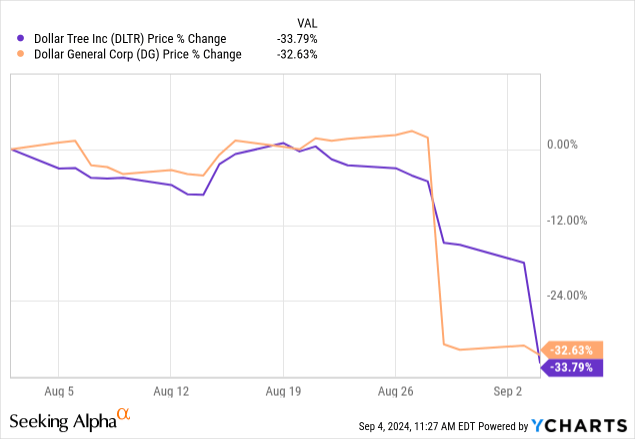

Investors in U.S. discount stores Dollar General (DG) and Dollar Tree (DLTR) have suffered a rough few weeks as each company reported Q2 earnings that missed on both the top and bottom line. Both firms also delivered disappointing guidance. Shares of Dollar General were first to crater last week, while its slightly smaller peer delivered the hammer on September 4.

Looking at options streams after Dollar Tree’s post-earnings fall, it appears that investors were on edge and had bid up implied volatility (at least on the put options). Nonetheless, DG’s poor showing apparently didn’t scare investors out of DLTR shares as much as they should have, as this latter stock has dropped some 20% on September 4. In hindsight, I’m sure many Dollar Tree shareholders were wishing they had taken a bigger cue from last week’s developments at Dollar General.

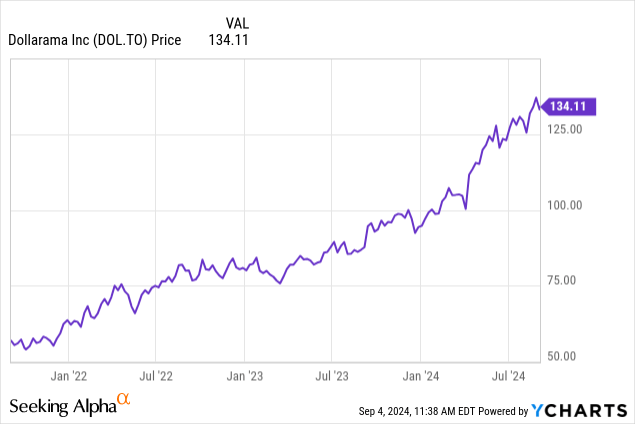

Meanwhile, north of the border, with segment leader Dollarama Inc. (TSX:DOL:CA) (OTCPK:DLMAF), there has been no meaningful share price reaction. Shares of the company are happily trucking along despite the fact that this third ‘dollar giant’ is set to report earnings next Wednesday, September 11.

Dollarama shares remain near all-time highs.

This article aims to explore the factors that are hurting Dollar General and Dollar Tree, and assess whether Dollarama is immune to those pressures in the Canadian market, or whether DOL.CA shareholders are asleep at the wheel after the long Labour Day weekend.

Dollar Store Industry

The origins of the two large Dollar Store chains in the United States both begin in the 1950s. Dollar General’s first store opened in 1955, while Dollar Tree outlets began operating in the late 1950s. While obviously a dollar went a much further 70 years ago than it does today, the original concepts still targeted what we would call a value shopper today. The stores would provide everyday low prices on a variety of household and variety items.

While a good skeptic would question how positive margins are even possible for stores only selling $1 items, the concept has proven quite profitable, not to mention popular. The companies buy from wholesalers in bulk, and then sell the items to customers in small package sizes. Sometimes items are repackaged smaller. While this may not be environmentally friendly, it’s certainly price-tag friendly, and allows the stores to earn profits. The model also encourages frequent visits, especially among lower income families, who buy what they can to hold them over for a week or just the next several days.

My understanding is that the original dollar stores operated with limited numbers of different products, which helped minimize administrative costs per item. Dollar General, at least, recently found new appeal in lower SKU counts, having reduced the number of unique items it is carrying at its stores.

Location is another key component of success for dollar stores. Many of the original locations in the second-half of the 20th century were in small towns or low-income neighborhoods, where the cost of owning and operating stores was lower. Placement away from major competitors also helps.

The dollar store model has brought a great magnitude of earnings and prosperity, at least until recently.

The history for Dollarama is a bit shorter, as the company operated only a modest number of stores until Bain Capital’s involvement began in 2004. However, the trajectory is much the same.

Growth Pains

Not to be confused with ‘growing pains’, what I assess is happening (and what I always expected at some point for this industry) are ‘growth pains’. I’m referring to the taking of a very successful concept and exploding it out into infinity, figuratively speaking. At least in my area, dollar stores (including Dollarama and copycats like Buck Or Two, Great Canadian Dollar Store, etc.), are a dime a dozen, pun intended (or dime a decemviri, technically). I’m also seeing larger and larger dollar stores with increased product assortments, located in more prosperous neighbourhoods and pristine retail locations.

I do believe the industry has overextended itself to the point where these large chains have distanced themselves from their original, and highly successful, concepts. Full disclaimer though that I’m a Canadian, and much more familiar with the Canadian retail marketplace that what’s taking place south of the border.

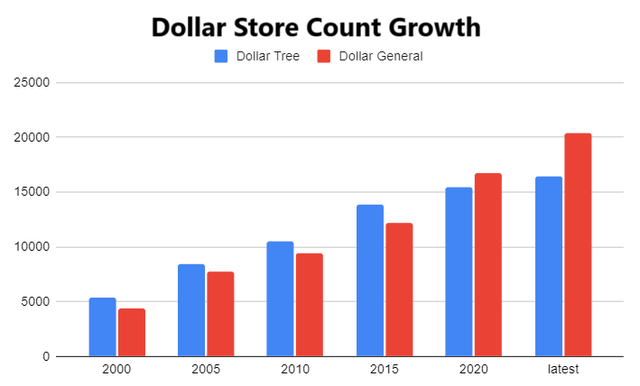

The below image charts the total store count for Dollar General and Dollar Tree (including Family Dollar brand stores).

author research of company filings

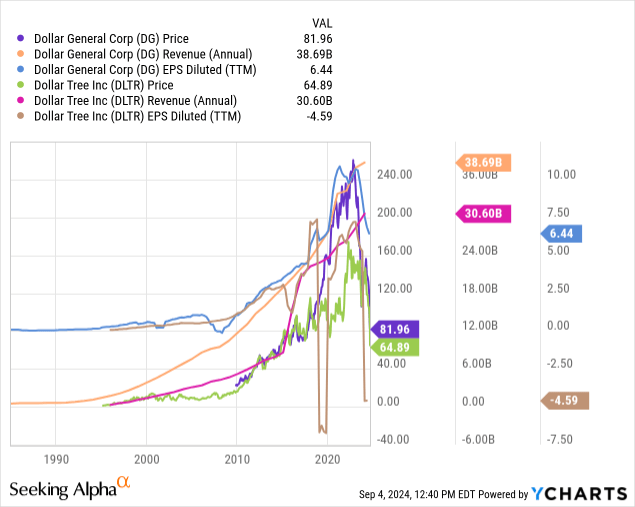

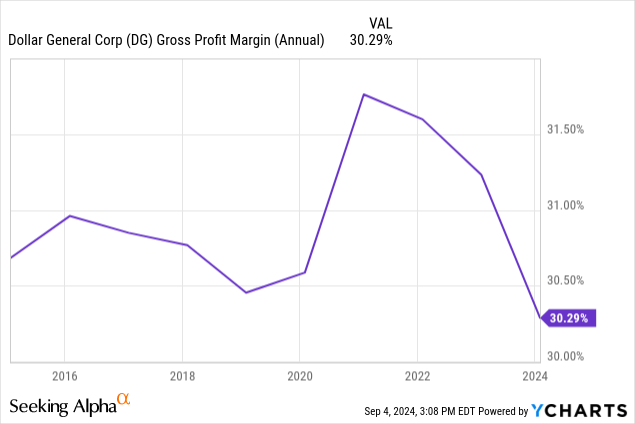

On August 29th, Dollar General announced that same-store-growth slowed to a dribble (+0.5%), with a decrease in average transaction value contributing negatively. Gross margin, which has been the definition of consistency, dropped more than 1% y/o/y and appears destined to land below 30% for the full year (for the first time in a decade+). 2024 GAAP EPS guidance was cut by nearly 20% to a range of $5.50-6.20 as compared to previous guidance of $6.80-7.55.

On September 4, it was Dollar Tree’s turn to disappoint. The company reported same-store sales growth of just +0.7%, continuing a trend of lower SSS (same-store sales growth for the past 4 quarters have been +3.9% +3.0%, +1.7%, +0.7%). Despite a tick up in gross margin, EPS came in at just $0.67 versus $0.91 a year ago, primarily on higher costs. Q3 revenue guidance was trimmed, but management dropped the Q3 EPS guidance to $1.05-1.15 versus consensus estimates of $1.32. Again, cost issues seemed to be the main culprit, along with same-store sales growth pressures. Revenues for the Family Dollar-branded stores have been particularly problematic, and the company is slowly lowering the footprint of this brand.

Dollarama In Focus

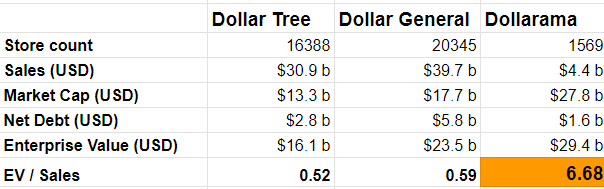

U.S.-based investors looking at Canada’s Dollarama for the first time would be forgiven for doing a double-take. The below table will raise some eyebrows until they’re atop your hairline.

author

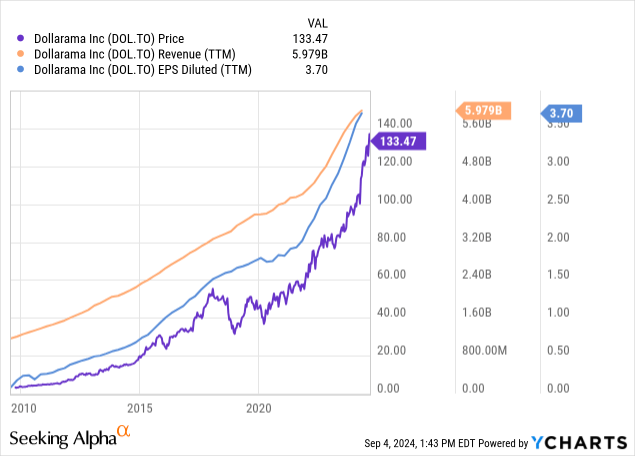

That’s right folks. Canada’s Dollarama is trading for 6.68x revenues on an enterprise value basis. The company’s market cap throttles its large U.S. peers, even with a store count of that’s less than one-tenth in size. So what’s going on here?

- True discount retailing, as American consumers know it, hasn’t really ever existed in Canada. Canadian shoppers readily endure higher prices, especially for imported goods, which is what makes shopping trips from Winnipeg to Grand Forks, ND so enticing, despite the poor exchange rate. The retail price point for much of Dollarama’s inventory is above CAD1, and product sizes vary.

- Consumables, which are low margin, represent about 80% of Dollar General sales, and also about 80% of Family Dollar-branded stores that Dollar Tree operates (equating to about 60% of overall Dollar Tree). Consumables reportedly represent less than 45% of Dollarama’s business (pg 38), which would align with my on-site observations. There are a lot of home accessory and seasonal items on Dollarama’s shelves that can command higher margins. And they do; Dollarama’s corporate gross margins are in the 47% range (versus ~30% for DG and DLTR).

- Dollarama is substantially more leveraged than its U.S. peers, carrying long-term debt of USD1.6 billion against a shareholder’s equity of just USD303 million. Debt/Revenues stands at ~0.37x for Dollarama versus 0.16x for Dollar General and just 0.11x for Dollar Tree. This lends itself to substantial earnings leverage, especially when things are going well.

- Dollarama also owns a majority stake (60.1%, recently up from 50.1%) in Dollarcity, a Panama-based joint venture that operates ~dollar stores in several Latin-American countries. Dollarama’s share of Dollarcity’s earnings in 2023 amounted to CAD75.3 million.

The fifth element is that Dollarama does trade at a much higher P/E than its American peers. Diluted EPS over the past 4 quarters has been CAD3.70, meaning that shares are trading at a P/E of 36x. Dollar General and Dollar Tree trade for ~12.6x and ~11x respectively. (**I used non-GAAP EPS for Dollar Tree’s quarter ending February 2024 to mitigate ~$2.6 billion in one-time charges).

Revenue growth is forecast by Wall Street Analysts to be about 10% for Dollarama versus about half that for DG and DLTR, which lands the company at a PEG of ~3.5x. This sounds awfully expensive.

