Introduction

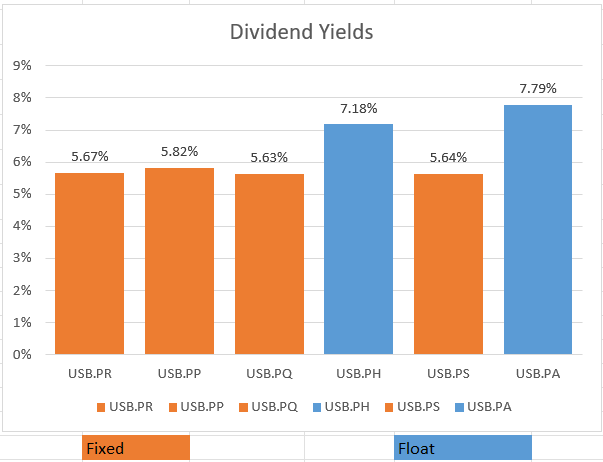

U.S. Bancorp (NYSE:USB) is a large regional bank that has not been immune to the industry struggles related to higher interest rates and the retention of deposits. Twice, I have examined the bank’s series A preferred shares (NYSE:USB.PR.A) as a good source of income, with the most recent update coming in January. Despite the run-up in price, the series A preferred shares still provide the most income when compared to the bank’s stock and other preferred shares, and I believe they are still a good buy for investors.

Author Spreadsheet and API

U.S. Bancorp’s Financial Performance

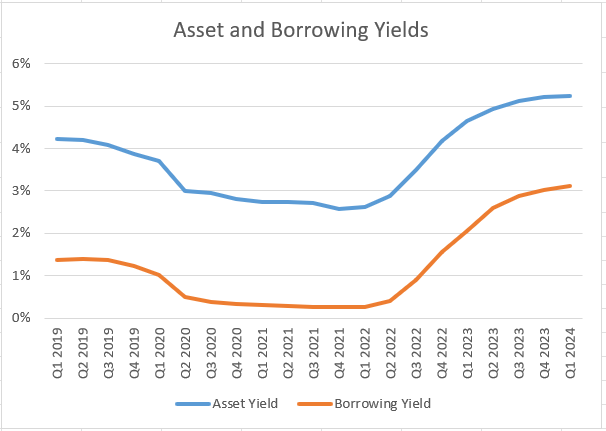

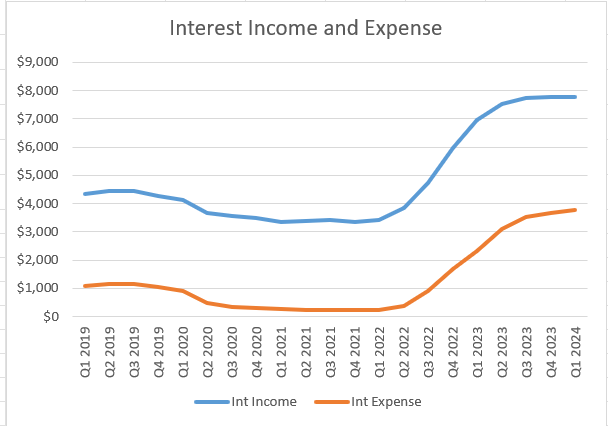

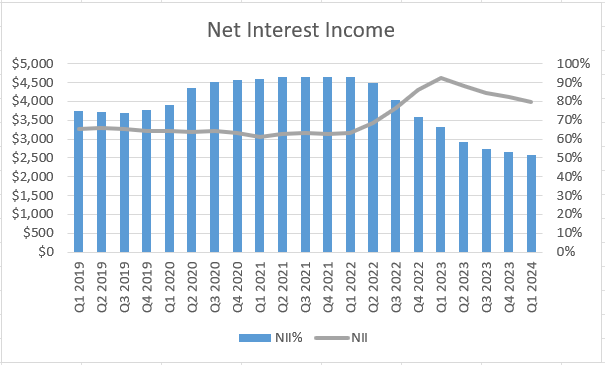

U.S. Bancorp has successfully managed to handle the higher interest rate environment. As interest rates have risen, the bank has been able to lend at higher rates and increase its interest income commensurate with interest expenses. Net interest income (interest income less interest expenses) has eased downward over the past few quarters but remains well above the levels generated during the pandemic.

Bank Financials

Bank Financials

Bank Financials

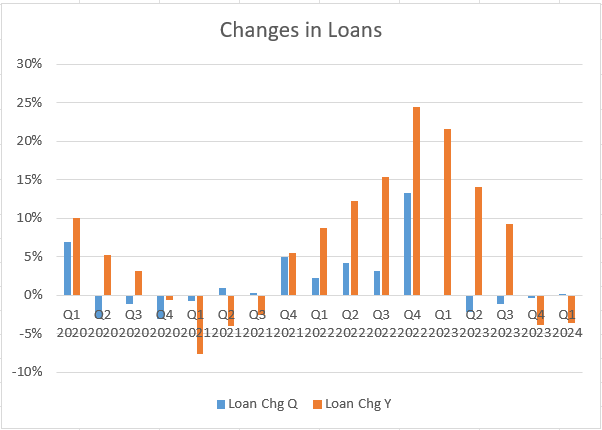

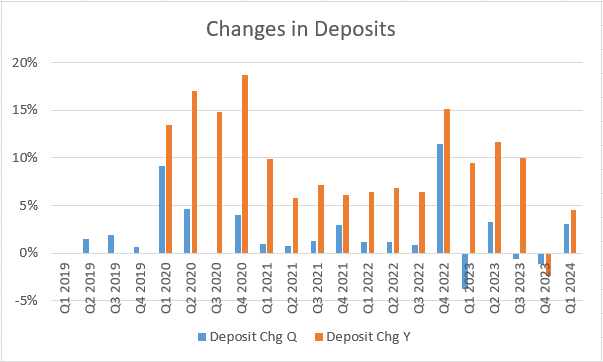

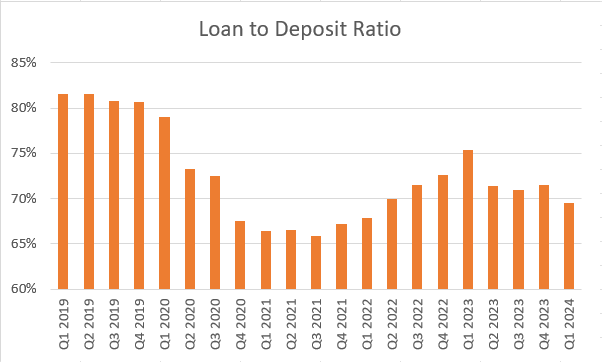

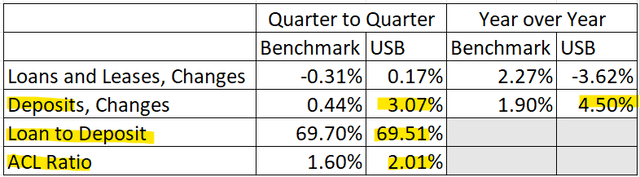

On the balance sheet side, U.S. Bancorp continued to restrain lending in the first quarter, but it was not because of issues attracting depositors. In fact, the bank had a great quarter with deposit growth by adding 3% to its deposit base. U.S. Bancorp has grown deposits by 4.5% over the past year, and combined with a 3.6% decline in loan balances, has brought its loan to deposit ratio down to a very manageable 69.5% which is under an industry benchmark and comparable to the larger “too big to fail” banks.

Bank Financials

Bank Financials

Bank Financials

Bank Financials & Weekly Commercial Bank Data from the Federal Reserve

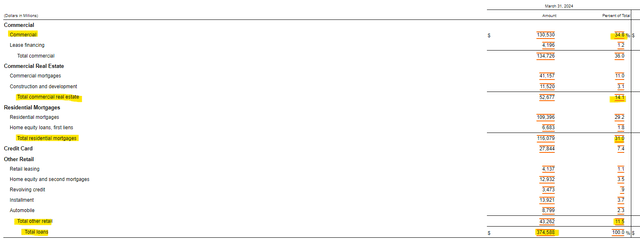

Loan Composition and Performance

While U.S. Bancorp’s loan balances are relatively light compared to deposits, investors should still examine the composition of the bank’s loans and identify potential risks. Commercial loans (not CRE) and residential mortgages comprise nearly two thirds of the bank’s lending combined. This is reassuring as residential mortgages are performing reasonably well and commercial loans tend to be short-term in nature and backed by liquid assets such as inventory or receivables.

