In January, I published a neutral outlook regarding the container shipping company Global Ship Lease (NYSE:GSL) in “Global Ship Lease: Red Sea Crisis Unlikely To Significantly Boost Profits.” At the time, there was significant speculation in the stock, as investors viewed it as a play on the Houthi Red Sea crisis that has continued to force Western fleets to deviate around Africa. Despite that, I did not expect significant changes to its stock price as most of its contracts were created prior to the crisis before rates rose. Further, although its TTM valuation metrics were low, GSL faced risks regarding its aging fleet and a potential global recession.

Since then, GSL has risen by ~8%, which is not much compared to its high usual volatility. That said, the stock had increased to $30 before reversing over the past two months, following the negative cyclical pattern seen in many stocks. In my view, we’re seeing more evident signs of a negative cyclical backdrop for global trade. On the other hand, the Red Sea trade crisis and the conflicts related to it have continued to escalate, indicating that geopolitics may create upward pressure on container shipping long enough that it aids GSL’s cash flow.

To me, a very significant geopolitical conflict may not support GSL, as that may exacerbate poor economic conditions; however, even with a mild economic slowdown, GSL may be a reasonable hedge against moderate geopolitical tensions in critical global trade areas. We must discount GSL according to its debt costs and depreciating assets due to its aging fleet.

Global Ship Lease Tracks Container Shipping

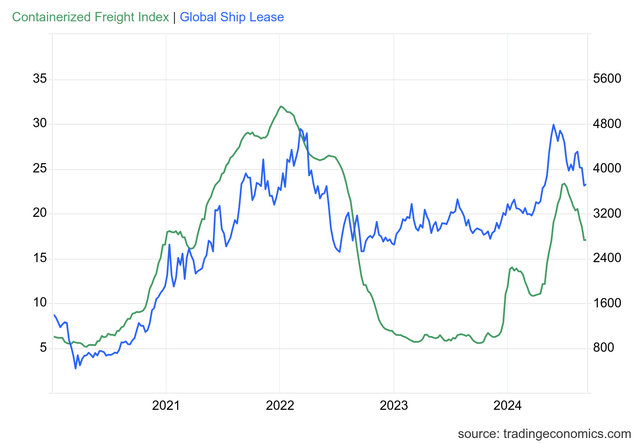

Global container shipping costs are not as high as they were during the height of worldwide supply chain issues created during pandemic lockdowns. However, they’re around as high as they’ve been since mid-2022 and around 3X above the typical pre-2020 level. GSL has closely tracked the rise and fall in container shipping rates. See below:

GSL Price vs. Containerized Freight Index (TradingEconomics.com)

The rise in containerized freight rates is primarily due to the Red Sea crisis. This has diverted most container vessels around the shorter Red Sea route around the Horn of Africa, creating a general shortage of container shipping vessels by increasing shipping times.

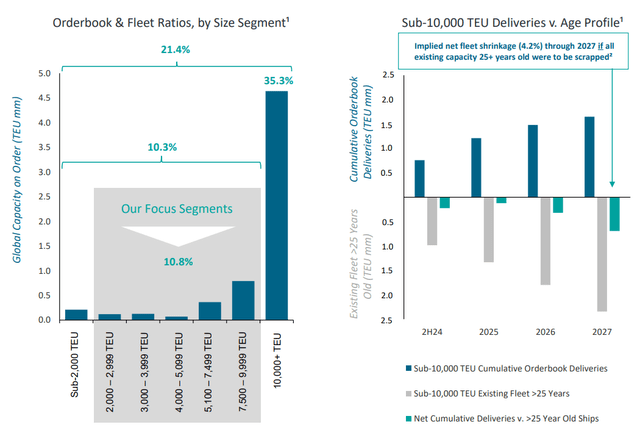

Container shipping vessels were already in mild shortage before this. The global container shipping fleet is around 14 years old today, at the high end of its usual age. The order book for new vessels was lower during the pandemic years, causing that figure to rise. However, as detailed in its last investor presentation, we’re seeing a rise in orders for large vessels, though not the mid-sized ones GSL focuses on. See below:

Global Containership Orderbook by Size (Global Ship Lease Investor Presentation Q2 2024)

By 2027, the fleet is expected to decline by 4.2% if all 25+ year-old ships are scrapped, which may not be the case. Most existing orders are for huge ships, not those in GSL’s operating focus. That may cause a more considerable shortage in the market for mid-sized vessels. However, today’s “Big Boat Era” seems to provide more supportive economics to large ships, as companies avoid investing in small ones. However, that has arguably exacerbated supply chain issues as these massive ships get stuck in ports.

