Investment action

I recommended a buy rating for Progyny, Inc. (NASDAQ:PGNY) when I wrote about it in mid-March this year, as I continued to view the long-term growth outlook as attractive. Based on my current outlook and analysis, I recommend a buy rating. My key update to my thesis is that I don’t think the weakness in 1Q24 revenue is indicative of a structural long-term impairment to growth. Historical US ART cycles suggest a solid long-term growth trend, and any downturn is typically met with a strong rebound afterwards, which gives me confidence that we will see a rebound eventually. Also, there are leading indicators that suggest the utilization rate is already back on track.

Review

Briefly touching on the latest results, PGNY reported earnings in early May, which saw revenue growth of 7.6% to $278 million, missing the street expectation of $290 million. Breaking down the growth, fertility benefit services saw growth of 8.1% to $169.8 million and pharmacy saw growth of 6.9% to $108.3 million. Gross margin declined by 18bps to 25.7%, while EBITDA margin expanded 14bps to 18.1%, which was $50.3 million on an absolute basis. Overall, 1Q24 results were disappointing, with revenue underperforming due to weak utilization, and that basically drove the stock down bigtime, from ~$32 to ~$26 today. Below, I talked about why I think this miss is just a one-off issue and why I still believe the stock is trading at very attractive levels.

On the miss, my view is that it wasn’t due to anything structural. The year started out right, with utilization rates in January and February trending in line with 2023. However, utilization saw a sharp decline in mid-March, and this drove the miss in revenue. What, I believe, happened was that a lot of patients are adjusting their expectations around access to maternal healthcare following the Alabama Supreme Court ruling, especially in states with the most restrictive laws for women’s reproductive rights. In other words, I believe utilization rates are being delayed and not permanently impaired. Once there is more clarity (the recent Senate bill should help to clear up any confusion), In fact, management already noted that in April, the utilization rates were stable and have improved from trough levels. Also important to note is that while utilization fell in states with more restrictive laws for women’s reproductive rights, there was no decline in demand for PGNY’s fertility benefits amongst employers in those affected regions. This is crucial because it means employees can continue to have access to affordable IVF (more potential demand and future utilization).

My expectations are that PGNY will see growth reaccelerate in the coming quarters, as there are several indicators that suggest demand remains solid. Firstly, the year-to-date pipeline remains very strong based on early indications. It was specifically called out that the pipeline is more active relative to last year. Notably, the industry pace of adoption seems to have picked up as: (1) PGNY is seeing more early commitments from a robust pipeline of not-nows mentioned last November; and (2) PGNY saw strong commitments in healthcare, auto, manufacturing, etc. My view on the increased adoption rate is supported by the fact that 45% of large employers offered IVF coverage to their employees, up from 23% in 2019. On an aggregate basis, statistics show a 10 pts improvement in IVF treatment coverage in 2023 vs 2020.

Conditionally, the not-nows represent the majority of the early commitments we received, and 2024 is proving to be no different with strong early commitments from leading brands in healthcare, auto manufacturing, travel and leisure, and media, as well as multiple state and local government populations. 1Q24 earnings call

One other indicator that also suggests demand remains healthy is that engagement has persisted at levels above 2022. This suggests that the current increase in adoption and growth in pipeline is not an outlier event that is one-off.

What gives me comfort in focusing on the long term is that IVF demand has historically been resilient, and I don’t see major catalysts that will change this trend moving forward. The CDC has historical data on ART cycles, and based on that data, ART cycles have continued to go up over the past 20 years, and the only periods where growth turned negative were during COVID and sub-prime, but growth rebounded immediately after each crisis ended. During sub-prime, ART cycle growth turned negative in 2009 and 2010, but rebounded back to 3.2% growth immediately in 2010, which was a similar growth rate seen pre-crisis (2005–2008 average growth was 3.7%). The same was true for the COVID period, which saw negative growth of -1% in 2010 but rebounded to ~27% growth in 2021.

Valuation

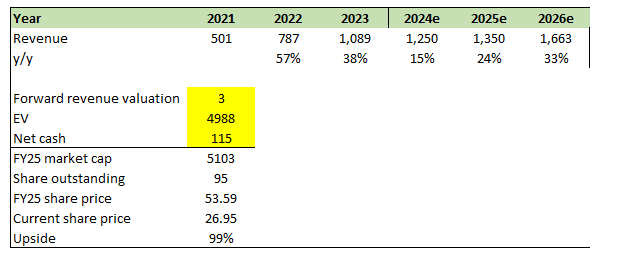

Author’s work

My view has not changed for PGNY. I still believe it can accelerate growth back to >30% eventually as all the short-term issues go away and the economy recovers. The problem is timing when growth will reaccelerate. Previously, I expected growth to hit >30% in FY25, but in order to be more conservative today, given the ruling issue and persistently weak economic outlook, I have pushed off my estimates by 1 year. Using FY24 revenue revised guidance of $1.25 billion at the midpoint (implying 15% y/y revenue growth), I projected a linear expansion in y/y growth rates to 33% in FY26, implying that PGNY will generate $1.66 billion of revenue in FY26. I don’t think this is a high hurdle, as this is a business that has grown by 38% just last year.

The market should react positively to growth acceleration over the years, and I believe PGNY should trade up to at least 3x forward revenue, which was where it traded at in FY23 when growth was >30%.

Based on these assumptions, I have a target price of ~$54 in FY25.

Risk

With the volatility in utilization, I think investors are going to be a lot more conservative in their estimates, especially with the guidance embedding a recovery in 2H24. Until PGNY shows that utilization improves on a reported basis, the stock may be rangebound in the near term. Also, according to historical cycles, if the economy continues to slow or tips into a recession, PGNY will be directly impacted.

Final thoughts

My recommendation is a buy rating despite a revenue miss in 1Q24. I believe demand is simply delayed due to recent legal uncertainties, not due to structural factors. I still believe in the long-term outlook of the business as historical trends show IVF demand is resilient, with strong rebounds following economic downturns. Also, there are leading indicators that suggest a rebound in utilization is already underway.

Read the full article here

Leave a Reply