SEC 10-Q

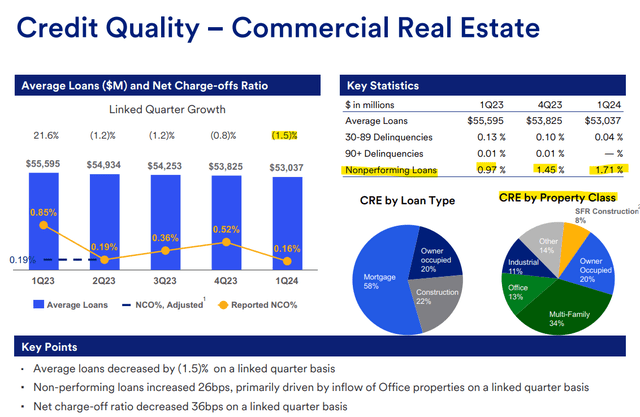

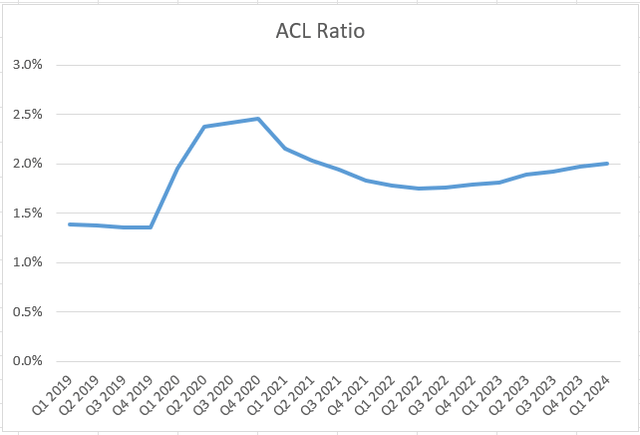

While office properties only comprise 13% of the bank’s commercial real estate loans, they are beginning to make some noise. In the first quarter, the bank’s commercial real estate nonperforming loans rose to 1.71% versus 0.97% in Q1 2023. These increases were specifically driven by the office sector and may influence the bank’s future earnings. Fortunately, the bank is preparing for loan losses with an allowance of 2% of gross loans, which is higher than the industry norm and on an upward build.

Bank Earnings Presentation

Bank Financials

Risks to U.S. Bancorp

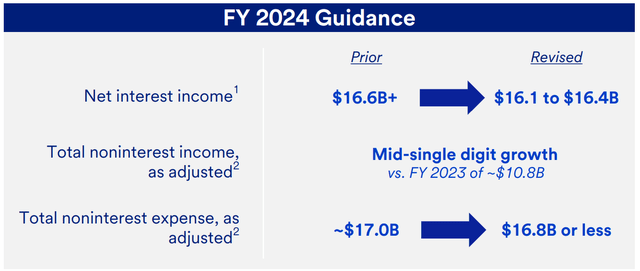

While loan losses still have the potential to eat into earnings, I believe a good amount of that is baked into a higher allowance for credit losses. However, I am downgrading U.S. Bancorp’s common shares from buy to hold as “higher for longer” interest rates appear poised to put downward pressure on future net interest income levels and the bank has lowered its full-year guidance following the release of its first quarter earnings. Guidance downgrades place more pressure and volatility on common shares as opposed to preferred shares.

Earnings Presentation

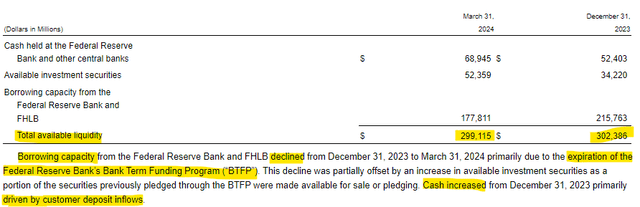

Uninsured deposits are a risk to the bank, as they can be withdrawn by depositors at the first sign of stress and create a run. While U.S. Bancorp does not disclose its uninsured deposits, investors should be relieved to know that the bank has nearly $300 billion of liquidity that it can tap into. This liquidity covers approximately 60% of total deposits.

SEC 10-Q

One final risk to be aware of comes in the form of lower interest rates and what those would do for the income portion of the Series A preferred shares. The Series A preferred shares are trading at a floating rate, so a lower three-month SOFR interest rate will reduce the value of the dividend. While investors may not like a lower income yield, they should be rewarded with a higher share price. Therefore, a drop in interest rates should provide income investors with an opportunity to sell the Series A preferred share for a capital gain.

Conclusion

U.S. Bancorp continues to do a good job managing the high-rate environment. The large regional bank is continuing to grow deposits while lending declines. Additionally, the bank has ample liquidity to handle any issues that may arise. With earnings guidance shifting downwards, and the rate outlook continuing to be uncertain, I believe it is best for investors to shift away from the common shares and into the Series A preferred shares.

Read the full article here

Leave a Reply