Note:

I have covered Aehr Test Systems (NASDAQ:AEHR) previously, so investors should view this as an update to my earlier articles on the company.

Shares of wafer level test and burn-in system supplier Aehr Test Systems, or “Aehr” have rallied by more than 80% since my last update on the company four months ago.

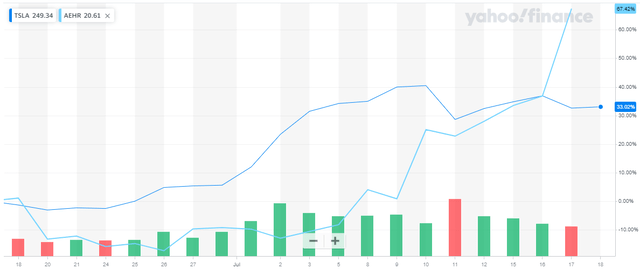

While the company’s core silicon carbide wafer level test and burn-in business remains challenged by lower-than-expected BEV production growth, investor sentiment has improved quite meaningfully in recent weeks with BEV posterchild Tesla (TSLA) leading the way:

Yahoo Finance

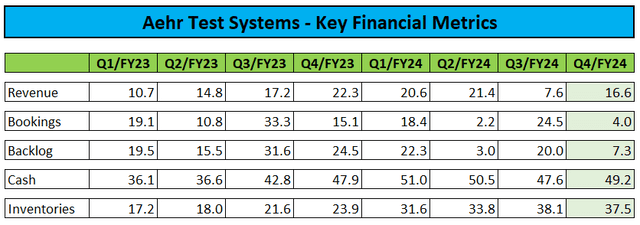

On Tuesday, the company reported Q4 and full fiscal year 2024 results in line with its preannouncement last week:

Company Press Releases / Regulatory Filings

While Q4 revenue of $16.6 million slightly outperformed management’s recently revised outlook, the company’s order intake of just $4.0 million was disappointing.

That said, Aehr managed to secure $13.5 million in new orders since the beginning of FY2025 thus resulting in effective backlog of $20.8 million.

The company remains heavily dependent on demand for its silicon carbide wafer level test and burn-in products but with BEV demand nowhere near previous expectations, Aehr’s core business will continue to be challenged in FY2025 as very much evidenced by management’s initial guidance:

For the fiscal year ending May 30, 2025, Aehr expects total revenue of at least $70 million and net profit before taxes of at least 10% of revenue.

Please note that the outlook includes approximately $10 million in contributions from the proposed $21 million acquisition of Incal Technology, Inc. or “Incal”, a small provider of burn-in test solutions, allegedly “used by a significant number of leading Artificial Intelligence (“AI”) semiconductor manufacturers“.

Incal Company Website

However, management was reluctant to provide details on Incal’s customers and revenue trajectory which in combination with the very modest purchase price raises questions regarding the company’s ability to turn this acquisition into a major growth driver. There’s basically no way that a red hot AI semiconductor growth play would sell for below 2x revenues.

At least in my opinion, the proposed acquisition might be less of a strategic move but rather an attempt to mask persistent weakness in the core business.

Kudos to Jon Gruber from Gruber & McBaine Capital Management LLC for asking the right question on the conference call:

Jon Gruber

Yeah, yeah, I mean good presentation, a lot of prospects, but what I don’t understand is with the acquisition, all these prospects (…) why is there no revenue growth excluding the acquisition?

Gayn Erickson

(…) It’s really about the push-outs that we saw with respect to the silicon carbide ramps, things we were expecting people to be coming in pretty strong. And we’re just looking at soft forecasts right now. We have multiple customers in our forecast that are going to buy one or two systems and not a lot of big ones. So our key customers themselves, for example and again, if you just look at the big silicon carbide guys, so let’s just back up so I’m not talking about my customers in general or who they are.

But I think if you look at the top four silicon carbide customers, they all guided down this year. And so, there have been people that are — we’re wondering how bad it was going be for us, and can we even continue to maintain our growth while they’re having a soft year followed by a strong year. So I think we’re — it’s the right thing to do right now is to communicate this. If we see strength in the second half come in harder than we are currently conservatively forecasting, then we’ll guide up at that time.

Quite frankly, management did not “communicate this” in the prepared remarks and only came up with the details after being poked by the analyst during the questions-and-answers session.

Adjusted for the Incal acquisition, management guided for FY2025 revenues to decrease by 10% on a year-over-year basis despite some success from the company’s diversification efforts with anticipated, meaningful contributions from new customers in the AI-acceleration and hard disk drive space.

Despite stated accretion of the Incal acquisition, management projected a 30%+ year-over-year reduction in the company’s net profit margin for FY2025.

Once again, it took an analyst question for management to provide more color on the issue:

Jed Dorsheimer

(…) And then could you just help me connect the dots? If I use, you know, you said $12 million with 2 months of $1 million, so $10 million for Incal. It would suggest that the core business is kind of your guidance for a conservative or down year at the low end of $60 million. But on the operating income, if it is immediately accretive, which I think was stated in there, are you making a significant investment in the OpEx to cause the EBIT to come down by 6% or so percentage points or is that — is something going on in gross margin?

Gayn Erickson

Yeah you know what it’s I’d say, it’s mostly the prior than the gross margin of it. We’ve actually made incremental expense investments, some of which candidly was in anticipation of much higher revenue this year, but it was things like the additional infrastructure we put in place in sales support infrastructure for all the selling that’s going on. And eventually those need to turn into orders, as we are now very diversified in terms of the number of engagements at high level, but they obviously need to come to fruition, otherwise you put all these dollars in place and they’re not helping.

So there’s explicit direct sales costs associated with that. We also have in our forecast, it’s a little different than last year, the mix of our customers changing with some new customers includes customers that today were engaged in both directly and with local reps in those countries and they have a commission structure in them that is higher up front than later. So we have a pretty material, I think it’s $700,000 — $800,000 or so in external commissions on, would seem to be the same dollars, but it’s actually dollars that are bought by new customers in new markets or new countries that has kind of messed us up a little bit. But I mean good money spent for sure, but that’s another one.

And then we’ve got some of the legal things, legal costs that we’ve talked about with respect to, I’m just going to use their code name with the acquisition, right, that are going on. And there’s a few other things just respect to some profit sharing and some other things are slightly different year-on-year. We definitely are making investments in R&D this year, both incremental to the — I’ll call it the wafer level burn-in product line, we have to get used to thinking about that, but also we’ll be making some incremental investments in the package part. (…)

Given the persistent weakness in the core business, President and CEO Gayn Erickson spent plenty of time on the conference call elaborating on the company’s diversification efforts with a special focus on AI in an apparent move to change the narrative away from silicon carbide.

At least when judging by Wednesday’s 20%+ move in the shares following an almost enthusiastic upgrade by Craig-Hallum analyst Christian Schwab, management did a great job and with expectations for FY2025 now set at very low levels, the risk of massive guidance reductions similar to last year has decreased considerably.

In combination with the recent change in investor sentiment, I am upgrading the company’s shares from “Sell” to “Hold“.

Bottom Line

Aehr Test Systems reported Q4 and full-year fiscal 2024 results in line with the company’s preannouncement last week. Adjusted for the proposed acquisition of Incal Technology, the company’s outlook for FY2025 was disappointing, as the core silicon carbide-related business will remain challenged well into FY2025 and potentially beyond.

However, management successfully highlighted the company’s diversification efforts in an apparent move to change the narrative away from silicon carbide.

As a result, Aehr Test Systems managed to lower FY2025 organic sales expectations well below consensus expectations without hurting the stock price.

While I have my doubts regarding the rationale behind the proposed Incal Technology acquisition and remain concerned about management’s apparent focus on the company’s stock price, I am raising my rating from “Sell” to “Hold” due to recent changes in investor sentiment and sufficiently derisked expectations for fiscal year 2025.

Read the full article here

Leave a Reply