Introduction

Trump Media & Technology Group (NASDAQ:DJT) has seen large swings YTD and is currently up 163%. I wanted to check the company’s financials, but the price action has nothing to do with fundamentals and everything to do with Mr. Trump and his die-hard followers. The play here is high-risk high-reward, but I think the odds of making money out of this one are against the rational investor. Shorting is unadvisable due to ridiculous fees, and the market will certainly stay irrational longer than you can remain solvent on this stock on fees alone. In my opinion, the company is not investment-worthy.

Very Briefly Financials

So, let’s dive in, shall we? DJT has around $270m in cash and equivalents, including restricted cash, as of Q1 ’24. That’s quite a bit of extra cash from the previous quarter. This increase was proceeds from the business combination and issuance of TMTG convertible bonds. No debt, so at least there’s that. I would usually say this sort of position is good for a company that is operating well, however, DJT may not be it.

The company’s revenues declined 31% y/y, while the costs of running the platform ballooned. In the latest quarter alone, the company saw a loss of $327.6m, $-3.61 a share. Most of the expense increases were due to an increase in share-based compensation. Again, if it were another company, like a fast-growing company with a small market cap, I would be fine with excessive SBC. However, DJT is an $8B company with less than $800k in revenues. I had to double-check if I was reading the quarterly statement correctly, because it is hard to believe that the company is bringing in eight hundred thousand dollars in revenue, while being valued at eight billion dollars.

Some might argue that the company is investing in the long term and such losses are expected. Again, there could be an argument for that, but with so little revenue, the clock is ticking.

There isn’t much more to say about the financials that haven’t been covered before. The staggering difference between the top line and the expenses is shocking, to say the least. DJT’s $270m cash cushion will keep it afloat a little while longer if the company’s cash burn remains around $9m a quarter, preferably it turns positive for it to last longer, but we need to see how it all works out over the next few quarters.

How is it generating revenue?

The business model of DJT solely depends on its social media platform “Truth Social”. Like all other social media platforms, the main, and only source of revenue of DJT is displaying ads to the users on the platform. So, you would think it would be very easy to track this sort of revenue if it involves users, right? Not really, the company doesn’t believe in “traditional KPIs”, such as average revenue per user (or ARPU), pricing, ad impressions, or sign-ups. We do not get to see the platform’s daily active users or monthly active users as with all other social media platforms out there and the reason is that the company is “focused on developing Truth Social by enhancing features and user interface” and currently the company is “evaluating the most relevant, reliable, and appropriate key operating metrics that align with its evolving business model”.

Anyway, let’s say those metrics aren’t “right” for the company’s vision and business model. Let’s say enhancing features and the user interface is the way to go, then why did the revenue decline? To me, it looks like even if the platform has been enhanced for the user’s ease of use, it is not enough to attract a huge base, and if there is no user base, no advertisers are willing to go on the platform.

Also, if the usual metrics aren’t right, how are potential investors supposed to evaluate the company, if there is no metric that they can look at to see how well the company is doing? Revenue alone may not be enough.

The Platform

I don’t know how many of you have tried to sign up for the platform, but I did recently to see how it looks. I almost didn’t sign up because I had to check the box to allow the platform to send me updates to my phone number. I only realized it was mandatory to check the box, until after I had been pressing the “Next” button for longer than I care to admit. Now that I was through, it was time to check out some of the tweets in the discovery tab, because I skipped who to follow. Given the low user base, the new posts are far and few between. I could see how people may find it stale eventually, since it is basically a private group chat that is only one-sided. I have to say, it was a rather smooth experience from what I tried; but within a couple of hours, I deleted my account.

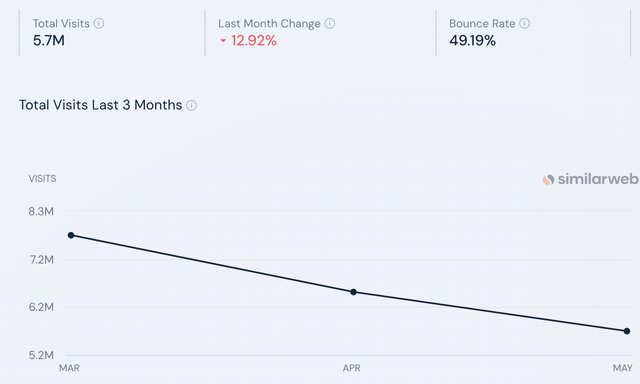

In terms of some metrics of the platform, there is a website where you can check some statistics, and we can see from the below image that the platform has lost 13% of traffic m/m and has been steadily declining since March.

SimilarWeb

Now, let’s compare the platform to its fierce competition. We can clearly see the vast difference in engagement. No wonder the company is making no money off its platform essentially. There isn’t enough traffic, and the traffic that does come through it is hardly suitable for many of the advertisers. Speaking of advertisers, a lot of the ads I saw were Trump merchandise.

SimilarWeb

Fundamentals don’t matter

This company is akin to GameStop (GME). It has a huge following of people who started off just being big fans of the company, regardless of the company’s lackluster performance. DJT has the support of Trump fans, who are not going to sell their shares for any reason. The price movements are not motivated by the fundamentals of the company. It seems to be traded on emotion, and many day traders try to catch such companies that have high volumes and momentum to ride the wave, either up or down.

Should you get involved?

I try to stay away from such companies that don’t seem to follow fundamentals. The price swings are so great daily, that you could be left holding the bags for a while until another emotionally filled rally, like the first presidential debate or the result of the hearing comes along. For DJT, a lot of the movements will depend on how the elections develop, or if anything happens to Trump after the hearing, which is set for July 11th. Before then, we also have the first presidential debate on June 27th, so expect volatility in the stock following that.

You may think this stock has to collapse, it’s only a matter of when, right? Why not short it? Well yeah, but that is a big when. To short the company’s stock, there is a very limited amount of shares available, and apparently to short 100 shares of DJT, would cost you up to $30,000 a year in interest alone. It is not worth it. The fees for shorting it are upwards of 600%. So, maybe if you already own some shares, and you want them to be available for short sellers, you could make some interest on your shares, but that would beat the purpose of you holding the shares and wanting them to go up instead of supporting the short sellers.

In summary, it is up to you how you want to play this stock, or any other meme stock for that matter. It’s a high-risk, high-reward situation for DJT, and I am not willing to take any chances here, especially when there is more dilution is on its way. The recent S-1 filing, states that the company is registering the issuance of up to 21.49m shares of common stock, which may consist of shares of common stock upon exercising of many different warrants, like placement warrants and convertible note post IPO warrants, along with a resale of shares held by the “Selling Securityholders” (paraphrased). It is not fully approved yet and is subject to change.

I don’t know how the company is going to survive on essentially very little revenue unless they surprise us next quarter. The cash position should keep it afloat for a while if it continues to burn at a similar rate as it did in the latest quarter. Trump is the largest shareholder of the company and other directors have a lock-up period for now, so they cannot sell their shares either, but who knows what is going to happen after that. There is just too much risk involved, and fundamentally the company is not doing great. You might catch a nice swing over the next month or two, seeing that the shares are primed for either direction right now. I think it’s been too quiet. I’m staying out of this one for now.

Read the full article here

Leave a Reply