Dear readers/followers,

In this article, I’ll provide you with an update on Persimmon PLC (OTCPK:PSMMF) (OTCPK:PSMMY). The company is a UK homebuilder. I haven’t been going into the UK market as much as I’d like, and this is something that I’ve been changing for the past year or so. Persimmon PLC is not one of those companies though. I can already hear some of you asking what I am thinking – investing in a British homebuilder in this environment. Well, everyone needs homes – and the UK is no exception.

Persimmon has an upside at the right price, as I established during my last article, and my stance at the time, for that article, was a “HOLD”. Since that time the company is up around 7%. The S&P500 is up almost 23%, and my portfolio is up close to 28% since November of last year, which is when I published that piece, which you can find here.

The valuation for Persimmon is still low, but the trends and risks for the company are also somewhat higher than in other businesses.

In this article, I’ll update at what price I’d buy, and what I would consider appealing for this 1.2%-yielding homebuilder.

Persimmon PLC – What upside exists after 8 months?

With over 50 years of history, the company has a few advantages. The least of this is the fact that the company has no debt, but is a net cash company, with a massive interest coverage of over 50x.

The company, aside from how things are looking right now, is actually a high-yielder. It’s at 7%+ at a payout ratio of less than 60%, but as I mentioned in my last piece, the company has recently “rebased” the dividend at a far lower overall level. Positively speaking, a very good company fundamentally, and with a low likelihood of fundamental deterioration.

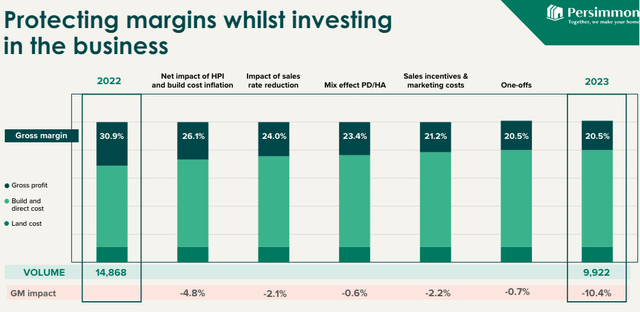

The headwinds and the reason for why the company is down is margin decline, with revenue down and ROIC below the WACC. Not entirely unexpected given the current macro trends – but there is a longer-term upside to take into consideration here.

The latest full results we have are the annual ones – which are new. Persimmon is one of those EU companies that provides only a trading statement or update, not a full quarterly result update.

For the full year of 2023, the company actually did pretty well. High Customer satisfaction ratios, almost 10,000 completions, an annual operating margin of 14%, a net cash of £420M. The company is protecting its margins.

Persimmon PLC IR (Persimmon PLC IR)

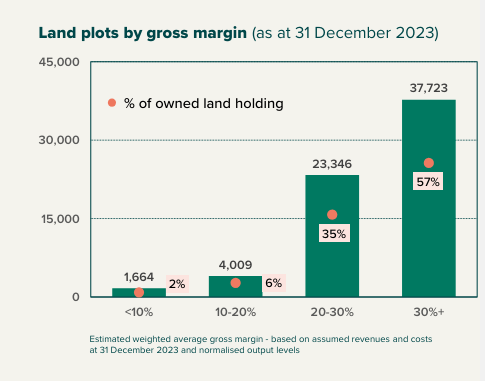

The company has a good portfolio of good quality land holdings and has a high confidence in the quality of those holdings. The company has a gross margin of 295 in its owned land holdings, and 92% of current plots are expected to have margins in excess of 20% of the current cost and revenue basis – a good result. Even if the company’s housing prices, or housing prices overall would decline by 10%, the company would see only a £28M impairment – and housing prices are not falling as high and as clearly as that.

Persimmon PLC IR (Persimmon PLC IR)

The company is, at the same time, maintaining the strength of its balance sheet, with a net asset value on a per share basis above £1/share, and an average cash position of £300M. At the year-end timing, the company’s outlook for the coming 2024E fiscal was at a 10,000+ volume for the year, with a slightly negative net financial income, at a tax rate of 29%. Margins would be, on a forecast basis, impacted by lower ASPs and embedded building cost inflation, and the recovery for the company is not likely to materialize during this year.

The company did have a pretty good start to the fiscal in 1Q, and management is currently confident, as of the latest trading update, to deliver the aforementioned 10k completions for the full year. Sales rates are growing, alongside good pricing – and inquiries and home visits are up as well, implying a solid sort of upside. The company’s forward order book is up 18% for the year, and Persimmon is expanding the outlet network.

This is despite completions YoY being down -but net sales being up on a per-outlet basis, with forward sales on a quarterly basis climbing up over £1B.

Persimmon PLC IR (Persimmon PLC IR)

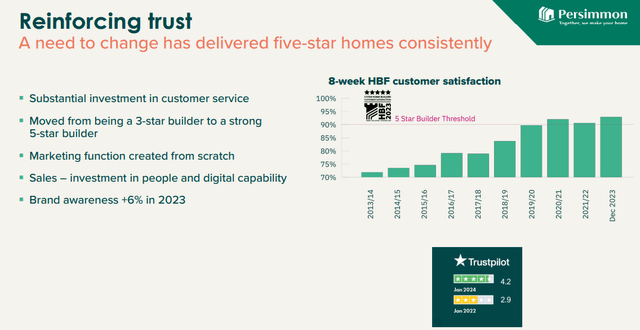

There’s also the fact that the company has seen a non-trivial improvement in product quality. The company has invested heavily in training, aligned incentives, and strengthened the management team. Better quality materials are being used for Persimmon homes, securing supplies from places like Spac4, BrickWorks, and Tileworks.

This in turn has led to significantly improved customer satisfaction rates – moving this company from a 3-star building company to a 5-star building company as of 2021.

Persimmon PLC IR (Persimmon PLC IR)

Some of this may simply be effective marketing and good reviewing, but I checked with some people in the UK I know to give their subjective opinion – which are to be taken with quite a bit of salt, of course – but they agreed that Persimmon over the past few years seems to have been improving its trends and quality as well as sales. If I lived closer, I would have taken a trip to look at one of the company’s newly-finished homes in somewhere like Anglia to get a feel for what the company does and how it’s improved.

But overall, all company trading trends show a positive direction and good fundamentals – good product propositions with ASPs double-digit below the market average, above-average sales, and resilient pricing despite a very competitive housing market with some negative macro trends.

Unlike many other companies, which I reviewed during its transformation, Persimmon PLC is a company that I am reviewing after the transformation of the company, with now “only” waiting for a shift in macro, but still doing quite well.

2023 represented a horrid crash in the company’s trading and valuation. Earnings cratered 67%, and are now slowly set to recover going forward. The pricing and valuation actually forecasted this trend and started dropping already in 2021, only to now be “ahead” of the curve is slowly recovering.

There are a number of reasons here why I’d be open to investing here at the right price – let me show you what I mean.

Persimmon PLC – At single digits, this is an easy 15% annualized to me – above it, not so much.

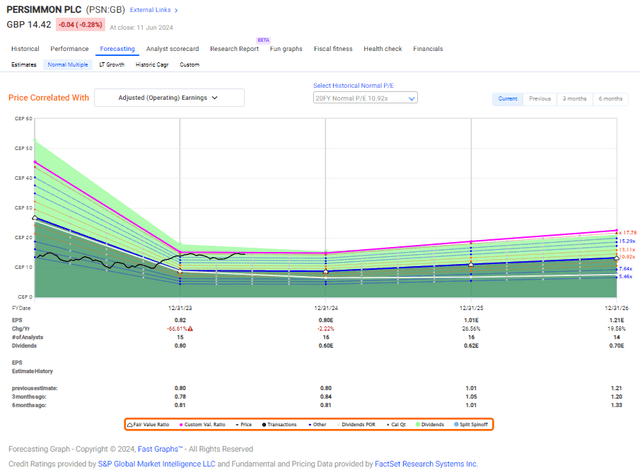

In my last articles, I went for a price target of just below £10/share for the native PSN ticker. The company now trades at roughly £14.4, estimating an EPS on an adjusted basis of £0.8/share for this year. That would imply that the current valuation is well over 16x P/E, despite the company being at a 20-year average of only 11x. It shouldn’t be surprising – Persimmon is a homebuilder/construction business, and the volatility inherent to these companies means that you are quite unlikely to see significant premiums over the long term.

