Market Commentary

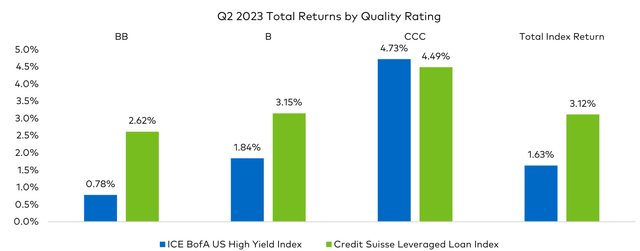

High yield bonds and leveraged loans produced gains in the third quarter, with leveraged loans outperforming their fixed rate peers. During the quarter, leveraged credit markets benefited from resilient economic data and increased optimism over an economic soft landing as well as better than expected earnings. At the same time, investors dealt with rising interest rates as the market began to factor in a ‘higher for longer’ interest rate environment. Further, while recession risks remain, those concerns moderated, providing a more favorable environment for lower rated credits, which meaningfully outperformed in the quarter.

In Q3 2023, over half of the sectors in the high yield bond market produced a gain. The top performing sectors were the Banking, Financial Services, and Media sectors. Conversely, the biggest laggards were the Real Estate, Transportation, and Healthcare sectors. Unlike high yield bonds, all sectors in the leveraged loan market produced a gain. The top performing sectors were Information Technology, Healthcare, and Housing. Meanwhile, the Retail, Gaming & Leisure, and Forest Products & Containers were the biggest laggards.

Following Q2’s increase, capital market activity for high yield bonds declined in Q3, with approximately two thirds of that total used to refinance existing debt. In addition, close to 25% of the quarter’s new bonds were used to finance leveraged buyouts (“LBOs”) or acquisitions. Conversely, leveraged loan new issue activity increased significantly from last quarter. Over the year-to-date period, primary market activity for high yield bonds and leveraged loans is ahead of the total issued during the same period last year. Like high yield bonds, refinancings represented the largest use of proceeds, accounting for close to 46% of the quarter’s total.

In Q3, high yield funds experienced outflows, which were dominated by ETFs. Conversely, after experiencing 15 consecutive months of outflows, leveraged loan funds received positive flows in August and September, which pushed flows positive for Q3. Further, CLO creation increased, and produced the highest quarterly total in over a year.

Lastly, default activity moderated in Q3 when compared to the elevated pace registered during Q2. At the end of Q3, the trailing twelve-month default rates for high yield bonds and leveraged loans were 1.3% and 1.9%, respectively. These levels remain well below their historical averages of approximately 3%.

Portfolio Performance & Attribution

The strategy generated a gross total return of 1.68% during the third quarter and outperformed the ICE BofA U.S. High Yield Index by 115 bps. In Q3, U.S. Treasury yields moved higher. As a result, the shorter duration relative to the benchmark for the representative account of the Polen Credit U.S. Opportunistic High Yield Composite generated a positive duration effect. Further, the portfolio’s income advantage relative to the benchmark contributed to the portfolio’s relative performance. Lastly, the portfolio’s aggregate restructured private equity holdings detracted from relative returns.

Focusing on quality attribution, the portfolio’s overweight to CCC2-rated issues and underweight to issues across the BB-rated spectrum contributed to relative performance during the quarter. Conversely, the portfolio’s aggregate security selection effect by quality rating was negative. Specifically, the portfolio’s B2-rated, CCC1-rated, and CCC2-rated holdings lagged those of the index and detracted from relative performance.

From a sector perspective, attribution shows that the sector allocation effect was negative and detracted from relative performance. This negative effect was driven by the portfolio’s overweight in the Capital Goods sector and underweight in the Energy sector. In addition, the sector security selection effect was modestly positive. The portfolio’s holdings in the Basic Industry, Capital Goods, Consumer Goods, and Transportation sectors outperformed those of the index and contributed to relative performance. However, these positive effects were partially offset by the negative effects produced by the portfolio’s holdings in the Healthcare, Media, Leisure and Telecommunications sectors, which lagged those of the index and detracted from relative performance.

In the third quarter, IPS Corporation and Husky Injection Molding were amongst the top contributors to performance.

IPS Corporation manufactures building materials and serves customers worldwide. The Company produces solvent cements, primers, cleaners, sealants, plumbing products, roofing products, and structural and assembly adhesives. The portfolio’s investment in the Company’s LIBOR + 7.00% Second Lien Term Loan due 2029 appreciated during the quarter. Although second lien loans generally rebounded in the market during the quarter, the Company also reported better than expected second quarter 2023 earnings. The portfolio continues to hold this position.

Husky Injection Molding Systems designs and manufactures injection molding equipment. The Company offers products such as injection molding machines, polyethylene terephthalate, preform molds, hot runners, hylectric systems, post-mold cooling machines, robots and related aftermarket parts and service. The portfolio’s investment in the Company’s 7.75% Senior Notes due 2026 and LIBOR + 3.0% First Lien Term Loan due 2025 appreciated in value as the Company reported better than expected second quarter earnings and provided an improved outlook for the second half of 2023. In addition, the Company’s sponsor pledged to support Husky in the face of approaching maturities coming due over the next two years. The portfolio continues to hold the Senior Notes and First Lien Term Loan.

CWT Travel Group Inc. (“CWT”) and Viasat (VSAT) were amongst the quarter’s largest detractors to performance.

CWT Travel Group is a travel management company that manages business travel, meetings, incentives, conferencing, and exhibitions, as well as handles event management. The portfolio’s investment in the Company’s 8.5% First Lien Notes due 2026, preferred equity, and restructured equity underperformed during the period as the Company faced continued operational challenges and a weak macroeconomic environment. In response to these shortfalls, the portfolio exited the foregoing positions in CWT at a significant loss during the quarter (with the remaining position still held in the warrants continuing to be marked at zero).

Viasat is a global satellite communications service and equipment provider to commercial and government customers. Specifically, the Company provides consumer satellite internet service to rural customers, in-flight broadband for commercial flights / airlines, and connectivity services and equipment for government use. The portfolio’s holdings in the Company’s 5.625% Senior Notes due 2025 and 6.5% Senior Notes due 2028 traded down during the quarter. In mid-July, Viasat disclosed that they experienced a potentially catastrophic failure of its Viasat-3 Americas satellite. This was during the unfolding of the antennas for the in-orbit satellite, having launched in late April 2023. The Company plans to provide an update in early November on functioning capacity of the satellite and the plan forward on the next 2 satellites in the Viasat-3 constellation. In addition, in September, the banks holding the bridge loans that financed the Inmarsat acquisition syndicated that financing in the broader market. That incremental supply of first lien loans and unsecured bonds weighed on the prices of existing tranches of debt, particularly amidst elevated operational uncertainty. The portfolio continues to hold its positions in this issuer.

Portfolio Performance & Attribution

Polen Capital did not make any significant changes to portfolio positioning during the quarter. However, we increased positions in existing holdings, particularly in first lien loans. We have a great degree of confidence and find the absolute and relative level of yields attractive for the risks incurred.

We added a new position in KIK Custom Products (“KIK”) and trimmed our position in UBER Technologies in the third quarter.

KIK Custom Products (“KIK”) manufactures and distributes household cleaning, pool sanitation and automotive performance chemicals. During the quarter Polen Capital managed funds and accounts initiated a position in KIK’s L+3.75% (0.50% floor) First Lien Term Loan due Dec-2026. KIK has strong market share in various consumer, non-cyclical products with favorable industry structures. These markets tend to have material barriers to entry and KIK has been disciplined over the last few years to maintain margin. Further, KIK should benefit from stable demand and commodity deflation. While some risk from customer concentration exists, the oligopolistic market categories KIK operates in makes this risk manageable in our opinion. Therefore, Polen Capital believes the somewhat short-dated First Lien Loan offers an attractive risk-reward profile.

Uber Technologies provides ride hailing services to customers worldwide. The Company develops applications for road transportation, navigation, ride sharing, and payment processing solutions. Polen Capital originally purchased the 4.5% Senior Unsecured Notes due 2029 in our client accounts on the back of the Company’s new focus on profitability and free-cash-flow generation. Our view was that the Company’s credit metrics would improve over the next two-to-three years to levels on par with investment grade issuers. The Company’s fundamental profile has improved which resulted in spread tightening. Given the yield currently offered on the Notes, Polen Capital sold down its exposure and used the proceeds to purchase higher yielding debt instruments.

Outlook

The lack of significant maturities facing the leveraged credit market has been a positive factor supporting the strong performance this year. Primary market activity in 2023 has increased relative to last year. As a result, since the start of the year the percentage of high yield bonds and leveraged loans maturing through the end of 2025 has been halved. That said, much of the new issue activity to date has been among higher rated credits, leaving lower-rated credits with a disproportionate percentage of debt maturing over the next two years.

Nonetheless, the relatively strong fundamental health of the high yield bond market has aided issuers seeking to refinance their debt, albeit at much higher rates. Many of these issuers locked in fixed rate coupons on their existing bonds before the Fed’s rate hiking cycle began. However, the higher coupon payments on newly issued high yield bonds could pressure the cash flow profile of certain companies. Issuers of floating rate leveraged loans are already grappling with higher interest costs. With inflation double that of the Fed’s preferred 2% target, it is likely that rates and floating coupons will remain higher for longer. Therefore, issuers would be well advised to de-lever their balance sheets, an action which we have started to observe.

Furthermore, the outlook for the economy remains uncertain. The negative yield spread, or curve inversion, between 10-year U.S. Treasury Notes and 3-month U.S. Treasury Bills signals that a recession is looming. However, based on year-to-date performance, the leveraged credit market does not appear overly concerned about an economic contraction in the near term. The high yield bond and bank loan markets have each generated strong returns over this period, as credit spreads have tightened and CCC-rated debt in both markets has outperformed its higher-rated peers. If the economy were to enter a recession, as issuers seek to refinance their fixed income obligations, we could see an acceleration in default activity.

While default rates rose during the first nine months of this year, high yield bond and bank loan default rates remain below longterm averages. Although we expect defaults to continue to increase, most estimates predict average conditions in the coming quarters. At Polen Capital, we are cautiously optimistic that default rates, particularly for high yield bonds, will not rise to levels experienced during past downturns should the economy fall into a recession. In the aggregate, we believe that the fundamental health of the high yield bond market is better than has typically been the case in instances where the economy has begun to slow. In addition, the maturity profile of the market is still favorable, although issuers will have to continue to address their upcoming maturities.

Although each credit cycle is different, it is often the case that an exogenous factor spurs the end of the cycle. We continue to see the risk of an exogenous factor influencing this credit cycle. Renewed angst about the banking sector or an increase in default activity among Commercial Real Estate borrowers could be the exogenous factor that causes spillover effects into corporate debt markets. Further, growing domestic and geo-political angst could also weigh on investor sentiment.

Despite the uncertain environment, we still maintain a constructive view of the market. Although we anticipate defaults to increase as the maturity schedule shifts, we believe current yield levels are very attractive and more than compensate investors for the increased risk. In addition, aggregate leveraged credit market fundamentals remain healthy. However, careful credit selection remains paramount. We continue to identify attractive opportunities amongst issuers across each segment of the leveraged credit market. We view the current environment as favorable for an active manager like Polen Capital to potentially generate significant alpha for its clients.

Dave Breazzano, Portfolio Manager | Ben Santonelli, Portfolio Manager | John Sherman, Portfolio Manager

Read the full article here

Leave a Reply