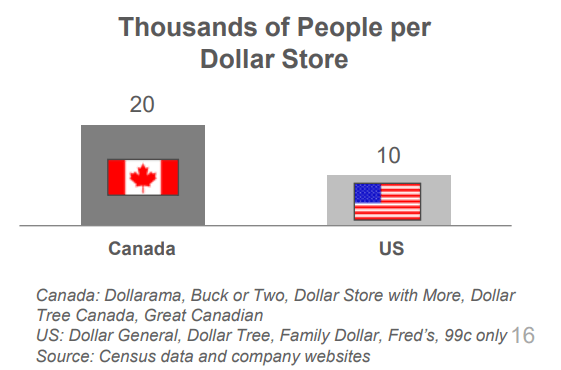

Some investors may be pinning their hopes on long-run growth potential in Canada, and indeed Dollarama has previously (2020) promoted that dollar store penetration is half what it is in the United States.

Dollarama (2020)

Unfortunately, the company’s recent investor presentations no longer display this comparison, but nonetheless I believe many investors see long-run growth space for dollar stores in Canada. Dollarama itself has targeted 2,000 locations (27.5% growth) for Canada by 2031.

Catalysts For Dollarama Downside

Dollarama stock is a rare retail play that has seen almost no drawdowns in its history, with the exception of a 40% decline during the late-2018 market swoon. For the rest of its existence, it has been a fairy-tale ride up into the chrome chandeliers. Investors have embraced steady growth, leveraged profits and a dividend that increases nearly every year despite its meager size.

This is a stock I cannot get behind at its current valuation. But beyond that, there are notable risks to the story that I believe point to potential downside, including:

- The existing leverage – leverage is a great tool to amplify profits, but once those business profits are already amplified, there’s nowhere left to go.

- Growth runway doubts – I’m skeptical about Dollarama’s ability to continue increasing locations in Canada for years to come. Dollar store penetration might still be lower in Canada than the U.S., but we must not forget that Dollarama stores truly aren’t equivalent to the type of discount retailing that is seen south of the border.

- Price risk from a weakening consumer – since a large proportion of Dollarama’s stock is priced well above $1, true value consumers may shy away from discretionary purchases, especially since more than 50% of the company’s sales come from non-consumables.

- Latin-America exposure through Dollarcity – if the world economy is indeed set for a slowdown as many fear, emerging countries usually bear the brunt of the pain.

- Possible inventory pain – Any Dollarcity pain could be doubled in times of trouble, given that Dollarama supplies the majority of product to Dollarcity. In a downturn, Dollarama could get stuck with excess inventory.

- Dollarcity shareholder put rights – Let’s triple that trouble since, as per below, Dollarcity stockholders hold put rights that could require Dollarama to purchase shares of Dollarcity that it does not already own.

Dollarama

Dollarama is a retail darling that has thrived with very few setbacks since its inception. However, given the risks listed above, this is a situation that could get ugly really fast, especially at a premium valuation of 36x TTM EPS, if the clouds roll in. Although it’s been proven foolish many times to equate the Canadian and U.S. retail markets, Dollar General and Dollar Tree have signaled that discount retail isn’t bulletproof, and the bullets are getting through the vest right now. We haven’t even mentioned the problems Big Lots (BIG) is recently facing. While they will never be equivalent, the Canadian and U.S. retail landscapes likely still have much more in common than they do in differences. Seeking Alpha’s News Team recently raised a warning that Walmart might be destroying the dollar store model, and every American investor should remember that Walmart is as big of a player in Canadian cities as those south of the border.

Valuation And Risks

In my view, the maximum valuation that I think Dollarama deserves would be something equivalent to Ollie’s (OLLI) which has a closer margin profile and product assortment. Ollie’s is trading at a TTM of 27x. Affording that to Dollarama’s trailing earnings brings me to a share price target of CAD99.90 (just the kind of price you’d find on a sticker) versus a recent trading price of $134. That represents 25% downside potential.

I’m currently Short shares of Dollarama, but I am looking for an entry into OTM put options for a potentially bigger payday. I’m exploring contract expiries as near as September 20, given that the company is set to report their Q2 results on September 11. Unfortunately, the options are not very liquid.

Variant View

I find the variant view difficult to subscribe faith in, but it remains possible that the struggles Dollar General and Dollar Tree are seeing don’t translate to Dollarama in Canada. The Canadian consumer could remain healthy for years to come, and customers here may distinguish Dollarama’s offerings from the type of competition that exists in the United States. It remains possible that Dollarama could tally the location growth it targets without any sort of economic setbacks. Interest rates may continue to decline and reduce the impact of Dollarama’s current debt leverage.

Options Risk

For any investors who choose to follow me into the put options on Dollarama, there remains the distinct possibility of a timing lag. Dollar General and Dollar Tree are seeing pressures today, but the retail environment in Canada may be similarly affected only several quarters from now, if at all. Out-of-the-money options have a high risk of expiring worthless, and are in many ways a gamble, even if it’s an educated one.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply