Please note all $ figures in $CAD, not $USD, unless otherwise stated.

Introduction

I’ve been mildly bearish on regulated utility companies for a while, but given that the sector has been out of favor lately, I thought it would be good to discuss my favorite idea in the Canadian regulated utility sector, Canadian Utilities (TSX:CU:CA) (OTCPK:CDUAF). My investment thesis revolves around a pivot to lower carbon energy sources, higher backlog over time, and continued growth in the core Alberta utilities business. I also believe that because of its discount relative to its peers and an improving balance sheet, shares of the company look attractive today.

Company Overview

Canadian Utilities is a holding company that owns regulated utilities in the province of Alberta. As a regulated utility owner, the company earns revenues through the sale of electricity and natural gas transmission and distribution across operations in Alberta, Saskatchewan, as well as northern regions of Canada. With $3.7 billion in annual revenues, the company is one of the largest regulated utility companies in Canada. It also has significant non-regulated businesses that include hydro, solar, wind, and natural gas electricity generation assets in Western Canada, Australia, Mexico, and Chile. The majority of the company’s voting shares are controlled by ATCO Ltd. (ACO.X:CA), a company I previously covered, which in turn is controlled by the Southern family.

Track Record of Consistency

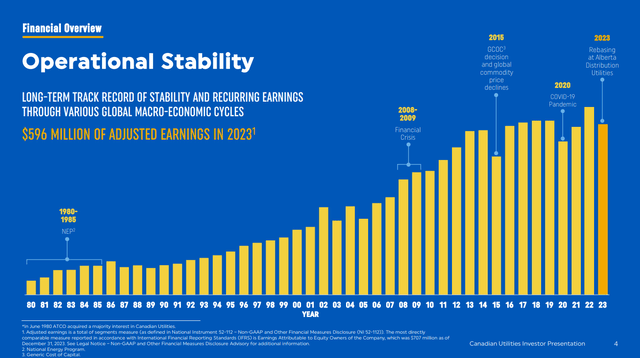

Before analyzing one of the sleepiest businesses I know, it should be said that an investment in Canadian Utilities isn’t going to make you rich. Rather, it can be a vehicle that investors can rely on for steady and predictable performance year to year. While the company’s revenues are only up 7% over the last ten years (source: S&P Capital IQ).

Especially during weaker economic periods like recessions and global financial crises, Canadian Utilities has proven to be a ‘safer’ investment that’s fared better on the downside. For example, during the 2008-09 financial crisis, earnings actually increased and the company’s shares only declined about 23% between those two years.

Investor Presentation

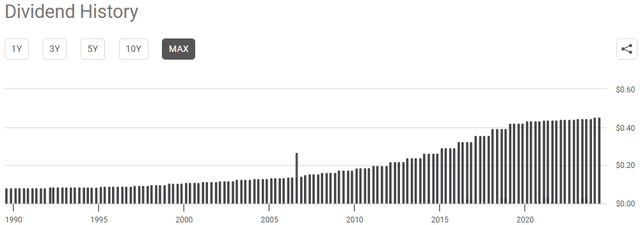

One of the major selling points about Canadian Utilities as an investment is its track record of dividends. For income-oriented investors as well as retirees looking for reliable dividends, Canadian Utilities has been a company investors can turn to. Over the last 52 years, the company has had a track record of delivering annual dividend increases, which is the best record of any Canadian publicly traded company.

With a quarterly dividend of $0.45 per share, the increases in the dividend in recent years haven’t been much (~1% per year on average), but it’s a dividend supported by utility cash flows at an 81% payout ratio, leaving a bit of a buffer. At the current price, the yield is approximately 6.0%, so investors are getting a very attractive yield that has potential to go higher.

