The uranium sector has been on a tear for the last few years and it is not hard to understand why. Multiple catalysts accompany this bull cycle and the base case for the bull thesis lies in the fact that the supply may not meet the required demand and ramping up supply is not something that happens overnight. This is where I believe an opportunity exists for a company like UR-Energy (NYSE:URG)(TSX:URE:CA). The company has an established production base in the U.S. (great jurisdictional appeal), is a low-cost producer, and ramping up supply quickly with a clear growth path. Therefore, I believe it is well-suited to capitalize on the fundamentally bullish uranium market condition that is being witnessed now and I am currently long on the company.

Uranium Bull Cycle Catalysts for this decade

I believe the following catalysts are accompanying the whole bull cycle –

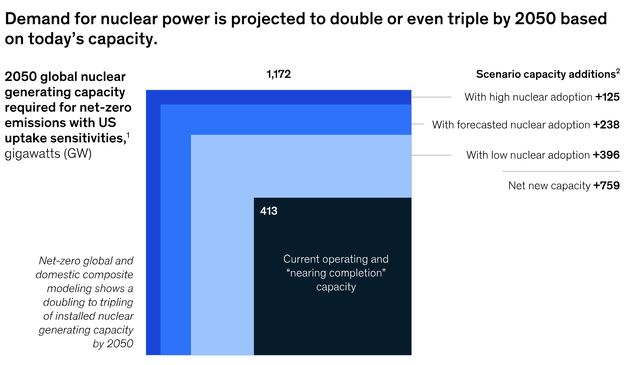

1. Demand for Nuclear Energy: The sentiment has swung from the extremely negative (post-Fukushima disaster) to being the only viable long-term solution in the fight against climate change. Global demand for nuclear power as a carbon-free source of baseload electricity to meet rising energy needs (while transitioning away from fossil fuels like coal) will keep rising as countries choose to keep their nuclear plants operational for longer or have new build-outs. The IEA expects global nuclear generation to be almost 10% higher in 2026 compared with 2023.

McKinsey

2. Uranium Supply Constraints: Years of persistently low uranium prices forced many miners to cut production and make minimal capital investments. This supply discipline and the long lead times to bring new mines online have created a Uranium supply crunch as demand picks up. The Uranium Producers of America predicts that the US will need to open 8-10 new major mines in the next decade to meet the rising demand.

3. Uranium Supply from Russia: The Russia-Ukraine conflict has highlighted energy security risks for many nations reliant on Russian uranium supplies. This has accelerated efforts by countries to secure domestic uranium sources and diversify supply chains away from Russian imports. Recently, President Joe Biden signed a ban on imports of enriched uranium from Russia, which provides about a quarter of the reactor fuel in the US, making it the country’s top supplier (The signing unlocks approximately $2.7B in funding in previous legislation to build out the U.S. uranium fuel industry)

Company’s May 2024 Update on Ur-Energy Operations

Wrapping up, as uranium prices have more than tripled over the past three years, the economics or demand for uranium miners and related companies have significantly improved, attracting investor interest back into the sector after years of underinvestment. Additionally, inflation in the past three years has fueled a commodities rally of which Uranium has been a key beneficiary. So let us see how well Ur-Energy is positioned to capitalize on these catalysts.

Where does Ur-Energy stand in this cycle?

First a little bit of history about Ur-Energy. It is a uranium mining company focused on developing and operating in-situ recovery (ISR) uranium facilities in the United States. The company was founded in 2004 and has been producing Uranium for a little over 10 years. Their Lost Creek Mine where they started their production in 2013, was low-cost production but the management decided to slow it down post-Fukushima disaster and the demand and the sales contracts dropped.

Fast forward to last year, the improvement in Uranium demand gave management the confidence to kickstart their operations into high gear. Currently, their active mine is licensed for 1.2M lbs./year, while the processing plant is permitted for 2.2M lbs./year. The excess capacity gives the company flexibility to process uranium from its other projects (Shirley Basin) or toll process material for other producers. This is a great strategy for the company as the infrastructure is in place should the company decide to ramp up its operations as the demand takes off even further and/or diversify its projects.

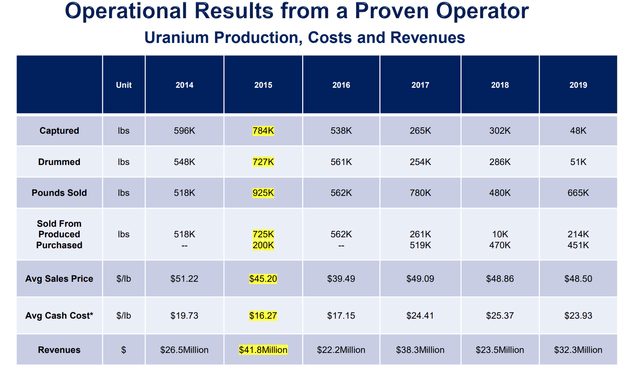

Ur-Energy company is a Proven Low-Cost Producer with U.S. Jurisdiction Appeal

Ur-Energy company has proved its ability to produce uranium at low costs which allows it to remain profitable even at lower uranium prices. In the last two quarters of 2023, the average cost per pound sold was $28 and the average price per pound sold into term contracts was $60.45 which resulted in an average gross profit per pound sold of $32.41 and an average gross profit margin of nearly 54%. Additionally, what makes this production all the more attractive is the fact that Ur-Energy’s U.S. assets appeal to utilities seeking reliable domestic uranium sources amid supply chain concerns, especially given recent geopolitical tensions impacting Russian uranium supplies.

Company’s May 2024 Update on Ur-Energy Operations

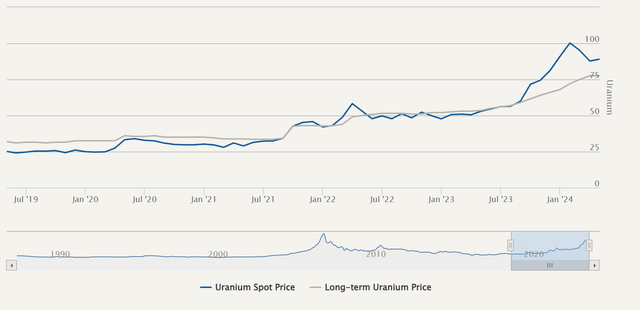

Leverage to Rising Prices

Uranium Price Chart (Cameco)

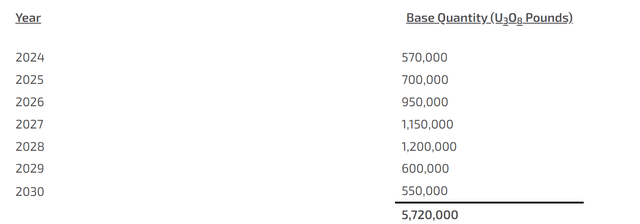

The spot pricing market is much more attractive with a peak price that we saw earlier in the year reaching highs above $106 per pound. Both spot and term pricing markets are driven by utilities and a strengthening market means more requests for long-term engagements. The company contract book now stands at a total of 5.7M lbs. with deliveries occurring from 2024 – 2030. Sales prices are expected to cover all production costs and be profitable. These prices will increase every year and will also adjust based on market conditions. Here is the kicker. The contracts do not preclude further participation from the company. Over 50% of the licensed capacity from 2024 – 2030 remains available for sale in the spot or long-term market.

Clear Growth Path

The company has obtained all major permits and licenses to bring its high-grade Shirley Basin project online as a satellite operation to Lost Creek. The CEO in his latest letter to shareholders has mentioned that they are working on bringing this site to production and the objective is to be a two-mine company by the first quarter of 2026.

When the Shirley Basin mine and satellite plant are constructed and operational, our Company-wide licensed and constructed production capacity will be 2.2M pounds per year.

– John W. Cash, Chief Executive Officer

The best part about their growth strategy is their plan to build a satellite plant that will minimize capital and operating expenditures while retaining the ability to expand the plant. This will drive margins as they grow further boosting their cashflows.

