Thesis

With the massive spike in volatility that occurred on Monday, August 5, 2024, investors are probably asking themselves if it is a good time to buy volatility here to hedge against any future market fear tantrums. The answer to that question is yes, but choose wisely the instrument you are using.

In this article, we are going to explore the ProShares VIX Short-Term Futures ETF (BATS:VIXY), and highlight to investors why this tool is not an appropriate one to use for long-term portfolio hedging.

What does VIXY actually do?

As per its literature and definition, the exchange-traded fund:

Seeks investment results, before fees and expenses, that track the performance of the S&P 500 VIX Short-Term Futures Index.

When it comes to the above index, the S&P landing page gives us the following definition:

The S&P 500® VIX Short-Term Futures Index utilizes prices of the next two near-term VIX® futures contracts to replicate a position that rolls the nearest month VIX futures to the next month on a daily basis in equal fractional amounts. This results in a constant one-month rolling long position in first and second month VIX futures contracts.

The index therefore represents a long position in the first front months VIX futures contracts:

August VIX Futures (Investing.com)

The above chart is the one for the August VIX future contract, whereas the entire ladder can be found on the CBOE page here. What you will notice is that despite the VIX index spike above 60 on Monday, the August futures contract did not move much above 30. And there is a reason for that. A futures contract pays out on settlement date, and a historic analysis of VIX levels will show you that the ‘fear index’ does not spend too much time above 30 historically.

So even during VIX spikes, the market is basically saying that volatility will come down shortly, even if ‘come down’ means a level in the 30s. Capital markets cannot function during constant fear, and we are defining that as VIX above 35 (our own definition). We think that a prolonged period of VIX above 35 (call it 2 weeks) will prompt the Fed to intervene. The market seems to think the same, with the front August contract never going above 35 in the past few days.

By buying into VIXY, you are therefore taking a long position into the VIX futures rather the index itself, therefore being hampered in performance due to the above-mentioned factors.

VIXY only makes money in distinct events

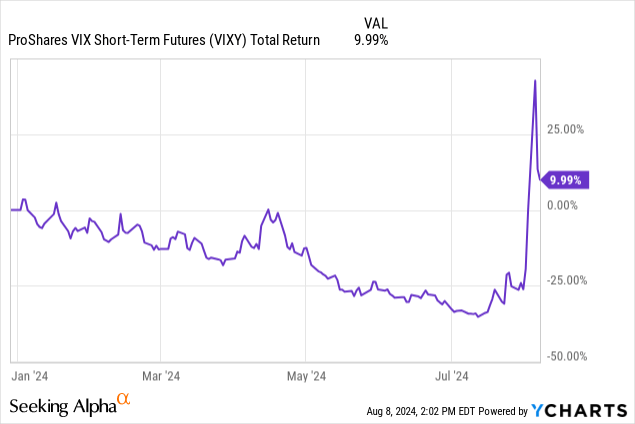

Due to negative roll in VIX futures, VIXY only makes money in very distinct events when VIX futures spike. While it is up 55% in the past month, you might be shocked to find out that it is up only 9.9% for the year, and was down -33% before that:

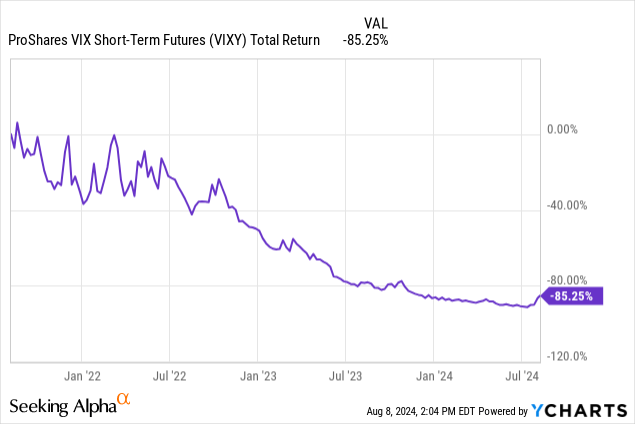

Nobody can time the market, yet this instrument really need outside black swan events in order to break-even for the year. On a longer time-frame, the fund’s total return is abysmal:

On a 3-year look-back period, the ETF is down a shocking -85%, highlighting the damage to the negative roll. This is not a buy and hold hedge for a portfolio, and even if you are lucky to buy it in the right year, you might just barely be breaking even.

We do not think VIXY is a buy and hold portfolio hedge, but a short term speculative tool that is best used by day traders or investors with very short time horizons.

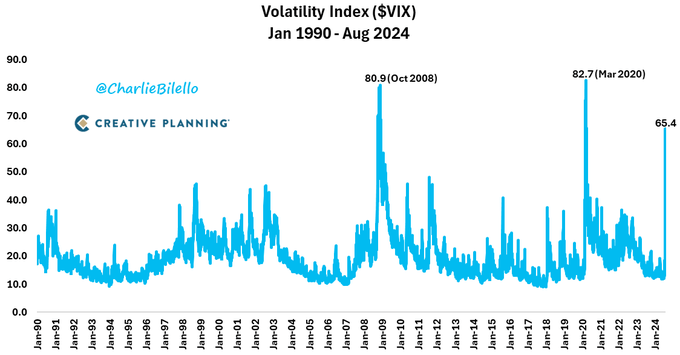

Having established VIXY only makes money in very few cases, let us put the current VIX spike in historic perspective:

VIX (Creative Planning)

What we experienced on August 5, 2024 is the third-largest spike in the VIX since 1990. Let that sink in. Yet VIXY is up only 9.9% for the year. After such an event, it is highly unlikely we get a spike of the same magnitude. The VIX might be staying in the 20s going forward, but that does not help VIXY. The negative roll effect will hold, irrespective of the absolute level in the VIX. Therefore, from a macro perspective, VIXY has more downside than upside for the rest of the year.

What can be used to hedge a portfolio?

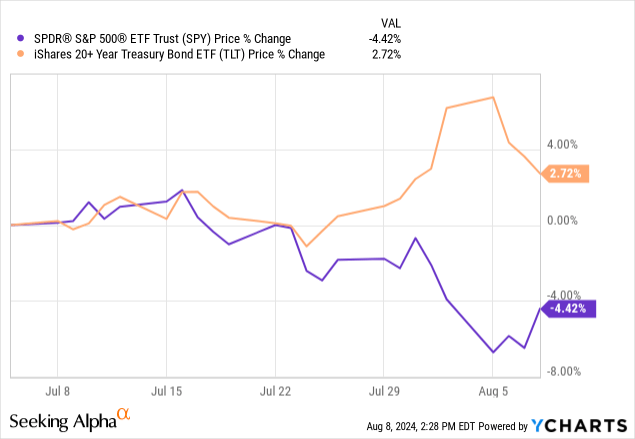

After a tough 2022 when bonds and equities broke their historic negative correlation, we are back in an environment where a recession will cause lower rates, thus higher bond prices. A natural hedge therefore is buying Treasuries, a trade that can be expressed for higher duration bonds (above 10 years ideally). We can clearly see the hedge aspect provided by bonds in the past month:

While the S&P 500 is down -4.4%, the iShares 20+ Year Treasury Bond (TLT) is up 2.7%, and more importantly peaked at 5% during Monday, August 5, 2024. Treasuries are yet again a safe harbor, with investors flocking to this asset class when markets are in turmoil. We have covered TLT in the past with a ‘Buy’ rating.

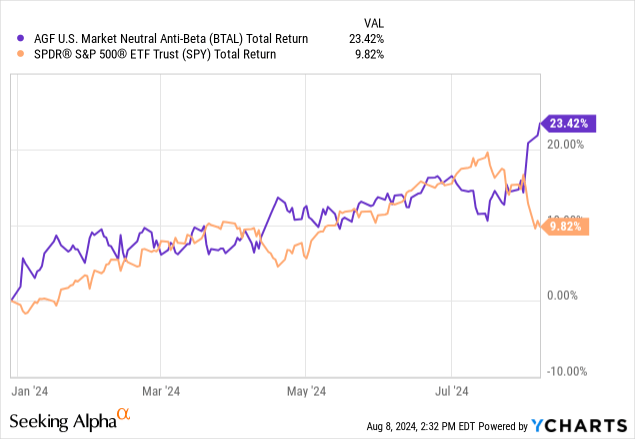

Market neutral funds are another way to hedge your portfolio. We covered such a security in our article BTAL: A Smart Way To Hedge The Market which shows why this security provides for a good portfolio hedge in today’s macrocycle. Let us look at how BTAL did against the SPY:

BTAL is up 23% in 2024, and more importantly has been up in the past week as the SPY sold off violently. Read our article (link above) that goes into detail regarding the fund mechanics.

Conclusion

VIXY is an exchange-traded fund. The vehicle aims to provide the returns of the S&P 500 VIX Short-Term Futures Index, which contains the front months VIX futures contracts. VIXY suffers from the negative roll effect in futures trading, and is down -85% in the past three years. Despite its 55% gain on the back of the August 5, 2024 VIX blow-up, the ETF is up only 9.9% for the year, highlighting the damage it can do to a portfolio. We do not consider VIXY an appropriate buy and hold hedging tool, but a mere short term speculative trading tool. The article highlights robust alternatives in the hedging space, while showing why VIXY is set to underperform now that a black swan event has already occurred in the volatility space.

Read the full article here

Leave a Reply