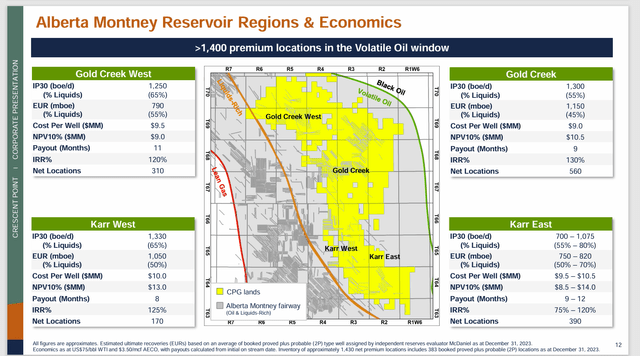

Alberta Montney

This is the most significant of the company assets. The wells are profitable enough to imply a very low breakeven point.

Crescent Point Energy Summary Of Alberta Montney Economics Of Company Properties (Crescent Point Energy Corporate Presentation May 2024)

As shown above, the wells themselves are tremendously profitable. Management claims to have projects underway to improve results. Such projects, if successful, add to the safety of the idea that the acquisition campaign will be a success because it lowers the price at which purchasing the assets was worth doing.

The acreage shown above is roughly half of the company’s projected production.

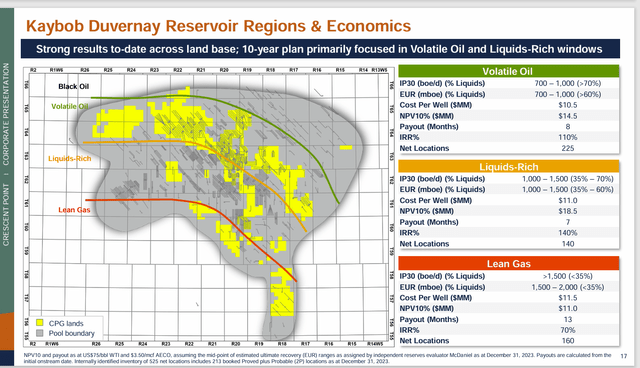

Kaybob Duvernay

This is the second-largest production area in the company portfolio. Like the largest one shown before, the profitability of the wells implies some very low breakeven points.

Crescent Point Energy Summary Of Kaybob Duvernay Acreage Profitability (Crescent Point Energy Corporate Presentation May 2024)

Just about all of the core acreage allows the company to shift drilling from mostly oil and liquids to lean gas as industry conditions dictate. This may allow for greater profitability throughout the industry business cycle because sometimes natural gas does vary from its long-term relationship with oil. The acreage obtained by management allows for a flexible future going forward.

Usually in this industry, management will drill a well that returns the drilling costs plus a reasonable profit. Once that happens, management may or may not hedge the production as they already have “made their money” and the rest is “on the house”.

The paybacks shown above indicate that it is very easy to hedge to make those minimum profit goals for these wells. The longer the payback, the more challenging it is to assure a reasonable profit for capital dollars spent. The industry has a general rule that paybacks should be within two years for it to be worth the risk of drilling a well. In the current environment, many payback periods I report are less than half that as shown above.

Other Properties

The most significant of the other properties is a waterflood project in Saskatchewan. This project provides considerable cash flow with a minimal amount of capital investment. It will be likely held as long as it produces decent cash flow.

Summary

The strategy to change to a growth and income play remains intact. Management is now in the “housecleaning” and asset optimization part that makes quarterly comparisons very hard for investors.

Still the adjusted cash flow in the first quarter, if annualized, heads towards the C$2 billion range (at least) for the full fiscal year.

Crescent Point Energy Capital Structure and 2024 Guidance Summary (Crescent Point Energy May 2024, Corporate Presentation)

The enterprise value is fairly cheap for a company that should generate about $2 billion in cash flow because it is roughly only 5 times that cash flow. It probably should be closer to 10 times cash flow.

As management optimizes operations and optimizes the production mix as well, this company is likely to report earnings growth and cash flow growth in excess of revenue growth for a few years.

The strong buy is based upon a roughly 4% dividend combined with a 10% per year earnings growth and some price-earnings ratio expansion. The dividend is likely to be defensible in a down market with weak commodity prices because it is such a low percentage of the cash flow.

This management is likely to make opportunistic acquisitions from time to time in the future that may well make the earnings growth projection look conservative. But those acquisitions will not be at the pace of previous years. Now the focus will be on organic growth and low costs.

Read the full article here

Leave a Reply