All stated amounts are in Canadian dollars except where otherwise stated.

Dear readers/followers,

Medical Facilities Corporation (OTCPK:MFCSF) is one of those investments that I made and where I acted “incorrectly”. I sold my small stake many years ago but kept an eye on the business. I started coverage again in late 2023, with a “Hold” rating, but then gave a “Hold” rating in April of this year as well. After both of these ratings, the company saw a substantial increase in valuation, which means that there’s a risk that I incorrectly valued the company relative to the risk profile and upside.

In this article, I’m going to look at the company again. In my last article, where I gave the company a PT of $6.5, the company still continued to outperform upwards from this. The question becomes not only did I incorrectly value the company and is there a reason for this upside, but also is there more upside to this?

Obviously, the company is seeing a current trend of outperformance. But at the same time, it’s important to point out that the company is not in any way outperforming over the long term. In fact, in 2019 when the company started dropping it was trading above $15/share. It’s now at $13.90/share. The 10-year RoR for investors is negative ~22%.

So while risk-tolerant investors have seen a significant upside in 2-3 years, that is not the case for long-term shareholders.

Let’s see what we have here as of the latest quarterly report, which came in on August 6th.

Medical Facilities Corp – a 2Q24 update

Revisiting this company reminds me a lot of when I had a stake in the business, and spent a lot of time digesting, researching, and theorizing about results and potential upsides. Let me be clear that DR.UN, or Medical Facilities Corp, is not in any way a bad company. When I invested in it, and the rest of the market as well by the way, it was just perhaps somewhat overestimated on the upside, and with a bit of underestimation and a bit of “too conservative” for the risk consideration.

But in a positive macro, with less leverage, and with some better considerations for some of its assets, the business idea and the concept were very sound.

This is also what we’re seeing at this particular time. The company is seeing increases in revenue, in surgical cases, and a significant increase in operational income of 21% (although excluded for share-based compensation plans, more on that little detail later). EBITDA increased 13.7% as well, but again, adjusted for SBC. The company managed to repay $5M on its credit facility – but remember that this business Is actually a quite small business – so $5M is quite a bit – and returned almost $4M to shareholders through buybacks.

The company went from being a monthly to a quarterly dividend payor. That’s when it lost most of the market “support”. It also cut the dividend to the bone and currently yields less than 2.6% for the native DR.CA ticker, which makes it a no-go for me from that alone. The relative risk/reward ratio when taken this into consideration just isn’t there to me.

But, I may also have misjudged/misvalued this business – so let’s keep going.

Medical Facilities Corp remains a play on a mix of payor, case, and operator mixes and diversification. When these go according to plan, the company does well – as we see this quarter. Surgical cases are up, and this in turn drives operational income and EBITDA. This in turn enables paying debt, which improves the profile even further.

Also, a significant positive for the company is the full forgiveness of the PPP loans outstanding as of 2 months back. Full details here:

Subsequent to quarter end, the U.S. Small Business Administration finished its review pertaining to $6.9 of the $12.0 million in PPP loans outstanding as of June 30, 2024. Their review concluded with no findings, confirming full forgiveness of these particular loans. As such, we plan to record this $6.9 million amount as government stimulus income in the third quarter and reverse the corresponding liability previously recorded under government stimulus funds repayable. We will continue to seek forgiveness on the remaining PPP loans, diligently pursuing all reasonably available channels for reversing any remaining denials.

(Source: Jason Redman, President/CEO of Medical Facilities Corp)

A full quote is warranted here, I believe, due to the significance of this. It’s basically like “getting” that money back and leaving the company in an even better position. It also explains some of the things happening to the company’s share price at this time.

This company now generates close to half a billion CAD per year in revenues, from which it makes around $88M in annual EBITDA from 114 physician partners across the nation. This is due to ownership of qualitative surgical facilities across the US. The business idea is a good one – involve physicians in the running of their facilities, with direct management involvement, resulting in superior processes and engagement. The company’s focus on leverage and high yield made the company “fail” to sustain its previous model a few years ago, but it’s fair to say at this particular point that the trouble seems to be over. The company’s facilities seem better managed, and the mix seems better, with a focus on short-duration, non-emergency surgeries, diagnostics, imaging, and pain management. Most of it Is Orthopedic and Neurosurgical procedures, and the reviews for the company are very solid.

Medical facilities Corp IR (Medical facilities Corp IR)

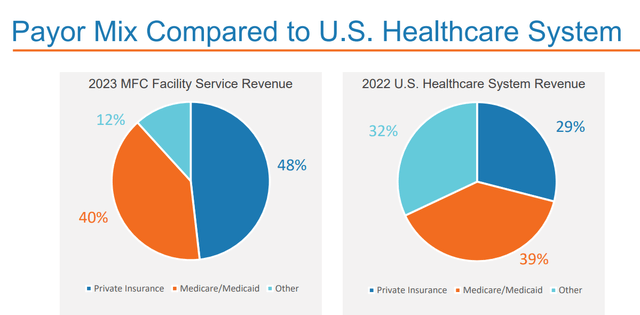

The payor mix is now also better diversified- with 32% private, 29% other, and 39% Medicare/Medicaid in 2022 for the US healthcare system, while MFC has a 2023 revenue mix mostly coming from the private sector.

Medical Faciliies corp IR (Medical Faciliies corp IR)

The company has been using its vastly improved position to purchase back significant amounts of shares. This is part of why the company’s share price has seen such upside over a relatively short time. Since September of -22, the company has, in fact, bought back over 5M shares of its common stock, for almost $40M, which comes to almost 50% of a year’s worth of company EBITDA going only to share buybacks.

The company also increased the dividend – but not exactly to an impressive yield because it’s still at an overall comparatively low level to where it was.

The main problem with this company is not what it is doing and how it’s going – because these are positive trends. Instead, the problem is that the company is a relatively small player working in the healthcare sector and with a less-than-stellar history, no credit rating worth considering, and a low yield. The potential for upside and looking at it relative to other potential investments here does not result in a particularly attractive overall view for MFC.

Outside of my coverage, most coverage of this company is now over 4 years old. Most seem to have abandoned this company as a potential investment. It’s not that easy for me.

Let’s look at where the valuation stands today, and how it could be considered from here on and forward, depending on how the company does.

Medical Facilities Corp Valuation – Attractive, at least potentially, but also potentially too risky

To get any sort of fair value for this company we need to discount for the impacts of buybacks, while also taking a look at what’s happening to the remainder of the company. We have some interesting things that are happening here – the first of which is that the company has reported for the past 2 years a negative amount of SBC, which I have not seen for many years since I looked at some Dell (DELL) statements. The reason could be the suspension of options and then accounted for real cash expenses when the company pays some things out to option holders. However, it’s a small amount (less than $800k per year), so I’m willing to overlook this for now.

Instead, let’s look at the actual company valuation, which currently comes to a P/E multiple of around 10x. This is to be compared to an average P/E of 15x, but the company is also generally quite “volatile” here – so there’s that to consider as well. Also, the fact that the company has a 58-80% chance over a 1- to 2-year basis to negatively miss its estimates – so even though the company is currently estimated to increase at 70% EPS increase this year, the likelihood of this seems so-so.

What I would want to do is forecast this company, due to its historical failures, at below 10x P/E. I put the valuation at somewhere of a 9-11x normalized P/E over time, which when we take current estimates is no more than a 9-12% annualized rate of return, which as things stand here is not enough to make me interested.

The company remains an unrated and low-yielding healthcare-exposed business, with a very poor history in terms of operating performance and shareholder returns.

For that reason, I’m unwilling at this point to go in at above $10/share, and I would give the company a “Hold” here until it goes back to a single-digit share price. At that time, I’d be willing to revisit this thesis.

My risk considerations for this company are as follows.

Medical Facilities Corporation – Risks

Risks to this company would be primarily backward-facing. The company has a well-established history of not performing very well over the past 10 years, and that is a period where most investments, if you follow “valuation logic” and focus on qualitative businesses, have done fairly well for themselves. At the very least, we haven’t lost money – but MFC has.

For that reason, even though things seem substantially better at this time, I would still be somewhat careful here and would say that the valuation does not in full reflect a “proper” weighing of risk/reward. Yes, some might argue the company has double-digit return potential here. I say you can get 10-15% far easier and with an A-rating, rather than an unrated, relatively small business.

For that reason, I’m very careful here and would consider MFC a “Hold” still.

Thesis

- Medical Facilities Corporation is a business with the idea of partnering with physicians and surgeons to manage various specialty care institutions around North America, focused on the U.S.

- The company has been through multiple iterations, including being a high-yielding monthly payor that failed to hold on to this trend and had to cut down its dividend not only in yield but also went back from its monthly to a quarterly dividend model. The company instead of increasing its distribution focuses on share buybacks given the very pressured valuation at this time.

- Despite what can be argued to be an attractive overall valuation, I do not view Medical Facilities Corporation as a “BUY” here – there are far better alternatives out there. At the current yield, I would “BUY” the company, barring no deterioration of fundamentals, at $ 9CAD for the native DR.UN ticker.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This company fulfills maybe 1-3 of my criteria depending on how you choose to apply them, and I do not view it as justifying an investment in any case here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply