The Energy Game

Celsius Holdings, Inc. (NASDAQ:CELH), the makers of the eponymous energy drink, have a lot of things going for them at the moment–sales are up and are expected to continue to grow at a rapid clip for the next several years. The last two months, however, have been quite volatile for the drink maker’s stock, peaking at near $100 in May 2024 before beginning a slide to $52, where it sits today.

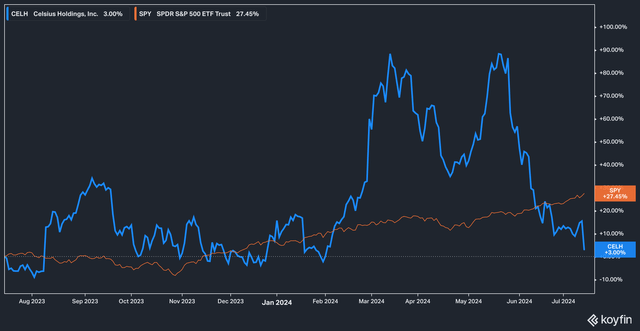

The above

CELH vs SPY (1Yr) (Koyfin)

sentiment is reflected in the stock’s total return profile over the last twelve months, which has been a real nail-biter for investors who have seen the stock dip near -10%, and surge all the way to +90% before settling today at a meager +3%.

So, what gives? And is the stock worth consideration today given the recent volatility? Let’s dive in.

Bad News Bears

The primary reason for the decline in Celsius’s stock price is fairly straightforward–certainty over future sales growth is waning. In the last few months, a slew of analysts have lowered target prices for the beverage company.

For example, on June 25th, Seeking Alpha news reported on Truist’s initiation of coverage at a Hold, along with a $60 price target. The position of the Truist analyst Bill Chappell is summed up here, and we’d wager that his thinking isn’t far off from most other analysts:

“We know of no other company that has been able to break through the 10% market share level other than Monster and Red Bull,” Chappell says in a nod to Celsius’ 11.5% market share… Chappell believes each incremental gain will be “tougher to attain than the one before it.”

To find new customers, Celsius will have to peel off loyal Monster (MNST) and Red Bull consumers as well as bring in new consumers to the category at a similar rate to the past couple of years to achieve the 30% and 34% top line growth expectations in 2025 and 2026, aggressive targets that may be more difficult than it looks.

We don’t think there’s anything controversial here–at some point, a brand’s growth slows as it establishes its customer base, and incremental gains become more difficult. We also think it’s interesting to note Chappell’s point that Celsius’ performance is, in some aspects, tied to that of its top rivals, Monster and Red Bull.

If that sounds a bit implausible, consider for a moment that in other categories (we’ll stick with beverages) poor performance from competitors often impacts the stock of its rivals, especially if the poor performance is secular in nature. For example, if Coca-Cola (KO) reports waning demand, PepsiCo (PEP) stock will often respond in kind, even if results haven’t been reported yet. And for the energy drink sector, expectations have been falling across the board.

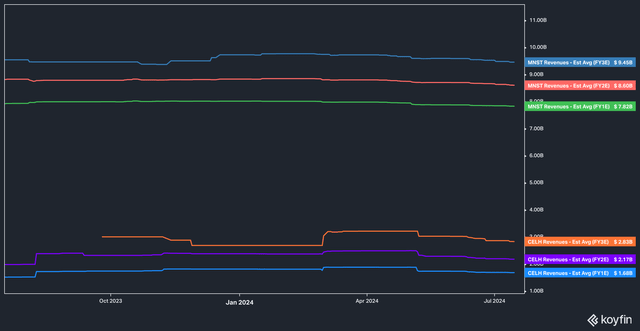

CELH vs MNST Expectations (Koyfin)

The above chart depicts the top line revenue expectations going out three fiscal years for both Monster and Celsius. While the image might not look particularly damning, estimates for both companies over the next three years are down off their highs, and the relatively flat line of expectations with a lack of upward revisions suggests a sector of the market that is beyond its peak growth phase.

An Indicator of Strong Management

On the positive side, management at Celsius has more or less done a good job of reacting to the sales downturn.

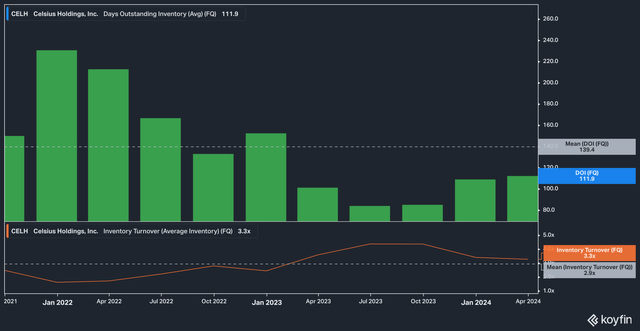

CELH DOI and Inventory Turns, Quarterly (Koyfin)

While days outstanding inventory has modestly ticked up over the last two quarters to 111, levels remain well below their January 2022 peak of 230 days.

Also encouraging for the Celsius story is the fact that inventory turns have remained above their three year average of 2.9x, coming in at 3.3x for the latest quarter.

We believe that these figures are important, especially for Celsius. Consider the fact that in 2020 Celsius posted $130 million in annual sales, compared with $355 million for the most recent quarter, and the rocket-like trajectory of the company comes into focus. The fact that management has demonstrated an ability to manage this growth–and the most recent bump in the road in terms of decelerating sales–is an indicator to us that Celsius is in capable hands.

This also gives an indication that Celsius will not fall prey to a similar trap that befalls many high-flying (usually tech) growth companies: the failure to adapt to market conditions when all-out growth no longer seems to be on the table.

Valuation & Expectations

As a growth stock, you might not expect Celsius to be cheap, and you would be correct, though we should note that today’s valuation is quite a bit cheaper than the levels seen in the past.

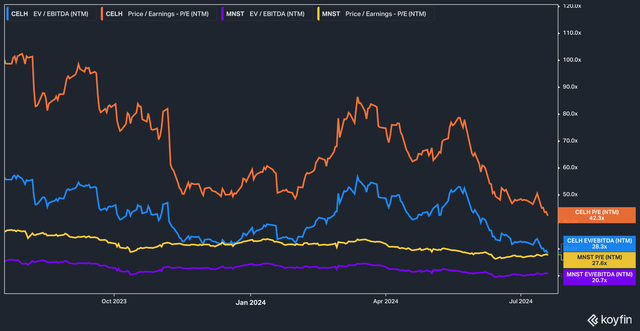

CELH vs MNST, P/E and EV/EBITDA (Koyfin)

Today, Celsius trades for 42x forward earnings expectations, a lofty premium compared with Monster’s 27x.

We think, then, that the real question around Celsius is whether or not Celsius’ valuation has hit a low and is likely to recover, or whether the contraction will continue. We see two scenarios here: should softness in the energy drink market remain, the premium between Celsius and Monster is likely to degrade further. If Celsius surprises, the gap may widen.

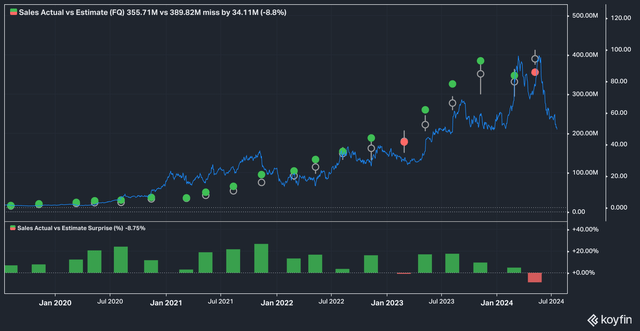

CELH Earnings (Koyfin)

Over the last few years, Celsius has posted an impressive track record of beating quarterly revenue estimates–with the notable exception of the latest quarter. This has caused analyst target prices to fall from an average of ~$90 from May to June to ~$79 today. This is of course a function of the aforementioned reduction in forward estimates.

Markets, however, often overshoot. We don’t believe it is unreasonable, should Celsius not post further deteriorating sales, that a reasonable price target for Celsius would be $60, assuming a further contracted multiple of ~28x FY 2025’s non-GAAP earnings per share.

Risks

Consumers are fickle beings: things that were all the rage one day can dissipate into a puff of smoke the next as attitudes and spending patterns change. This is the major risk we see in Celsius, that consumer demand for energy drinks may have, in fact, plateaued.

Consider that energy drink’s primary demographic are males aged 18-34. It is not outside the realm of possibility that moves by Celsius and other energy drink companies to entice and grow a new demographic could stall out or, worse, result in an expensive (in terms of development costs) line of drinks which fails to take hold.

The Bottom Line

We are impressed by management at Celsius and how they have been able to navigate a stunning amount of growth in such a short time without major operational fumbles along the way. While we think that there is a risk that demand for energy drinks could be waning, we believe that more data is needed before declaring the death of the energy drink market. To conclude, we cannot say definitively that Celsius’ growth story is over, but it does seem to have entered a new chapter, one which management seems capable of meeting head on. For those reasons, today we are positive on Celsius.

Read the full article here

Leave a Reply