Early April this year, I wrote an article on Morgan Stanley Direct Lending Fund (NYSE:MSDL), which went public only on January, 2024. Despite no meaningful track record as a publicly traded BDC, I issued a buy rating on MSDL mainly due to the following reasons:

- Conservative leverage profile, which was below the sector average.

- Significant diversification at sector and company level.

- Investment focus on stable and relatively defensive businesses.

- Excellent internal risk rating profile, indicating a healthy portfolio.

- Advantage of being connected to Morgan Stanley network, which should warrant a better deal flow.

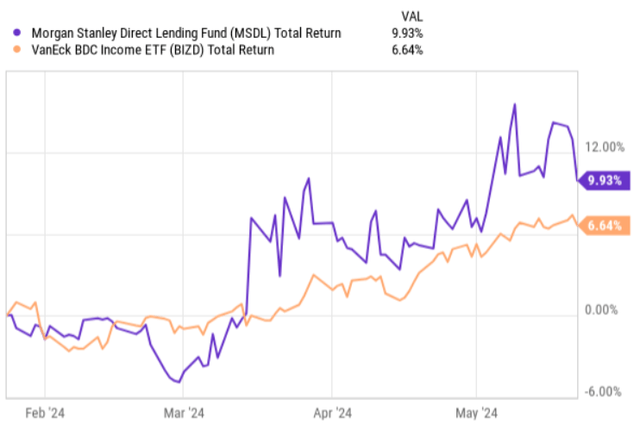

Since the publication of my article, MSDL has nicely outperformed the overall BDC market by roughly 330 basis points, where the index itself has registered rather decent results.

Ycharts

Now, earlier this month, MSDL circulated its Q1, 2024 earnings report, which, in my opinion, include several data points that are worth highlighting and contextualizing against the bull thesis here.

Thesis review

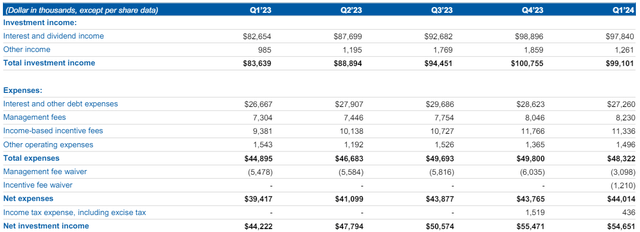

If we look at the core metrics, which measure the underlying performance of MSDL, we will notice somewhat suboptimal dynamic. For example, the top-line results for the first quarter landed at $99.1 million, as compared to $100.8 million in the prior quarter. In the meantime, the net cost base expanded a bit on a quarter on quarter basis (albeit the increase was very minimal). As a result of this, the net investment income figure contracted by 1%.

Theoretically, we could draw a conclusion from this that the MSDL has landed in a position in which the growth outlook does not look that promising.

MSDL 1Q24 Earnings Presentation

Yet, this would be a wrong way how to interpret these data points. There are several reasons for this, which I will outline below.

First, we have to understand that Q4, 2023 included some notable extraordinary items that inflated the results. In other words, the slight decrease in Q1, 2024 relative to Q4, 2023 is mostly explained by a reduction in non-recurrent repayment income, which should not be considered a core item. For example, if we compared Q1, 2024 results to those of Q3, 2023, we would arrive a decent growth in top-line of ~5%.

Second, by peeling back the onion a bit, it becomes clear that MSDL is indeed able to extract the benefit of being closely connected to Morgan Stanley investment banking branches.

The table below depicts how MSDL’s net investment volumes have been consistently positive over the past five quarters, which is not that common in the overall BDC space, where many players struggle to source in volumes because of inactive transaction markets. In MSDL’s case, the investment activity amounted to $232 million and the investment fundings totaled $168 million, which were partially offset by ~ $72 million in repayments, thus leading to a total net funded investment activity of circa $98 million.

MSDL 1Q24 Earnings Presentation

This is critical to maintain a positive momentum in the net investment income growth, especially against the backdrop of overall spread compression in BDC investments.

Third, while MSDL has managed to grow the portfolio it has not sacrificed the quality of its investments. At the end of Q1, 2024, the portfolio weighted average LTV stood at 43%, which is an indicative of robust balance sheets at the underlying portfolio company level. In this respect, it is also worth mentioning the situation at the internal risk ratings front. Ending Q1, 2024 MSDL had over 98% of its total holdings at rating 2 or better, which means that these investments are performing above expectations or even better. In terms of the non-accruals, the values remain very low, accounting for 40 basis points of portfolio book value.

Fourth, the dividend remains well-covered despite the fact that MSDL still carries one of the least leveraged balance sheets in the BDC sector. In this quarter alone, MSDL outearned its dividend by $0.13 per share, which leaves plenty of capacity to boost the distributions higher from here.

In the recent earnings call, Jeff Levin – President and CEO – provided a nice color in relation to MSDL’s dividend outlook:

So Q1 and now Q2 with the Board declaration that we just announced, our regular distribution has been $0.50. I think we’re ultimately trying to stick to maintaining that regular distribution in the coming quarters as well. In the prepared remarks, we also highlighted that we do have two special dividends at the tail end of this year of two $0.10 dividends. So ultimately that would be now looking at $2.20 in ultimate dividends that we’re projecting for the current period.

At the current share price, the planned dividend payments translate to a dividend yield of ~10%, which very enticing considering the aforementioned aspects.

The bottom line

From the surface it might seem that MSDL has registered worse performance than in the prior quarter as the top-line and net investment income have declined a bit.

Yet, if we assess the situation more carefully and adjust for the extraordinary items, we will notice a rather decent growth momentum. The net investment volumes continue to remain strong, while the portfolio quality still remains in a solid territory with a tiny non-accrual base. On top of this, MSDL has a significant growth potential stemming from the unutilized leverage capacity, which once the deal volumes starts to get back to more sizeable figures could be put at work to accommodate the expansion. Furthermore, despite the conservative leverage profile, MSDL’s is still able to offer ~10% in yield.

As a result of this, Morgan Stanley Direct Lending Fund continues to be a solid buy for me.

Read the full article here

Leave a Reply