Seeking Alpha

Strong Operational Performance

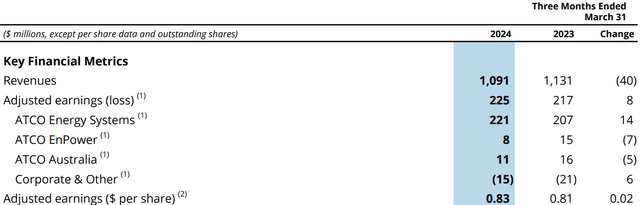

When looking at the latest quarterly results for Canadian Utilities, the company reported revenues of $1.09 billion, which was a 3.5% decrease from Q1 of last year. In terms of what drove the results, the lower revenues were mainly due to lower natural gas storage revenues as well as ATCO EnPower’s Forty Mile wind facility realizing lower prices during the quarter. Performance was also hindered by performance in ATCO Energy Systems, where lower revenues in electricity distribution and lower commodity prices negatively impacted results. These two segments were partially offset by the growth in rate base and higher ROE in ATCO Energy Systems.

Company Filings

As was mentioned last quarter, the company’s allowable ROE (i.e., the spread that it earns on the equity invested into projects) was increasing to 9.28% this year compared to 8.5% last year for Alberta projects. So far, the increase in allowable ROE has been a tailwind to adjusted earnings in both of the company’s electricity and natural gas businesses in Alberta.

Overall, the results seemed to be in line with what consensus was expecting given that the company reported a small beat of $28 million in revenue, but EPS missed by 1 cent.

On the Q1’24 earnings call, while the company noted a higher proposed ROE on the draft decision related to AA6 (Sixth Access Arrangement in Australia), management highlighted substantial changes between the draft and final decision for the last access arrangement and mentioned that it would be too early to determine any earnings implication for the Australian utility. A finalized decision is expected in November 2024. Management views the Australian utility operations as a core business and a self-funding entity, and expects growth to be driven predominantly from energy transition opportunities.

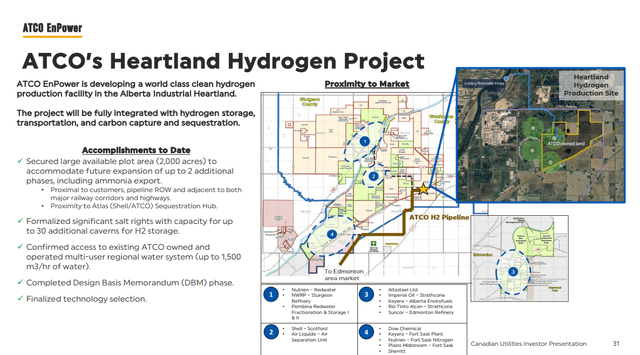

Another key highlight during the quarter was the company’s progress on the Heartland Hydrogen Project. This is expected to be a leading clean hydrogen production facility in Alberta’s industrial heartland and will be integrated with hydrogen storage, transportation as well as carbon capture and sequestration.

Investor Presentation

Stable Balance Sheet

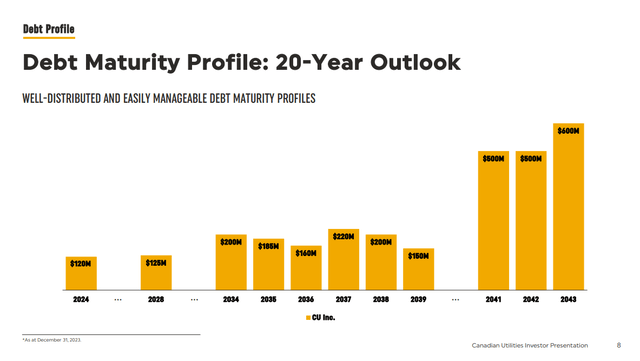

As for the company’s balance sheet, Canadian Utilities ended the quarter with $207 million on the books with available credit capacity of $2.1 billion. With A and A- ratings from DBRS and Fitch, respectively, the company maintains a solid investment grade profile. At quarter end, the company had net debt of $10.2 billion, for a Net Debt to EBITDA ratio of 5.1x.

While this looks high on an absolute basis, most of its debt is very long-term in nature in somewhat laddered maturities. With most of the debt at fixed rates and due in years beyond 2034, there isn’t a significant refinancing risk in the near term. Moreover, I view this structure as providing stability and predictability in managing debt obligations, which should insulate the company (to a certain extent) when it comes to interest rate fluctuations that could otherwise impact borrowing costs. An investment grade profile with robust and steady cash flows certainly helps in this regard, allowing Canadian Utilities to access debt capital markets with a low cost of borrowing.

