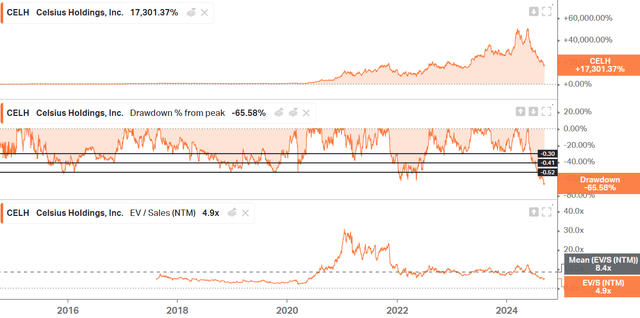

This is the third time I’m writing about Celsius Holdings, Inc. (NASDAQ:CELH), and it seems like now, when everyone hates it and the price drives the narrative, it’s worth reflecting again, more calmly, on all the bad and good things (and there are several) happening to the company.

The truth is that since my last article, things have gone quite poorly, but this only demonstrates the difficulty of market timing. Personally, I believe we will see Celsius stock reach new all-time highs again, and the returns that investors can achieve from current prices could exceed 20%. However, I already discussed my valuation and price targets in the previous article. This one will be more of an update on everything that has happened so far, especially highlighting the last two conferences.

Presents at Barclays 17th Annual Global Consumer Staples Conference, Sep-04-2024.

Piper Sandler Growth Frontiers Conference 2024, Sep-10-2024.

Koyfin

Things That Have Gone Wrong

Let’s start from the beginning. There are two main reasons why Celsius’ stock has fallen so much, although we could say that the high valuation it experienced five months ago could be the third, but that falls outside of the operational business.

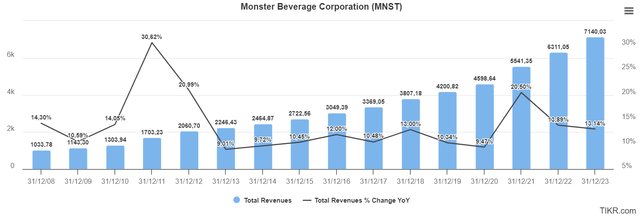

The first reason has been the negative sales growth that many companies in the sector are experiencing. This is something unprecedented in the history of the industry. In fact, in my first article, I mentioned that this was one of the few industries I prefer to value using EV/Sales because it’s the costs of raw materials, freight, transportation, etc., that are cyclical, not their sales. They say there’s always a first time, and now it’s the turn of the energy/functional beverage sector.

TIKR

And for the first time, really quite some time, that’s been affecting our category, the energy category. You’ve seen some of the top players even get into the negative growth for the first time in what seems like was a generation.” Toby David, EVP.

Still, there are reasons to be optimistic. For example:

we’ve been resilient. We’re 10% growth quarter-to-date year-over-year. This is 10x the category growth rate quarter-to-date. So we feel really strong about where we’re positioned today” Toby David, EVP.

This sector weakness is mainly due to the decline in the convenience store channel, which typically accounts for around 65% of the sector’s sales. Other companies, such as Alimentation Couche-Tard (ATD:CA) (OTCPK:ANCTF), have also highlighted this in their earnings presentations.

Unfortunately, right now, a lot of that space came within convenience, and convenience is challenged. You’re seeing a lot less foot traffic within convenience, I think 4% you’re seeing within 7-Eleven and many others.” Toby David, EVP.

But again, there are still positive news within the negatives:

we saw a 39% increase in shelf space within the convenience store channel, which is where a significant portion of energy drink sales come from, especially with Red Bull and Monster. We are having ongoing meetings with retailers for 2025, and these meetings are very positive because of the incremental value Celsius brings to the category, attracting a different consumer, not just brand switching. Additionally, the basket value that Celsius brings is really important for retailers as well. Therefore, we are driving more dollars per basket than most of our competitors.” Toby David, EVP.

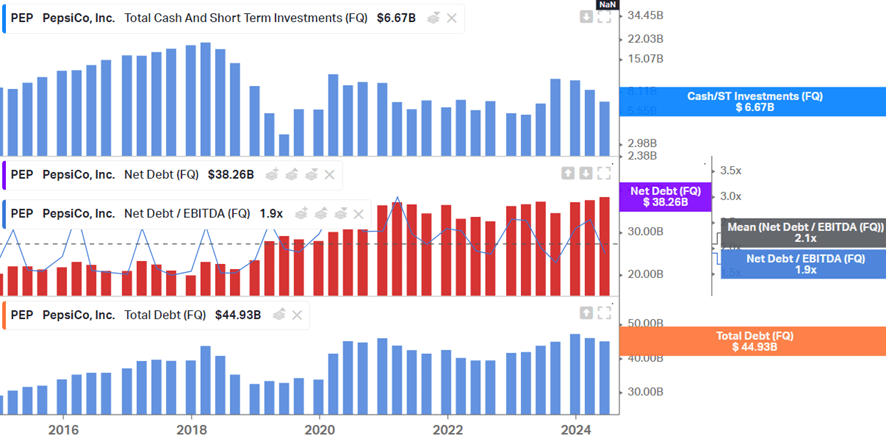

We’ve reached the tipping point: the issue with PepsiCo’s (PEP) inventory, its major customer, and its distribution partner. For a couple of quarters now, there has been a negative impact on Celsius’ sales due to Pepsi’s inventory management. For those who may not know, Celsius recognizes sales when it delivers products to Pepsi, but Pepsi, as the distributor, will recognize sales when it sells in the retail channel, food service, etc. (which we have seen is weak).

So, even though the retail channel might be performing well, it doesn’t necessarily mean Celsius is selling more. Instead, Pepsi is likely clearing out its inventories due to last year’s overpurchasing. The impact has been between $100 and $120 million in Q3 year-over-year, a much larger figure compared to the $20-30 million from previous quarters. Nevertheless, we see that Celsius continues to be the fastest-growing brand in the category, indicating that Pepsi is depleting its inventories and that this situation will be temporary. It reminds me a bit of what’s happening in the alcohol industry and the problems large players are facing with the de-stocking of their distributors.

In Celsius’ defense, this is something completely beyond the company’s control. If we want to think negatively, we might even consider whether Pepsi has done this intentionally to strengthen its position with Celsius. Some people say Pepsi might buy the entire company, but I don’t think so.

Let’s remember that Pepsi’s stake was acquired at $25 in 2022. Could this be a potential floor for Celsius’ stock price? Looking at several of its figures, a $CELH price of $25 would imply an EV of $5.1 billion, which would require paying quite a premium. In my opinion, Pepsi could potentially buy up to 20%, as their initial purchase of 8.5% could be doubled… Additionally, The Coca-Cola Company (KO) bought a 16% stake in Monster Beverage (MNST) at one point and now holds 20% due to buybacks.

Koyfin

Even so, this would be one of the two catalysts I’m most looking forward to. The second would be the launch of a range of drinks without (or with less) caffeine, which would significantly increase Celsius’ usage and total addressable market.

Positive Aspects

Having reviewed the negatives and considering that not everything is so bad, I’ll now focus on the remaining positive aspects.

They are number 2 (number 1 is Monster) in the sugar-free category with a 25% market share. The sugar-free segment now accounts for over 50% of the total category. Year-to-date, the sugar category is down 4%, while the sugar-free category is up 7%. And the announcement of new countries is coming soon.

They have also seen a 39% increase in convenience channels, and as mentioned before, the meetings for 2025 are going very positively.

Another key point is that the category isn’t losing consumers; it’s just changing the format in which they buy (for example, 12-24 packs that lower the unit price but increase volume, which is really what matters to me) and the frequency with which customers purchase.

So, securing that space is really critical for us. And when the category starts to rebound – which it will – I think it’s important to understand that the category isn’t losing consumers to other categories. If it were, that would be much more concerning. With all these space gains, we really feel we are well-positioned for 2025. As mentioned earlier, we are already having meetings with the largest retailers in the country for 2025 to see how much more space we expect to gain, and the meetings so far have been very positive.” Toby David, EVP.

And what we’re doing is really the big — next big opportunity for us is NACS in October, national convenience store show. And if you’re looking at the data and looking at the convenience, we are driving that growth in the category. So it puts us in a growth driver position. So we’re going to have a great story coming into these retailer meetings that are going to be coming up over the next several months.” John Fieldly, CEO.

They are going to change how they calculate and display market share because previously it did not include sites where they perform better than the competition, such as Amazon or Costco. “So we feel that MULOC+ really gives us better visibility on the overall health of the brand. Currently, we are around 11.8% market share. We are doing extremely well on Amazon, ranking between 1 and 2 in the energy category.” John Fieldly, CEO. This isn’t necessarily a positive thing, but it is a better reflection of reality.

They continue to emphasize one of the most important points of the thesis, which is how Celsius expands the TAM of the category, reaching market niches where traditional energy drinks have never succeeded.

Over 12% of our revenue through Pepsi comes from the food service sector, including hospitals, universities, Lowe’s, restaurants, and casual fast food. What’s interesting about Celsius and Pepsi – who are also surprised and excited about the opportunity – is that many of you here are having lunch while also drinking a Celsius, which is unique. It’s expanding the use occasion for the energy category.” John Fieldly, CEO.

Not to mention that in over 10 markets, including Boston, New York, and Florida, they have more than a 15% market share. Let’s remember that on Amazon, where it competes on an equal footing with competitors (no shelves or refrigerators…), it has more than a 20% market share.

They will also be one of the main sponsors of the fight between Jake Paul and Mike Tyson, which is already set to be highly impactful. On top of that, it will be the first live event broadcast live by Netflix (NFLX). There will be many eyes on it. Additionally, they sponsor Jake Paul, whose brother is the founder of the hydration drink Prime. They expect that over time, marketing expenses will achieve some operational leverage and represent a smaller percentage of sales.

Here’s what they mentioned: Finally, they provided some very interesting details about how they expand into new countries. First, they enter gyms, as we already know, and gradually expand into a few retail locations like Tesco (OTCPK:TSCDF) through exclusive contracts. These contracts provide better shelf space and benefit from larger-scale marketing by these bigger supermarkets.

Second, if they were to enter many retail locations simultaneously, inventory logistics would be much more challenging, and they could run out of stock in some places. This could lead those locations to delist the product due to a poor experience with the distributor.

They also noted that, unlike Monster, which has a significant margin difference internationally because it relies 100% on Coca-Cola’s distribution, Celsius can choose other distributors, not necessarily Pepsi. This is what they have done with Suntory in the UK. They expect not to have such a large margin gap between different geographies.

Conclusion

This has been everything that has happened in the last few months. Despite several things being more complicated than I thought, I see that what is entirely dependent on the management and the business continues to perform better than the rest of the category. Could it fall further? Perhaps if the impact on Q3 figures is greater than expected, it could drop to the $25 mentioned, but I see no reason why the thesis shouldn’t work in the long term.

Read the full article here

Leave a Reply