Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the third week of May.

Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the closed-end fund (“CEF”) markets for perspectives across the broader income space.

Market Action

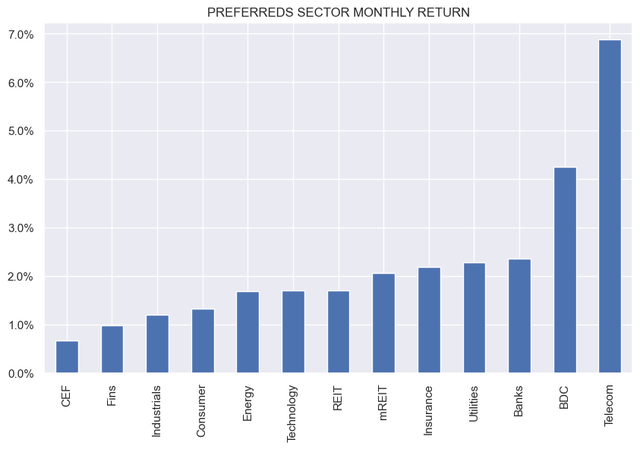

Preferreds had a good week as longer-term Treasury yields continue to fall. Month-to-date, all sectors are in the green, with the higher-beta sectors leading the way.

Systematic Income

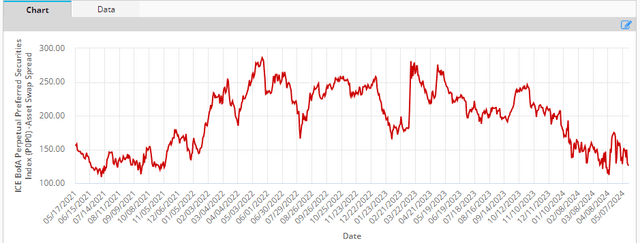

Preferreds credit spreads tightened back down after a recent blip, offering less value for investors, particularly with Treasury yields now lower as well.

ICE

Market Themes

There is renewed speculation about preferreds redemptions. The view seems to be that because short-term rates are not going to fall this year as much as anticipated earlier will motivate companies to redeem floating-rate instruments. The usual suspects here that people often think will get redeemed are AGNCN, NLY.PR.F, RITM.PR.A and RITM.PR.B, and many others.

The fact that stable short-term rates could incentivize issuers to replace their floaters with longer-term debt may sound intuitive; however, it assumes that the market stands still. When the consensus at the start of the year was for 6-7 cuts, the 5Y Treasury yield was around 3.85%. Now that people expect 1-2 cuts, the yield is at 4.45%.

In other words, it’s a lot more expensive to replace floaters with longer-term debt today than it was at the start of the year when people thought short-term rates were moving lower quickly. There is no free lunch. Many companies are probably kicking themselves that they didn’t lock in attractive longer-term yields earlier in the year because they thought the drop in short rates would make their floaters much cheaper to service. Now that short-term rates are expected to remain higher for longer, longer-term rates have risen as well, as one would expect.

The other thing to keep in mind is that these issuers can already refinance their preferreds at cheaper levels – by using repo or other secured facilities. AGNC can pay around 5.25% on the repo instead of paying close to double that on AGNCN. However, it has (so far) chosen not to do that, all of which begs the question is whether refinancing is a sure thing.

There are many reasons why companies issue bonds, so just because we see a new bond out there doesn’t mean it is there to refinance a preferred. For one, credit spreads are very tight. B-rated corporate spreads – roughly where many of the usual suspects like BDCs and mortgage REITs issue bonds – are at the tightest level in more than a decade. In short, bonds are cheap to issue and companies are tapping them.

FRED

Another reason why BDCs and REITs are issuing bonds is that their portfolio assets have increased in value, along with just about everything else in the markets over the past year. This has organically deleveraged their portfolios. If they want to push leverage back up to the target level, they need to issue more debt.

Another indication that bond issuance is not necessarily there to redeem preferreds is that we haven’t seen much of this so far. REITs like MFA and MITT issued bonds recently but haven’t done anything to their preferreds.

To be clear, we do expect some amount of preferred redemptions and, indeed, we have seen this in some sectors, banks especially. However, a broad-based redemption of floaters is unlikely in our view. Moreover, the issuance of debt is not a strong signal of upcoming preferred redemptions either.

All in all, we continue to favor many fix-to-float preferreds with upcoming call dates, particularly where the reset yield step up is high and where the price is below $25. This includes the two RITM preferreds mentioned above, as well as stocks like SNV.PR.E. Either the stock steps up to a very attractive yield or you get a small capital gain boost (and high annualized yield over a shorter period).

Market Commentary

Mortgage REIT PennyMac (PMT) preferreds came up on the service. Recall that management declared last year that PMT.PR.A and PMT.PR.B were not going to transition to a floating-rate as originally intended and will remain fixed. There was a Preferreds Weekly discussing some of the mechanics. When the news broke, there were a lot of hot takes about how the company would be buried with lawsuits, forced to cave, and switch back to a floating-rate.

Our view was that this was pretty unlikely for a number of reasons, both legal and practical, and here we are with PMT.PR.A declaring the same fixed dividend for its first floating-rate period. We don’t hear much about the avalanche of lawsuits and the commentariat has moved on, it seems.

PMT.PR.A looks best in the trio with an 8.8% yield. The PMT preferreds are a nice diversifier within the mREIT sector given PMT’s origination platform which provides some stability to book value as we saw during the COVID crash in particular.

Read the full article here

Leave a Reply