Investment Thesis

In our most recent article on BlackRock’s iShares MSCI China A ETF (BATS:CNYA), we concluded that it was not the time to give up on investing in this ETF. It was based on relatively attractive fundamentals and our expectations that the “animal spirit” would return to China.

We also made it clear that it would take time.

Time stands still for no man. We want to update our thesis based on the most recent events.

CNYA’s portfolio characteristics and performance of main components

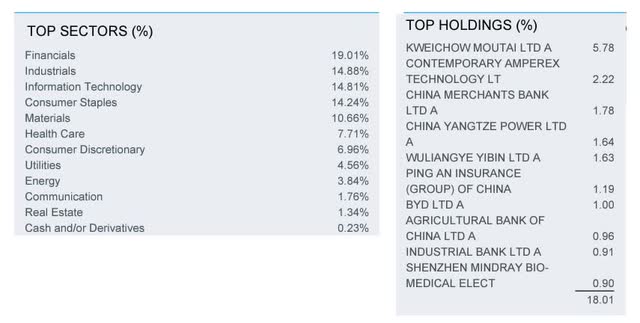

CNYA’s top holdings and segments (Blackrock)

We will focus on the six largest holdings in CNYA to see whether there has been any reduction or improvements in P/L in these companies.

Kweichow Moutai Ltd is a large manufacturer of alcoholic beverages. Their net profits, less non-recurring items, improved by 19% to RMB 75.7 billion Y-o-Y. The improvement in cash flow was even larger, at 81%.

Contemporary Amperex Technology Ltd. is in the business of manufacturing lithium-ion batteries for EVs and energy storage systems. Their net profits, less non-recurring items, improved by 42% to RMB 4 billion. Their net cash flow improved by 51.6% Y-o-Y.

China Merchant Bank Ltd. is the country’s seventh largest bank by assets, which stood at RMB 11 trillion at the end of 2023. The net profit attributable to shareholders was 6.2% higher at RMB 146 billion. The NAV per share was 36.71, which gives us an attractive P/Book of 0.94, based on the current share price of RMB 34.68

China Yangtze Power Ltd. is mainly involved in generating and distributing electricity made from hydropower. Their net profit attributable to shareholders, after excluding non-recurring profit or losses in 2023, was RMB 27.5 billion, an improvement of 28.6%.

Wuliangye Yibin Ltd. is engaged in the manufacturing and sales of liquor & wine, beverage, and refined tea products. They delivered a net profit in 2023 of RMB 31.5 billion compared to RMB 28 billion in 2022. That is an improvement of 12.5%.

Ping An Insurance Group, is China’s largest insurance company with 231 million retail customers. Their operating profit last year was RMB 118 billion, which was a reduction of 20% Y-o-Y. The main reason for the reduction was a loss of RMB 19.5 billion in their asset management division. This department has RMB 7 trillion in AUM. With the reduction in value of some of these assets, Ping An decided to revalue some of these assets, which caused this loss.

Despite tepid consumer demands, we can see from this research in general large companies in China delivered improvements in profits last year.

Widening gap between stock prices in the U.S. and China

In all our investment endeavors, we do need to ask ourselves what is the opportunity cost.

Sure, you could be right on the thesis, but how long time will it take to develop, and what could you have made choosing another alternative?

Widening gap between CNYA’s price and that of SPY (SA)

Arguably, indexes such as the S&P500, which is weighted based on the market capitalization of the companies, can become overly concentrated in one sector. The “Magnificent Seven”, as it is called, holds Apple (AAPL), Microsoft (MSFT), Google parent Alphabet (GOOGL), Amazon (AMZN), Nvidia (NVDA), Meta Platforms (META) and Tesla (TSLA).

In the State Street-managed S&P500 ETF (SPY), those seven companies constitute as much as 27.46% of the whole index. To me, it is somewhat crazy when a company like Nvidia is valued at more than three trillion U.S. dollars. That is nearly what the entire Hong Kong stock market’s capitalization of HKD 32.1 trillion is.

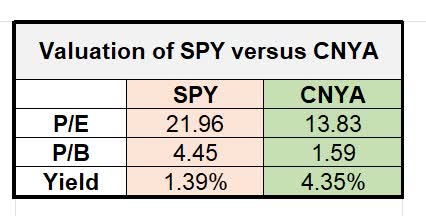

Nevertheless, when we look at valuation matrixes, such as P/E, P/B, and dividend yield, the American stock market is twice as expensive as the Chinese. We do not think that this large difference is justifiable.

Valuation matrixes of CNYA versus SPY (Data from State Street & Blackrock)

The importance of diversification must always be in our minds. Hence, there are good reasons why we should not overlook one geographical sector just because we have a particular liking for another.

Recent economic development in China

We shall focus on the two items which are the most expensive things any household buys.

They are a home to live in, and a car to move around with.

Let us start with cars. This is an area of big discord between China and the West at the moment.

There has been a sudden influx of Chinese-made EVs flooding the market. This is causing concerns for car manufacturers in Europe, and in the U.S. It has not yet flooded the market in the U.S., however, the American government pre-empted this development at the end of May by introducing a 100% import tax on EVs commencing 1st of August this year.

The European Union followed by imposing a tariff on imports of electric vehicles made in China of up to 37.6% effective from 5th of July

Chinese EV makers are now hunting for other markets, like Southeast Asia, to grow their market. They are also planning on building factories in Mexico and Turkey.

Now to real estate.

If you follow economic development in China, you know that the real estate market, and especially the real estate developers, is still not in good shape.

Thousands of unsold and unfinished apartments coupled with a low market sentiment are holding prices down. According to recent news from Chinese data provider CRIC, they estimate that 20 of the 30 larger cities they track, they expect that it will take more than 18 months to reduce stockpiles of unsold apartments.

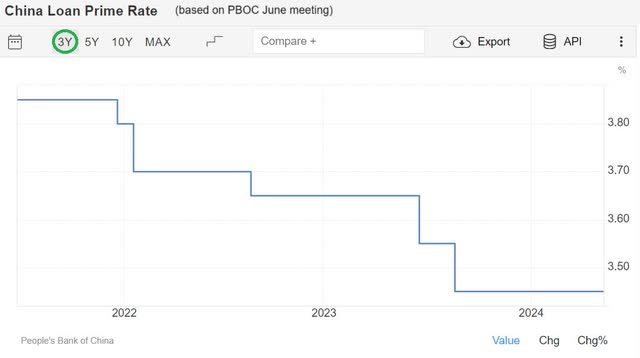

We had expected that the People’s Bank of China would reduce the interest further, however, at their June meeting, they decided to keep the key lending rates unchanged. The 1-year loan prime rate, which is the benchmark for most corporate and household loans, was maintained at 3.45%. The 5-year rate for property mortgages was kept at 3.95%

China’s 5-year loan Prime rate (Trading Economics)

In an article in SCMP on the 13th of June, they wrote that the PBOC implemented a plan in May to establish a re-lending fund of 300 billion Yuan to help clear some of this excess housing stock.

The re-lending policy is supposed to be implemented in a “market-oriented” way, based on the principles of “voluntary participation, demand-based purchasing, and reasonable pricing”. This is to avoid the addition of hidden debts, which have been so prevalent amongst provincial governments.

The Achilles heel is still poor market sentiment.

Hopefully, the action taken by PBOC will result in lower costs for the purchase of a home to live in. Speculators wanting to invest in additional units will most likely not benefit from these initiatives, which is a good thing.

Risk to Thesis

There is a risk that investors’ sentiment for investing in China will continue to be poor.

Potentially, the stock market in China could still rally without the support of foreign investors. In the past, most retail investors put their money into residential real estate. The cap rate is low, so the only way investors make money is the rise in prices. That has worked well in the past, but the last couple of years have been disappointing for those who invested in this asset class.

Risks of default by developers added to people’s misery.

Over time, we believe more and more private investors in China will realize the benefits that the equity market offers. The security regulators in China is also working on improving

Conclusion

We do not doubt that AI is going to be important for the economy going forward. The magnificent seven will be the initial benefactors of this.

The next stage is most likely going to be the industries that can harness the improvements in productivity from AI. We think China, as well as the rest of the world, will benefit from this equally. The race that is now going on in China to become more capable of producing the chips that enable them to become a force in this field will happen. It is only a matter of time.

Geopolitical tension between the large nations is not going away. It might even get worse. But we think that there is enough wisdom from all parties that they do need to learn to live together harmoniously.

To ignore the world’s second-largest economy, as an investor, is not wise.

We still think that ETFs like CNYA are a good place to invest in.

Therefore, our Buy stance remains intact.

Read the full article here

Leave a Reply