Dear readers/followers,

Back in November of last year, I covered the Stock market operator London Stock Exchange (OTCPK:LDNXF) (OTCPK:LNSTY). I have a history of focusing on operators such as this, with investments into both German and other European stock market operators and brokers, including some newer ones which are mostly digital. Brokers are, to my mind, a very good investment at the right price. Being a company that earns based on someone simply “transacting” is always a good thing – and this is what these companies do.

The London Stock Exchange Group, therefore, with its position in one of the major financial hubs in all of Europe, can be thought of as a very attractive play at the right price, provided their tradition of fundamentals and margins continue unchanged at the high pace and quality we’ve been seeing.

It’s worth mentioning though that I do not yet own a stake in this business. The reason for this is simple – the valuation has been unattractive for the most part, and as I mentioned in my last article, the company is to me a “HOLD” here.

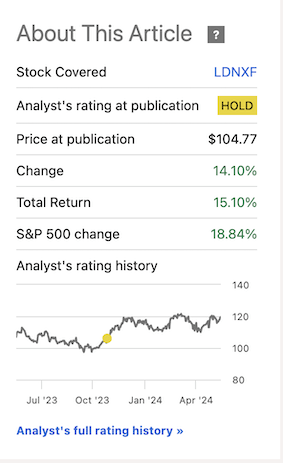

Since that article, which you can find here, the London Stock Exchange has also mostly underperformed the broader market, despite being up 15% – the market and my own portfolio is after all up far more than this.

London Stock Exchange Returns (Seeking Alpha)

London Stock Exchange – Updating for 2024-2025E

In my last article, I pointed to solid, but not above-peer fundamentals and trends for this stock market operator. The company is smaller than some of its competitors, and I argue that with Brexit London doesn’t have the same clout as it once did, with Paris, Frankfurt, Amsterdam, and Brussels slowly taking over as some of the major financial hubs. However, I have been increasing my allocation to the overall stock market operators and stock markets in Europe over the past few years – London and England are the latest of this.

I have been allocating to businesses like Vodafone (VOD), Reckitt Benckiser (OTCPK:RBGPF), and National Grid (NGG), as they have become attractive, to name a few which now make up a solid part of my portfolio and exposure both to the isles and to the British pound.

And on the surface level, this company has some very solid advantages and trends worthy of your consideration for investment. Gross margins are well above 85%, and with the age of this company, it’s not wrong to call this company one of the oldest operators on the planet.

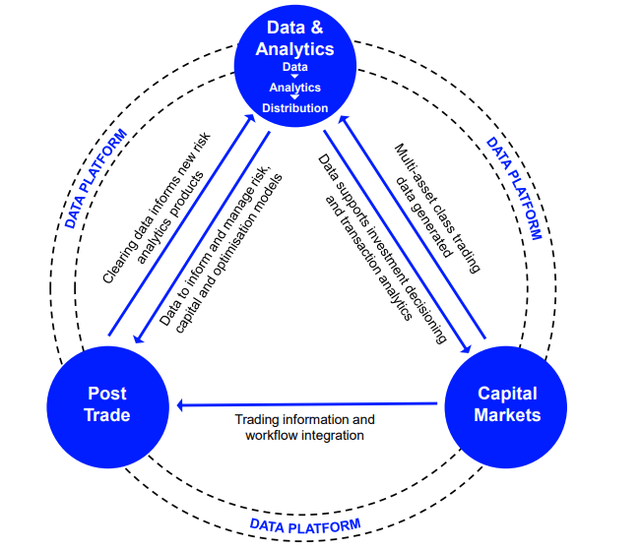

The only way to maintain a general level of appeal in this market is to be a vertically integrated operation in the markets. My investments in this sector are this way, and LSEG is the same way.

LSEG has exposure to capital markets, data & analytics, as well as post-trade services. It’s not as strong as Deutsche Börse (OTCPK:DBOEY) and with as leading market positions given Clearstream and other services, but it’s still an interesting and profitable operation.

LSEG IR (LSEG IR)

And like its peers, the company expects double-digit growth from a myriad of fields – including investment solutions as well as trading and banking segments.

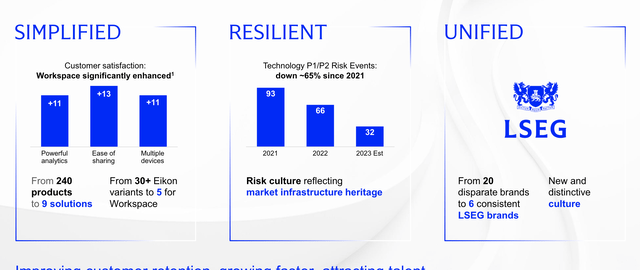

The last results we have to follow up on are the 1Q24 results. This company has beaten its own growth targets relatively recently (2020-2023), so is quite solid here. Its integration and streamlining from over 240 products to only a 9-solutions-based business model has resulted in increased efficiency and reduction in risk, and also from 20 to 6 consistent corporate LSEG brands.

LSEG IR (LSEG IR)

The company still isn’t as good as some of its peers, but its journey is still ongoing, so I expect improvements here over the next few years as well.

1Q24 confirms these trends. The company delivers growth of over 7% per year, with good performance from every single division on the company, with Capital markets leading the charge at over 14% YoY growth. The company’s subscription sales have increased at a level of 6% per year, and the company has an active capital allocation of £500M, which is directed at a mix of buybacks now and going forward. The company is targeting over £1B of buybacks during this fiscal, the refinancing of several bonds, and some M&As – in short, the company is significantly growing here, and we can expect more from LSEG going forward.

LSEG communicates confidence with regards to its growth prospects, and is clear in its results orientation that it considers it highly likely to deliver the previously-communicated rate of growth as of Fall of 2023.

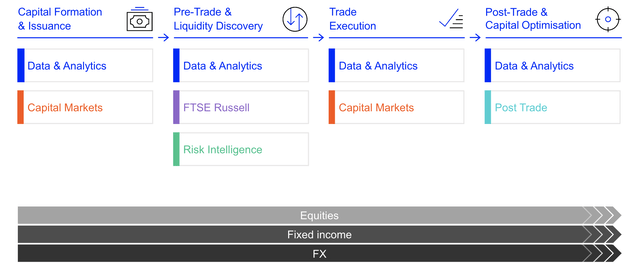

The company is also pushing further towards its Microsoft Partnerships, and as of the current stage of its development, represents a wide array of attractive segments in every step of the lifecycle of a trade or investment.

LSEG IR (LSEG IR)

Aside from its partnership with Microsoft, it’s also partnering with Aladdin, part of BlackRock (BLK). Despite being a British player, the company has a considerable part of its business mix from the Americas and 15% from Asia. More than half of the company’s business is outside of Europe and most of the business is, as one would expect, on the sell side with only 17% of the mix on the buy side.

In terms of its offerings, LSEG remains a heavily data-focused market participant/company. 50% of the company’s revenues are from Data & Analytics, with only 5% from things like Risk Intelligence. Post-trade and capital market services are growing though, and a more diversified mix is part of what I want to see for LSEG.

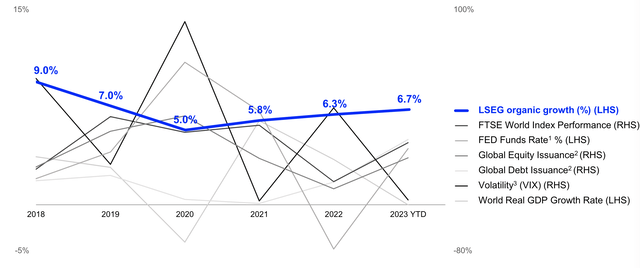

Despite an overall significant volatility in the underlying markets, this company has maintained a comparatively steady and balanced rate of organic growth.

LSEG IR (LSEG IR)

What perhaps remains the biggest downside of LSEG is that the company isn’t a clear market leader in any one segment. It’s a market participant in most. Even its largest segment, Data & Analytics, only sees the company at 10-12% of the segment in terms of market share. There are larger players here, larger players in Europe even, and I remain focused on these for as long as LSEG remains “too expensive” relative to the appeal the investment offers.

Overall, I say that the strong markets where LSEG operates make for a very attractive foundation for investing in LSEG at the right price. The company’s partnerships will add further value to the proposition of investing here, and the fact that LSEG is significantly ahead of its transformative plan after only 15 months of execution shows that the company is doing well.

