Introduction

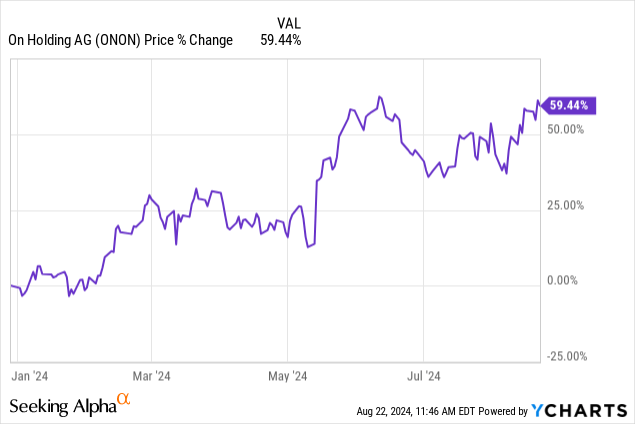

On Holding (NYSE:ONON) – the viral, premium performance sportswear brand — is up about 60% so far this year, outperforming pretty much every single company in its peer group, including Nike (NKE) and Lululemon (LULU), which are down 20% and 50% this year, respectively.

What is up with the stock lately? How was On able to outperform by such a wide margin? And with the stock up so much, is it time to take profits and run (pun intended)?

I have highlighted some of the reasons why On is a great stock to buy, but as you can probably tell by the title of this article, I believe On is still undervalued at current prices and has more room to run over the next few quarters.

Let me elaborate.

Growth: Taking Market Share

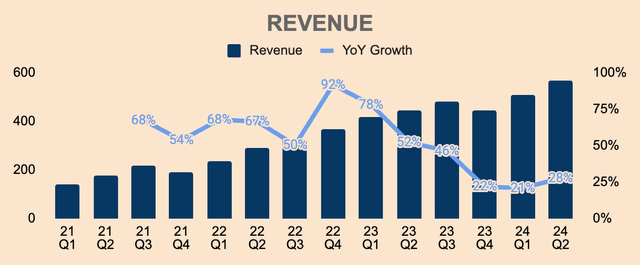

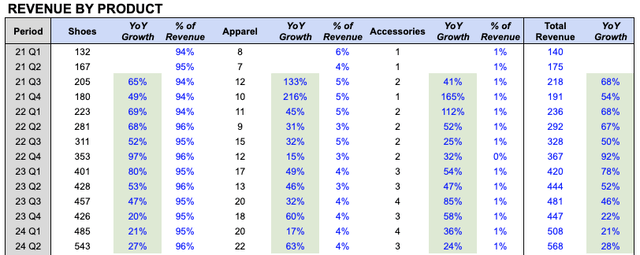

After several quarters of growth deceleration due to tough YoY comps and door closures, On’s Revenue growth reaccelerated again, delivering 28% growth in Q2 to CHF 568M in Revenue, a new record-high for the company. This testifies to On’s powerful brand moat, virality, and execution, even in an environment challenged by high-interest rates and weakening consumer sentiment.

Author’s Analysis

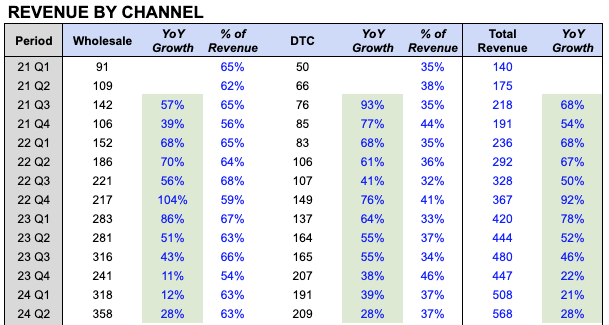

Wholesale Revenue was CHF 358M, up 28% YoY, as most of the impact from non-strategic wholesale partner door closures in EMEA is “more or less over now”. Even so, overall wholesale store growth was only 5% in Q2, much lower than its historical growth of “roughly 10% YoY”, which means that On was able to grow Wholesale Revenue more rapidly despite entering fewer wholesale doors, pointing to higher productivity per wholesale store.

Author’s Analysis

On the other hand, its DTC channel slowed down quite a bit, growing “only” 28% YoY to CHF 209M, as the company continues to drive brand awareness and expand its retail store network globally.

Regardless of the current slowdown, management expects DTC growth of above 30% in Q3 as they “have seen a reacceleration of our DTC growth basically already in the second half of Q2, but also in the first weeks of Q3”, driven by “record visits coming to our website”.