The fact that Persimmon has a yield of less than 5% while expecting earnings not to grow this year, but perhaps the year after, also means that you’re paying quite a bit and not really “getting” much out of it. Here is the company’s 20-year premium to the valuation we’re seeing today.

F.A.S.T graphs Persimmon PLC Upside (F.A.S.T graphs Persimmon PLC Upside)

What you see over time here is a price that more often than not outside of a recession was closer to £20-£30/share than not. Any time you could buy this company in the last 20 years, and if you’re willing to hold, you’d have come out on top. It’s my general view that this is a likely scenario for the future as well, provided you’re able to buy it cheaply and the trends hold. The company is not a great business to hold during any sort of volatile or recession-type environment, as showcased by the recent few years where we’ve seen significant declines.

The progress since my last article is really only a slight correction upward, and not indicative for where the company may go during 2024-2025, in my opinion. Persimmon has a lot of ground to cover before earnings are even close to historical levels. The question that becomes crucial to answer is at what price we want to buy Persimmon, given that we’ve seen the company trough down to 2 “quid” per share and below during recessions.

However, I still don’t believe £2/share to be realistic in the least – that would be far too cheap – but I do think the company could go lower than it is today, and I want to generally stick to my overall PT – I want a single-digit share price for this business.

Let’s revisit analysts here – because I can tell you that if you forecast Persimmon at something like a historical average, you’re only getting around 4-5% at current forecasts – and this is not something I’m willing to entertain at this time. Analysts are at a mixed sort of view for the business, but we also need to recall that more than 55% of the time, the company actually beats the forecasted estimates by more than 10-20% (Paywalled F.A.S.T graphs link).

So there is that trend. Out of the 17 analysts follow the company and go from £9.8 on the low side to £23 on the high side, which is a very high level given where the company is expected to go from here. Out of those 17, however, only 3 are at a “BUY” recommendation, despite an average PT of £13/share, which even now is below the price the company is trading at.

In short, I’d continue to be very careful about Persimmon and what potential it could hold for you. I’d say that there are better companies here – even better building and home companies, and this is not a good option for most investors here.

I’ve noted that some analysts have a “BUY” on Persimmon here – but I am not one of them. Going forward, I want to see better recovery in earnings, but because Persimmon is dependent on the housing market, I view this as unlikely.

I stick to my “HOLD” with the following thesis.

Thesis

- Persimmon Plc remains one of the leading homebuilders in the UK and Britain. It has an attractive set of fundamentals, little to no debt with a solid net cash position, impressive vertical integration, a massive land bank, and a good track record working with the intricacies of the British system. If I were to invest in British homebuilding, then Persimmon Plc would be at the top of my list. It also has a proven record of improvements over the past few years.

- However, the company requires an attractive valuation in order to justify my risk of my capital. At the current levels, the company barely manages to under conservative estimates scrape together a double-digit upside. I could literally get almost 9% from an investment-graded pref stock – which makes this sort of investment an absolute no-go in this macro – and that stance is one I remain at in June of 2024.

- I want Persimmon stocks at a single-digit share price if I am to invest, and I give the company a price target, at the intro here, of £9.8/share for the native. I’m not shifting my target at this time.

- This makes the company at this time for 2H24, a “HOLD”.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic and high enough upside based on earnings growth or multiple expansions/reversions.

This company currently fulfills 3 out of 5, making it a “HOLD” for me.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply