In my ‘Sell’ report published in April 2024, I highlighted IDEXX’s (NASDAQ:IDXX) high-quality business in consumables and software, as well as the stock’s hefty valuation. IDEXX reported its Q2 result on August 6th, lowering the full-year organic revenue growth to 6.2% – 7.8% for FY24. The guidance cut is primarily caused by reduced U.S. clinical visits. While I think the lower clinical visits are macro-driven and short-term in nature, the stock price remains overvalued and has not fully accounted for the near-term headwinds. Therefore, I reiterate a ‘Sell’ rating with a one-year price target of $440 per share.

Low Diagnostic Frequency for Non-Wellness Visits

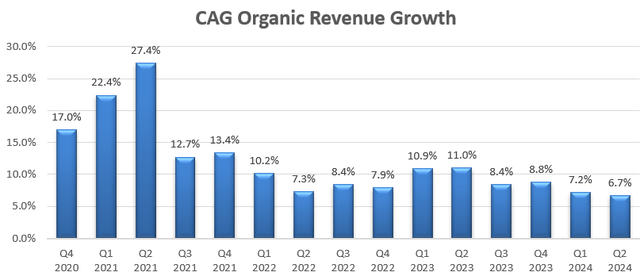

While the U.S. diagnostic utilization per clinical visit expanded during the quarter, the diagnostic frequency per clinical visits declined modestly, particularly for non-wellness visits. As disclosed during the call, the reduction in clinical visits negatively impacted revenue growth for pain management drug treatments. As a result, the Companion Animal Group segment’s revenue growth decelerated to 6.7% organically in Q2, as shown in the chart below.

IDEXX Quarterly Earnings

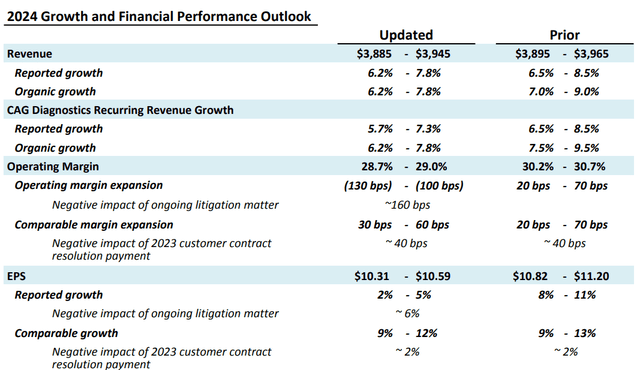

Management anticipates that the weakness in U.S. clinical visits will continue in the second half of FY24, leading the company to lower its full-year guidance, as shown in the chart below.

IDEXX Investor Presentation

I think the low U.S. clinical visit will persist in the near future for the following reasons:

- The current high-interest rate and weak labour market have softened consumer sentiments. According to McKinsey’s latest survey on May 31st, consumers reduced spending on nonessential goods in the second quarter of this year due to tightening cash flow. This weak consumer sentiment is likely to negatively impact IDEXX’s non-wellness-related business.

- During the earnings call, the management called out some ongoing staffing and productivity challenges, which affected the growth of clinical visits. However, I believe the primary issue is weak macroeconomic conditions, with staffing and productivity issues potentially being temporary.

As long as high-interest rate remains, I do not anticipate a recovery in clinical visits in the near future.

Test Menu Expansion for Catalyst Platform

On June 4th, IDEXX announced the launch of the Catalyst Pancreatic Lipase Test, a single-slide solution designed for canine and feline patients suspected of pancreatitis. The company plans to launch the menu expansion for catalyst platform in the U.S. in the upcoming quarter, with a global rollout in Q4 this year.

I think the menu expansion is quite important for IDEXX’s catalyst platform, as the new menu will provide veterinarians with quantitative results at the point-of-care in under 10 minutes.

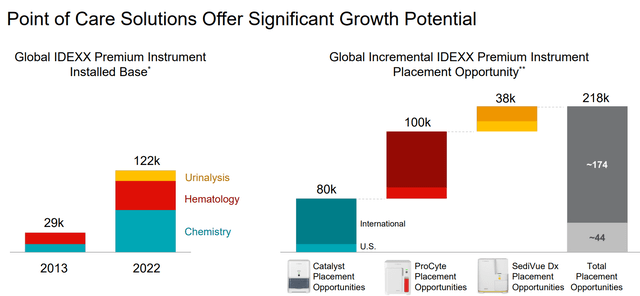

Point-of-care diagnostics have been a strategic focus for IDEXX in recent years. As shown in the slide below, IDEXX has tremendous placement opportunity for their premium point of care instruments, including Catalyst, Procyte and SediVue Dx. I anticipate IDEXX will continue to launch new products or enhance existing portfolios to further expand the point-of-care market, which will drive the growth in diagnostic business.

IDEXX Investor Presentation

Outlook and Valuation

For FY24’s growth, I am considering the followings:

- Historically, the companion animal business has grown at a double-digit in the past few years. Considering the weakness in the U.S. clinical visit, I anticipate the business will grow by7% in FY24, assuming 5% pricing growth and 1% volume growth.

- For the water and Livestock, Poultry and Dairy (LPD) businesses, I assume they will grow at 6%, in line with their historical average.

I calculate the overall revenue will grow by 7% in FY24.

For the growth rate from FY25 onwards, I assume their companion business will return to historical growth trajectory, growing at 12% annually. Additionally, I forecast LPD and Water businesses will grow by 6%. Therefore, the normalized revenue growth from FY25 onwards is projected to be around 11.4%.

I model 30bps annual margin expansion for IDEXX, assuming 10bps contribution from pricing increase; 10bps from SG&A operating leverage and 10bps from R&D leverage.

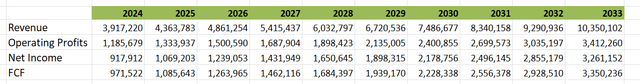

With these parameters, the DCF summary is:

IDEXX DCF

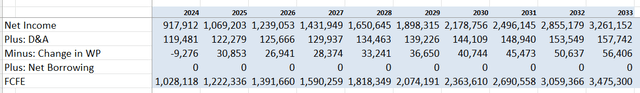

The free cash flow from equity is calculated as follows:

IDEXX DCF

The cost of equity is calculated to be 14% assuming risk-free rate 3.8% (US 10Y Treasury Yield); beta 1.46 [SA]; equity risk premium 7%.

The one-year target price is calculated to be $440 per share after discounting all the future free cash flow from equities.

Upside Risk

As I give IDEXX a ‘Sell’ rating, I am considering the following upside risks:

- As discussed in my previous article, IDEXX has a strong position in software and services, which contributes recurring revenue for the company. While low U.S. clinical visits could negatively impact the company’s diagnostic business, their software and service segments might deliver higher-than-expected growth, potentially boosting the stock price.

- If the equity market enters a bear market, IDEXX might be favored by the market, especially by institutional investors. IDEXX is a high-quality growth company with a resilient business model. The company has maintained positive organic growth over the past 16 years, including through several recession periods.

End Note

The low U.S. clinical visits created tremendous growth headwinds for IDEXX. While I consider these macro challenges will recover in the future, the stock price has not fully factored in the near-term growth headwinds, in my opinion. Therefore, I reiterate a ‘Sell’ rating with a one-year price target of $440 per share.

Read the full article here

Leave a Reply