So going a bit back to the big picture, our D2C channel is extremely healthy and we see record visits coming to our website. We see that all our key D2C metrics. So from new customers to repeat purchase rates to average item value, all those things are at historical high levels and basically showcase the strength of the channel. And we talked about the app and other new elements that clearly put ourselves in a strong position to capture that customer that is shopping online.

(Co-CEO and CFO Martin Hoffman — ONON FY2024 Q2 Earnings Call)

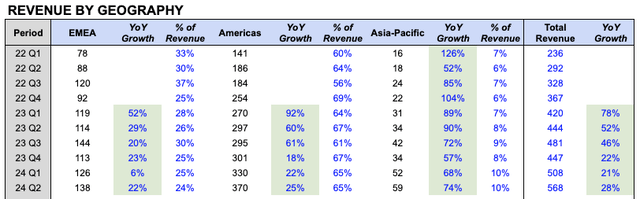

Breaking it down by geography, growth was strong across all regions:

- EMEA Revenue was CHF 138M, up 22% YoY, a decent reacceleration, driven by the UK market, as well as door closures no longer impacting the top line.

- Americas Revenue was CHF 370M, up 25% YoY. However, growth in the region was slower than expected due to “product availability challenges and delayed or missed deliveries, primarily due to the ongoing transition of our Atlanta warehouse”. That said, management expects continued impact from this warehouse transition in the back half of the year, which means America’s Revenue growth may be muted in the near term. The good news is that this is not a demand issue, but rather, a supply and logistics problem, which should point to higher growth in the region once the transition is complete.

- Asia-Pacific was the highlight of the quarter, growing 74% YoY to CHF 59M — even more impressive, Asia-Pacific Revenue grew 85% YoY on a constant currency basis. Moving forward, expect growth in the region to remain robust as “current demand is clearly exceeding supply”.

Author’s Analysis

Growth across all product segments continued to be strong:

- Shoes Revenue was CHF 543M, up 27% YoY.

- Apparel Revenue was CHF 22M, up 63% YoY.

- Accessories Revenue was CHF 3M, up 24% YoY.

Author’s Analysis

Going forward, expect the second half of the year to be “as packed as the first” as the company gears up for additional product launches. More specifically, On plans to launch the following products throughout the remainder of the year:

- Cloudsurfer 2

- Cloudnova X

- Cloudboom Strike LightSpray

- Cloudtilt Zendaya edition

The Cloudboom Strike LightSpray should be a big hit as it is probably the most unique and innovative running shoe ever created, featuring “an ultralight upper that is sprayed, not built, in a one-step process automated by a robotic arm in just three minutes”.

The non-LightSpray version, the Cloudboom Strike, is priced at $280 a pair and is already sold out on On’s website — the shoe was launched in mid-July. The LightSpray version is priced higher at $330 a pair, but even so, I believe the shoe will sell out in a matter of weeks or even days.

Considering its robust retail expansion, new product launches, and ongoing brand partnerships with figures like Zendaya, I believe On will easily surpass its full-year Revenue constant currency growth rate of at least 30%, which management reiterated. This also means that Revenue growth is expected to accelerate further in the back half of the year.

More importantly, On should continue to take market share from incumbents like Nike and Adidas (OTCQX:ADDYY), solidifying its market position and growth story for the long haul.

Profitability: Acceleration Imminent

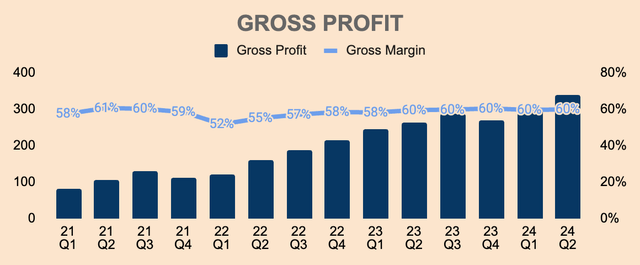

Gross Profit for the quarter was CHF 340M, up 29% YoY. On maintained its industry-leading Gross Margin at 60% in Q2, as the company continued high share of full-price sales, reflecting strong pricing power. Moving forward, On continues to expect Gross Margin of around 60%.

Author’s Analysis

Operating Expenses as a % of Revenue was 52%, which increased by 1pp YoY but flat QoQ. On continues to invest in growth, especially in brand awareness where the company ramped up Marketing Expenses by 37% YoY, to support its brand-building initiatives during the Olympics in Paris.