Conversely, GSL’s fleet had a TEU-weighted average age of 17.2 years at the end of 2023. This is crucial because it implies the company is unlikely to benefit from the shortfall in orders. Its fleet is not expected to survive, on average, much over six to seven years (25-year life expectancy assumption), and, with many ships at the end of their lives, it may be more exposed to maintenance, environmental, and inefficiency risks – as noted in its annual report (pg. 11).

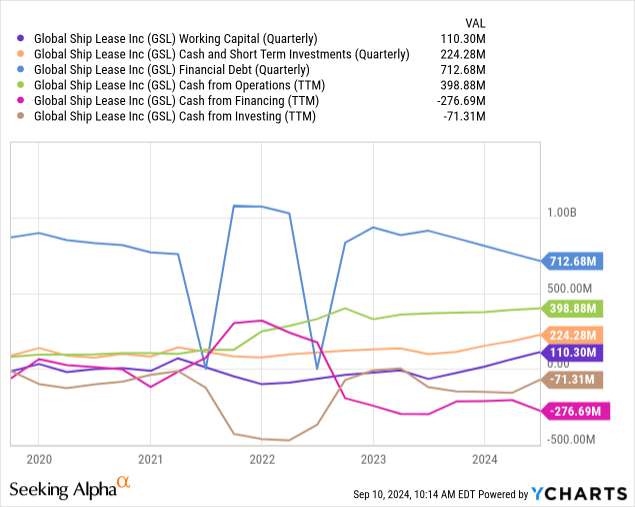

The company is not too focused on acquiring younger ships. As noted in its last investor call, that is not due to a lack of potential deals but “a symptom of discipline,” likely as it prioritizes cleaning its balance sheet before making allusions. Although that may prove a risky strategy, I think it is reasonable considering how much financial pressure the company was under before 2020. As its operating cash flow has risen, it has made some efforts to lower its financial debt and has recently seen a rise in liquidity that may be used for more acquisitions. See below:

The bulk of its negative cash from financing is going to debt reductions. Its total dividends paid TTM are $62.5M, which is low compared to its income and operating cash flow. As noted in its presentation, its cost of debt compared to the base rate has declined markedly as its solvency has improved. Its TTM interest costs have dropped from around $75M a year and a half ago to ~$30M over the past twelve months, indicating significant balance sheet improvements.

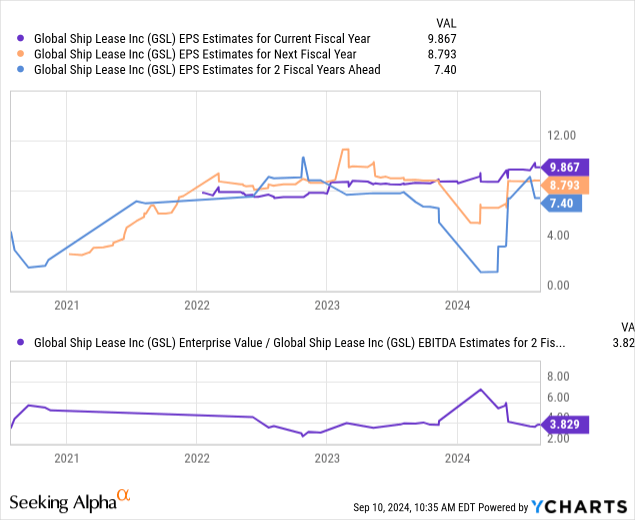

GSL’s Valuation Improves With EPS Outlook

The company’s EPS is $9.15 TTM, the highest in years. In 2023, its income for this year and 2025 was expected to decline significantly as container shipping rates were back at the abysmal lows seen before 2020. In early 2024, I expected intervention or peace talks would cause a quicker end to the Red Sea crisis; however, it now appears it could last for years. Thus, we’re seeing a sharp reversal in its future EPS forecast, implying it may retain profits near its current highs. Further, its “EV/EBITDA” using two-year ahead EBITDA estimates is now at 3.8X, slightly below the range it held in recent years. See below:

I think GSL’s valuation today is better than in January, primarily because the geopolitical issues causing higher container rates have only escalated since then rather than cooling. All major shipping companies generally avoid the area, as they have no reason to create unnecessary risk. My last GSL article notes that the key will be if rates remain high as it rolls 2026 and 2027 contracts forward. That seems more likely for now, though it is still not guaranteed. At any rate, its contracts are high enough that the company’s EPS is still expected to remain above $7 over the foreseeable future.

Economic Slowdown May Impair Stock Price

GSL has been down around 30% since June as concerns regarding the global economy have risen. The decline we’re seeing in stocks, and partially the drop in oil, likely signifies a decline in global consumer demand for goods. Containerships are more exposed to this risk because a small glut of vessels will often drive rates much lower, and demand for finished items can often decline faster in a recession.

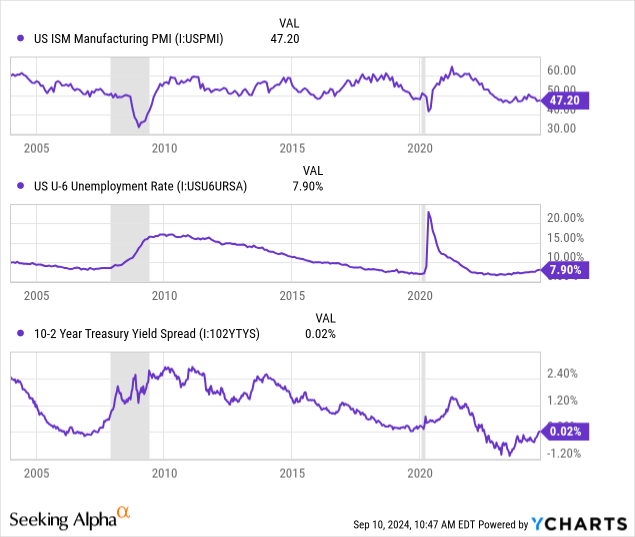

In my view, a recession is likely based on economic data. The manufacturing PMI has been in a contracting position since 2022. The yield curve is now positive after being extremely inverted, with curve re-steepening often coinciding with a recession. The unemployment rate is also increasing, particularly the critical U-6 unemployment rate. See below:

I believe the U-6 unemployment rate is very telling of the economy because it accounts for underemployment. That figure continued to rise in August, even though the overall unemployment rate dropped slightly (likely as hurricane impacts faded). Indeed, these data do not give us a 100% certainty of a recession in 2025, but in my view, they’ve never presented as bearish a signal as they are today.

The situation in Europe and other Western nations does not appear very different. Even China’s economy seems to be under considerable pressure. This is bearish for GSL because a slight decline in global consumer demand may push the container shipping market back into a glut, meaning it may not roll contracts forward at today’s abnormally high rates.

That leaves GSL investors in a tricky position, as it is uncertain if geopolitical tensions on container shipping will offset a slowdown. It depends on whether the geopolitical issues continue to grow. If they become too large, such as a war involving countries with large navies, GSL may be in a precarious spot.

Although I think a recession is likely, it is unclear if consumer demand will falter significantly, as that depends mainly on the government’s reaction to such. For example, the global government stimulus and deficit reaction to the 2020 recession (partly caused by government lockdowns) led to a sharp and persistent increase in consumer goods spending.

The Bottom Line

In the short run, a recession may lead to a sharp decline in GSL’s price, as we may see today. Rates would likely decline, hampering GSL’s future EPS outlook. That said, even if its EPS fell to $4 to $5 by 2027, its “P/E” ratio would be 4-5X today, so it is valued for a significant decline in income.

Further, a market decline could be opportune for GSL, allowing it to acquire younger ships at a more attractive price. Since its cleaner balance sheet, it may have more cash buying power in a slowdown than some of its peers. On top of that, an economic downturn would lower rates, further alleviating its interest costs.

Overall, I remain neutral on GSL because I think there may be more concern regarding the economy. That said, it may be an attractive long-term buy-and-hold opportunity even at its current price. I’ll be watching the market and waiting for GSL to decline to around $15 before I turn more bullish on it. Though I think it is fairly valued today and likely undervalued, I prefer a lower price, given it is unclear how cyclical pressures may impact its EPS over the coming years.

Read the full article here

Leave a Reply