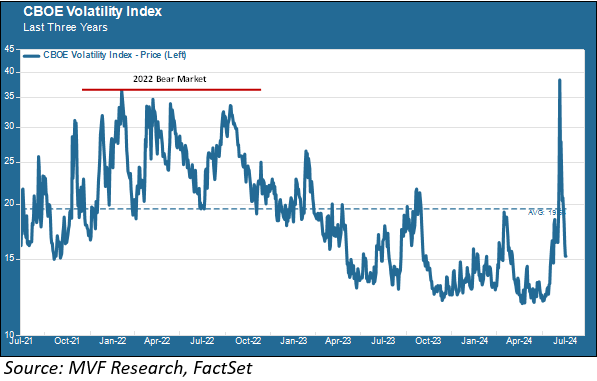

Two weeks ago to the day, a soft jobs report sent risk asset markets into a tizzy. The report from the Bureau of Labor Statistics on August 2 seemed in investors’ minds to validate two data points from earlier that week, one a survey on manufacturing activity and the other a weekly tally of new filings for unemployment, suggesting that the economy was slowing at a faster than expected clip and could be in recession by the end of the year. Bearish sentiment ticked up. Investors bought lots of Japanese yen because that’s one of the things people do when a risk-off mood sets in (and also because the Bank of Japan raised interest rates). That, in turn, sent Japanese stocks into a double-digit tailspin the following Monday, and for the briefest of moments it looked like the apocalypse was at hand. The CBOE VIX index, a measure of volatility, shot up and closed at a higher level than at any time during the 2022 bear market (at one point during the day, it reached levels not seen since the global financial crisis of 2008).

As the chart shows, the fear peaked very quickly and then plummeted. A handful of upbeat macro reports last week contrasted with the gloomier tone of the prior week’s data. Fed officials pushed back hard against the panicky calls for an emergency rate cut that pinballed from one talking head to another in the financial media. By the time last week’s new unemployment claims filings came out lower than expected (i.e., fewer new claims filers), the composite picture seemed to be more or less back to what most of us have been projecting as a base case for some time now – slowdown yes, recession no.

Crossing 3.0

Another important piece of the economic puzzle was up for review this week. On Wednesday, we learned that the headline Consumer Price Index fell below three percent (year-on-year) in July, registering at 2.92 percent with a slowing in most categories (shelter being a notable exception). The CPI excluding food and energy prices also continued its downward trajectory, with prices rising 0.2 percent in July for a year-on-year increase of 3.2 percent. These numbers were more or less in line with expectations and probably strengthen the case for the Fed to finally begin cutting rates when the Federal Open Market Committee meets on September 18. How much? In the wake of the market jitters from early last week, the bond market was pricing in a full 0.5 percent September rate cut. We think that is unlikely. Following Wednesday’s CPI report, we got more evidence of consumer strength with a better than expected retail sales report on Thursday (and yet another week of lower than expected new unemployment filings). A standard-issue 0.25 percent reduction in the Fed funds target seems to be appropriate for an economy that is still growing (at a slower rate) while inflation moves incrementally lower.

Next Week In Jackson Hole

So it would seem that the apocalypse is not at hand. That doesn’t necessarily mean that all’s well and back to the brandy. Our key takeaway from the past couple of weeks is that markets are twitchy, and it doesn’t take much for sentiment to suddenly lurch negative. Valuations remain expensive by historical standards. Geopolitical developments are very much in the news, and while they normally don’t have an outsize effect on market trends, they can contribute to an overall vibe of uncertainty.

Next week is the last week of August, and for central bankers that means a week in the idyllic environs of Jackson Hole, Wyoming. The Jackson Hole confab often serves as a platform for the Fed to set out a policy vision, and we may get a clear message from Jay Powell, when he gives his keynote address next Friday, about what to expect from the Fed between now and the end of the year. He is likely to reaffirm the points he made two weeks ago about the twin goals of stable prices and healthy employment coming into better balance. Whether he goes further to guide conclusively towards that September rate cut remains to be seen – but it might help markets become a little less twitchy.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here

Leave a Reply