In May, I analyzed Frontier Group Holdings (NASDAQ:ULCC) (Frontier Airlines) and upgraded the stock to buy. However, the reality is that the buy rating has not worked out as the stock has tumbled 38% and over a 1-year period the stock is down over 60%. With a decline this significant, I believe it is important to reassess my rating for Frontier Airlines which I will do in this report.

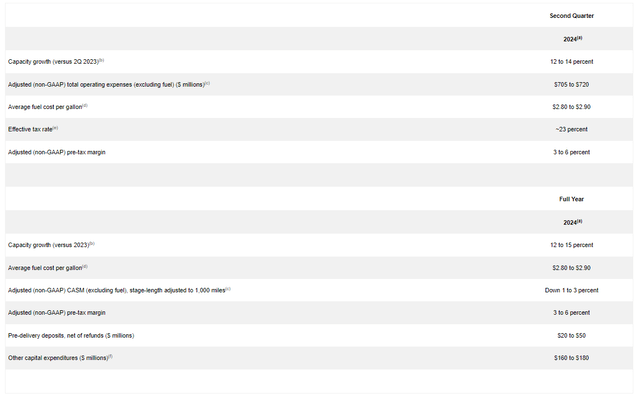

What Does Frontier Airlines Expect For Q2 2024 Earnings?

Frontier Airlines

During the first quarter earnings release, Frontier Airlines has guided for capacity expansion of 12 to 14 percent which is significantly higher than we see other carriers pursuing. The company is expecting pre-tax margins of 3 to 6 percent. It’s a stark contrast with Spirit Airlines which is expecting to be lossmaking during the quarter. One major reason seems to be that whereas Spirit Airlines has a quarter of its fleet grounded, Frontier Airlines has less than 2% of its fleet grounded. On a fleet of nearly 150 airplanes only two airplanes are grounded. That is the impact that Pratt & Whitney geared turbofan issues have on operators and operators such as Frontier Airlines that opted for engines from rival CFM International are at an advantage here.

What Are Analysts Expecting For Frontier Airlines in Q2?

Frontier Airlines will report second quarter earnings on the 26th of July before markets open. For the second quarter, analysts expect 6.6% growth in revenues to $1.03 billion which coupled with the capacity forecast shows further weakening in the unit revenues. Over the past three months, revenue estimates have come down as there were six downward revisions and one upward revision. Earnings per share are expected to be $0.14 indicating 55% growth and we saw four analysts revising upwards and five analysts revising downwards. Over the past two years, Frontier Airlines missed revenue estimates 5 out of 8 times and beat estimate on EPS all times.

Is There Reason For Concern For Frontier Airlines?

If we look at the second quarter results that have been posted by airlines, I wouldn’t say that there is any strong reason for concern. It should be noted that while Frontier and Spirit are both ultra-low cost carriers, their dynamics are different. With that I mean that Spirit Airlines is seeing significant pressure from maturing debt and grounded airplanes. That is not an industry wide trend.

What is, however, a fact is that air fares are falling as also became evident in the latest CPI readings and demand is softening. In other words, we are looking at some overcapacity in the market and there aren’t many opportunities to redistribute capacity. Some airlines are focusing on the Visiting Friends and Relatives or VFR market and that used to be a market that airlines generally don’t really want to cater towards. So when they do, I believe you can see it as a strong indicator that there aren’t many other opportunities to deploy capacity and seats would otherwise remain empty.

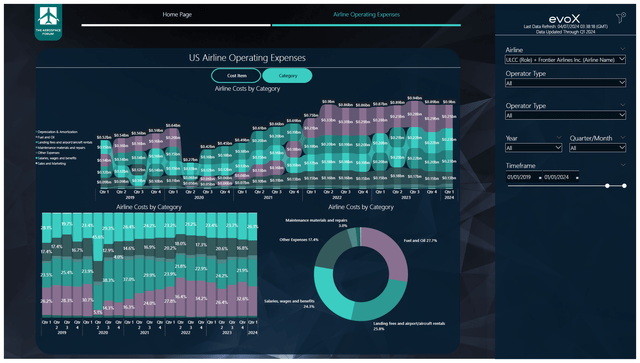

The Aerospace Forum

What is somewhat concerning for low-cost carriers worldwide is that LCCs used to derive strength from keeping costs low and subsequently discount aggressively on fares. Looking at the costs we see that costs have risen from $640 million pre-pandemic to $900 million. That is a 40% growth rate against a 32% increase in capacity. Given the 21% inflation between 2020 and 2024 that is actually quite good. Filtering out fuel costs the increase would be 42.3% and 17.5% after adjusting for inflation. So, Frontier Airlines has that cost control in order nicely as far as I can see.

Is Frontier Airlines Stock Really A Sell?

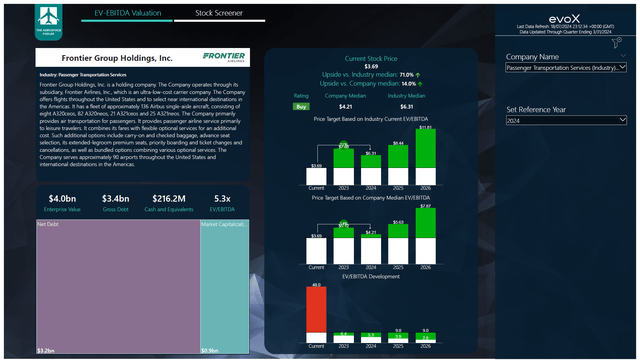

The Aerospace Forum

As far as I can see Frontier Airlines does not suffer from a lack of cost control. So, that is one problem Frontier does not have and it also does not have the problem of having to park part of its fleet. So, perhaps smearing the entire negative sentiment of airlines and LCCs in particular on Frontier Airlines as well might not be justified, but we have to look at the projections to know for sure.

Our model now better incorporates lease debt in the valuation and uses the most recent projections which actually were actually 5% than previously estimated. However, as we now better incorporated the leases into the structure, at 6x EV/EBITDA I believe that there is 14% upside with a $4.20 price target and the reality is that while the share price continues to tank, there should be significant upside in the years ahead.

Perhaps that is also the problem when it comes to Frontier Airlines. The company went public during the pandemic and we don’t have strong historical indicators for its valuation. I have incorporated a reduction in free cash flow burn from around negative $300 million in 2023 to break-even by 2026 and it is absolutely critical for Frontier Airlines to deliver on improvement in its operating and free cash flow trajectory.

So, with a lot of uncertainty Frontier Airlines is in some way more prone than other airlines to market sentiment and that market sentiment is not in favor of airlines at this time. So, I believe Frontier Airlines is an extremely speculative buy. I still see the upside, but I also note that the company has to show improvement in its operating cash burn in the quarters ahead, else we will be pointing at a potential for improvement that is not materializing.

Conclusion: Frontier Airlines Is A Difficult Stock To Own Or Value

Looking at Frontier Airlines costs, I believe they are better than what we are seeing at other low cost carriers. The carrier is also not facing the shortage of airplanes that other airlines are facing or at least not to the same extent. So, while LCCs are pressured due to the cost inflation I believe Frontier Airlines is positioned better among LCCs and ULCCs. Perhaps the mistake I made in my previous assessment was to allow Frontier Airlines to trade one year ahead of earnings while there most likely is too much uncertainty to really justify that.

I continue to expect that cash burn will taper and that would unlock some upside. Until that time and due to the lack of historical indicators specific to Frontier for investors to hold on to, the stock is likely to remain extremely volatile which leads to a speculative buy rating that I will definitely reconsider by year-end.

Read the full article here

Leave a Reply