Palo Alto Networks (NASDAQ:PANW) is realizing the strength of platformization adoption as more companies transition from a single-point solution to total platform adoption. Given the increasing trend the firm is realizing, I believe this can drive significant growth while bolstering margins in the coming quarters as Palo Alto continues to execute on new customer adoption. Despite the challenging macroeconomic environment, I believe there will be a driving force behind continued cybersecurity adoption, especially with Palo Alto’s release of their Prisma Access Browser, which has the potential to reduce customer TCO by 80%. I reiterate my BUY rating for PANW shares with a price target of $433/share at 14.56x eFY26 price/sales.

FinChat

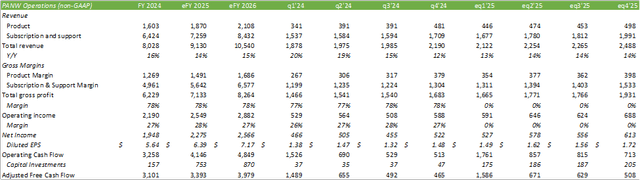

Palo Alto Networks Operations

Palo Alto is realizing the strength of platformization as more customers turn from single-point solutions to platformization. Management cited one of their largest, high 8-figure deals with Schlumberger (SLB), who signed on with all three platform offerings. Schlumberger was previously an existing firewall and XSOAR customer, broadened their cybersecurity investment with Palo Alto Networks to expand their firewall footprint and add Prisma Access and Prisma Cloud.

It is becoming more prevalent that customers are turning from single-point solutions to buying into the total platform, or multi-platforms, that Palo Alto has to offer. Palo Alto added 90 new platform customers in q4’24 alone and now has over 1,000 of their largest 5,000 customers under the platform model. Palo Alto’s overall goal is to convert single-point customers to a single platform and drive expansion into becoming multiplatform customers. The business case makes sense. As management had laid out in their prepared remarks for q4’24, breach remediation with Palo Alto’s platform has reduced exposure from days to minutes and hours.

One of Palo Alto’s landing tools is their SASE, which grew 40% in FY24. Over a third of SASE customers were new to Palo Alto and can potentially transition to investing in the broader platform. I believe one of the biggest drivers for adoption of Palo Alto’s SASE offering is that enterprises continue running the hybrid work environment, which may pose as a security challenge as more devices gain access behind the firewall. Palo Alto changed the game in q4’24 with the launch of their Prisma Access Browser, which essentially cuts out the middleman of using a 3rd party browser and URL filter by combining all the features into one package. Palo Alto boasts that their browser increased applications’ performance by 5x and offered customers 80% less TCO (total cost of ownership) with bring your own device. This can potentially improve the customer experience significantly in the instance of leveraging temporary staff or contract labor.

The firm is also beefing up their subscription offerings with their “advanced” features. This includes Advanced URL Filtering, Advanced WildFire, and Advanced DNS Security. Advanced URL Filtering was released in q4’24 and is expected to begin ramping in eFY25. In total, Prisma Cloud has 14 modules for customers to choose from to bolster their security posture. With their recent acquisition of Dig Security, Palo Alto released their data security posture management module, which helps integrate data security within Prisma Cloud. Palo Alto also released AI security posture management as their 14th module. Given the popularity of GenAI applications in the workplace, Palo Alto created an approval list for the 136 available GenAI apps, with 54 allowed and 82 blocked. Ideally, this will help prevent data loss and defend against malicious responses to ensure a safe and effective adoption of GenAI in the workplace.

One factor that brings a certain appeal is Palo Alto’s acquisition of QRadar from IBM and the associated partnership. QRadar is expected to bring $10s of millions in revenue in eFY25 as customers transition from the legacy SIEM to XSIAM. I believe this deal has the capability of converting a good proportion of these customers from single-point solutions to investing in a total platform solution offered by Palo Alto, especially post-XSIAM conversion. IBM (IBM) will also be working with Palo Alto in cross-selling Palo Alto’s platform offerings as a preferred security solution. Despite Palo Alto not necessarily receiving a technological advantage as a result of the acquisition, Palo Alto will gain access to a new customer base with the inclusion of additional deals driven by IBM. So, despite the deal only bringing south of $100mm in annual revenue, the potential for land-and-expand provides significantly more value.

