Flexsteel Industries, Inc. (NASDAQ:FLXS), the furnishings manufacturer, has continued to report financials that the company previously guided for, causing the massive stock rally. Despite the continued financial turnaround in an increasingly challenging furnishings market, the stock hasn’t yet rerated enough to reflect the increased earnings prospects.

I previously published an article on the company, titled “Flexsteel Industries: A Window Of Opportunity“. The article, published on the 19th of January, went over Flexsteel’s recently reported incredibly strong preliminary Q2 results and outlook that sent the stock into a rally. I initiated Flexsteel at a Buy rating as the updated outlook completely changed Flexsteel’s earnings outlook without the news being fully priced in. While the stock continued to rally after my article was published, shares have now begun to fall in recent months. As a result, the stock has now returned 9% compared to S&P 500’s better return of 14% in the period.

My Rating History on FLXS (Seeking Alpha)

Financials Have Performed as Guided

The Q2 results showed revenues and a normalized EPS of $100.1 million and $0.57, respectively, in line with the previously given preliminary financials – the operating margin of 4.6% showed an impressive year-over-year expansion of 3.6 percentage points, as the revenue growth of 7.5% also pushed margins higher.

The next quarter followed with a similar improvement, as was guided in January – Q3 showed revenues 8.2% higher than in the previous year at $107.2 million, slightly exceeding the prior guidance’s upper limit of $106 million – Flexsteel’s continued demand momentum even seems to be exceeding what the company’s management expected in early 2024. The adjusted operating margin came in at 5.2%, in the upper half of the previously given 4.5-5.5% guidance range.

Jerald Dittmer, Flexsteel’s CEO, continued to relate the very strong financials into operational efficiencies, cost savings, and most notably improved product development. A notable factor in the improvements seems to be an improved inventory position, as excess inventories have mainly now been sold off with $96.6 million in inventories remaining from a high of $228.5 million at the end of FY2021.

For Q4 and FY2025, the guidances have been kept the same – Flexsteel continues anticipating $107-112 million in sales in Q4 with an operating margin of 5.0-6.0%, a mid-point year-over-year improvement of 3.5% and 1.5 percentage points respectively. For FY2025, revenues of $416-432 million are guided, corresponding to a mid-point growth of 3.0%. With the higher revenues a 5.5-6.5% operating margin is expected, showing continued expected margin expansion even after FY2024. With the current performance, I believe that the guidance could even turn out to be too conservative especially considering the Q3 guidance beat.

To summarize the financial performance, Flexsteel has performed as well as the January press release let investors believe, even exceeding expectations in Q3. The company continues foreseeing such improvements ahead, too, and the current financial strength makes me believe in such strong demand.

Flexsteel’s Georgia Plant is Being Closed to Improve Operations

Flexsteel announced the plan to close the Dublin, Georgia manufacturing plant with the Q2 report. The move is expected to improve lead times, reduce handling damage, and improve other overall operations of the company’s manufacturing and logistics. The manufacturing plant is responsible for less than 5% of Flexsteel’s sales.

Due to the closing, Flexsteel experienced $2.6 million in restructuring costs in Q3, and expects to incur $0.4-0.5 million more in restructuring costs in Q4, mainly related to employee separations. The annualized savings from the closing are expected at an impressive $4.0-4.5 million, being very notable for the total bottom line while seemingly already integrated into the previously given FY2025 guidance, though.

The plant has been planned to close in Q4 of Flexsteel’s fiscal 2024, meaning by the end of June, and is planned to be listed for sale after the closing – investors could quite soon hear from the sale of the manufacturing plant, bringing additional cash to pay down remaining debt.

The Furnishings Industry’s Pressures Haven’t Affected Flexsteel

The furnishings industry as a whole has performed incredibly weakly in past quarters, as for example Bassett Furniture (BSET) reported a -19.6% revenue decline in its latest quarter, Hooker Furnishings (HOFT) a decline of -23.2%, and Lovesac (LOVE) a decline of -6.1% despite usually rapid growth. Flexsteel has also noted the increasingly challenging macroeconomic environment but continues to post incredibly solid financials regardless.

The weakness could eventually catch up to Flexsteel if the industry doesn’t improve soon, as the incredibly weak housing market that furnishings sales depend on are still waiting for interest rates to decline. Yet, an improvement could also pose an even higher demand recovery for Flexsteel, too.

Derek Schmidt Has Been Appointed as CEO

Jerald Dittmer announced his departure from the CEO position in December 2023. In April, Derek Schmidt was appointed as the new CEO, starting at the position at the start of July. Schmidt came from inside the company, as Schmidt has previously worked as the company’s CFO with an increasingly large control over Flexsteel’s operations. I believe that the appointment is great, as the newly appointed CEO has been driving Flexsteel’s so far incredibly successful turnaround strategy.

FLXS’s Valuation Remains Attractive

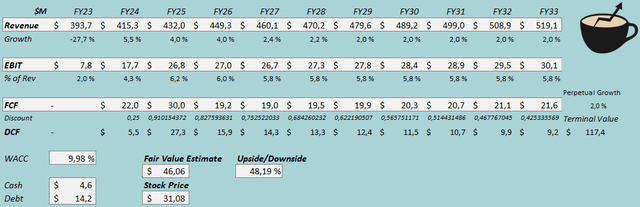

With the demonstrated financials, I feel slightly more confident in estimating sustained long-term earnings – in my updated discounted cash flow [DCF] model, I now estimate a 5.5% growth in FY2024 at the upper end of the guidance, and a growth of 4.0% in FY2025 relating to the upper part of the given guidance range. Afterwards, I now estimate growth to slow down into 2.0%, slightly higher than my 1.5% estimate previously as I am now more confident in estimating sustained long-term sales volumes.

With the proven financials, I now estimate slightly higher sustained margins at a sustained 5.8% EBIT margin compared to 5.5% previously. I now estimate great cash flows in FY2025 due to the guidance, and including the sale of the Georgia manufacturing plant.

The DCF model still significantly undermines Flexsteel’s long-term aspirations of $750 million in sales, a 8% operating margin, and annual free cash flow of $40 million that were again communicated in the April investor presentation – for example, my model only estimates cash flows of $21.6 million in FY2033, around half of the targeted level.

DCF Model (Author’s Calculation)

The estimates put Flexsteel’s fair value estimate at $46.06, 48% above the stock price at the time of writing – while the market has now had time to digest the Q2 preliminary update, higher sustained earnings aren’t still priced in despite the shown performance in an incredibly weak furnishings market. I believe that the investment case continues to carry a good risk-to-reward, especially as the model estimates upside even with conservative estimates compared to Flexsteel’s ambitions.

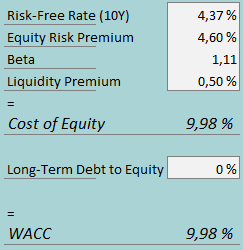

A weighted average cost of capital of 9.98% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

As Flexsteel continues to pay down debt, I estimate the company to eventually have no interest-bearing debt. To estimate the cost of equity, I use the 10-year bond yield of 4.37% as the risk-free rate. The equity risk premium of 4.60% is Professor Aswath Damodaran’s estimate for the US, updated on the 5th of January. I have kept the beta estimate at 1.11. With a liquidity premium of 0.5%, the cost of equity and WACC both stand at 9.98%.

Takeaway

Flexsteel has reported greatly improving earnings that the company guided for with the preliminary Q2 press release, even exceeding the Q3 revenue range. The Georgia plant’s closing looks to aid profitability further in FY2025 – while the macroeconomic outlook is very aggressively pressuring the furnishings industry, Flexsteel sees no issues as cost cuts and the improved products offerings’ demand continue creating a foundation for a sustained turnaround. The stock still hasn’t appreciated the turnaround’s earnings potential even when estimating earnings conservatively. As such, I remain with a Buy rating.

Read the full article here

Leave a Reply