Introduction & Investment Thesis

I last covered Dynatrace (NYSE:DT) last month before its Q1 FY25 earnings, where I outlined some of the important metrics and commentary to look for in the earnings call to assess its investment thesis. I had also maintained my “hold” rating given my belief that there wasn’t sufficient upside to initiate a long-term position as the management had yet to revive its growth story.

Since then, the company reported its earnings, where revenue and non-GAAP income from operations grew 21% and 24% YoY, respectively, beating guidance. However, while the management pointed to the growing favorable environment for observability software, where it believes it is well positioned to capture market share given its robust product innovation, go-to-market strategy, and financial discipline, it did not raise its FY25 revenue and earnings outlook. Simultaneously, while its ARR per customer remained anchored at $400,000, the management did not reveal the number of $1M+ ACV deals as part of its large enterprise penetration roadmap.

I believe that the stock is fully valued at the moment, and as a result, I have reduced my position by more than half to book profits and de-risk as I wait on the sidelines to assess how the company progresses on its roadmap to capture Net New ARR while growing spend per buyer at the same time. Therefore, I will maintain my “hold” rating at the moment.

The good: Strong growth in Net New ARR, TAM Expansion from industry tailwinds, Superior Financial Discipline

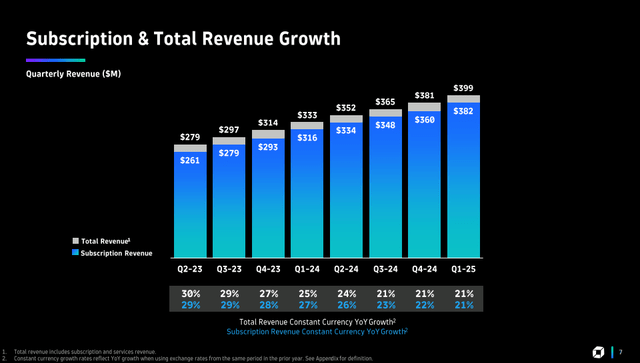

Dynatrace reported its Q1 FY25 earnings, where total revenue grew 21% in constant currency to $381M beating estimates, with Subscription Revenue accounting for 94.5% of revenue and growing at 22%. In Q1, Net New ARR grew 23% as it added 162 new logos, with ARR per new logo at $140,000, consistent with Q4. Meanwhile, overall ARR per customer remained anchored at $400,000.

Q1 FY25 Earnings Slides: Trend of Subscription Revenue growth

During the earnings call, Rick McConnell, CEO of Dynatrace, outlined that there is a growing urgency of observability software with the recent industry-wide outage that impacted billions of end users globally. With respect to the outage event, Dynatrace worked with a number of their customers, which included companies in healthcare, airline, and insurance, to leverage logs on Grail and Davis AI to enable their teams to better focus on their recovery efforts of their most critical systems.

The management also pointed out that the TAM of the observability and application security market is expected to grow steadily over the coming years, fueled by tailwinds of cloud migration and AI, with CIOs prioritizing IT budgets to build resilience against application performance problems, user experience issues, and cybersecurity threats. As businesses continue to consolidate their siloed point solutions into fully integrated end-to-end platforms, the management believes that it is well positioned to capture market share in the coming years with its product innovation roadmap driving increased productivity, cost efficiencies, improved security, and elevated user experiences. Recently, Gartner also positioned Dynatrace the furthest for Completeness of Vision and highest for Ability to Execute.

In terms of their go-to-market strategy, I had earlier discussed that they are focusing on strengthening their partner network and internal sales organization to win large enterprises, particularly those that have the highest potential ARR, while deepening adoption of its product suite with its existing user base. In Q1, Dynatrace completed territory and account coverage changes while increasing investment in customer success to drive successful deployment, adoption, and expansion.

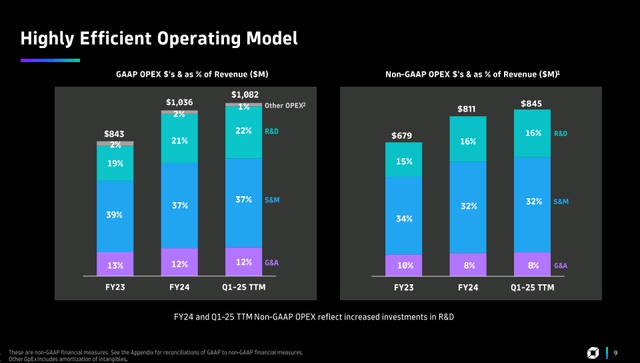

Shifting gears to profitability, the company generated $114M in non-GAAP income from operations, which grew 24% YoY to $114M, with a margin expansion of 100 basis points to 29%. While the management is operating with strong financial discipline, where operating expenses are growing at a slightly slower pace than overall revenue growth, what should help it unlock further operating leverage is expanding on sales productivity to land in larger deals as well as growing ARR per customer as it takes advantage of its product innovation and go-to-market strategies to gain market share in the coming years.

Q1 FY25 Earnings Slides: Evidence of strong operational discipline

The bad: No mention of $1M+ net new deals, Retention rate declines year-over-year, Management did not raise guidance.

However, unlike the previous quarter, the management did not reveal the number of million-dollar ACV deals, which likely indicates that they did not have sufficient success on the front. While the ARR per new logo still remained at par with Q4, I believe that in order for a significant pickup in investor sentiment, they would need to see the company growing their net new ARR per logo as well as ARR per customer as well.

Simultaneously, its net retention rate also declined year-over-year to 112%. While it moved up by 1 percentage point sequentially, which could indicate an initial sign of a turnaround, this is an important metric that will determine how successful the company is in deepening the adoption of its product suite. During the earnings call, Jim Benson, CFO, highlighted that it should see improving NRR rates as it drives a higher number of DPS (Dynatrace Platform Subscription) licensing deals where the premise is to provide customers less friction and more flexibility in the buying process, which should lead to more consumption of capabilities as it drives business value to customers.

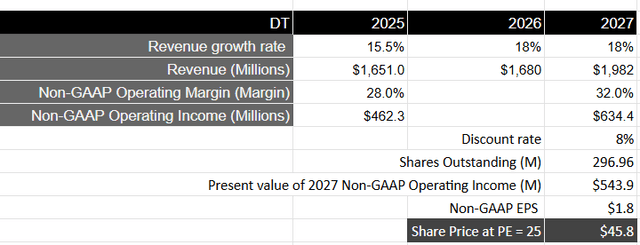

In the meantime, the management kept its revenue and earnings guidance unchanged, which is a little disappointing in my opinion. At the moment, it is expecting to grow its revenues in the 15% range to $1.65B with a non-GAAP operating margin of 28% to generate roughly $462M in non-GAAP operating income. During the earnings call, the management noted that they are taking a prudent approach to their guidance because their go-to-market strategy will take place to mature as well as the uncertain macroeconomic environment and the growing trend of vendor consolidation deals. Particularly on the seasonality of ARR, the company expects 40% of Net New ARR to land in the first half of FY25, with the remaining 60% to land in the second half with a full-year foreign exchange headwind of roughly $10M on revenue. On the other hand, its key competitor Datadog (NASDAQ:DDOG) is projected to grow at a faster rate in the low to mid-twenties region over the next two years with a larger total revenue compared to Dynatrace, which raises questions about its market share.

Revisiting my valuation: Risk-reward is not attractive

Since there has been no change in FY25 revenue and earnings guidance, along with my assumptions for its longer-term growth rate, I will keep the same assumptions for my valuation model as in my previous post, where I expect the company to accelerate its growth rate in the high teens over the next two years after FY25 generates $1.98B in revenue as it sees its go-to-market model mature to capture larger deals and enterprise penetration with targeted partners and an efficient sales team.

Similarly, from a profitability standpoint, Dynatrace should see its margins improve close to 32% by FY27 as it unlocks operating leverage from streamlining expenses and driving higher spend per buyer, resulting in a non-GAAP operating income of $634M, which will be equivalent to a present value of $543M when discounted at 8%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15-18, Dynatrace should trade at 1.5 times or a PE ratio of 25, given the growth rate of its earnings during this period of time. This will translate to a price target of roughly $46, which is 8% lower than where the stock is currently trading at.

Author’s Valuation Model

My final verdict and conclusions

I reduced my position by half last week as I wanted to book in profits amid an uncertain outlook for the stock. I continue to believe that there are strong fundamentals backing Dynatrace as it aligns its product innovation, go-to-market strategy, and operating foundation to capture TAM in an environment where the demand for observability software is likely to grow amid cloud migration and rising AI workloads. However, with declining NRR rates along with the lack of mention of any $1M+ new deals, I think the stock will likely remain range-bound until the management is able to demonstrate a growth-oriented outlook and guidance. Therefore, I decided to de-risk my position and book gains on more than half of my position while I wait for progress in the coming quarters to decide what to do with the remainder of my position. At the moment, I will maintain my “hold” rating until a more attractive entry-point presents itself or the growth outlook changes on the company.

Read the full article here

Leave a Reply