Palo Alto Networks Financials

Corporate Reports

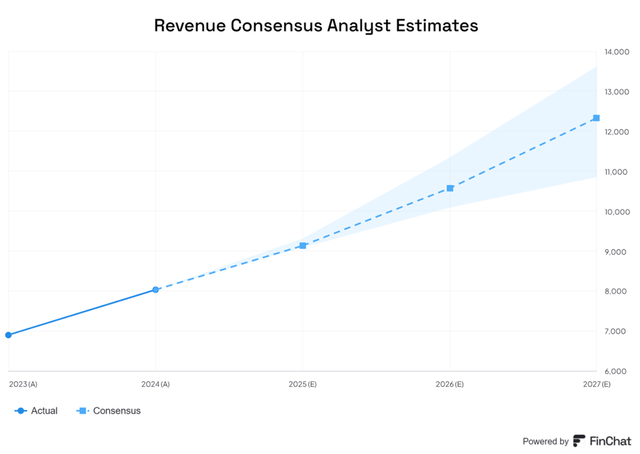

Looking ahead to eFY25, I believe Palo Alto will realize 14% top-line growth and scaled growth in eFY26 as a result of their partnership with IBM and growing platform adoption. I believe top-line growth will be driven by both these endogenous factors plus additional exogenous factors such as increasing nation-state threats as global stability remains in flux. I anticipate this scaled growth will be reflected across operating margins as more subscription-based services are adopted as a result of platformization. Management is also implementing AI features internally to improve operational efficiency that may result in a leaner and more effective organization. One example management provided was in their AI employee experience that automates IT-related tickets. This feature is expected to relieve their service desk operations by 80%.

For eq1’25, I’m forecasting $2.12b in revenue and $1.49/share in adjusted diluted EPS. For eFY25, I’m forecasting $9.13b in revenue and $6.39/share in adjusted diluted EPS.

Risks Related To Palo Alto Networks

Bull Case

Palo Alto Networks is realizing strength by scale as customers transition from single-point solutions to total platformization. Advanced features such as their web browser offers customers a strong cost-savings business opportunity as employees will no longer require a company-issued laptop or PC in certain cases as the feature protects the company at the endpoint. CrowdStrike’s (CRWD) recent Windows incident may draw further interest in Palo Alto’s offerings as the firm allows customers greater control over system updates. Further AI adoption at the workplace may drive growth for Palo Alto’s related subscription offerings.

Bear Case

More cybersecurity companies are following suit with the platformization model and may deter customers from switching over. This in part may be driven by the current macroeconomy environment and may push enterprises to consider remaining on their current platform. The recent jobs revision may also create some insights to the macro environment and may suggest headcount may not be as strong as anticipated, leading to fewer endpoints that need protection at the enterprise level. CrowdStrike reported strong growth in their q2’25 earnings results, suggesting that the impact wasn’t as bad as initially anticipated.

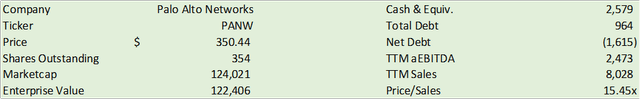

Valuation & Shareholder Value

Corporate Reports

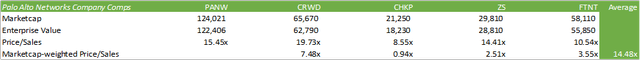

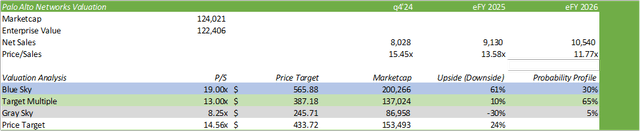

PANW shares currently trade at 15.45x trailing price/sales, a premium to its cybersecurity peers and a discount to platform competitor CRWD.

Seeking Alpha

Given Palo Alto’s growth initiatives, I believe PANW shares may realize some convergence towards CRWD as a result of greater platform adoption. Given this factor, I’m increasing the top trading multiple in my valuation table to 19x as a high target for PANW shares to trade at. Using an average probability of the array of historical trading multiples plus the price convergence factor, I rate PANW shares with a BUY rating with a price target of $433/share at 14.56x eFY26 price/sales.

Corporate Reports

Read the full article here

Leave a Reply