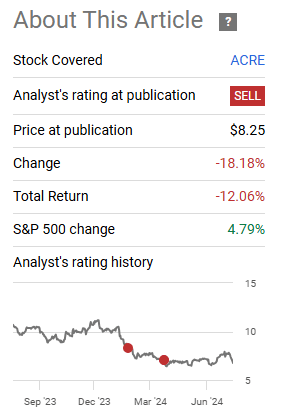

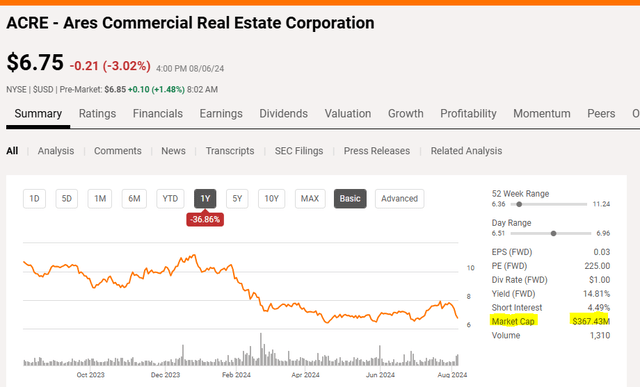

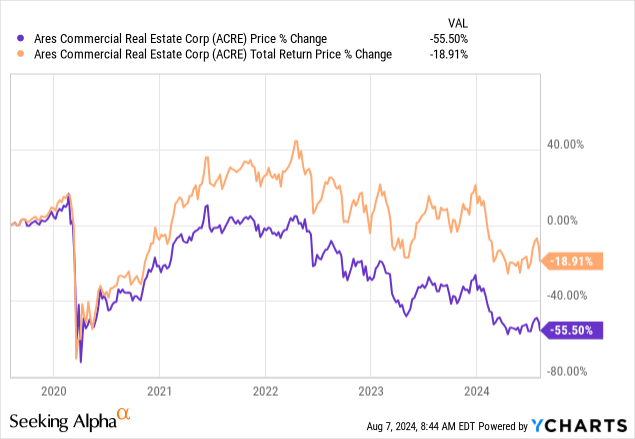

We first wrote about Ares Commercial Real Estate Corporation (NYSE:ACRE) in February 2024. The idea then was that the poor distribution coverage would result in a cut, sooner rather than later. The actual distribution cut came within two weeks, and the stock has responded in kind. Total returns have been negative, even accounting for the distributions.

Seeking Alpha

In our subsequent coverage, we made the rather unusual call that a second distribution cut would be coming within a year. It has been three months since that article and the stock is flat. The recent results did provide an opportunity to see whether everything is on schedule or not, and we dived right in.

Q2-2024

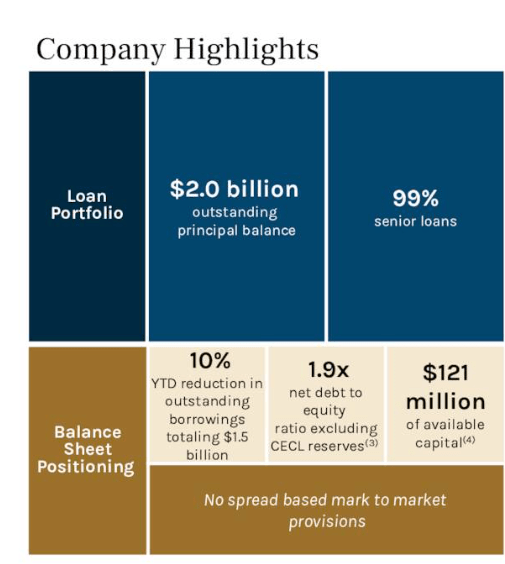

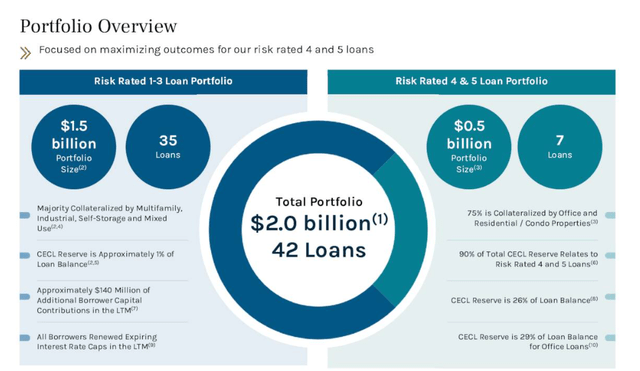

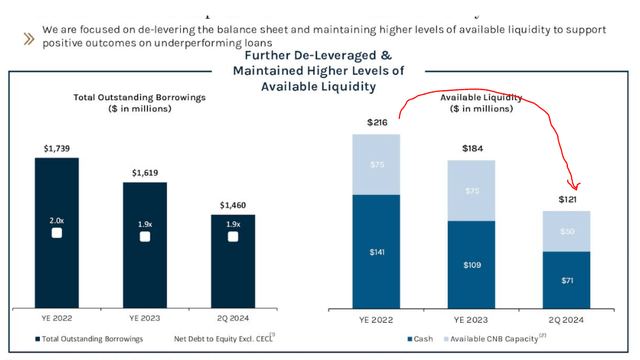

The company’s slide work started off by highlighting the key reasons you should invest here. That includes their debt reduction year to date and the fact that they were running only a 1.9X debt to equity leverage ratio.

ACRE Q2-2024 Presentation

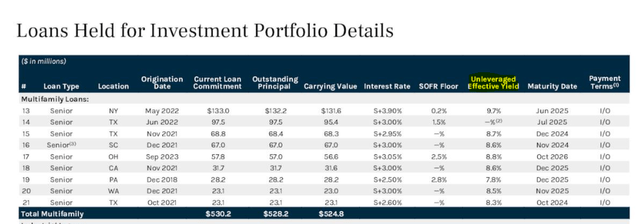

Unfortunately, the other half of that same first slide showed what an unmitigated disaster the income statement was in Q2-2024. GAAP (yes, pay attention income chasers) was negative 11 cents. Their distributable earnings metric was also at negative 12 cents. One final metric thrown in there was the distributable earnings excluding losses, which came to 18 cents.

ACRE Q2-2024 Presentation

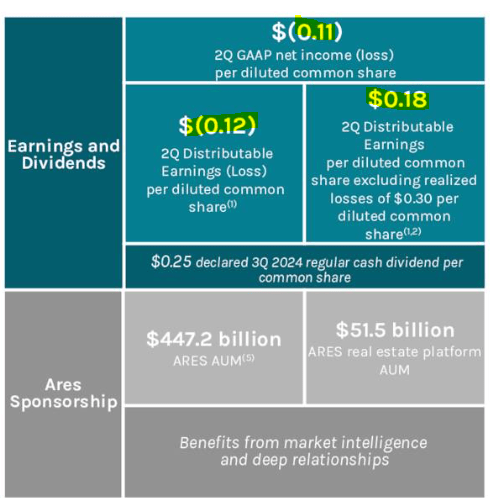

In case you were alarmed by the fact that none of them came close to the 25 cents of declared distribution, we would suggest you are too late. At this point you should be in panic mode, not just worried. So what went wrong this quarter? Well, for starters, another large loan went on non-accrual and this was in the multifamily arena. They also took a bath on a level 5 office loan, which was sold at a big loss.

ACRE Q2-2024 Presentation

But let’s get back to that multifamily loan. Of course, the bullhorn might go that this was just one loan. It was already a risk level 5. So what’s the worry? The worry as always is that ACRE has not shown the ability to make many good loans. The number of these that keep falling into non-accruals is fairly extremely. Let’s not forget that $98 million isn’t exactly chump change for ACRE. Their entire market capitalization is $367.43 million.

Seeking Alpha

Let’s also not forget that they have risk 4 and 5 rated loans that exceed their market capitalization, by a lot.

ACRE Q2-2024 Presentation

These are some of the salient features you need to be aware of before you go diving into that “I am getting a 15% yield” mentality.

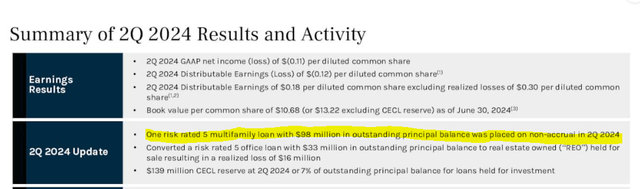

Outlook

They did not cut the distribution, despite all their own metrics showing that they were nowhere close to making it work. As those losses work their way into the books, ACRE will have to reduce debt further to prevent its leverage from creeping up. The side effect of that is that its liquidity keeps dropping.

ACRE Q2-2024 Presentation

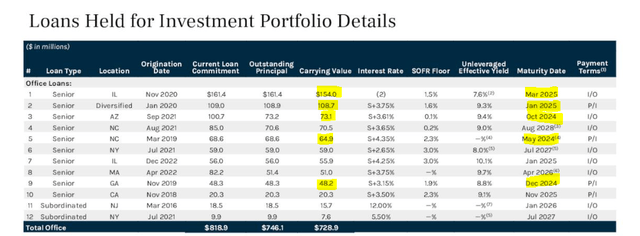

It will drop even further if ACRE insists on paying that outlandish uncovered dividend. The office portfolio itself is about 2X the market cap and well in excess of even the tangible equity. A lot of these are coming up for renewal soon, and we expect more losses here.

ACRE Q2-2024 Presentation

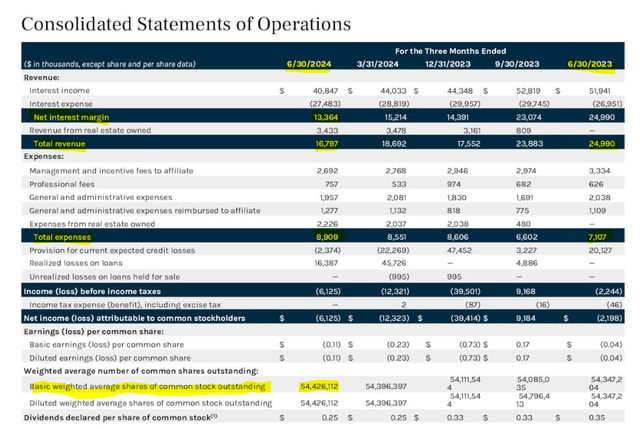

As this quarter showed, even multifamily is cracking, and the loan that dropped into non-accrual was its second largest in that space. A reminder here that ACRE is not getting those unleveraged yields because it is lending to AAA level projects.

ACRE Q2-2024 Presentation

There is likely to be substantially more pain. Of course, investors might try and latch on the Fed rate cuts. If those happen in the context of a moderate or severe recession, you are unlikely to get any aid from them. Also, do note that there is a big lag between cuts and an impact to ACRE. We would think 12-18 months or so. But let’s just look at the distribution potential here, assuming that we don’t see further damage.

The consolidated statements of operations shows how net interest margin has been collapsing over the last 4 quarters. We have dropped from circa $25 million to $16.8 million. Just that net interest income minus the expenses gets us close to $8.0 million quarterly run rate.

ACRE Q2-2024 Presentation

Some of that is depreciation on real estate owned, but that is a very fair cost on these properties that it has been forced to takeover. $8.0 million divided by 54.4 million shares gets us to under 15 cents a share. That is your absolute best-case situation for a distribution in 1-2 quarters.

Verdict

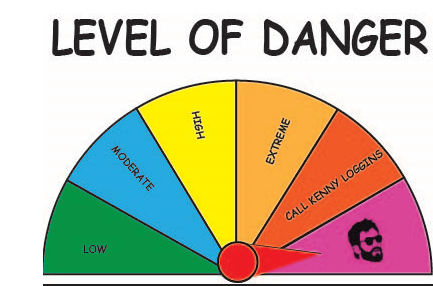

ACRE held the line of the distribution. The rationale likely was that they wanted to avoid a panic. But a sustainable run-rate in the best-case situation is around 15 cents in our opinion. If they want to build a buffer to tackle their issues, 10 cents a quarter distribution makes more sense. Of course, that would kill the stock. It likely reprices to a 15% yield on that 40 cents fairly quickly. That is where it will get to before it draws in the new investing champs salivating at a 15% yield and “discount to book value”. ACRE now gets the maximum rating on our proprietary Kenny Loggins, dividend danger, scale.

Author’s Scale

There is a reason ACRE has been a bad pick even among mortgage REITs over the last 5 years.

We downgrade this to a Strong Sell and look for at least a 40% distribution cut within 2 quarters.

Read the full article here

Leave a Reply