Cashed-up

Ur-Energy company is debt-free and has $54M of cash on its balance sheet. This again puts the company in a favorable position for growth. With a strong cash position and no debt burden, the company can self-fund to an extent further exploration programs, feasibility studies, permitting processes, and initial development/construction costs for their ongoing projects (Allows for the advancement of projects towards production without the need to raise additional capital through equity, debt, other financing options, and/or without being restricted by existing debt covenants or repayment obligations)

Personally, I like the financial discipline and the lower investment risk that comes with companies with healthy balance sheets. The growth potential is the cherry on top.

Ur-Energy Company’s Q1 Results

Reviewing the results I continue to see progress in their operations which gives me more confidence in my thesis –

- Ramp up in Lost Creek has continued with more infrastructure for ore production (Approximately 38k pounds produced and 34k shipped with total finished inventory at 79k pounds)

- A new sales agreement signed in April commits to delivery of 100k pounds annually from 2026 – 2029, a portion of which is tied to production milestones. Below is a summary of their delivery agreements at the end of last quarter.

Sales Agreements (Q1 Results)

- Financially, for Q1, no sales were recorded, cash stands at $54M(a decrease of $5.8M QoQ), $14.5M was spent on operating activities, $0.8M used for investing activities, and $9.6M from financing activities was generated.

- The company has guided 2024 production to be 550k – 650k pounds (sufficient to cover the delivery agreement).

Ur-Energy’s valuation is fair when you consider the growth ramp-up

Valuing Ur-Energy stock based on the present situation would not be accurate considering the whole thesis rests on their growth positioning. By 2026, if it is producing at its full capacity of 2.2M pounds per year and can realize the demand for its full production, we can calculate its revenues based on a blended rate range (Blended simplifies revenue calculation as they would have multiple contracts in place, each being fulfilled at a different price and they may also be selling into the spot term market). Note that in this calculation we are excluding revenue from interest income and waste disposal fees.

Author generated

1. Current EV ($454M) is calculated considering their market cap of $506M, debt-free, and cash in hand of $54M.

2. I took $60/lb. as the base case scenario as they already are in the process of realizing contracts with this pricing in place (In 2023 Q3/Q4, the average price per pound sold into term contracts was $60.45. These contracts were likely inked in 2022. Also, in their May 2024 Update on Ur-Energy Operations, they mentioned that the US Uranium Reserve Dept. of Energy issued contracts in December 2022 including the purchase of 100k pounds from Ur-Energy at $64.47/pound )

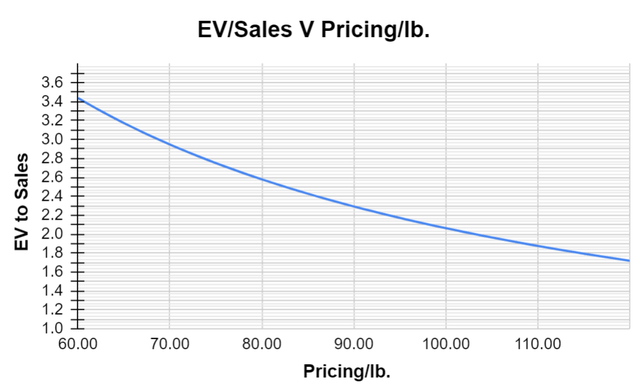

3. Going forward, maintaining the thesis that Uranium pricing remains strong, any additional contracts will be signed at a price higher than $60/pound. In my chart at the furthest end of the pricing curve, we have $120/pound. A blended rate of $120/pound is highly unlikely and will remain as a tail scenario. But in this pricing range, we can see EV/Sales varying from 3.4x to 1.7x. A reasonable blended/average rate could be $80/lb. which puts our ratio at 2.6x a very attractive prospect considering established miner such as Cameco is trading at a much higher valuation.

But what if we cannot realize the production and sale of 2.2M pounds per year?

Author generated

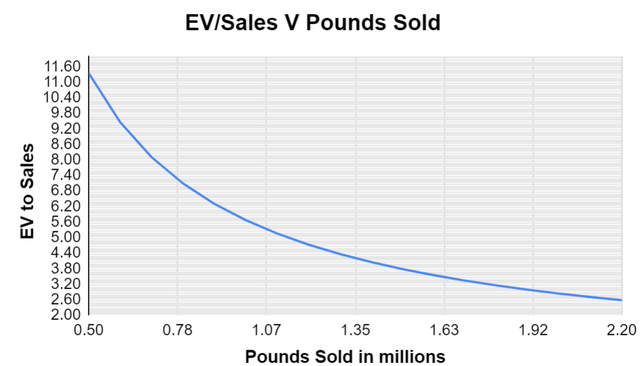

1. Fixing the price at $80/lb. the chart above shows how valuations vary depending on the actual realized sales.

2. 2.2M is at the high end of the range which may not be realized even if they have committed to expanding capacity to that extent by 2026 (Production delays are common in the mining world). But by 2026, sales contracts are in place for 0.95M, giving us an EV/Sales ratio of 5.7x. This is still low considering that the biggest established Uranium miner traded publicly (CCJ) is trading at 13.5x.

Valuation Comparison with Boss Energy (OTCQX:BQSSF)

We can also make a much more relatable comparison with Boss Energy (OTCQX:BQSSF). Boss Energy has had a similar journey to Ur-Energy. Both have a history of operating and idling their Uranium mines. Both are focused on in-situ recovery. Both are debt-fee and cash-rich. Their timelines for production ramp-up also look similar. Management anticipates ramping up the mine’s uranium production to 2.45Mlb/year in the next 2-3 years and has an export permit of 3.3Mlb/year. They also have a stake in a U.S. asset which will help them boost their production. They recently closed their first market-based sales agreement for 1Mlb/year to a US-based utility with contract commencement in 2025. When we assume that they will be able to meet their production target and achieve actual sales of at least 1Mlb/year, at $80/lb., below is the valuation range we will end up with (I also believe that Boss Energy is a little behind in terms of progress in production when compared to Ur-Energy)

| Shares Outstanding | 408.94M |

| Market Capitalization | $1.2B |

| Physical Uranium | $110M |

| Cash | $154M |

| EV | $0.936B |

| EV/Sales (1Mlb/year – 3.3Mlb/year) | 11.7x – 3.9x |

At its mid-point (7.8x), Ur-Energy comes ahead (5.7x) which makes me think Ur-Energy’s valuation is fair at current levels.

Risks to this thesis

Even though the company is a junior miner, I am pleased to see that many of the conventional risks that apply to miners do not apply to Ur-Energy. During my risk analysis exercise, below is the table I ended up with.

| Risk | Reason it’s not applicable |

| Exploration | The company is sitting on properties that have proven themselves and in the near term, no new exploration is necessary |

| Financing and liquidity | The company is cash-rich and has a debt-free balance sheet. |

| Commodity Price Volatility | We have clarity on the pricing and many developments point to current and future price support. |

| Jurisdictional and Geopolitical | It is based in the U.S. |

| Management | Management is experienced |

The only risk I see right now is on the operational side. The company is in the process of ramping up production, has signed contracts, and committed to sales from 2024 and onwards. Every signed contract further underscores a fully operational Lost Creek (even Shirley Basin) could become necessary to fulfill the terms of the contract. It is not uncommon for miners to run into operational delays due to any number of reasons (lack of equipment, technical expertise, etc.) which runs the risk of the company buying in the spot market (which as we saw is priced at a much higher premium) and fulfilling the contract at a much agreed upon lower price (relatively).

There is also an extremely low probability risk of a Fukushima-style type of black swan event which could again derail progress made in nuclear industry (But this risk is not company-specific and more industry-wide)

Final Call

I own shares of Ur-Energy and will be adding more to my position on any technical corrections. I also would like to keep a close eye on their progress towards their production ramp-up and will post an update here before the end of the year.

Read the full article here

Leave a Reply