Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the third week of July.

Market Action

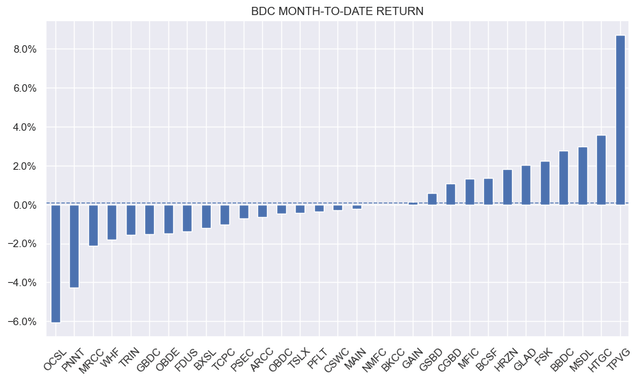

BDCs were down around 2% this week, driven by a sentiment air pocket towards the end of the week. Month-to-date, the sector is flat with OCSL underperforming and TPVG outperforming.

Systematic Income

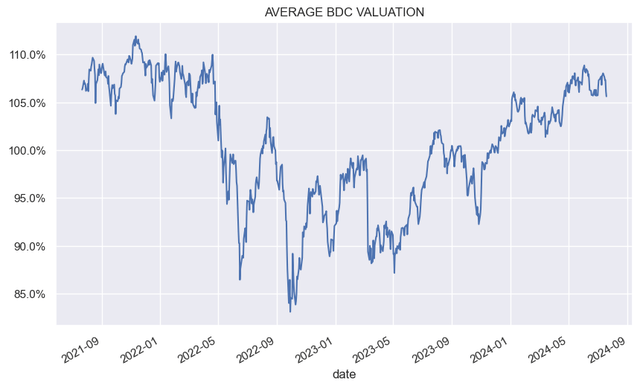

As expected from the weak price action, BDC valuations moved lower, though not by much and remain elevated.

Systematic Income

Market Themes

Private lender Blue Owl which runs two public BDCs OBDC and OBDE has acquired Atalaya Capital which manages asset-based credit assets such as consumer, commercial finance and real estate assets. Blue Owl wants to be a “full spectrum” provider in private credit. The asset-backed credit market is much larger than either the syndicated loan market or the private credit market. This allows Blue Owl to push into a new part of the credit market and diversify away from its corporate loan focus.

Blue Owl has been on a buying spree, and Atalaya marks the third acquisition in recent months. Blue Owl has also completed its takeover of Kuvare Asset Management, adding $20bn in assets under management and helping to link up with the insurance industry. The buyout of Prima Capital Advisors added a further $10bn in assets, adding to its presence in property investing.

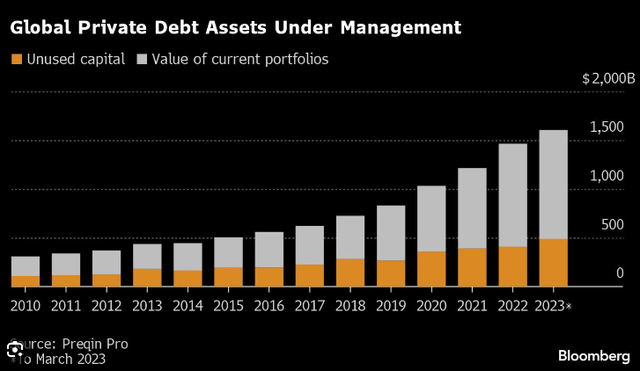

Global private credit AUM has moved north of $1.5trn recently, with much of that composed of dry powder. It is no surprise then that industry players are doing deals and consolidating. It is also good to see that the available capital is not always just thrown into new lending, which would lead to tighter spreads and looser covenants. A measure of discipline is necessary to keep portfolio quality high, particularly in the current slowing macro environment.

Bloomberg

Market Commentary

We saw some positive preliminary Q2 results this week.

Capital Southwest (CSWC) net investment income is estimated at $0.685 – that’s on par with the previous quarter. The NAV is expected to be around $16.60 around 1% lower than the previous quarter. Leverage is around 0.75x – a bit below the previous quarter and has been trending down. Similar message to a few of the other estimates – a slight drop in the NAV and a similar level of net investment, resulting in a positive total return for the quarter. Public credit spreads were unchanged during the quarter so we are only going to see markdowns on idiosyncratic problems in BDC portfolios.

Main Street Capital (MAIN) estimates its NAV to be around $29.80 for Q2 – up around 0.9% from the previous quarter. This NAV growth is actually on the low side for MAIN, but it’s still very respectable. We are unlikely to see big NAV gains across the BDC sector in Q2 as holdings have already been marked up. If there are gains, it’s in the usual OID (original issue discount) amortization, which will come in as additional retained investment income.

Portfolio losses are unlikely to exceed net income so we should see decent total performance from the sector though we shouldn’t be surprised by occasional air pockets as we’ve seen from the likes of TPVG and TCPC in the past year or so. Higher-quality BDCs should outperform in this environment.

Stance And Takeaways

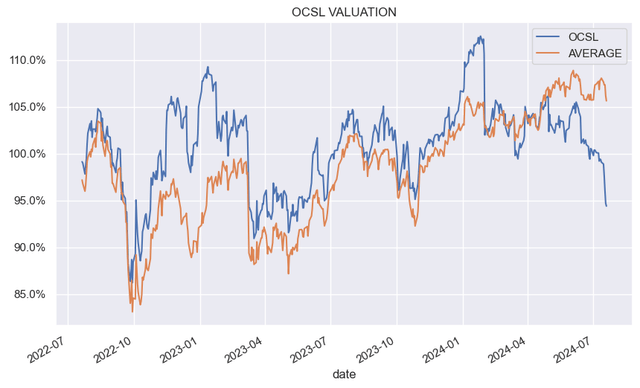

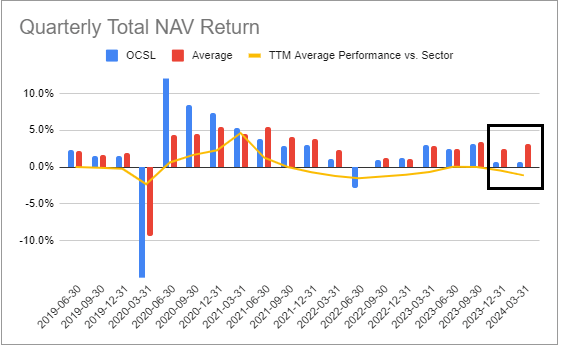

We are keeping an eye on OCSL. The stock has underperformed recently and has moved to a valuation well below the sector average and a 5% discount to book.

Systematic Income

We fully exited the stock a few months back at a premium valuation but will consider adding a new position if its underperformance continues. It’s not a slam dunk allocation at this point given its disappointing back-to-back quarterly results. Its portfolio quality remains a question mark, and we look forward to its Q2 reporting.

Systematic Income BDC Tool

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!

Read the full article here

Leave a Reply