Two-storey residential building in Ottawa, Canada

Note: All amounts discussed are in Canadian Dollars. Securities discussed trade primarily on Canadian exchanges. Canadian options are not accessible by US investors.

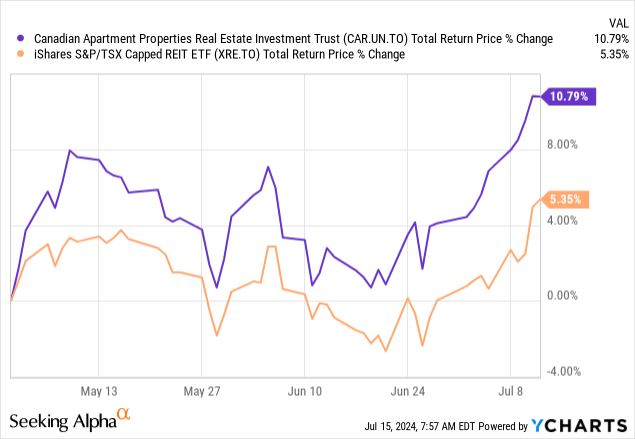

On our last venture out into analyzing Canadian Apartment Properties Real Estate Investment Trust (TSX:CAR.UN:CA), we upgraded the REIT to a Buy and after staying on the sidelines for about 18 months. Right or wrong, we prefer to make calls based on valuation and technicals. Singing eternal praises of a company because it is fundamentally sound, is never on the agenda. The buy rating had to do with compelling valuation and some strong tailwinds which were enough to offset the interest rate headwinds. CAPREIT has delivered in spades since then with 10.79% total returns. This is about twice that of iShares S&P/TSX Capped REIT ETF (XRE:CA).

But our core thesis did call for a modest overall return profile of 7% annually on the stock ownership (12% or so using covered calls). So has the rapid jump impacted the potential return profile? Let’s see the Q1-2024 results.

Q1-2024

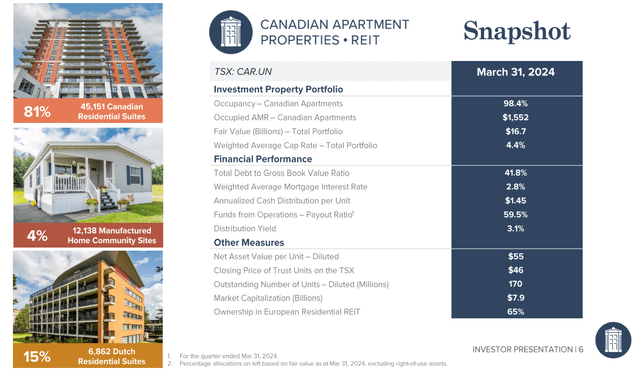

In Q1-2024, CAPREIT’s overall numbers remained extremely strong with occupancy at 98.4%. Overall NAV remained stable as higher net operating income (NOI) added about 1% to the total.

CAPREIT Q1-2024

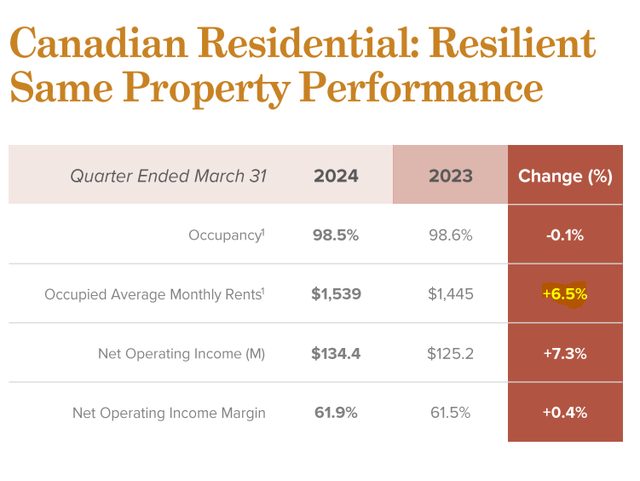

On a same property basis we got to see the occupied average monthly rent move up 6.5%. Strong expense control helped NOI expand faster to reach 7.3% growth. NOI margins remain near the highs as 61.9%.

CAPREIT Q1-2024

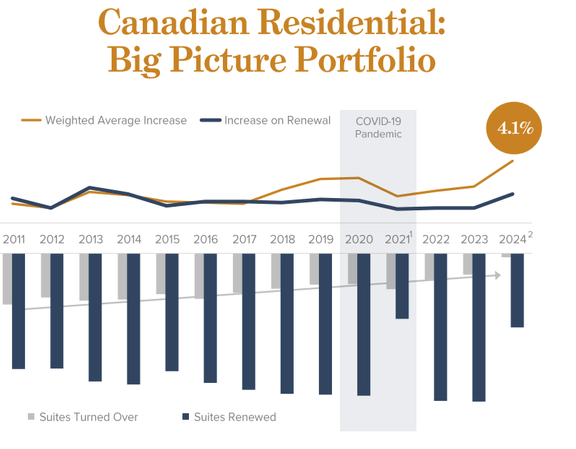

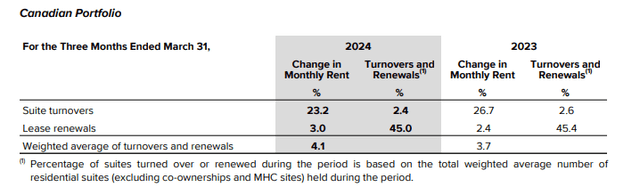

The fundamental call for investing in CAPREIT can be seen in the weighted average increase in rents. You can see in the picture below that increases on renewal are quite little but the weighted average increase is fairly substantial. As a result suites turned over is coming to a crawl.

CAPREIT Q1-2024

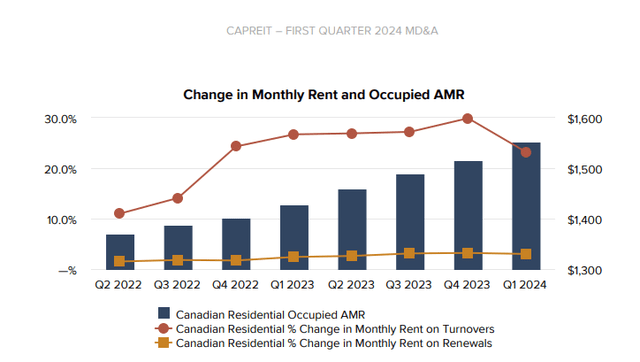

This makes sense as market rents in Ontario and British Columbia are miles ahead of the rents in place on CAPREIT’s suites. Because of rent control, CAPREIT can only increase rents modestly on existing renewals. But when people move out, that’s when the magic happens. This is better visualized by the next two images. The first one shows the change in monthly rent on suite turnovers. 23.2% is extraordinary.

CAPREIT Q1-2024

Some might quibble about the percentage moving lower, but one has to keep in mind that there are base effects in action here. Just look at where the current rents are in relation to 1 year and (almost) 2 years ago (Q2-2022 quarter shown below).

CAPREIT Q1-2024

So the fact that we are still seeing 23.2% increases on turnovers is impressive.

Outlook

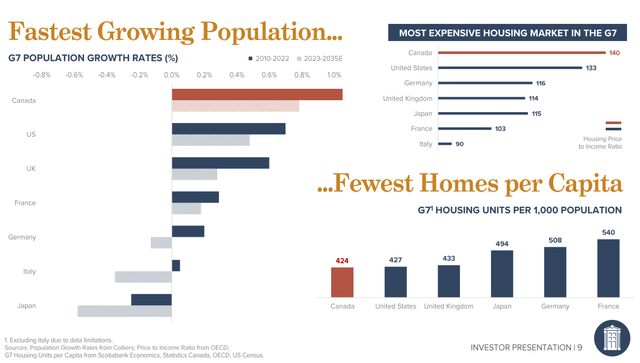

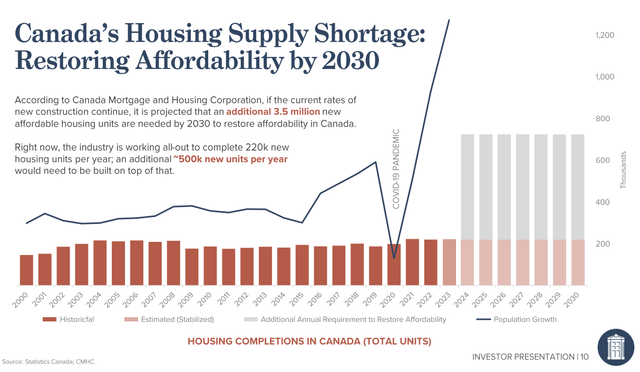

The story is still about the gap between in-place rents and market rents on new leases. This built-in growth will give CAPREIT a clear runway for at least 5 years. We should see same property NOI growth of at least 5% a year and possibly as high as 10% in some years. It is fairly rare when you can have that level of confidence in a REIT, but the market rents make this a near certainty. In the interim, Canada is “boasting” about the fastest population growth via immigration. This comes in the face of the least affordable housing market and building the fewest homes per capita.

CAPREIT Q1-2024

On the next chart Canada’s population surge looks like a AI stock going parabolic.

CAPREIT Q1-2024

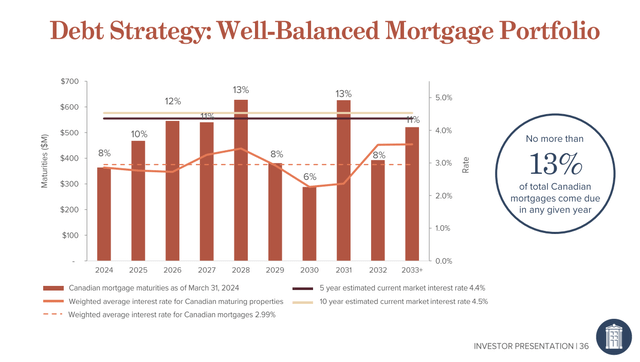

If all of this sounds disastrously bad, it may be because it actually is that bad. But from an investment stand point, there has been no better time to own a rental building than today. CAPREIT’s one of the best if not the best in the business. The debt maturity profile looks like a small headwind and definitely looks less problematic than it did 12 months back.

CAPREIT Q1-2024

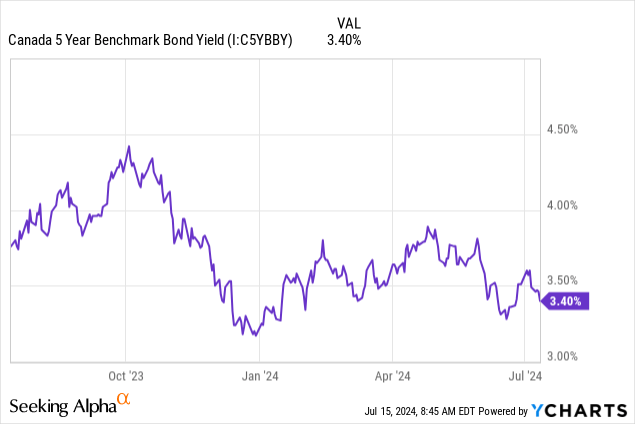

The reason is that NOI has been strong enough to offset interest rate pressures and the average refinancing rates are moving lower. A good measure for this is Government of Canada 5 year bond yield. You can pull up this chart and add about 90 basis points to see where we stand on the 5 year CMHC refinancing rates.

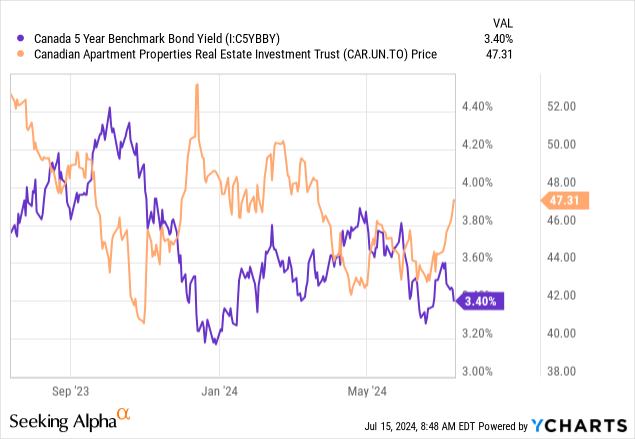

You can also visualize the inverse relationship between these yields and CAPREIT’s price.

We remain comfortable with owning this and think a very long term (say 5 years) move to at least $60 is probable. This would happen even without any more interest rate cuts. That move may not sound like a lot in a market spoiled with crazy moves on technology stocks. But it is an appealing wealth builder to us. As always we set up each position with a covered call. That tends to limit movements in either direction. But also produces good returns with relatively low volatility. We maintain a Buy rating here despite the increase in stock price. On a relative basis a couple of residential REITs have become slightly more attractive since our last article (better NOI growth, weaker price action). That is where we allocated fresh capital.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply