The best thing that happens to us is when a great company gets into temporary trouble… We want to buy them when they’re on the operating table. – Warren Buffett

We love growth companies, but not the price the market usually demands for their shares. One option we have found useful, and which has very significantly boosted Berkshire Hathaway’s (BRK.A)(BRK.B) performance, is to buy growing companies when they are experiencing temporary setbacks. One of the best examples is Buffett’s purchase of American Express (AXP) shares during the ‘salad oil’ scandal.

One such company currently experiencing a number of temporary headwinds is Shoals Technologies Group (NASDAQ:SHLS). Shoals is a leading provider of electrical balance of systems (EBOS) solutions for solar plants, energy storage, and electric vehicle (EV) charging infrastructure. Think cables, harnesses, interconnect systems, combiner boxes, and other nuts and bolts accessories required to connect solar panels and EV chargers to the grid. It might appear that these are relatively simple products to manufacture, but brand and technology remain critical. Customers do not want solar plants to stop producing energy because a simple component failed, and these products usually have to last for decades, despite being exposed to harsh weather conditions. The company puts significant effort into the engineering of its products, and it proudly shares that it holds 47 patents.

We are optimistic about its long-term prospects given its exposure to secular tailwinds, including the rapid growth of the utility-solar sector, and growth of the EV charging infrastructure. Unfortunately, growth has disappointed recently in both of these sectors, and the company has additionally faced a few issues. These include a competitor allegedly infringing on the company’s intellectual property and a warranty issue caused by a supplier that delivered defective wires. While the company is suing the supplier, it is taking responsibility with respect to customers, and fixing the issues is expected to cost a meaningful amount of money.

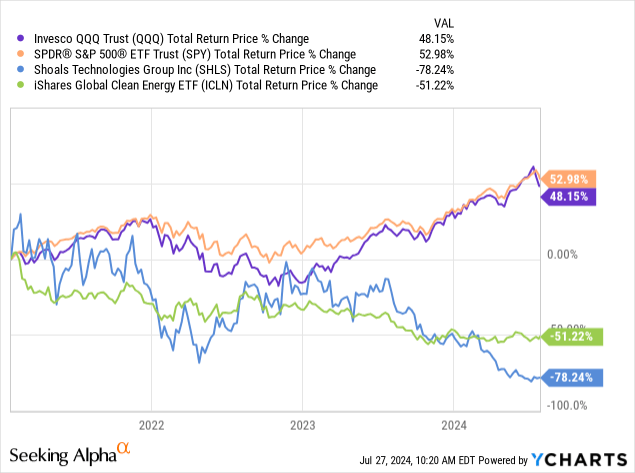

The company had its IPO in January 2021 at a share price of $25, a time when there was significant excitement about clean energy companies. Since then, the attention of many investors has moved to artificial intelligence companies such as NVIDIA (NVDA), which, combined with the temporary headwinds the company is facing, has resulted in a massive share price decline. The underperformance is staggering, with the S&P 500 index (SPY) and the technology-focused Invesco QQQ Trust (QQQ) delivering roughly 50% returns since then, the company has lost almost 80% of its value, a significantly worse performance than the iShares Global Clean Energy ETF (ICLN). On the positive side, we believe a lot of pessimism is already reflected in the share price and shares could perform very well if the company manages to reignite growth.

Temporary Headwinds

Most people are aware that renewable energy is growing rapidly, and that it will be critical in order to decarbonize our planet. More recently, governments have also realized that energy security is critical, as Europe learned after Russia’s invasion of Ukraine. That has given many European countries an added incentive to accelerate wind and solar growth.

In the short term, however, the industry is experiencing several issues that have constrained its growth. These go from supply chain issues to a massive queue to get projects connected to the grid, increased import tariffs on some components, and other regulatory issues. Many of these issues are likely to prove transitory, and we are also optimistic given Shoals’ track record of outperforming the market and its rapid growth in international revenue.

Financials

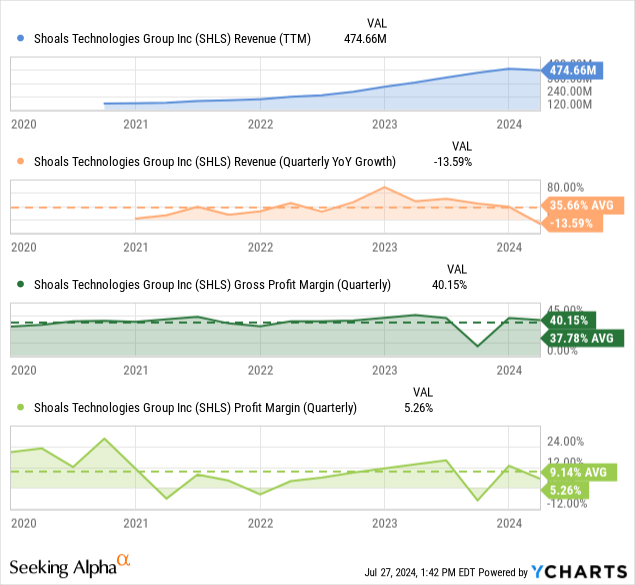

It is striking how revenue and the share price have moved in opposite directions since the company’s IPO. While the share price has collapsed, revenue has more than doubled. Admittedly, shares are usually richly valued in IPOs, especially if there is excitement in the company’s sector. Also, in the most recent quarter, the company did see revenue decline of about 14%, mostly as a result of project pushouts. Lower revenues also impacted the gross profit margin by about 570 basis points. On the positive side, awarded orders were up 17% compared to the previous year, the company’s international segment is growing rapidly, and Shoals was able to carry out debt refinancing that lowered its interest expense. It is also worth noting that Shoals average quarterly year-over-year revenue growth rate since it went public has been above 35%.

Balance Sheet

Another indicator moving in the right direction is the company’s leverage, which has significantly improved since the first quarter of 2022 when it had net debt to adjusted EBITDA of roughly 4.4x. In the most recent quarter, the company reported that this has further improved to close to 1.0x.

Given that Shoals is generating positive free cash flow, the company expects to continue deleveraging and reinvesting capital into the business. It will probably also use some of its free cash flow for the recently announced stock buyback plan. If the $150 million repurchase authorization is fully utilized, the company could buy back more than 10% of its shares at current prices.

Secular Tailwinds

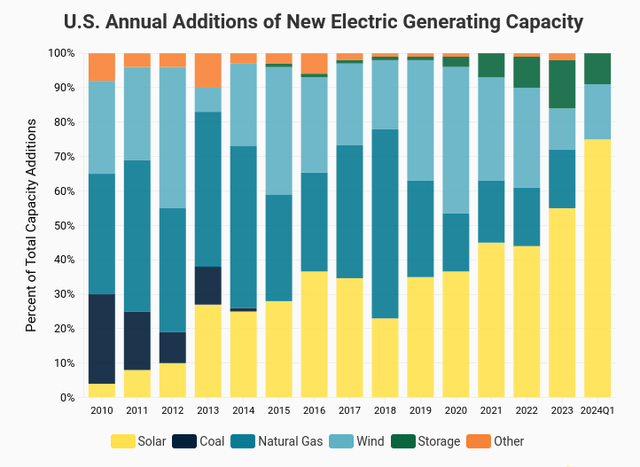

Sometimes it is easy to give too much importance to temporary headwinds and miss the forest for the trees. One important reason that we are optimistic about Shoals’ future is that solar energy continues to take market share, with 55% of all new electric capacity added to the grid in 2023 coming from solar. As the Solar Energy Industries Association (SEIA) pointed out, this is the first time in eighty years that a renewable energy resource has captured the majority of new capacity additions.

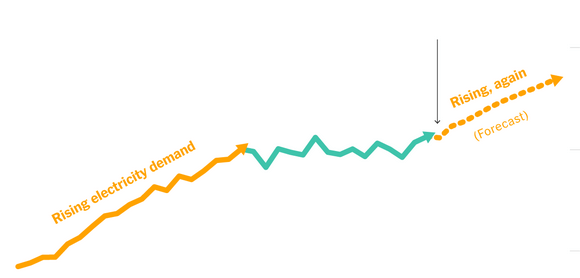

SEIA/Wood Mackenzie

At the same time that solar energy is increasing its share of new capacity additions, the overall demand for electricity is seeing accelerated growth. For some years, electricity use had seen very little growth, as users changed their light bulbs for LEDs and bought more energy-efficient appliances. Now, the energy efficiency low-hanging fruit appears to be mostly gone at the same time that new applications require significant amounts of electricity. These include data centers, particularly those focused on AI applications, as well as electric vehicles and the increasing use of air conditioning. A NY Times article, makes a good case for why utilities (XLU) are expecting energy consumption to start growing at a rapid pace after some years of stagnation.

NY Times

Future Outlook

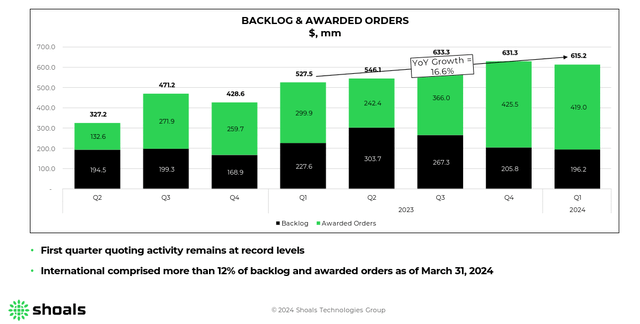

Despite the recent revenue decline, it is likely that the company will soon return to delivering revenue growth given that its backlog grew by double digits compared to the previous year. Longer-term, we are even more optimistic given the secular tailwinds previously discussed, and the company’s track record of growing faster than its market.

Shoals Investor Presentation

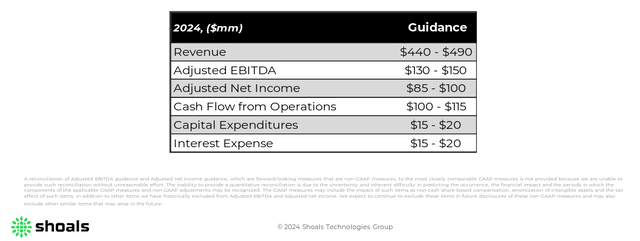

The company’s guidance calls for FY2024 adjusted EBITDA in the $130 million to $150 million range, while its enterprise value is about $1.3 billion. This puts the forward EV/adj. EBITDA multiple below 10x, which, we believe, is too low for a company that has historically delivered revenue growth above 30%, even if it is currently going through a revenue growth speed bump.

Shoals Investor Presentation

Valuation

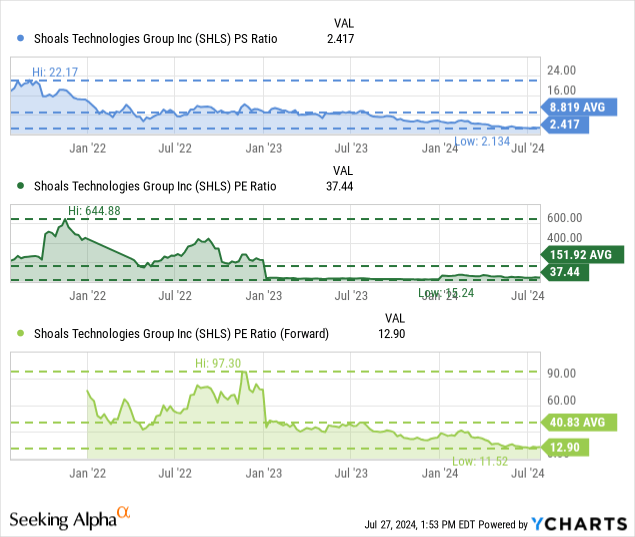

Given that revenue has meaningfully increased the last few years, and the share price has declined, the valuation multiples have necessarily compressed. For example, the Price/Sales ratio has compressed by a factor of almost 10x, going from over 22x to about 2.4x. We also believe that a forward Price/Earnings ratio of about 12.9x is low for a company with significant growth potential.

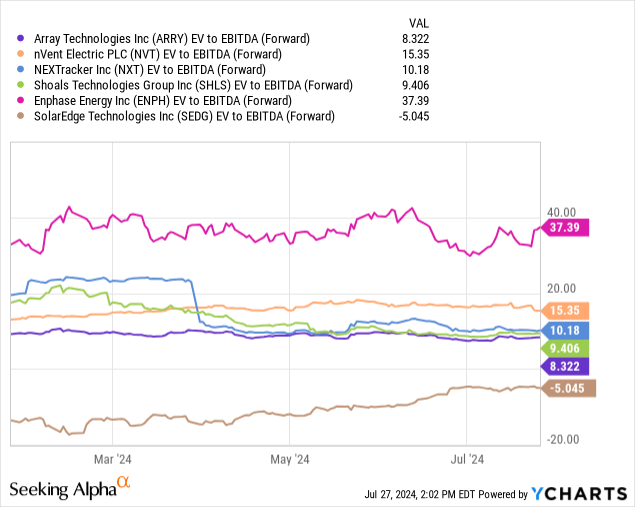

Shoals is not the only company with significant exposure to the rapid growth of solar energy, with inverter companies such as SolarEdge Technologies (SEDG) and Enphase Energy (ENPH) being particularly popular with renewable energy investors. SolarEdge currently has a negative forward EV/EBITDA as the company is expected to deliver losses, while Enphase does not look that attractive with a ~37x multiple. We believe Enphase does deserve to trade at a premium given that it probably has the strongest competitive moat of the group shown in the graph below, but we are not ready to pay a 37x forward EV/EBITDA multiple for the shares. Based on their historical financial track records and current low valuations, we believe that Nextracker (NXT) and Shoals are looking very attractive at the moment.

Risks

Utility-scale solar has been experiencing severe interconnection issues, high-voltage power equipment and labor availability challenges, and regulatory obstacles. This has resulted in growth deceleration and there is no guarantee that the issues will be resolved anytime soon. Still, solar has proven it can take market share from other energy generation technologies, and electricity use is expected to inflect to higher growth.

More specifically to Shoals, it is having to sue a competitor for alleged patent infringement, and there is no guarantee the company will succeed with the legal proceeding. It is also facing the warranty issue, which the company estimates could end up costing the company about $185 million. Mitigating some of these risks is the company’s history of excellent operational execution, a strong balance sheet, positive free cash flow, and increasing international diversification.

Conclusion

While Shoals is currently facing real headwinds, we believe the market has overreacted. This has created a potential opportunity to buy shares in a growth company at a very low valuation. There is no guarantee that growth will return, but the fact that orders are trending in the right direction, and the strong secular tailwinds of the solar industry, we are optimistic about the company’s prospects. With its stock buyback announcement, Shoals shows it believes the current share price undervalues its long-term growth potential.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Growth Idea investment competition, which runs through August 9. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Read the full article here

Leave a Reply