Following our update on Deutsche Börse and taking advantage of the latest communication (2024 July and August volumes), today we are back to comment on Euronext (OTCPK:EUXTF) (OTCPK:ERNXY). During this time, the company confirmed its defensive nature. Here at the Lab, we positively report our supportive view of 1) the company’s non-volume revenue growth, 2) discount to peers, 3) a positive EU regulatory framework development, and 4) an ongoing deleverage story combined with a tasty and growing dividend per share.

Mare Evidence Lab’s past analysis

Q2 Earnings

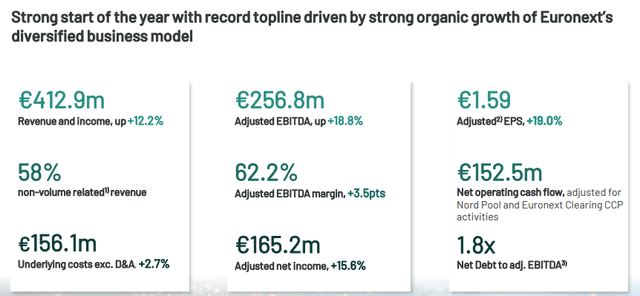

Very briefly, the company reported sales up 12.2% to €412.9 million (Fig 1) with an excellent performance in non-volume revenues, representing 58% of the company’s total sales. The adj. EBITDA reached €256.8 million and was up by +18.8% compared to last year. The EBITDA margin reached a record high of 62.2%. According to the P&L analysis, the net income came in at €165.2 million, with an adjusted EPS of €1.59 (+19.0%). The compiled consensus shows Euronext sales and EBITDA were 1.9% and 3.2% beat, respectively. This was driven by higher post-trade and better-than-expected trading activities in fixed income. Looking at the details, only two segment lines missed the expectation, i.e., derivative trading with a minus 1% performance and market solutions with a minus 7% result.

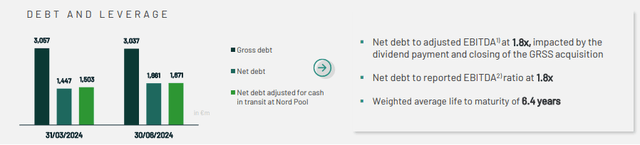

Euronext’s net debt-to-adjusted EBITDA ratio was 1.8x, up 0.2x from Q1. This quarter-on-quarter increase was due to the company’s annual dividend payment and the GRSS acquisition. In number, net debt increased by 11% to €1.67 billion.

Euronext Q2 Financials in a Snap

Source: Euronext Q2 results presentation – Fig 1

Why are we positive?

-

Although Q3 2024 usually faces seasonal headwinds, looking at the volumes, we expect continued momentum in investor services, technology solutions, and net treasury income. In addition, fixed-income trading was solid in both July and August;

- The company communicated the start of Nordic and Baltic power futures trading & clearing in late August. This was an acquisition date back in early 2020. Here at the Lab, this is a logical extension of Euronext’s product offering and shows the company’s in-house capabilities. The business is focused on power spot trading, with CAGR sales of 13% in the period. This segment represents only 3% of the company’s current total sales and lacks the derivatives franchise, where Deutsche Börse has a leading market share. Thanks to the Optiq platform, Euronext might start to compete in the futures market in 2025. Still related to the innovation, Euronext also launched a Wireless Network called EWIN. This solution is intended to increase the order transmission speed between London and Bergamo, where Euronext’s primary data center is located. By leveraging the higher transmission speeds with this new solution, Euronext might increase its market share penetration in its derivatives business;

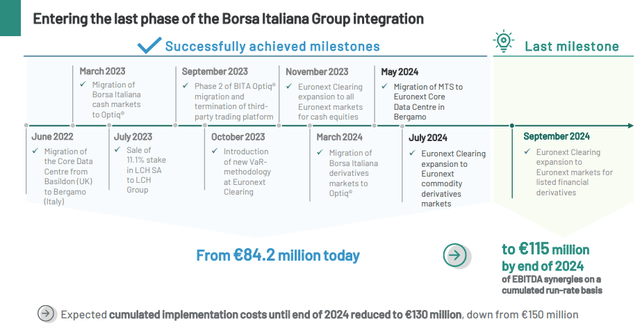

- The company delivered €5.2 million of annualized EBITDA synergies in the second quarter, bringing the total annualized synergy run rate to €84.2 million. The remainder of the cost-saving target will come in following the transfer of derivative clearing expected in Q3;

-

The CEO is expected to unveil innovation capabilities and organic/inorganic growth opportunities with a new upcoming CMD on November 8th. During the analyst call, the CEO recalled that Euronext is always open to new acquisitions, confirming that new M&A is a tool, not an end, and must fall within the financial discipline. The company aims to diversify activities or expand in Continental Europe. That said, reporting the latest British news, the next potential target could now be Nasdaq’s activities in Northern Europe, which include the Stockholm and Iceland stock exchanges and the Spanish stock exchanges controlled by the Swiss group Six. Having recently analyzed Deutsche Börse, the regulators stopped the Nasdaq Norther acquisition, and this might be seen as positive news for Euronext.

Adjusting Estimates and Valuation

Last time, after the Q1 results, we incorporated Global Rate Set Systems sales and EBITDA, increasing the company’s sales and adjusted EBITDA to €1.59 billion and €888.5 million, respectively. In our assumption, we also expected a higher net debt-to-adjusted EBITDA of 1.9x (Fig 2). This was a beat on our expectations. On a negative note, the company lowered its expected implementation costs for the Borsa Italiana synergies from €150 million to €130 million with no change to other KPIs guidance (Fig 3). Given the Q2 EBITDA beat with 80 basis points higher than our estimated numbers, we slightly increased our net income projection due to lower operating costs. In numbers, excluding potential M&A activities, we arrive at a 2024 net profit of €680 million with an EPS that moved to €6.5. We also see support from the ongoing deleverage path. With higher net earnings expectations and a P/E target of 19x, we increased our valuation from €91 to €123.5 per share. Looking at the peers, Deutsche Boerse AG and LSEG trade at a P/E of 20.01x and 19.73x, respectively. Euronext trades at 15.3x, while in the last five P/E averages, the company’s valuation was set at 19x. Therefore, this valuation is also very much aligned with peers.

Euronext lower net debt to EBITDA

Fig 2

Euronext lower synergies

Fig 3

Risks

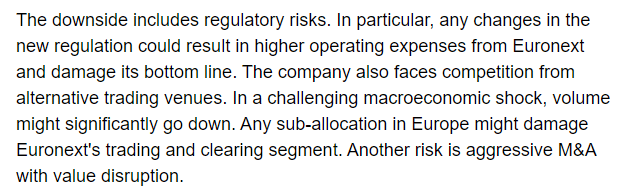

Our team believes Euronext’s previous risk section is already comprehensive (Fig 4). In addition, we might report wage inflation and competitive risks in vertical transactions such as derivatives. Any lower volume might impact the company’s bottom line. Euronext also faces macroeconomic risk. Indeed, if economic growth comes in below expectations, this could negatively impact the listing fees generated by the company.

Mare Evidence Lab’s past analysis

Fig 4

Conclusion

Here at the Lab, there is the CMD catalyst in early November. The company might provide new sales guidance until 2027. In addition, we expect a derivatives expansion plan combined with new positive takes on growing the non-volume-related division. We expect a positive response from the sell-side community and buy-side analysts. This was a remarkable start to the year, and our buy rating is confirmed.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply