Overview

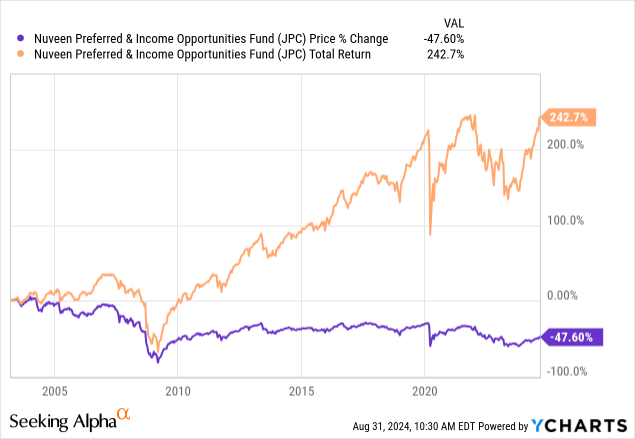

Nuveen Preferred & Income Opportunities Fund (NYSE:JPC) offers investors the opportunity to obtain a total return comprised of high current income through a diverse portfolio of preferred and other income producing securities. JPC operates as a closed end fund and the notable feature is that at least 50% of invested securities are rated investment grade, which is not that common in the world of high-yielding credit investments. JPC has a public inception dating back to decades to 2003, which means we have two decades of performance to reference. JPC also sports a management fee of 1.24% but total fees amount to 4.26% after including the interest expense from leverage. However, we can see that the price has decreased by 47.6% throughout the fund’s lifetime. Thankfully, the high distributions offset this and have provided total returns exceeding 242%.

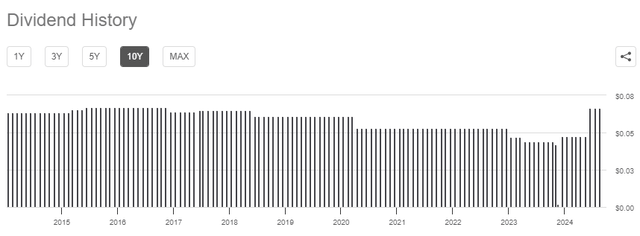

The total returns can be attributed to the consistent high distribution rate offered by JPC. At the moment, the dividend yield sits around 10.15% and is distributed out to shareholders on a monthly basis. While the dividend history is a bit choppy, the monthly distribution can be highly appealing for the investors that prioritize income. The first group of investors that come to mind would be retired investors that don’t necessarily care for price appreciation, but still want consistent income. However, I remain a bit skeptical on the sustainability of the distribution when taking the prior performance and inconsistent payouts into consideration.

Additionally, we have plenty of sources of uncertainty throughout the remainder of 2024 that can negatively impact performance. The US Presidential elections accompanied by future interest rate cuts may cause shifts in the market that can negatively impact JPC. Since JPC operates as a close end fund, the price can trade at either a discount or premium to its net asset value. JPC’s price has moved up over 16% YTD but still trades in that discount territory, so I also aim to share some thoughts around valuation and outlook that make me a bit cautious here. I first wanted to discuss the different portfolio strategies involved here that makes JPC such a unique fund. I will admit that I find JPC as flawed in structure, which ultimately keeps me from considering a position. However, if you are a current shareholder, I wouldn’t necessarily run for hills yet.

Flawed Fund Strategy

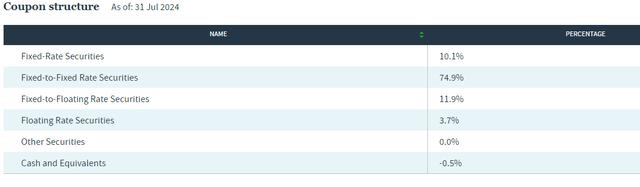

JPC is quite complex as the fund invests in a variety of income focused securities such as preferred stocks, convertible securities, corporate bonds, and other hybrid securities for example. For these securities, JPC follows a few different coupon structure, but ultimately has a majority exposure to fixed-to-fixed rate securities. This simply means that these debt investments initially pay a fixed rate for a certain period of time, but then switch to a new fixed rate for the remainder of its term. For example, a security can have a total term of 10 years and pay one fixed rate for 5 of those years. After the first 5 years are completed, the fixed rate changes to something new throughout the remaining lifespan.

Nuveen

JPC does have some exposure to floating rate securities, however, accounting for 3.7%. There is also an 11.9% exposure to fixed-to-floating rate securities. It’s unfortunate because if JPC had a larger exposure to floating rate securities, the fund may have been able to more efficiently grow NAV during the last two-year period when interest rates were hiked to their decade highs. The positive side to a fixed rate focus is that the income generated from the portfolio of investments is more predictable and stable.

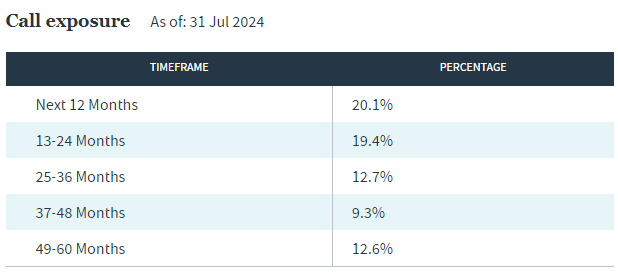

Speaking of predictable and stable, I do want to raise some concerns about the future stability of earnings. It seems that 20.1% of JPC’s securities can be called by the issuer within the next twelve months. Just to add some context here, these callable securities can be ‘redeemed’ by the issuer as a way to refinance the debt at lower cost. As interest rates are expected to drop soon, this may impact earnings and total income generated from JPC is 20.1% of their portfolio is vulnerable to being redeemed and refinanced.

Nuveen

Based on the most recent fact sheet, JPC’s top five equity holdings are focused on banks. JPC contains a total of 320 individual holdings within. Diversified bank exposure accounts for 44.8% of the portfolio. This is followed by allocation to Capital Markets and Insurance, both accounting for 13.6% and 13.3% respectively. This focus on the financial sector could present some concentration vulnerability, as JPC lacks a wide range of diverse exposure to other sectors that can offset negative impacts. The top five positions are as follows:

- JPMorgan Chase (JPM) – 1.5% of portfolio

- Wells Fargo (WFC) – 1.3% of portfolio

- Societe Generale (OTCPK:SCGLF) – 1.3% of portfolio

- UBS Group (UBS) – 1.3% of portfolio

- Barclays (BCS) – 1.3% of portfolio

Lastly, it appears that JPC uses leverage with the intent to boost returns when the opportunity arises. I dislike that the current leverage rate sits at 38.06% with an average cost of 6.21%. I think that this is alarmingly high when you consider the distribution rate is a bit over 10%. I am curious on whether or not JPC would be able to effectively cover the distribution without the use of leverage. Additionally, it doesn’t quite seem like the use of leverage has helped the fund obtain any meaningful NAV growth over the last decade.

Valuation & Vulnerabilities

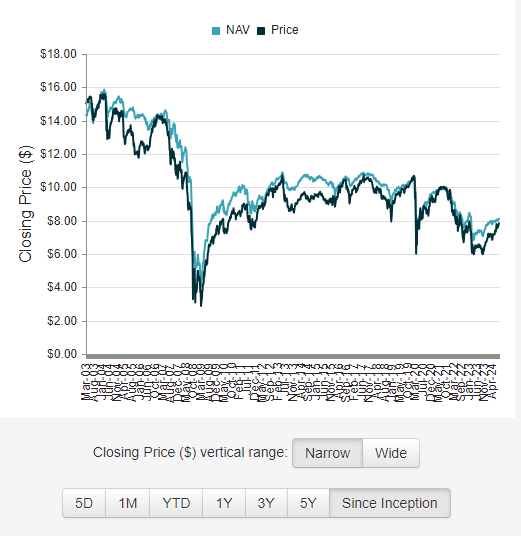

When it comes to determining the valuation on these types of funds, one of the first things I look for is whether or not the NAV has a history of growth. Looking over its two decade long history, the NAV has basically trended downward throughout the fund’s lifetime. We can be a bit generous and excuse the period around 2008 caused by the Great Financial Crisis but even excusing that, the NAV has failed to grow over the following decade. We can also see that the pandemic drop of 2020 set course to another downward trend that JPC has not yet recovered from.

CEF Connect

Over the last decade, JPC has almost always traded at a price that sat at a discount to NAV. The price currently trades at a discount to NAV of 3.32%. However, the recent price up has made entry here a bit less attractive when you consider that the price has traded at an average discount to NAV closer to 7.62% over the last three years. Perhaps the anticipation of interest rate cuts has helped boost the price upward, but I fail to locate any reasons that have justified the price gains.

CEF Data

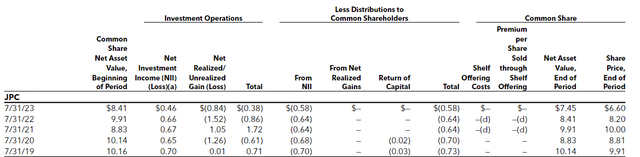

This prompted me to take a look at the most recent 2023 annual report to dig into the earnings details. We can see that the NAV at the end of 2019 amounted to $10.14 per share but has since decreased down to $7.45 per share. If you look at the history of the total investment operation gains, JPC has only fully covered the distribution in 2021. This was achieved from a combination of net investment income and net realized gains from the underlying securities. In 2023, JPC pulled in net investment income totaling $0.46 per share, but this was offset by larger realized losses of $0.84 per share.

JPC Annual Report

It seems like the use of leverage has contributed no meaningful gains to the portfolio as net investment income actually shrank over the last five-year period. The distribution was increased by a massive 40% back in June, but I do not think that it is sustainable. Perhaps the fund management is confident that they’ll be able to generate enough income to support the new distribution rate, but the prior performance indicates otherwise. I did spot the following statement on one of the announcements regarding the distribution raise.

These distribution increases are intended to provide higher monthly or quarterly cash flows to shareholders, enhance shareholder returns, as well as help support secondary market trading in each of the fund’s shares. For funds trading at a discount to NAV, the distribution increases are aimed at increasing demand for each fund’s common shares, which may, over time, help narrow the discount between the fund’s market price and its underlying net asset value. – Nuveen

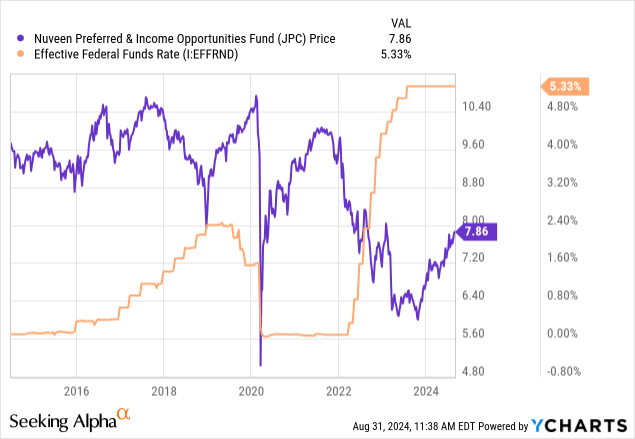

Despite the majority of JPC’s consisting of fixed rate securities, it seems like the fund has been vulnerable to period of higher interest rates. When interest rates were aggressively hiked throughout 2022 and 2023, the price of JPC rapidly retracted to the downside for about two years straight. Typically, higher interest rates results in an increased cost of debt on the balance sheet for borrowers which can then lead to a higher rate of defaults. Perhaps the floating rate portions of their portfolio remain more sensitive to these changes and should be taken into consideration when looking forward.

The Fed has stated that the time for interest rate cuts has come, and the markets are anticipating interest rate cuts in September. While we do not know how aggressive or light these cuts will be, there’s still the chance that interest rates remain higher than what we’ve become accustomed to over the last decade. A prolonged period of elevated rates could continue to negatively impact the growth of JPC.

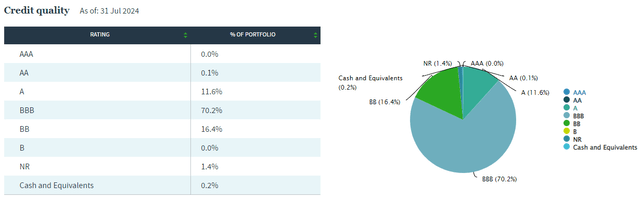

One of the appeals of JPC is that it maintains a high percentage of investments that are rated investment grade. Just for reference, anything with a credit rating below BBB is considered below investment grade. Therefore, approximately 81.9% of their portfolio contains investments that are investment grade and should theoretically offer a higher degree of security and a higher probability of growth. However, this has not been the case as seen from the continuous NAV reduction. It could be that about 43.7% of JPC’s investments are non-US based.

Nuveen

Dividend

As of the most recently declared monthly dividend of $0.0665 per share, the current dividend yield sits slightly over 10%. However, I am cautious on how long this distribution rate will be supported before it is once again reduced. Looking over the last decade, we can see that the distribution was more frequently decreased than raised. It may be too soon to tell how the future raise will be supported, but I would not count on it remaining at this level for an extended period of time.

Seeking Alpha

Despite the lack of growth, long-term shareholders would have been able to essentially create their own growth by reinvesting their distributions and investing additional capital over time. However, I think that this sort of defeats the purpose of having an income focused fund if it requires additional reinvestments to grow your income amounts year after year. I would imagine that most of the investors looking at a fund like JPC would like to actually utilize some of this income.

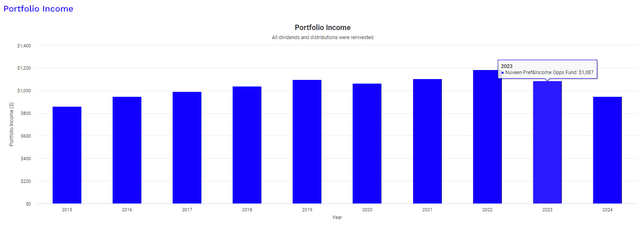

I ran a back test to help visualize how an investment would have grown income over time. With an original investment of $10,000, you would have been able to grow your income if you reinvested all dividends received back into JPC. In addition, the graph below also assumes that you did not contribute any additional capital to your initial position of $10,000 besides the reinvested dividends. In year 1 of your investment, your annual income would have totaled $861. Fast-forward to 2023 and your income would now sit at $1,087. Almost a decade of reinvesting dividends to only increase your income by about $200 seems like wasted time.

Portfolio Visualizer

It should also be noted that the distributions received from JPC are classified as ordinary dividends since they are made up of net investment income and realized gains. Therefore, JPC may be best utilized in a tax advantaged account to offset the tax burden. Ordinary dividends have less favorable tax treatment than the qualified dividends received from more traditional stocks and ETFs.

Takeaway

In conclusion, I remain a bit cautious on the outlook of JPC. The fund has consistently failed to cover the distributions over the last five-year period, and the recent dividend increase of 40% may be unsustainable. Additionally, the fund’s price to NAV discount has decreased considerably, which makes entry here a lot less attractive. The long-term deterioration of the underlying net asset value is a bit concerning and shows that the underlying portfolio of investments has not been effective at delivering growth. Therefore, I am rating JPC as a hold for now, as I want to wait for a new annual report to be released to determine whether or not the fund’s internal performance has improved.

Read the full article here

Leave a Reply