While we eagerly wait for Trulieve Cannabis Corp (“Trulieve”) (OTCQX:TCNNF) (CSE:OTC:TRUL)’s 2024 Q2 financial results to be announced on August 6, several events took place that are worthwhile for an update to keep fellow investors informed.

In the long run, I still recommend a “Buy” rating on Trulieve, but in the short term, a “Hold” rating may be more prudent if you already have acquired or added positions of Trulieve.

Introduction

Trulieve is one of the largest multi-state cannabis operators. As of July 21, 2024, Trulieve operates a total of 205 dispensaries across its regional hubs, which are Florida, Pennsylvania, and Arizona.

While Trulieve opened 3 new dispensaries in 2024 Q1, it appears that Trulieve opened 5 more dispensaries in 2024 Q2 as it added its 200th dispensaries on June 3.

In July 2024 alone, Trulieve opened another 5 dispensaries (1 in Pennsylvania and 4 in Florida). This really shows the growth trajectory that Trulieve is on, especially in Florida, preparing for the potential legalization of adult-use cannabis in November 2024.

For 2024 Q2, as a result of the opening of 12 dispensaries alone (5 in 2023 Q4, 3 in 2024 Q1, and 5 in 2024 Q2), I would expect significant revenue growth compared to the same quarter last year and moderate revenue growth compared to 2024 Q1.

Rescheduling and 280E Tax

In April 2024, in addition to the news that the Florida Supreme Court approved the ballot measure to legalize recreational cannabis in November 2024 if this ballot gets over 60% vote, the U.S. Drug Enforcement Administration (“DEA”) initiated the process to reschedule cannabis from Schedule I to Schedule III.

The hype at the time propelled Trulieve’s stock price to increase by almost 40%. This hype has since faded away, resulting in Trulieve’s stock price falling back to $10.33 per share, almost exactly what it was trading at prior to the news from the DEA on April 29, 2024.

seekingalpha.com/symbol/TCNNF

This fallback in stock price is primarily a result of three reasons, it appears:

- The market seems to have realized that it is going to take some time before cannabis is changed to Schedule III.

- The market may have realized that even if cannabis is changed to Schedule III, other than its impact on 280E tax, such rescheduling won’t benefit the broad industry as much.

- IRS recently warned cannabis operators that 280E tax must still be paid, holding their position.

Lengthy Rescheduling Process

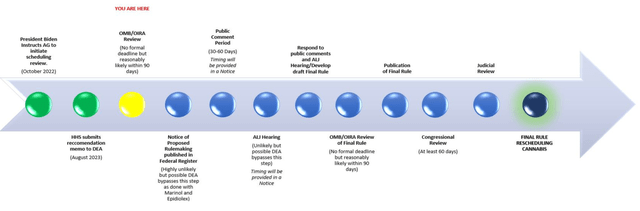

The chart below shows very nicely how long the rescheduling can potentially take. In some instances, rescheduling of a drug took 9 years. However, there are instances where rescheduling of a drug took as short as 180 days from the moment the process is initiated.

The chart below was published on May 14, 2024. The DEA actually proceeded to the next step by publishing the Notice of Proposed Rulemaking on May 21, 2024. The proposed period for public comment will end on July 22, 2024. Still, even with the best-case scenario, there is some time ahead before cannabis is officially classified as a Schedule III drug.

Foley Hoag LLP

Rescheduling Impact to Cannabis Operators

There are three changes that the U.S. cannabis industry desperately needs overall:

- Removal of 280E tax

- Allowance of interstate commerce

- Allowance of regular banking and listing on U.S. stock exchanges

Rescheduling of cannabis will impact point #1 above, but won’t have any impact on point #2 or #3. while there is no enforcement from the federal agencies on state-legal cannabis operators when cannabis is classified as Schedule I, it is likely that there is still no enforcement when cannabis is classified as Schedule III.

Having cannabis as a Schedule III drug would provide more opportunities for researchers to study the medicinal effect of cannabis, potentially opening doors for points #2 or #3. However, these studies will take years to yield results.

The allowance of interstate commerce won’t likely take place until cannabis is legalized on the federal level.

The allowance of regular banking and listing on major U.S. stock exchanges won’t likely take place, either, unless FinCEN issues some sort of guidance to protect financial institutions clearly from participating in the state legal cannabis industry.

IRS Position on 280E Tax

Trulieve was the first among cannabis operators to publicly announce that they filed amended tax returns for the years 2019 to 2021 in October 2023 before these returns were statutorily barred as part of their bold tax strategy. These amended tax returns not only tried to claim tax refunds from states but more importantly, these tax returns tried to claim tax refunds from the IRS. Trulieve even received as much as $113 million in tax refunds from the IRS that it claimed for.

Shortly after this move by Trulieve, many other cannabis operators followed suit to file amended tax returns, including Ascend Wellness.

These amended tax returns are demanding hundreds of millions of tax refunds from the IRS.

On June 28, 2024, the IRS clarified in a press release that 280E tax must still be paid and cannabis operators who filed amended tax returns are not entitled to a tax refund, essentially closing the floodgate.

Canna Provisions vs. Garland Case and Other Arguments

While this clarification by the IRS has resulted in a slight decline in Trulieve’s stock price, speculating that Trulieve’s bold tax strategy may no longer work, Trulieve’s stock price quickly recovered in the days after. The market may realize that Trulieve has already yielded significant benefits from its bold tax strategy, and this IRS announcement doesn’t change much to what Trulieve holds.

While Trulieve has not publicly stated its rationale for filing these amended tax returns with the IRS, there are several possibilities.

One of the potential arguments, although a stretch I believe, may be that Trulieve is leveraging the 2018 Farm Bill and the definition of hemp. Basically, Trulieve could argue that cannabis doesn’t contain a high quantity of the psychoactive ingredient, THC, and shouldn’t be subject to 280E tax. Cannabis only contains THCa. THCa turns into THC only when heated above a certain temperature.

The other argument that is more probable is related to the Canna Provisions vs. Garland, which tries to overturn the ruling from the Gonzales v. Raich case back in 2004.

In simple terms, back in 2004, the ruling from Gonzales v. Raich case argued that illegal cannabis activities within a state can be smuggled across the state border, and the 280E tax is enforced as such.

However, the Canna Provisions vs. Garland case argued that it’s been 20 years since 2004 and the state legal cannabis industry has evolved significantly. State legal cannabis activities are accurately tracked and documented, which proves that no legal cannabis products have crossed the state line. As a result, intrastate activities should not have federal intervention including the 280E tax.

While these arguments including other unknown positions held by Trulieve are uncertain in terms of its chance of winning over the IRS, as the rescheduling of cannabis and the Canna Provisions vs. Garland progress, other arguments may appear in favor of Trulieve.

It may be a legal battle that the IRS doesn’t want to engage in to get back the $113 million tax refunds already paid to Trulieve, as long as no other tax refunds are given.

For 2024 Q2, we expect some major updates from Trulieve on its tax strategy and whether it intends to resume making 280E tax installments to the IRS. If Trulieve resumes making 280E tax installments, it may signal that Trulieve believes that there is a real chance that Trulieve’s arguments do not stand.

Valuation

Trulieve’s valuation stands still at $1.92 billion at this time, which is still quite low compared to its peers (Green Thumb Industries – $2.63 billion and Curaleaf – $3.08 billion).

Above is a quick comparison of these major MSOs’ valuation change between May 21, 2024, and July 22, 2024. While Trulieve’s valuation is still the lowest, the gap between them has shrunk significantly.

We will dive deeper into Trulieve’s valuation when 2024 Q2 results are published in early August 2024.

Between now and then, I recommend a “Hold” rating to wait and see.

Conclusion

As we await Trulieve’s 2024 Q2 financial results on August 6, several noteworthy events occurred that required attention. Trulieve’s expansion continues, with the addition of multiple new dispensaries signaling its growth trajectory, particularly in anticipation of Florida’s potential legalization of adult-use cannabis. The rescheduling of cannabis and the implications of the 280E tax remain key drivers for the industry, with Trulieve at the forefront of navigating these challenges. In the long run, Trulieve remains a strong buy, but for now, a “Hold” rating is prudent for existing investors as we monitor the upcoming financial disclosures and regulatory developments.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply