July 23rd ended up being a pretty big day for shareholders of Owens & Minor (NYSE:OMI). Shares of the company closed up 7.6% after two different press releases came out. The first involved news that the company was making a major acquisition. This particular purchase, based on the data available, looks like it will be truly transformative and will further the company’s goal of significantly growing its Patient Direct operations over the next few years. And the second ended up being preliminary guidance covering the second quarter of the company’s 2024 fiscal year. Overall, that data came in fairly positive compared to what analysts had been anticipating.

Fundamentally speaking, Owens & Minor has been struggling over the past few years. Even as revenue has grown, the company’s profits and cash flows have taken a hit. This comes as the company works to transform its operations for the purpose of creating long term shareholder value. My first inclination when I saw this major transaction come through was that management would be better off looking inward to find the problems within the business than to look outside for a solution. This is a natural thought when you keep in mind the fact that, often, companies must pay a premium to absorb other firms. And a firm that is already dealing with issues should not be focused on trying to extract value from a high-priced purchase. However, by the time I completed my analysis of the situation, I can only count myself a fan of this maneuver. This should be a truly value-accretive move by the company and investors would be wise to think of it in that way.

A look at preliminary results

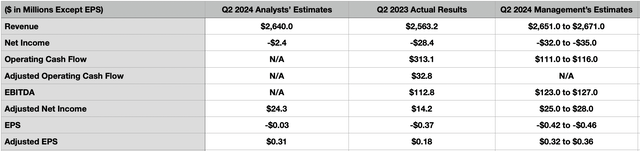

Before we get into the details of the acquisition in question, I think it behooves us to look first at the preliminary results that management released. Before the market opens on August 2nd, Owens & Minor is expected to announce official financial results for the second quarter of the 2024 fiscal year. But leading up to that point, management does have a range in which they think most relevant results will come in. Revenue, for instance, is expected to be somewhere between $2.65 billion and $2.67 billion. If this comes to fruition, it would be a nice uptick compared to the $2.56 billion the company generated the same time last year. It would also be slightly above the $2.64 billion analysts were anticipating.

Author – SEC EDGAR Data

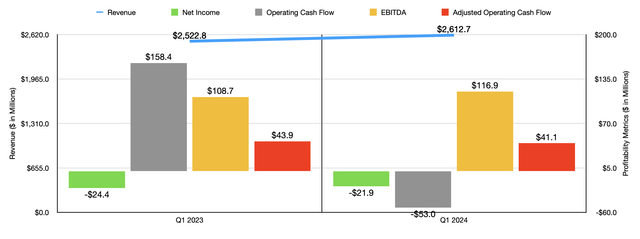

On the bottom line, management now anticipates earnings per share to be negative by between $0.42 and $0.46. That would imply a net loss of between $32 million and $35 million. Unfortunately, this would be far worse than the $0.03 per share loss, or $2.4 million net loss, analysts were expecting to see. It would also represent a worsening compared to the $0.37 per share loss, or $28.4 million net loss, that the company reported for the second quarter of the 2023 fiscal year. On an adjusted basis, the picture is a bit different. Management expects a gain of between $0.32 and $0.36. This would mark an improvement over the $0.18 per share gain reported the same time last year. And it would also be a hair higher than the $0.31 per share that analysts expected.

In a move that is uncharacteristic of companies that announce partial preliminary results, management did provide some other interesting data points as well. They said that operating cash flow should be between $111 million and $116 million. Analysts have not provided any estimates there. But for context, operating cash flow in the second quarter last year came in at $313.1 million, while the adjusted figure for it came in at $32.8 million. Meanwhile, EBITDA is expected to be between $123 million and $127 million. This would be comfortably higher than the $112.8 million reported the same time last year. And lastly, management said that net debt should be between $68 million and $71 million lower than what it ended up being in the first quarter of this year. For the purpose of analyzing the company moving forward, I have incorporated the midpoint reduction in net debt here.

Owens & Minor

When it comes to the 2024 fiscal year in its entirety, management anticipates revenue of between $10.5 billion and $10.9 billion. This would stack up nicely against the $10.33 billion reported for 2023. Adjusted earnings per share should be somewhere between $1.40 and $1.70. If we hit the midpoint of guidance, this would translate to adjusted net income of $121.7 million. Last year, adjusted earnings totaled $105.5 million. And finally, EBITDA is expected to come in somewhere between $550 million and $590 million. For 2023, EBITDA ended up being $525.8 million. For the purpose of analyzing the company, I’m going to use the midpoint of guidance for EBITDA. And I’m also going to assume that adjusted operating cash flow, which adjusts for changes in working capital, ends up rising the same rate year over year as EBITDA is expected to.

A transformative move

Now that we have the preliminary results out of the way, we can get to the most exciting development. This is of the company’s decision to acquire a privately held company by the name of Rotech Healthcare Holdings (ROTK). If you are not familiar with Rotech, you are not alone. I have honestly never heard of the company before seeing this news. But according to management, Rotech provides home medical equipment to customers in the US. Through the 325 operating locations that it has nationwide, spread across 46 different states, the company generates around $750 million in revenue each year. And with an EBITDA margin of nearly 30%, we are looking at EBITDA of approximately $210 million. This is based on the EV to EBITDA purchase multiple of the business of 6.3.

Owens & Minor

The purchase price agreed upon comes out to $1.36 billion. However, Owens & Minor is receiving $40 million in tax benefits as a result of this purchase. That should bring the net purchase price down to $1.32 billion. Ultimately, this transaction has the ability to bring additional profitability to Owens & Minor because, within the first three years of completing the deal, management hopes to capture around $50 million in annual run rate synergies. Given how long these synergies will take to capture and uncertainty regarding whether they even will be captured, I have not incorporated them into my analysis of the transaction. Upon closing of the deal, which Owens & Minor expects to occur later this year, the firms net leverage ratio will pop to 4.2. That’s up from 3.2 using current net debt and midpoint EBITDA for 2024. However, within 24 months following the close of this transaction, management expects to bring the net leverage ratio below the 3 handle.

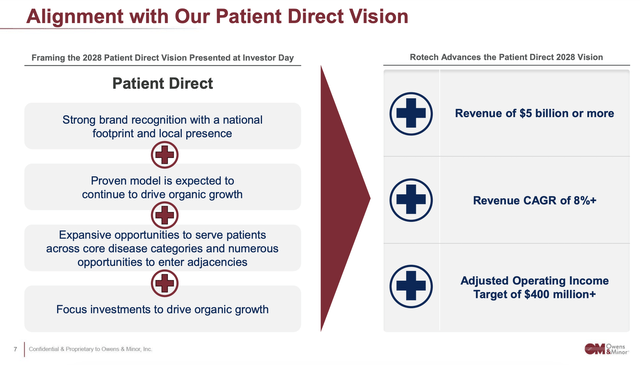

Owens & Minor

This transaction is being done in large part for the purpose of growing revenue associated with the company’s Patient Direct segment to $5 billion a year or more by 2028. For those not familiar with Owens & Minor, the Patient Direct segment is the smaller of the company’s 2 operating segments. Through this, the company provides delivery of disposable medical supplies that are sold directly to patients, not to mention home health agencies as well. It also provides integrated home health care equipment and other services across the US. Its offerings include those free use when providing in home care and delivery across a variety of health needs. Examples include for diabetes treatment, home respiratory therapy, obstructive sleep apnea treatment, and more.

The company’s larger segment, which was responsible for 75.3% of overall revenue in 2023, is the Products & Healthcare Services segment. Through this unit, the company provides a wide array of medical and surgical supplies to healthcare providers on a global scale. Its service offerings to these firms include supplier management, analytics, inventory management, clinical supply chain management, and more. It also offers up other services such as manufacturer programs. You can think of this unit as a medical supply distribution business that Mostly utilizes a third party company to deliver most supplies that it sells in the US. The medical surgical products that the segment provides include, but are not limited to, surgical drapes and gowns, facial protection products, protective apparel, medical exam gloves, and more.

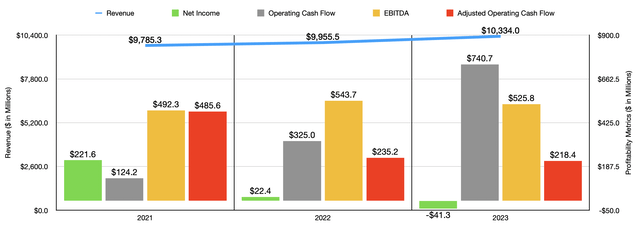

Author – SEC EDGAR Data

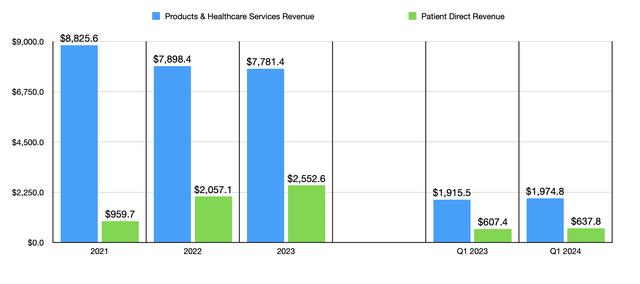

Over the last few years, Owens & Minor has been faced with some problems. In the chart above, you can see financial performance covering the 2021 through 2023 fiscal years. Revenue for the business has grown consistently during this time, with sales ticking up from $9.79 billion to $10.33 billion. But when you look at the chart below, you can see that this is really the story of two different businesses. On the one hand, you have the Products & Healthcare Services segment, which actually saw revenue contract from $8.83 billion to $7.78 billion during this window of time. Most of this drop in sales occurred between 2021 and 2022, when revenue plummeted by 10.5%. Management attributed this to overall reduced hospital demand for its products. Instead of ordering, customers relied on their existing stockpiles of products and the firm also had to deal with unfavorable price changes. This was especially true in the gloves category. Given the timing of this, the drop is almost certainly attributable to the ending of the COVID-19 pandemic.

Author – SEC EDGAR Data

During the same timeframe, the Patient Direct segment posted remarkable growth. Sales skyrocketed from $959.7 million to $2.55 billion. Most of this came from 2021 to 2022, when revenue spiked by 114.4%. Management attributed much of this increase to the firm’s acquisition of Apria in March of 2022. That particular purchase cost shareholders $1.7 billion. But it looks to me as though it was $1.7 billion well spent. I say this because revenue continued to grow to $2.55 billion, a year over year gain of 24.1%, in 2023. $308 million of this increase was because 2023 was the first full year in which Apria was owned by Owens & Minor. However, the segment also enjoyed $187 million in organic revenue growth because of new patient starts and high retention rates from existing customers.

Author – SEC EDGAR Data

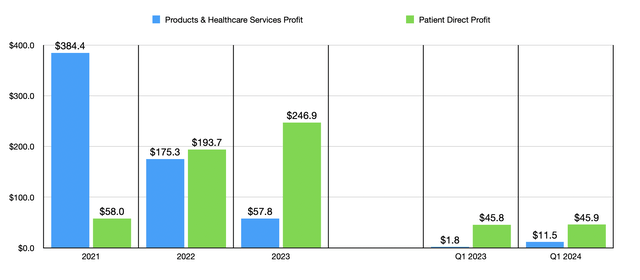

On the bottom line, the picture has been anything but great. Net income went from $221.6 million in 2021 to negative $41.3 million in 2023. This was really the result of a decline in profits under the Products & Healthcare Services segment from $384.4 million to only $57.8 million. Reduced glove pricing caused by a cessation of the COVID-19 pandemic impacted the firm’s revenue to the tune of $241 million in 2023. And if there’s one thing that you know about me, I acknowledge that pricing changes can have significant impacts on a firm’s bottom line. Their profitability metrics also took a hit during this time. Even though operating cash flow rose significantly, once we adjust for changes in working capital, we get a decline from $485.6 million to $218.4 million. It is true that EBITDA rose during this window of time. But with even adjusted net income falling from one year to the next, the picture was overwhelmingly negative.

Author – SEC EDGAR Data

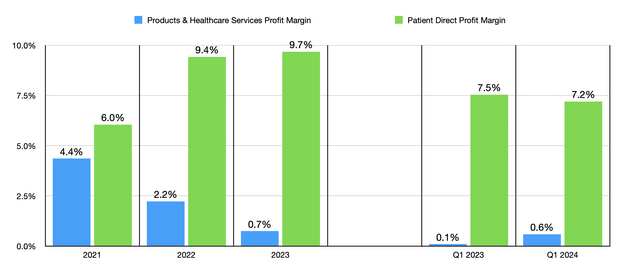

As disappointing as the decline in profits for the Products & Healthcare Services segment was, the Patient Direct segment reported a jump in income from $58 million to $246.9 million. Much of this was because of the increase in sales during this three-year window. But another good chunk was attributable to improved profit margins. Back in 2021, the segment had a profit margin of only 6%. By 2023, this had grown to 9.7%. By comparison, the Products & Healthcare Services segment reported a drop in its profit margin from 4.4% to only 0.7%.

Author – SEC EDGAR Data

For the 2024 fiscal year, we have seen mixed results. Revenue in the first quarter of the year came in at $2.61 billion. That’s up from the $2.52 billion reported one year earlier. Surprisingly, the Products & Healthcare Services segment did see an improvement in revenue from $1.92 billion to $1.97 billion. However, the company also benefited from sales under the Patient Direct segment expanding from $607.4 million to $637.8 million. Net income improved slightly from a loss of $24.4 million to a loss of $21.9 million. This came as the Patient Direct segment saw its profits remain virtually flat. The improvement, then, was mostly because profits for the Products & Healthcare Services segment grew from $1.8 million to $11.5 million. Other profitability metrics, as the chart above illustrates, were mostly mixed.

Given the higher profit margins associated with the Patient Direct segment, it’s not surprising that management is so focused on growing sales for that unit to $5 billion by 2028. And the easiest way to get there is by means of acquisition. The good news is that this purchase looks to be very attractive. If we take the $210 million of EBITDA associated with the deal and apply an interest rate on the debt of 7.13% (matching the interest rate on the firm’s debt in the latest quarter), we should end up with operating cash flow of around $115.9 million. Applying this to historical operating cash flow for 2023 and projected operating cash flow for 2024, and applying the $210 million of EBITDA to both years, it becomes pretty simple to see the attractiveness of this acquisition.

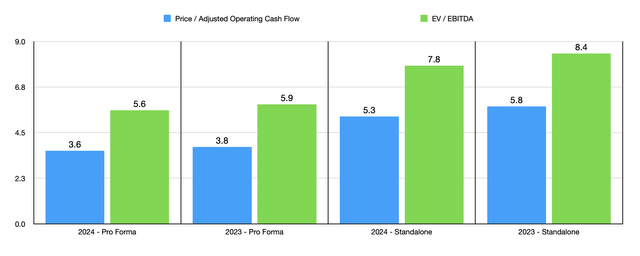

Author – SEC EDGAR Data

In the chart above, you can see how shares are priced on a pro forma basis. This assumes that Rotech has been a part of Owens & Minor since the start of 2023. That chart also shows how shares of Owens & Minor are priced on a standalone basis. Even though this transaction sees leverage increase, the overall trading multiples, without exception, improve under the scenario in which the transaction occurs. This alone is enough to tell me that management made a savvy move here. And judging by the market’s reaction that saw shares close higher for the day on July 23rd, it seems as though the investment community agrees with me.

Takeaway

Over the past few years, Owens & Minor has gone through a lot of changes. The dying down of the COVID-19 pandemic has caused problems for its largest unit. However, management has been very focused on building up the Patient Direct segment. This latest maneuver, combined with generally favorable results and guidance provided for the second quarter of the 2023 fiscal year, makes me feel confident that management is on the right track. Add on top of this how cheap shares are, and I have no problem rating Owens & Minor a solid ‘buy’ at this time.

Read the full article here

Leave a Reply