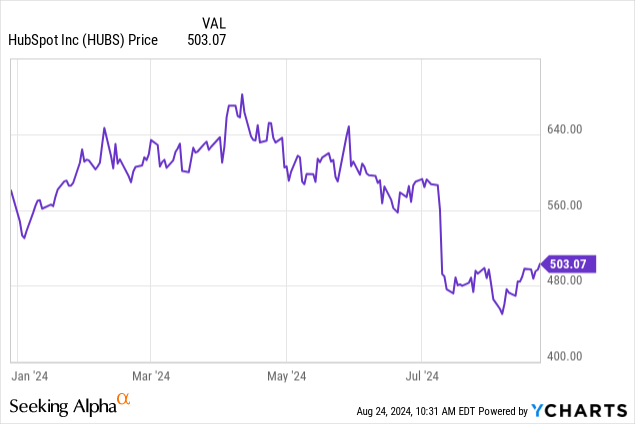

Despite the broad market recovery that has taken place over the past several weeks on hopes of sharp rate cuts this September, a number of tech stocks still remain well off YTD highs and are down for the year: including HubSpot (NYSE:HUBS), which cratered in early July on news that Alphabet (GOOG) had abandoned its takeover pursuit.

Shares of HubSpot have now dramatically underperformed the S&P 500 as well as peer tech stocks, now down nearly 10% year to date:

Wait on the sidelines until HubSpot reaches the low $400s, risks and opportunities are well-balanced here

I last wrote a neutral article on HubSpot in May, when the stock was still trading closer to $600. Now, HubSpot is ~20% lower, while the company has also posted better-than-expected (albeit decelerating) Q2 results and boosted its full-year outlook. I’m not shaken at all by the loss of the Alphabet acquisition (the fact that talks apparently reached mature stages sets the stage for a future acquisition, whether by Alphabet or another large software company that wants a high-quality CRM tool like HubSpot), but I am still mindful of the company’s slowing growth rates in the wake of a still-hefty valuation. With this in mind, I’m reiterating my neutral opinion on this stock.

At current share prices, I see a balanced bull and bear case for HubSpot. On the positive side for this company:

- Despite playing in the crowded CRM space, HubSpot distinguishes itself by focusing on inbound marketing. Rather than emphasizing direct sales forces, HubSpot’s software concentrates on marketing to customers who have already engaged with the brand on their own. It applies these principles to its own sales operations, which has helped the company achieve high operating margins by not spending excessive amounts on field sales.

- Great growth and profitability balance. Though HubSpot has fallen just shy of the “Rule of 40” mark, the company continues to impress with its ability to grow at a ~20% pace despite its large scale, while also boosting its pro forma operating margins to the mid-teens.

At the same time, however, we have to be careful of the following risks:

- CRM is one of the most competitive arenas in software. HubSpot operates in arguably the most competitive vertical in enterprise software, competing against deeper-pocketed incumbents like Salesforce (CRM). Though HubSpot has certainly made a niche for itself in focusing on inbound marketing, the current macro landscape has many enterprises shrinking down their vendor counts and trying to consolidate their tech infrastructures as much as possible – which may favor larger “portfolio software” vendors like Salesforce and Oracle.

- Over-concentration to SMB customers, on top of a tough macro environment for sales and marketing. HubSpot’s core customer base is the exact headcount that most of corporate America is trying to reduce. Layoffs in sales and marketing departments have continued well into 2024, which will pressure HubSpot’s seat expansion as well as ability to land new clients in an age of downsizing. Additionally, the company’s appeal for SMB customers puts it at greater risk of churn.

Valuation remains one of the core concerns for me as well. At current share prices near $505, HubSpot trades at a market cap of $25.83 billion. After we net off the $1.94 billion of cash and $457.2 million of convertible debt off HubSpot’s latest balance sheet, the company’s resulting enterprise value is $24.35 billion.

Meanwhile, for next fiscal year FY25, Wall Street analysts are expecting HubSpot to generate $2.99 billion in revenue, or 16% y/y growth (decelerating from the current quarter’s 20% y/y growth pace). This puts HubSpot’s valuation at 8.1x EV/FY25 revenue, while many other mid-large cap software companies currently growing at a mid/high-teens pace (think Workday (WDAY), Salesforce) are currently trading at a ~5-7x range.

To me, I’m willing to buy HubSpot with confidence if it reached a 6.5x EV/FY25 revenue multiple, or a price target of $410 and ~18% downside from current levels. Until then, remain on the sidelines.

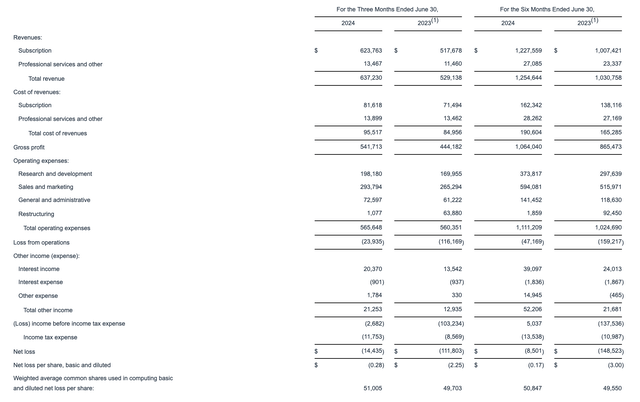

Q2 download

Let’s now go through HubSpot’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

HubSpot Q2 results (HubSpot Q2 earnings release)

HubSpot’s revenue grew 20% y/y to $637.2 million, decelerating three points from Q1’s 23% y/y growth pace but beating Wall Street’s expectations of $619.3 million (+17% y/y) by a three-point pace as well. HubSpot has historically had a tendency to guide low and give the markets a series of beat-and-raise quarters, and it’s likely that the company will be able to achieve better than a 16% growth rate in FY25.

As a reminder, earlier this year, the company decided to lower its pricing for smaller customers in order to remove the barriers to entry for new adopters. The company notes that it has continued to be successful at driving in new customers while also encouraging them to expand their subscriptions over time. At the same time, upmarket enterprise customers are also doing well, with high attach rates for multi-hub (multi-product) deals. Per CEO Brian Halligan’s remarks on the Q2 earnings call:

In up markets, our Q2 results were driven by multi-hub and large deal momentum. We saw more customers start with or expand into multiple hubs, resulting in larger deals. Over 45% of new business in our polls tiers came from customers using three or more hubs. Within customers adopting multiple hubs, we saw three popular combinations. Marketing and sales hubs our main front doors, marketing sales and Service Hubs, innovation in Service Hub is driving momentum and marketing sales from Content Hub after content Hub launch in April. The higher mix of multi-hub deals and the momentum we have with upmarket customers led to larger wins in Q2 […]

We continue to see solid expansion trends with a multipoint increase in net revenue retention rate at month three for customers on the new pricing model as they buy exactly what they and expand when they need more. Overall, we continue to have high conviction that the pricing change is the right decision for our customers and therefore, for HubSpot.”

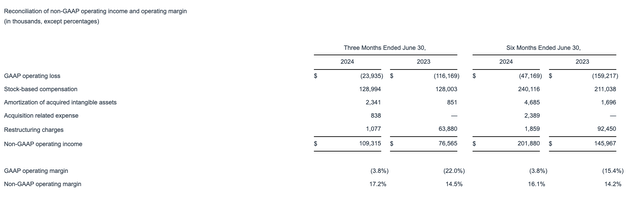

And on the profitability front, we note as well that HubSpot’s pro forma operating margins increased 270bps y/y to 17.2%:

HubSpot operating margins (HubSpot Q2 earnings release)

The company’s pro forma EPS of $1.94 beat Wall Street’s expectations of $1.64 with an 18% upside.

Key takeaways

In my view, HubSpot’s correction after the Alphabet deal fell apart has pushed the stock closer to buying territory, but I’m still waiting for a more advantageous entry point in the low $400s. Put this stock on your watch list, but don’t dive in just yet.

Read the full article here

Leave a Reply