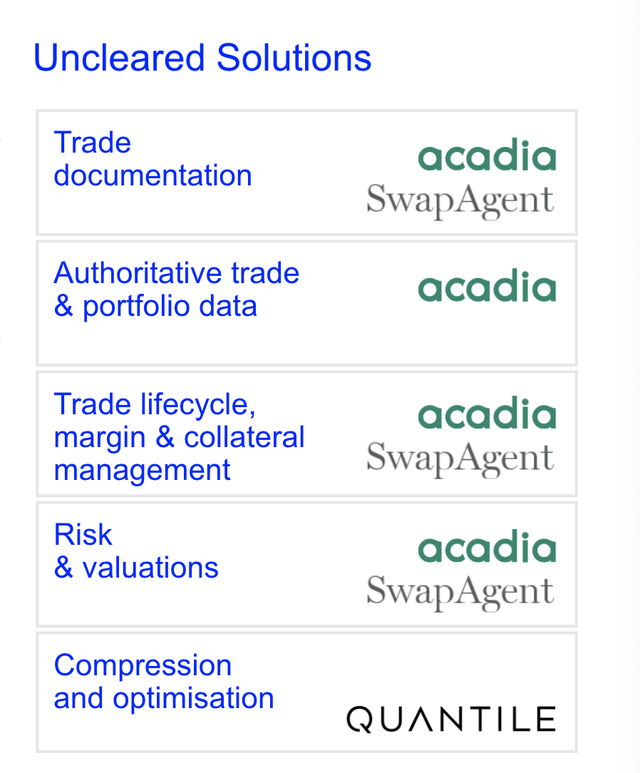

There also remains a significant untapped opportunity in the markets that LSEG is “on top of”, in the form of OTC derivatives, a $39T market that over 49% remains uncleared at this time, with an increasing need of capital from regulation, and counterparties requiring trade routing and contract solutions. This is a company direction where M&As are going, and this is perhaps one of the more interesting potentials for LSEG.

LSEG IR (LSEG IR)

So, I say the company remains fundamentally attractive, and would also say that the main issue has been, and remains valuation.

So let’s see what we have here for the next few years.

LSEG – The company warrants a lower price, as I see it

LSEG, as I mention here, is also the native ticker for the company on the LSE, the London Stock Exchange.

The company trades typically over the 20-year average at something like 20-21x P/E – and I also have zero issues forecasting the company at those rates. The company is worth as much. It’s A-rated, with a solid trend of beating or hitting its estimates, and only a slight off-chance of not meeting them (Paywalled F.A.S.T graphs link).

The problem we find ourselves in is one of clear premiumization of this company. For the 5-10-year average, the P/E has risen to 26-29x P/E, and I do not believe the company will grow at this rate or manage this sort of premium with this low yield in a world where the risk-free rate is far better. In short, I believe the company should be traded far closer to its longer-term trends.

What exactly would this entail?

Given that we’re currently at almost 28x P/E, this would require, to generate the 15% annualized RoR that I am looking for, that LSEG works its way up to at least 29x P/E over the long timeframe – and that is with a 13-14% annualized growth in EPS, which is above the company’s average and leaves LSEG with very little room for error.

This is not a way in which I like to invest. Evaluating the company at the 20-year average with a 21x P/E gives us a potential annualized RoR of less than 3% at this forecast and these estimate, and this is simply not good enough.

My last PT was at around £72/share. I am not changing that price target as of this time, which is a level we saw in early 2023. Because there are more attractive companies available in the same space, and this company is too expensive, I do not view this as an attractive potential at this time.

Other analysts give the company a mixed set of targets – but all of them above my own. 17 analysts are giving the company between a low of £86 and a high of £130/share, bringing this to an average of £105/share with 6 analysts at a “BUY” recommendation.

Another way of saying this is that the analysts currently are validating the 28-30x P/E premium for this company. It’s a stance you can take, but I believe it is only valid if you accept not only the current but also well beyond the forecasted growth estimates. I believe this to be far too exuberant for this company.

I also believe there to be meaningfully more attractive investments out there at this time.

For that reason, I give you my following thesis for the company here.

Thesis

- London Stock Exchange Group is one of the largest stock market operators in all of Europe. The company is fundamentally qualitative and isn’t going anywhere. At the right valuation, I would say this is certainly a “BUY” with a double-digit upside.

- Unfortunately at this price, it takes a 26-28x P/E to see a double-digit 15%+ annualized RoR upside – which is well above the average, and well above the historical average of 19-20x P/E here. I view this valuation as unsustainable in the longer term.

- I do not view the company as materially more attractive after looking at the latest quarter, 1Q24, and would retain a conservative outlook and price target here, preferring to invest at a cheaper price. We’ll see how things look in 2Q24.

- I give the company a “HOLD” rating here and set my PT at around £72/share. It’s a conservative one, but there are better companies to invest in here, even in this sector.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

In short, I do not view the upside as high enough here to interest me compared to far more attractively valued peers. I give the company a “HOLD” here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply