Happy Memorial Day! I also want to thank everyone who has served or is serving and express my deep appreciation and condolences to anyone who made the ultimate sacrifice to protect our freedoms.

I’ve been bullish on the S&P 500/SPX (SP500) and stocks in general when covering the major averages lately. However, I must express some (near-term) caution as new negative technical factors materialize.

Did We Witness A Blow-Off Top?

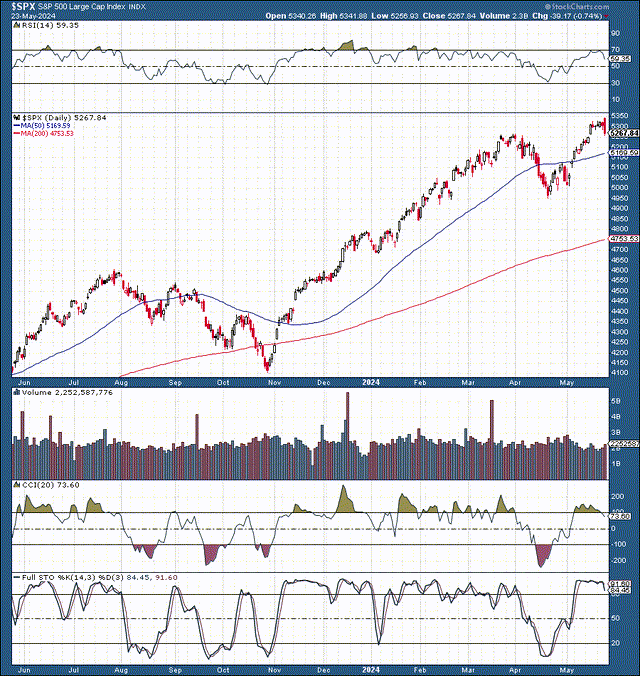

SPX (StockCharts.com)

The SPX opened around a new ATH recently (Thursday), yet the market declined by about 0.75% by the session’s end. Despite the constructive long-term setup, the market may need a more pronounced pullback or a consolidation phase to digest the recent stock appreciation.

Technical indicators such as the RSI, CCI, and full stochastic also suggest that the market may need a more considerable consolidation phase before achieving decisive new highs.

This dynamic aligns with the potential for increased rotation and consolidation in the 5,300-5,100 range while the crucial support range remains at the 5,100-4,900 level. Therefore, we could see more sideways price action before moving to new ATHs again.

What To Look For As We Advance

We have some critical data coming this week. Consumer confidence, GDP, and (most importantly) the PCE will be out on Friday. More specifically, it’s the core PCE that interests us most. The last core PCE was 2.8%, hotter than the 2.6% estimate. The latest CPI reading was slightly better than expected, and we want a similar trend with the PCE.

The Core-PCE To Decrease More

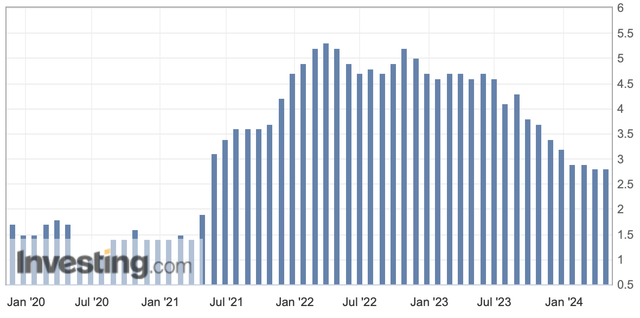

Core PCE (Investing.com)

Preferably, we will see a core PCE of 2.7% YoY or lower. This better-than-expected reading should foster a favorable reaction from the market, and we could see an extension to the recent rally, granted that construction inflation numbers come in on Friday. This trend of falling inflation is positive and implies we could continue seeing lower inflation readings in future months, enabling the FOMC to cut rates soon.

The FOMC – Set Up To Cut Soon

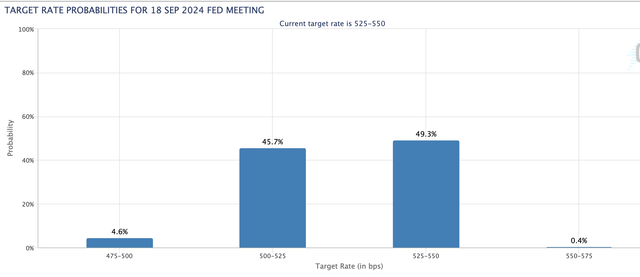

Rate probabilities (CME Group)

There is about a 50/50 probability that we will see at least one rate cut on/by the September 18th FOMC event. Also, the rate-cut probabilities could be skewed too much to the hawkish side now, and we may see rate-cut probabilities increasing as future inflation readings and other constructive data materialize. This dynamic creates a favorable backdrop for stocks and other risk assets moving forward, as a more accessible monetary environment should increase the appetite for risk assets, enabling high-quality stock prices to rise.

Are The P/E Ratios Sustainable?

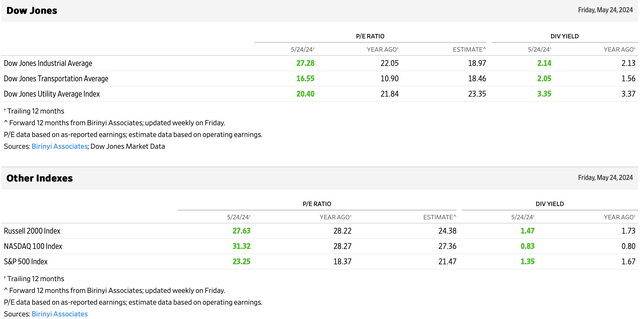

P/E ratios (WSJ)

While the SPX’s 23 and the Nasdaq 100’s 31 P/E ratios may seem expensive, they could be relatively cheap, provided the upcoming macroeconomic environment, growth prospects, alternative asset classes, opportunity costs, and other factors.

The market is poised for strong growth, with a forward P/E ratio of 21.5 for the S&P 500 and 27 for the Nasdaq 100. Furthermore, R2K’s forward P/E ratio of 24 signals the potential for further market expansion and small/mid-cap outperformance, reinforcing a positive and confident outlook.

We could see better-than-anticipated earnings growth and multiple expansions as the Fed cuts rates. The current P/E ratios could expand further, and the valuations may not be expensive.

Why The Market Likely Is Moving Higher

Many stocks have appreciated considerably, and even though there should be considerable upside ahead, we may see more rotation, consolidation, and pullbacks. Still, intermediate and long-term fundamental factors remain solid, with growth likely to improve and the Fed likely to cut interest rates soon. Moreover, we may see the probabilities for a cut sooner increasing, as future inflation data may come in better than the maker expects. Due to this constructive dynamic, I am keeping my year-end SPX target range at 5,800-6,000 despite the possibility of more volatility in the near term.

Read the full article here

Leave a Reply