There is a very high probability that you have heard of a company by the name of DoorDash (NASDAQ:DASH). In case you haven’t, the firm operates a platform that allows its users to order, for quick delivery, food from restaurants, as well as goods from convenience stores, retail establishments, and more. Over the past few years, the business has really grown at a rapid pace. As impressive as its top line expansion has been, its bottom line improvement has been even more remarkable. To be clear, the company still has some issues it needs to sort through. But I have no doubt that the future for the enterprise looks promising.

Usually, when you buy into a fast-growing company, you are expected to pay a premium for that growth. The expectation is that growth will be strong enough to eventually justify the valuation, plus any upside that you might want. In some cases, this turns out quite well. But in others, it can be painful. As an example, consider from the time I last wrote about the company, back in December of 2020. Even though shares were expensive, I felt as though some upside for investors would be warranted in the long run. That led me to rate it a ‘buy.’ Unfortunately, this was one of the few instances that I was dead wrong about. Since then, shares are down 36.6%. This compares to the 49.3% increase seen by the S&P 500 over the same window of time.

The company’s overall financial condition is undoubtedly significantly better since then. But between my own evolution as an investor, with a focus more on value and less on growth, I have to re-evaluate the situation. Even though I believe the company will do well for itself in the long run, shares still look very pricey. It is possible that the picture could change for the better in a fairly short window of time. But I think it is premature to expect that to happen enough to justify upside from here. Because of this, I have decided to downgrade the stock to a ‘hold.’

Rapid growth

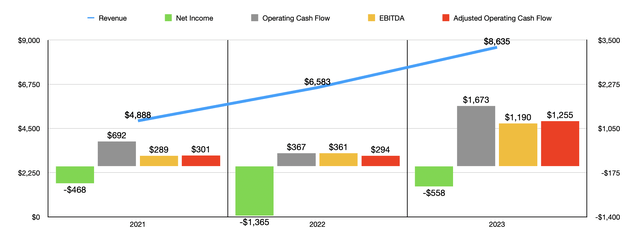

Author – SEC EDGAR Data

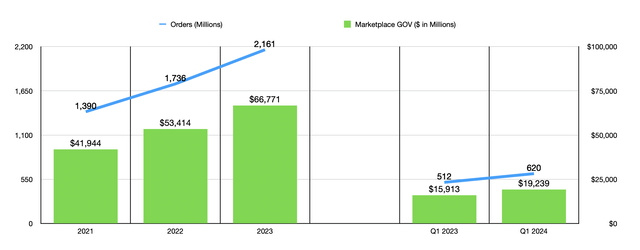

Over the past few years, DoorDash has seen some really impressive growth. Revenue for the company jumped from $4.89 billion back in 2021 to $8.64 billion in 2023. That’s an annualized increase of 32.9%. There are a couple of indicators that discuss why this expansion took place. For starters, the number of orders placed on the platform exploded higher, rising from 1.39 billion to 2.16 billion. That’s 55.5% growth in the span of two years. As a result, Marketplace GOV, or gross order value, jumped from $41.94 billion to $66.77 billion. For clarity’s sake, the company defines marketplace GOV as the total dollar value of orders completed on the company’s platform. This is inclusive of taxes, consumer fees, membership fees, and more.

Author – SEC EDGAR Data

Management has not been terribly clear when it comes to the number of subscribers to its premium services. These include not only its DashPass users, but also its Wolt+ users. Wolt, for context, is its Finland-based online food delivery service. Unfortunately, data for 2021 is not available. But we do know that from 2022 to 2023, the number of premium subscribers expanded from 15 million to 18 million.

On the bottom line, the picture has been mixed but has generally shown signs of improvement. The firm went from a net loss of $468 million in 2021 to a loss of $1.37 billion in 2022. That loss narrowed, fortunately, to only $558 million in 2023. Other profitability metrics have shown a similar trajectory. Operating cash flow, for instance, dropped from $692 million in 2021 to $367 million the year after. But in 2023, it ballooned to $1.67 billion. If we adjust for changes in working capital, we get an eventual rise from $301 million to $1.26 billion. And over the same window of time, EBITDA for the company expanded from $289 million to $1.19 billion.

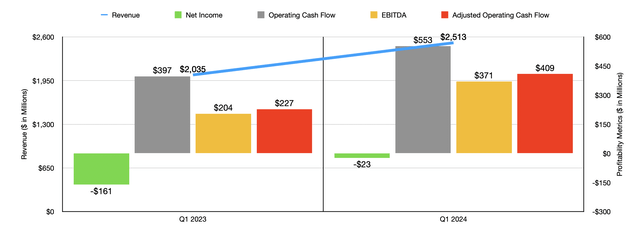

Author – SEC EDGAR Data

Growth for the company has continued into the 2024 fiscal year. At present, we only have data for the first quarter. But for that time, revenue for the company came in at $2.51 billion. That happens to be 23.5% above the $2.04 billion generated the same time one year earlier. An increase in the number of orders from 512 million to 620 million, as well as a rise in Marketplace GOV from $15.91 billion to $19.24 billion, was instrumental in pushing this higher.

Naturally, the company’s bottom line has continued to improve. The firm’s net loss narrowed from $161 million to $23 million. Operating cash flow nearly doubled from $397 million to $553 million. On an adjusted basis, it also nearly doubled, jumping from $227 million to $409 million. And lastly, we have EBITDA. It managed to jump from $204 million to $371 million. Clearly, the picture for the company is improving at a rather drastic base. And that is absolutely encouraging from the perspective of investors. This has been the hope for all growth businesses. As firms scale, they are able to eventually cut down on costs and exercise pricing power over their markets. When this occurs, there is the potential for not only continued attractive growth, but also for expansion on the bottom line.

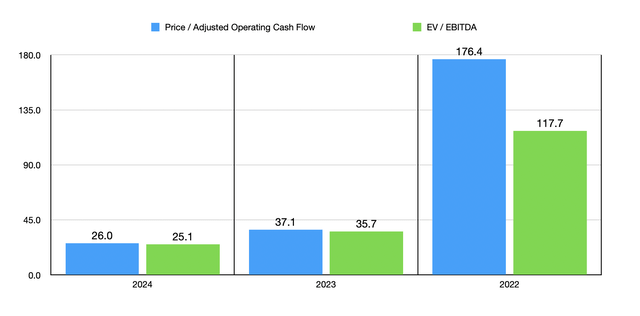

Author – SEC EDGAR Data

This doesn’t necessarily mean that the company makes sense to buy into at this point in time. As great as the picture has been from a fundamental perspective, shares are quite pricey. In the chart above, you can see how shares are priced using data from 2022 and 2023. This chart also looks at a forward estimate for 2024. You see, for the second quarter of this year, management has forecasted EBITDA of between $325 million and $375 million. At the midpoint, this would be about 34.4% above what was seen the same time last year. If we assume that the third and fourth quarters of this year will grow at the same rate, year over year, as what is expected for the second quarter, this would imply adjusted operating cash flow this year of $1.79 billion and EBITDA of $1.70 billion. Even in this case, shares are looking a bit lofty.

Even though I have decided to keep the company rated a ‘hold,’ this does not mean that I don’t believe in its potential for further growth. When focused on just the US market alone, the online food delivery space was valued at about $210.6 billion in 2022. That is expected to grow to $556.1 billion by 2030, for an annualized growth rate of 11.8%. That’s a solid amount of growth, for sure. Obviously, there are international opportunities for the business as well. And management has been making moves on that front. Back in 2021, only $11 million of the company’s revenue came from international sales. By 2023, international revenue accounted for $854 million of the company’s top line. However, that still means that 90.1% of the firm’s sales come from its domestic market. So our emphasis should certainly be on that space.

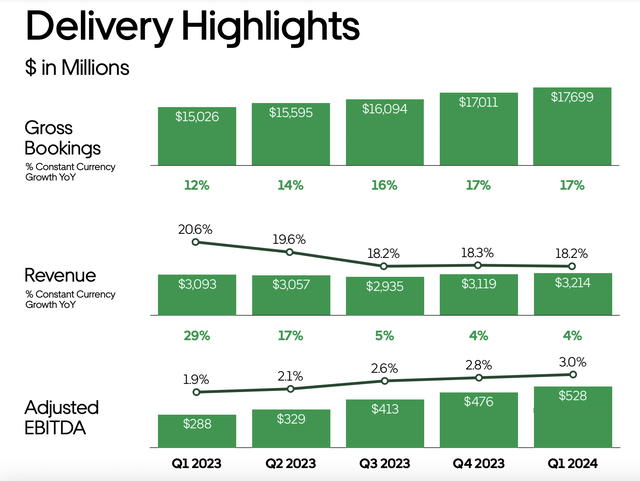

Another thing to keep in mind is that competition in this industry is fierce. Domestically, the other big player that’s publicly traded to be aware of is Uber Technologies (UBER). That company puts all of its delivery related activities under its Delivery segment. Fortunately, overall growth from a revenue perspective has been quite modest. In the first quarter of 2024, for instance, Uber Technologies’ Delivery business generated revenue of only $3.21 billion. That happened to be only 3.9% above the $3.09 billion reported one year earlier. However, profitability for that segment has shot up, with EBITDA skyrocketing from $288 million in the first quarter of 2023 to $528 million the same time of 2024.

Uber Technologies

Management at Uber Technologies has also been investing pretty heavily in this space. In May of this year, the company acquired the foodpanda delivery business that was then owned by Delivery Hero SE. This is essentially Delivery Hero’s food delivery operation in Taiwan. The purchase price agreed upon was $950 million. In addition to this, Uber Technologies Agreed to make a $300 million investment directly into Delivery Hero SE. Earlier in May, Uber Technologies also announced that it was partnering up with Instacart (CART). That partnership will allow Instacart customers to order from hundreds of restaurants through the Instacart app, in addition to the roughly 1,500 national, regional, and local retail banners that they can order from that represent 85,000 stores. This will come at no additional cost when grocery and/or restaurant orders are above $35 each.

Takeaway

Operationally speaking, DoorDash is doing quite well. I would like to see the company finally turn and keep a profit. But it looks as though that’s not too far off on the horizon. In the long run, I fully expect the firm to do well for itself and its investors. But this does not make it an ideal opportunity. Despite attractive growth, particularly on the bottom line, shares are still a bit pricey. In addition to this, it will have to fend off against serious competition, most notably from Uber Technologies. Given the competitiveness of this market and how shares are priced, I think it would only be appropriate to rate the company a ‘hold’ at this time.

Read the full article here

Leave a Reply