After the close of Tuesday’s regular session, Immersion Corporation or “Immersion” (NASDAQ:IMMR) reported strong second quarter results. However, the company’s recent acquisition of a controlling stake in Barnes & Noble Education (BNED) has resulted in the unfortunate requirement to consolidate the new subsidiary’s financial results.

The consolidation of Barnes & Noble Education’s highly seasonal operations will result in Immersion reporting massive losses in the first half of each calendar year, followed by strong profits in the second half.

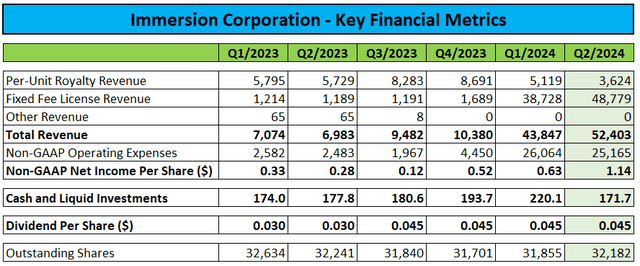

While Immersion hasn’t stopped breaking out revenues and assets for its core licensing operations, the Q2/2024 numbers for non-GAAP operating expenses and non-GAAP net income per share include the contributions from Barnes & Noble Education:

Regulatory Filings / Company Press Releases

Reported increases in fixed fee license revenue and profitability in H1/2024 have been mostly the result of a litigation settlement and related licensing agreement with Meta Platforms (META) as well as the recent renewal of existing agreements with key licensees Nintendo (OTCPK:NTDOY, OTCPK:NTDOF) and Samsung Electronics (SSLNF).

As these payments won’t repeat in the near future, licensing revenues are likely to come down quite meaningfully in the second half of the year. However, with Barnes & Noble Education’s busiest quarter straight ahead, Immersion is likely to report a very strong Q3 in November.

The sequential reduction in the company’s cash and liquid investments reflects Immersion’s recent $50.1 million investment (net of reimbursements) in Barnes & Noble Education, as also outlined in the company’s quarterly report on form 10-Q:

As part of the Transactions, the Company acquired 42% of all outstanding common shares of Barnes & Noble Education, as well as control over Barnes & Noble Education through the five Immersion-appointed board seats.

The total consideration transferred was approximately $50.1 million, consisting of $52.2 million in cash consideration paid to Barnes & Noble Education less $2.1 million in transaction costs incurred by Immersion but reimbursed by Barnes & Noble Education.

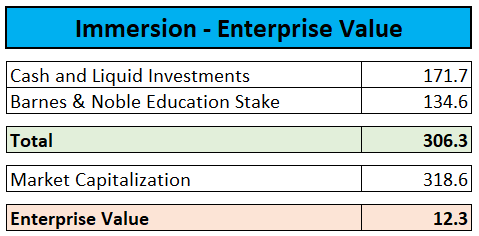

In exchange, Immersion received approximately 11 million shares of Barnes & Noble Education with a current market value of close to $135 million, which translates into an almost 170% gain within just two months.

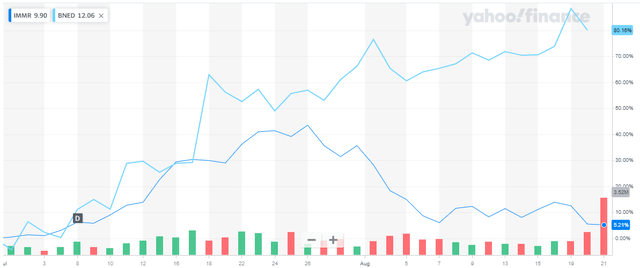

Since the beginning of July, Barnes & Noble Education’s stock price has doubled on favorable regulatory developments and hopes for strong growth in the company’s all-important First Day Complete (“FDC”) offerings, as outlined in great detail by fellow contributor The Minotaur in a recent article.

Adding Immersion’s cash and liquid investments to its stake in Barnes & Noble Education leaves almost no value for the company’s core licensing business:

Yahoo Finance / Author’s Calculations

Given the company’s recent success in its licensing efforts, Mr. Market’s judgement appears a bit harsh here, but the inherent unpredictability and low reputation of the business appears to keep most investors sidelined.

Fellow contributor Gary Bourgeault actually called Immersion “The Haptic Ambulance Chaser” in an article published early last year, while some tech news outfits are outright labeling the company a “patent troll“.

Management’s approach to shareholder communication and capital returns doesn’t exactly help things either, as the company declines to hold quarterly conference calls and only pays out a measly quarterly cash dividend of $0.045 per share with an annualized yield of below 2%.

While Immersion has an active $50 million stock repurchase program, the company hasn’t bought back any shares so far this year.

With stock-based compensation no longer offset by repurchases, the number of outstanding shares has moved back up in recent quarters.

In order to attract new buyers to the stock, management would likely have to resume share repurchases and increase the quarterly cash dividend quite meaningfully.

Immersion could also try to monetize its recently acquired stake in Barnes & Noble Education and distribute the proceeds in form of a special dividend. However, any share sales into the open market would likely cause Barnes & Noble Education’s stock price to collapse.

That said, further appreciation in the value of the company’s stake in Barnes & Noble Education might also result in a lift to Immersion’s share price, albeit this is not a given by any means as evidenced by the chart comparison:

Yahoo Finance

At least in my opinion, Immersion is cheap for a reason, as market participants are scrutinizing the lack of predictability and uncertain long-term value of the company’s core licensing operations.

In addition, the performance of Barnes & Noble Education will depend on a favorable regulatory environment. Should the Department of Education make changes to the current opt-out model for inclusive access programs, the company’s business would likely take a major hit.

Moreover, the consolidation of Barnes & Noble Education’s highly seasonal operations is likely to confuse investors going forward.

For my part, I am not willing to become exposed to these uncertainties, even with the core licensing business valued at bargain levels.

Consequently, I am initiating coverage of Immersion Corporation with “Hold“.

However, investors feeling comfortable with the business model and Barnes & Noble Education’s prospects might consider betting on a near-term increase in shareholder capital returns, which I consider the approach best suited to lift Immersion’s stock price.

Bottom Line

Immersion Corporation’s core licensing operations delivered strong second quarter results, with profitability boosted by the recognition of new licensing deals with tech giants from the likes of Meta Platforms, Samsung, and Nintendo. However, these payments won’t repeat in the second half, so results are likely to be lower going forward.

While the acquisition of a controlling stake in Barnes & Noble Education has turned out to be a major winner for the company, the requirement to consolidate Barnes & Noble Education’s highly seasonal operations will make it more difficult for investors to assess Immersion Corporations financial performance.

The recent recapitalization has put Barnes & Noble Education on stronger financial footing, but the company remains dependent on a favorable regulatory environment.

For my part, I am not willing to become exposed to the inherent uncertainties of Immersion Corporation’s business, even with the core licensing operations valued at bargain levels.

As a result, I am initiating coverage of Immersion Corporation with “Hold“.

Read the full article here

Leave a Reply