Investor Presentation

Outlook

Canadian Utilities is scheduled to report Q2’24 results on August 2nd and there are a few things I will be watching for when the results come out. Firstly, investors should watch for any indications on the company’s progress on an FID target for mid-2025 with Heartland Hydrogen Hub. Previously, management has talked about FEED sanctioning for the Heartland Hydrogen Project this year, so we might expect some updates on that front in Q2’24.

On the Q1’24 conference call, management noted that the company is looking for a strategic partner for the project as well as an offtake partnership, which should materialize for Q2’24. They also mentioned that the company continues to explore offtake agreements and is observing interest from businesses locally and from Southeast Asia for hydrogen and hydrogen derivative products. Canadian Utilities is aiming to provide an update on securing a partnership for this project next quarter, so this is something that investors should look forward to.

In terms of the financial results, analysts are estimating between $0.33 and $0.44 in EPS for the quarter (average is $0.40) This is lower than the $0.83 actual EPS earned in Q1’24, but would imply 9.3% growth on a year-over-year basis. Overall, I wouldn’t be surprised to see the results come in on the high end of the range given the incorporation of higher rates and rate-base growth, earnings from assets coming into service in the past several months, as well as higher earnings at the Distribution utilities compared to a cost-of-service rebasing year.

Valuation and Wrap Up

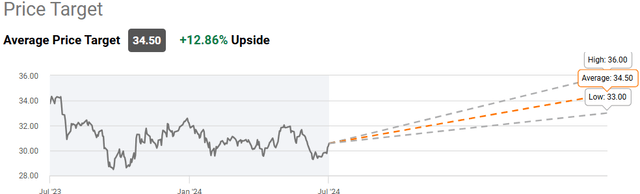

All 5 sellside analysts who cover Canadian Utilities have a ‘hold’ rating on the stock with an average price of $34.50, a high target of $36.00, and a low of $33.00. From the current price of $30.57, this implies about 12.9% upside, not including the current dividend yield of 6.0%. With 18.9% total return potential, despite all analysts having a ‘hold’ rating, I think the company’s price target suggests strong return potential.

Seeking Alpha

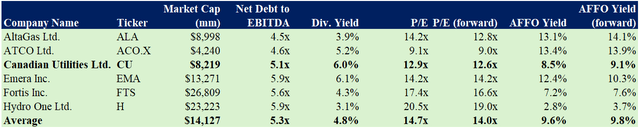

When comparing Canadian Utilities to its Canadian listed regulated utility companies, the company trades at 12.6x forward earnings, compared to the group average of 14.0x (source: S&P Capital IQ). Out of my peer group set, only ATCO and AltaGas (ALA:CA) trade at cheaper valuations. Given the company’s higher dividend, lower leverage, and better valuation on P/E and AFFO yield, I think that Canadian Utilities’ shares offer compelling value.

Author, based on data from S&P Capital IQ

In addition, Canadian Utilities is trading at 12.9x LTM P/E, below its historical five-year average of 16.1x (source: S&P Capital IQ). I believe this to be unwarranted given the growth potential arising from energy transition opportunities as well as the ability for the business to generate solid returns from its core Alberta utilities business.

As for the risks to the investment thesis, most of the company’s risks are macroeconomic related and apply to most utility companies. Primary risks would include unfavorable regulatory and policy changes (as regulators determine the allowable ROE that Canadian Utilities is allowed to earn), political risk, and damage to company assets as a result of outages and facility disturbances. Historically, Canadian Utilities has navigated through both good times and bad, and I see no reason why they wouldn’t continue to do so in the future. Their track record suggests a strong ability to manage through various economic and regulatory environments. However, I’d still monitor these risks going forward as they could impact the company’s financial performance.

Altogether, I think Canadian Utilities is a solid buy within the utility sector. As the company continues to pivot to a lower-carbon energy future across its businesses, I expect this to translate into upward revisions to its capital project backlog and incrementally bolster growth. In addition, I wouldn’t be surprised to see the core Alberta utilities businesses to continue to earn solid returns under their respective regulatory arrangements. As a result, given the attractive valuation, strong balance sheet, and stable infrastructure franchise, I rate shares of Canadian Utilities as a ‘buy’.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply