Michael Burry, the investor famous for his big short in the 2007 subprime mortgage bubble, has upped his stake in Alibaba (NYSE:BABA), according to recent 13F filings by his firm Scion Asset Management. He increased the number of BABA shares he held by 24%, while cutting many other positions. BABA now occupies 21% of the portfolio, and is Burry’s largest holding. Together with three other major Chinese stocks, Baidu (BIDU) and JD.com (JD), Chinese stocks occupy about 45% of Burry’s holdings.

This appears bullish for large-cap Chinese stocks and particularly Alibaba. The dichotomy of investment opinion on Chinese stocks is quite interesting. Some just see China as absolutely uninvestable, largely because of the Chinese Communist Party and their tight grip over all aspects of the country. It certainly doesn’t help that the world is undergoing deglobalization, the perception of U.S. leadership is declining, China is trying to assert its dominance over Taiwan, and Xi Jinping is seemingly more of a strongman and demagogue leader of China than anyone we’ve seen since Mao Zedong. Others believe this risk is well overblown and has compressed the multiples of Chinese stocks to lows that make them a deep value play. For BABA, a case can be made that the buybacks and rich cash position alone makes the growth story very likely to unfold. The rock bottom valuations are just more margin of safety.

While I tend to lean toward the first side, I believe there are times where sentiment makes it reasonable to take speculative positions. I think this could be one of them. BABA stock and the Chinese large cap index, FXI, have both been punished by the market in the last few years.

BABA and FXI (Seeking Alpha)

BABA is trading at very attractive valuations despite being very profitable. In fact, BABA has an overall A+ profitability grade on Seeking Alpha and scores quite well on most of the common valuation metrics of like PEG, PE, EV/EBITDA, and PB ratios.

Buybacks And Dividends

The most bullish fundamental development is probably buybacks. BABA is increasing buybacks and has retired 5% of its shares in FY24. Buybacks are the perfect way to return cash to shareholders because they don’t have to be taxed until the shares are sold at a profit. BABA also started paying a dividend at the start of 2024, and it has only a 11.7% payout ratio, which makes this cash flow very safe.

BABA has a very strong cash position. Most recent statement shows $12.68 of cash per share. It also shows free cash flow per share of $7 and basic earnings per share of $3.86. I think the buybacks and dividends are quite safe by this assessment alone. The forward dividend rate is just $2 per share. If just half of the remaining $5 of the $7 of free cash flow goes towards buybacks, then we will see cash per share increase dramatically.

As it stands, BABA has only spent $5.8 billion on the last quarter’s buybacks. This reduced the share count by 2.3%. $5.8 billion is less than a third of the $19.4 billion TTM levered free cash flow. With a sizable cash position and a fantastic cash flow situation, this current pace of buybacks could likely be sustained for a while. It’s hard to imagine how the price can continue to stay down when all this buying pressure will be pushing it up.

Chinese Tail Risk

Of course, the elephant in the room here is the CCP. If China invades Taiwan, we can expect that Chinese stocks will be delisted from Western markets, which is exactly what happened to Russian stocks in 2022. In this case, BABA shareholders (as owners of the ADR) will be completely wiped out, even though the real Alibaba shares could still be trading in Hong Kong.

This tail risk absolutely must be considered. China has been doing provocative military drills all around Taiwan. The occurrences of such drills have seemingly increased over time. Xi Jinping has stated very recently that the two countries are destined for reunification. Given that Xi is already 71 years old and that might desire to be the leader who sees this “destiny” through, I think we do need to be very careful about this particular risk.

Another tail risk is that the Chinese economy probably isn’t doing too well. The CCP isn’t all that transparent with how it reports numbers, and many of its command economy policies have started to backfire spectacularly. Evergrande, for instance, is a fairly recent example of immense value destruction caused ultimately by the CCP’s intention to artificially pump up GDP numbers. We have little way of knowing what kind of contagion might be lurking underneath the surface. What we do know is that average Chinese people are starting to rush into physical gold as a safe haven. This is definitely an indication of widespread bad sentiment, and oftentimes that can be a self-fulfilling prophecy.

The smaller risk is that weakness of the Chinese consumer will hurt Alibaba’s top line. As a consumer discretionary business, BABA doesn’t enjoy low demand elasticity. A weaker Chinese economy will cause much of BABA cash flows to sour. Sentiment would get worse and buybacks would have to slow down. That would collapse the core thesis of cash flow induced buy pressure on the stock.

The much bigger risk is that the CCP’s best move to distract the population from a declining economy could be to attack Taiwan. This would be a highly sensible political move. Any economic malaise caused by the deteriorating Chinese economy could be blamed on the rest of the world placing sanctions on China. Also, Xi could finally have a shot at forcing reunification.

The Trade

I think OTM call options might just be the most appropriate trade here. You can limit your downside to the premium of the option. This would be insurance in case the tail risks play out. Sentiment is quite bad right now, so being a contrarian could pay off big, and the lower upfront cost to buy a call is perfect for taking a highly asymmetric bet.

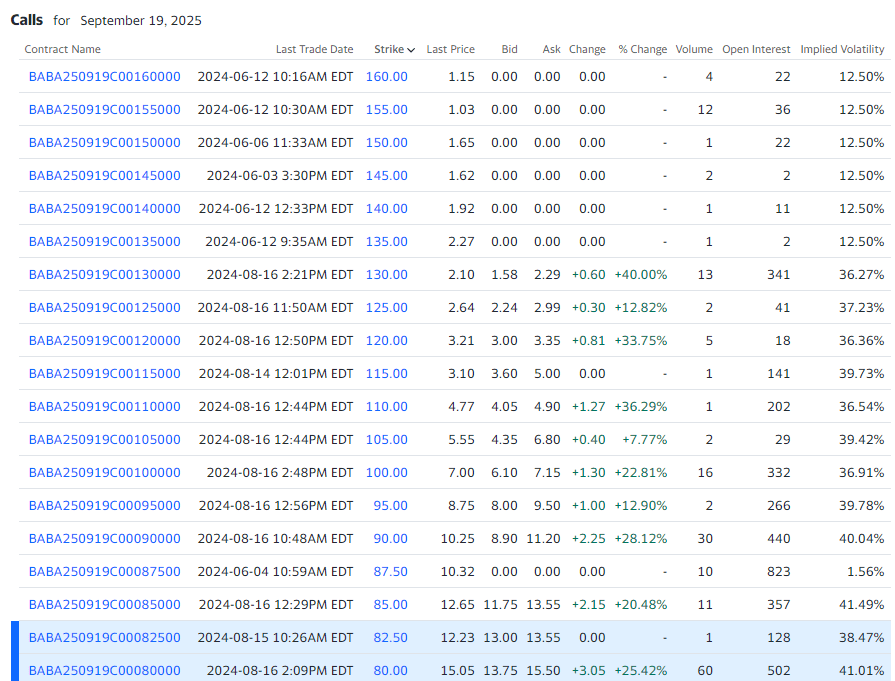

BABA OTM calls (Yahoo! )

I think BABA has traded quite reflexively. Back in 2021, sentiment around all Chinese stocks started to sour, and it has piled on for the last 3 years. If the buybacks can cause the price to go up more and that gets the sentiment to change, we could likely see a rally to $120 per share, which is about 50% up from where we are right now. Thus, buying the BABA 120 call expiring in September 2025 for $320 would be a good deal.

What’s nice is that BABA’s calls are priced at lower implied volatilities as the strikes go higher. This could be a sign of pretty depressed sentiment. Any kind of revaluation upwards could push the value of OTM calls higher by reassigning them with a higher IV.

The current ATM call expiring in 4 months is about $800. So if BABA is near 120 within 6 months, this contract could more than double. The weakness is that time decay is very real for OTM options. Every day BABA stays around current levels will eat away at the principal investment. Thus, this is a high risk, high potential return trade that purposely limits one’s downside, out of awareness of the present tail risks.

Read the full article here

Leave a Reply