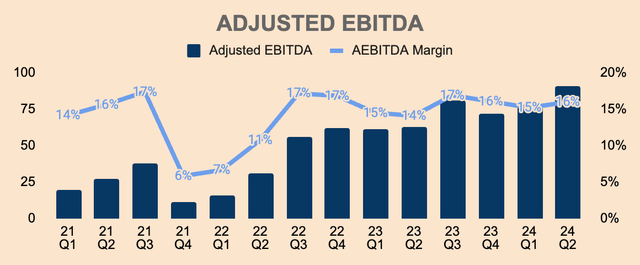

As a result, Adjusted EBITDA saw little improvement over the last few quarters. In Q2, Adjusted EBITDA was CHF 91M at a 16% Margin. However, management expects full-year Adjusted EBITDA of 16% to 16.5%, which implies a slight acceleration in Adjusted EBITDA in the second half of the year. This is due to:

- Higher volume, which will drive scale efficiencies against its fixed cost base.

- Higher DTC sales during the holidays — relative to Wholesale — which has a higher Gross Margin profile.

- Lower Marketing Expenses as a % of Revenue now that the heavy marketing activity during the Olympics is behind them.

Author’s Analysis

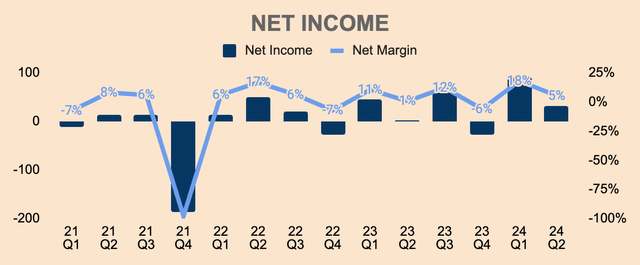

This should lead to higher Net Income as well, which was CHF 31M in Q2, representing a Net Margin of 5%.

Author’s Analysis

That being said, we should see strong operating leverage in the long term as On gains marketing leverage over time. In addition, On is investing in building a fully automated warehouse in Atlanta, which is on track to go live in the first half of next year.

Moreover, with its breakthrough LightSpray manufacturing technology, On would be able to produce shoes at much lower costs given that it will utilize robots to create the upper of the shoes in just three minutes — and with way fewer parts as well.

This essentially moves On “from an OpEx-led production model to more of a CapEx model”. As On scales this technology, Operating Expenses as a % of Revenue should decline, leading to an acceleration in margin expansion.

Health: Growing Cash Hoard

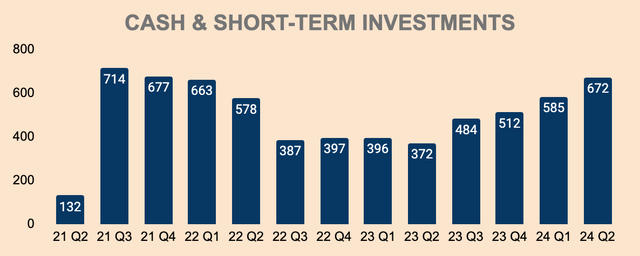

Over the last few quarters, On’s balance sheet has done nothing but expand, expand, and expand. As of Q2, Cash and Short-term Investments were CHF 672M, up CHF 87M QoQ. In addition, the company has no long-term debt.

Author’s Analysis

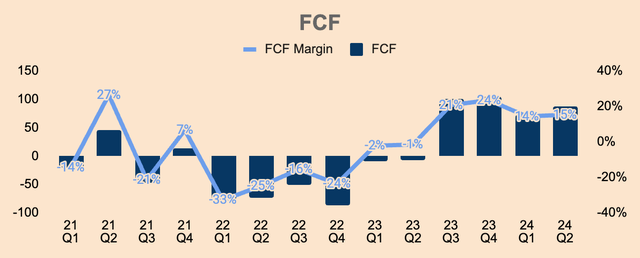

Free Cash Flow remains robust at CHF 87M in Q2, representing a FCF Margin of 15%. Inventory grew from CHF 365M in Q1, to CHF 401M in Q2, as On prepares for the holiday season.

Author’s Analysis

Given that the company is now cash flow positive, that demand is in excess of supply, and that momentum is at an all-time high, we can expect On’s cash hoard to grow over time, fortifying its balance sheet in the process.

Valuation: Plenty of Upside

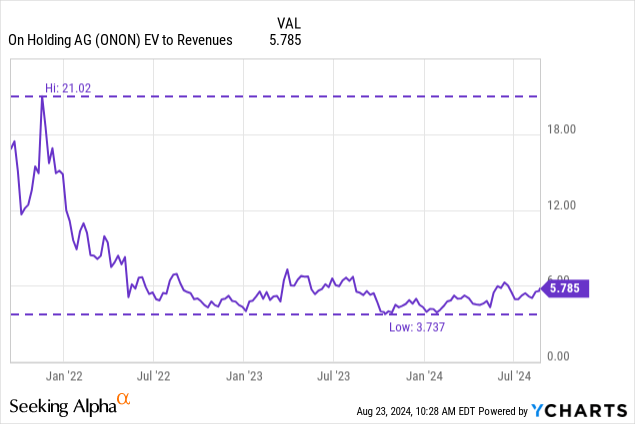

Despite being up 60%+ YTD, On stock is still trading at the bottom range of its historical multiple, at about 5.8x its Revenue, so investors are still getting a good deal on the stock.

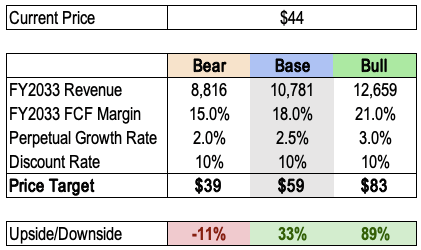

My base-case price target is about $59 a share, which represents an upside potential of 33% based on the current price of $44. This is based on very conservative assumptions:

- FY2033 Revenue of CHF 10.8B, which is a 20% CAGR.

- Long-term FCF Margin of 18%, which assumes ZERO improvement in FCF Margin. This is very unlikely given current business momentum and investments in automation, but I just want to be extra conservative here. For reference, On’s TTM FCF Margin was 18%.

- Perpetual Growth Rate of just 2.5%.

- Discount Rate of 10%.

Author’s Analysis

That said, On stock has had a great run lately, and like all runners, the stock might take a breather for a while before running its next lap. In other words, I won’t be surprised if we see a pullback — but in my opinion, the long-term trajectory of the stock remains up and to the right.

Risks

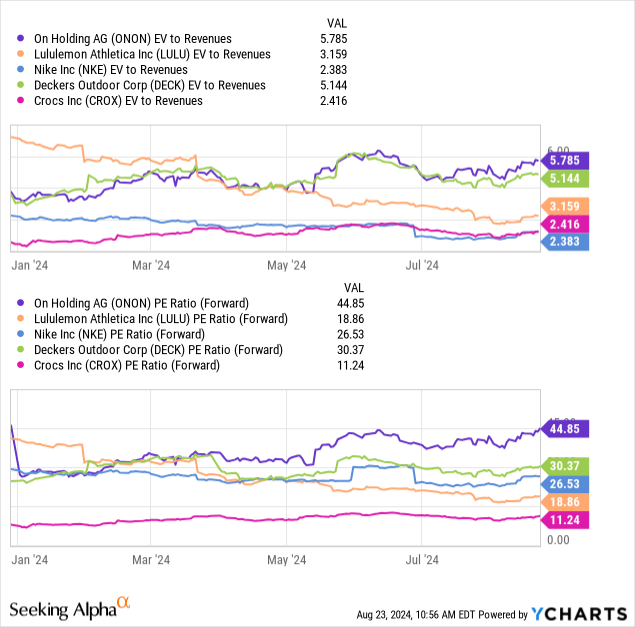

- Premium Valuation: As it stands, On stock is probably the most expensive stock in its peer group, both on an EV to Revenue and Forward PE basis. Sure, the premium valuation is justified given its higher growth rate and the fact that it is taking market share from the big players. However, this also means that there’s little margin for error for the stock.

- Competition: The sportswear industry is highly competitive with players such as Nike, Adidas, Lululemon, Under Armour (UA), Hoka (DECK), and many more — On’s growth ambition could be limited, and price competition could also lead to margin erosion.

Thesis

Despite the tough macro environment and fierce competition, people are buying On shoes at a record pace — a testament to its strong brand, innovative technology, and sleek design.

Additionally, the company is set to take even more market share over the next few years as On’s brand awareness continues to grow, especially in nascent markets like Asia. Furthermore, its innovation pipeline remains exciting, which should support growth for the foreseeable future.

While the stock is up substantially over the last year, at only $14B in Market Cap, On stock still has plenty of upside left as it continues to revolutionize the running industry.

Read the full article here

Leave a Reply